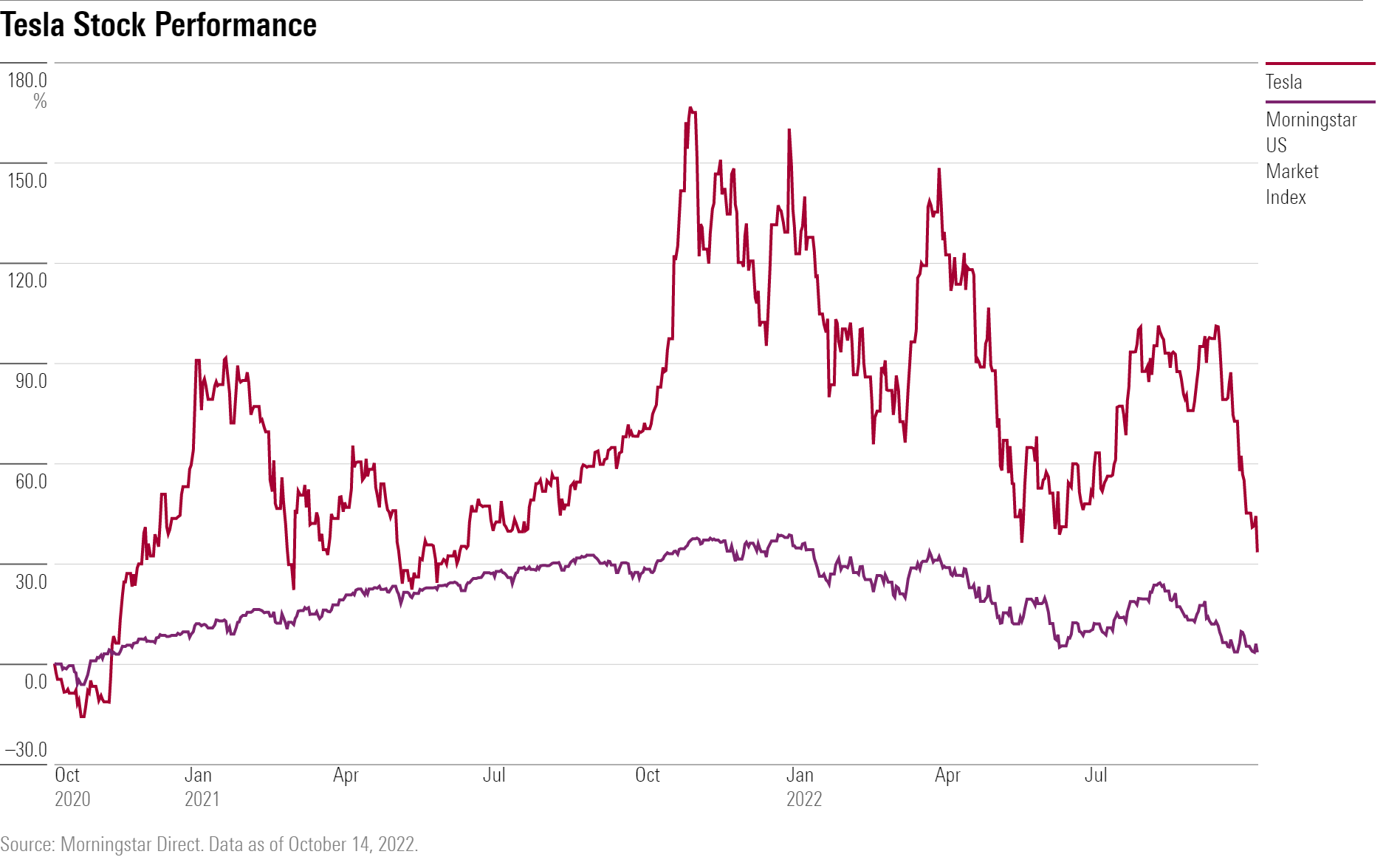

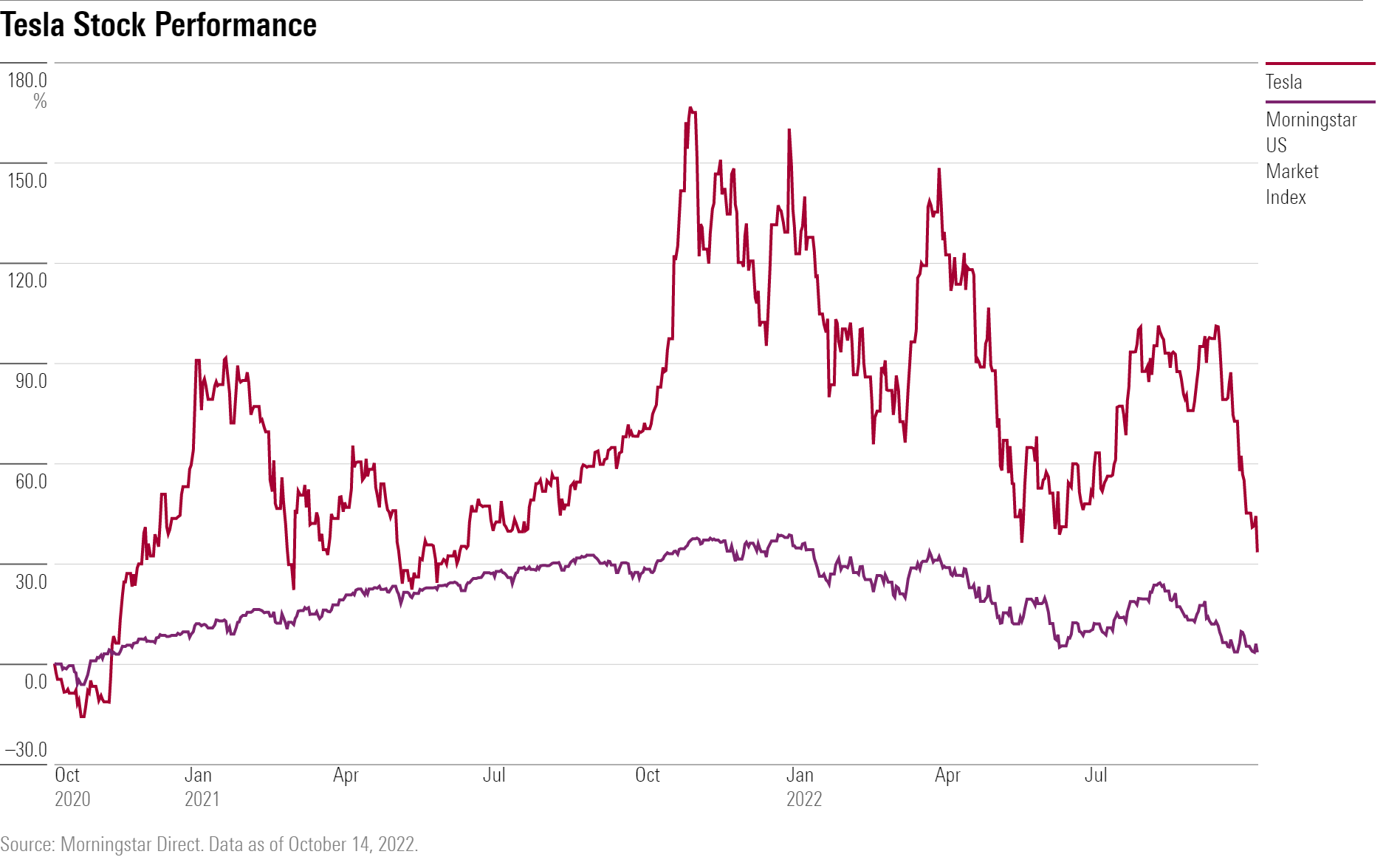

Tesla Stock Performance: Q1 Profit Decline And Political Fallout

Table of Contents

Q1 2024 Tesla Profit Decline: A Deep Dive

Tesla's Q1 2024 earnings report revealed a significant drop in profitability, raising concerns among investors. This section will delve into the key factors contributing to this decline.

Analysis of Financial Results

The Q1 results showcased a [Insert Percentage]% decrease in profit compared to the previous quarter. Revenue figures also fell short of expectations, signaling a slowdown in growth. Tesla attributed this decline to a combination of factors, including increased competition, the impact of aggressive price cuts, and persistent supply chain disruptions.

- Net Income: [Insert Q1 2024 Net Income Figure] (compared to [Q4 2023 Net Income Figure])

- Revenue: [Insert Q1 2024 Revenue Figure] (compared to [Q4 2023 Revenue Figure])

- Earnings Per Share (EPS): [Insert Q1 2024 EPS Figure] (compared to [Q4 2023 EPS Figure])

Analyst predictions prior to the report were significantly higher, leading to a negative market reaction immediately following the release. Several analysts revised their price targets downward, reflecting the uncertainty surrounding Tesla's future profitability.

Impact of Price Cuts on Profitability

Tesla's strategy of aggressive price cuts, implemented to boost sales volume, significantly impacted profit margins. While sales volume did increase, the reduced prices per vehicle more than offset the gains, resulting in a lower overall profit.

- Sales Volume (Pre-Price Cuts): [Insert Data]

- Sales Volume (Post-Price Cuts): [Insert Data]

- Average Selling Price (Pre-Price Cuts): [Insert Data]

- Average Selling Price (Post-Price Cuts): [Insert Data]

The long-term sustainability of this pricing strategy remains a key concern. Maintaining market share through price competition could erode profitability further if not accompanied by significant cost reductions or increased efficiency.

Supply Chain Challenges and Their Influence

Tesla, like many other manufacturers, continues to grapple with supply chain disruptions. These challenges impacted production volumes and contributed to the Q1 profit decline.

- Battery Material Shortages: [Explain the impact of shortages on production]

- Chip Supply Constraints: [Explain the impact of chip shortages on vehicle production]

- Logistics Bottlenecks: [Explain the impact of logistics issues on delivery timelines and costs]

Compared to competitors with more diversified supply chains, Tesla's vulnerability to these disruptions appears more pronounced, highlighting a critical area needing improvement.

Political Fallout and its Effect on Tesla Stock

Beyond the financial challenges, Tesla's stock performance is also heavily influenced by political factors.

Regulatory Scrutiny and Investigations

Tesla faces increasing regulatory scrutiny concerning its autonomous driving technology and safety features. Ongoing investigations and potential fines could significantly impact the company's financial outlook and investor confidence.

- NHTSA Investigations: [Summarize ongoing investigations and potential consequences]

- SEC Investigations: [Summarize ongoing investigations and potential consequences]

- International Regulatory Scrutiny: [Highlight any international regulatory challenges]

Links to relevant news articles and official reports should be included for further details.

CEO Elon Musk's Public Statements and their Market Impact

Elon Musk's frequent and sometimes controversial tweets and public statements have a demonstrable effect on Tesla's stock price. His pronouncements, whether related to the company's performance or unrelated personal matters, can trigger significant volatility.

- Example 1: [Tweet/Statement and Market Reaction]

- Example 2: [Tweet/Statement and Market Reaction]

- Example 3: [Tweet/Statement and Market Reaction]

This highlights the significant risk associated with a CEO whose public communication style is often unpredictable and can significantly impact investor sentiment.

Geopolitical Risks and their Influence

Tesla's global operations expose it to various geopolitical risks. Trade disputes, political instability in key markets, and changes in international regulations can all impact Tesla's stock price.

- China Market Risks: [Analyze potential risks related to the Chinese market]

- European Union Regulations: [Discuss the impact of EU regulations on Tesla's European operations]

- Supply Chain Geopolitics: [Analyze the geopolitical aspects of Tesla's global supply chain]

Tesla's exposure to these risks needs careful consideration when evaluating its long-term prospects.

Tesla Stock Performance: Future Outlook and Investment Considerations

The Q1 profit decline, coupled with the ongoing political headwinds, paints a complex picture for Tesla's future. While the company remains a technological innovator in the electric vehicle sector, navigating these challenges effectively is crucial for maintaining investor confidence and driving future growth.

Future Predictions: The outlook for Tesla stock performance is cautious. While the company's long-term prospects remain positive, overcoming the current hurdles related to profitability, supply chain stability, and political scrutiny will be essential.

Investment Advice (Disclaimer): This analysis is for informational purposes only and does not constitute financial advice. Investing in Tesla stock carries significant risk, and individuals should conduct their own thorough research and seek advice from a qualified financial advisor before making any investment decisions.

Call to Action: Stay updated on Tesla stock performance by following reputable financial news sources and conducting your own thorough research before making any investment decisions. Understanding the interplay of financial performance and political factors is crucial for navigating the complexities of investing in this dynamic company.

Featured Posts

-

Saudi India Energy Collaboration Two Oil Refineries In The Works

Apr 24, 2025

Saudi India Energy Collaboration Two Oil Refineries In The Works

Apr 24, 2025 -

Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025

Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025 -

Understanding The Liberal Party Platform A Voters Guide

Apr 24, 2025

Understanding The Liberal Party Platform A Voters Guide

Apr 24, 2025 -

Ohio Derailment Buildings Contaminated By Toxic Chemicals For Months

Apr 24, 2025

Ohio Derailment Buildings Contaminated By Toxic Chemicals For Months

Apr 24, 2025 -

Ella Travolta Kci Johna Travolte Ocarava Ljepotom

Apr 24, 2025

Ella Travolta Kci Johna Travolte Ocarava Ljepotom

Apr 24, 2025