Tesla's Q1 Earnings: Political Controversy Impacts Financial Results

Table of Contents

Political Factors Impacting Tesla's Q1 Performance

Tesla, as a global leader in the EV industry, is acutely sensitive to shifts in political climates worldwide. Several key political factors significantly influenced its Q1 performance.

Government Regulations and Subsidies

Changes in government regulations and EV subsidies across major markets directly impacted Tesla's profitability and competitiveness.

- Changes in EV Tax Credits: The reduction of federal EV tax credits in the US, coupled with varying subsidy policies across Europe and Asia, created complexities in Tesla's pricing strategies and market penetration. For example, the recent adjustments to the Clean Vehicle Tax Credit in the US affected consumer demand and Tesla's sales projections.

- Environmental Regulations: Stringent environmental regulations regarding battery production and recycling added to Tesla's operational costs. Meeting these new standards required significant investment in infrastructure and process optimization, impacting profit margins.

- Import Tariffs and Trade Disputes: Ongoing trade disputes and fluctuating import tariffs in several key markets added uncertainty to Tesla's supply chain and increased its operational costs. For example, tariffs on imported raw materials and finished goods in certain countries impacted profitability.

Specific examples:

- USA: Reduction in EV tax credits.

- China: Changes in local content requirements for EVs.

- European Union: Stringent emission standards and upcoming bans on combustion engine vehicles.

Geopolitical Uncertainty and Supply Chain Disruptions

Global political instability significantly disrupted Tesla's supply chain throughout Q1.

- Material Shortages: Geopolitical tensions in certain regions led to shortages of key raw materials, such as lithium and cobalt, essential for battery production. This constrained Tesla's production capacity and impacted delivery timelines.

- Logistical Challenges: Political unrest and port congestion in various parts of the world caused delays in shipping and transportation, further impacting the timely delivery of vehicles and components.

- Factory Closures: While not directly related to political events, indirect effects such as energy crises or resource restrictions impacted production at certain Tesla factories.

Key materials affected:

- Lithium (primarily sourced from Australia, Chile, and China)

- Cobalt (primarily sourced from the Democratic Republic of Congo)

- Nickel (sourced globally, with geopolitical risks impacting supply)

Public Relations and Brand Perception

Elon Musk's public pronouncements and controversial actions significantly impacted Tesla's brand perception and, consequently, its sales.

- Social Media Controversies: Musk's highly publicized tweets and social media activities generated both positive and negative attention, affecting consumer sentiment towards the brand.

- Political Endorsements: Musk's political endorsements and affiliations influenced public perception of Tesla, impacting its appeal to various consumer demographics.

- Negative News Coverage: Controversies surrounding Tesla's workplace culture and autonomous driving technology negatively impacted its image and market value.

Specific controversies:

- Controversial tweets impacting stock prices.

- Public criticism of government regulations.

- Negative press regarding workplace safety and autonomous driving technology.

Tesla's Q1 Financial Results: A Detailed Analysis

Tesla's Q1 financial performance revealed a complex picture, reflecting the interplay of strong vehicle deliveries and the challenges posed by political factors.

Revenue and Profitability

- Revenue: Tesla reported [insert actual Q1 2024 revenue figures] in Q1 2024. [Compare this to previous quarters and expectations – add percentage increase/decrease].

- Net Income: The net income was [insert actual Q1 2024 net income figures]. [Compare this to previous quarters and expectations – add percentage increase/decrease].

- Earnings Per Share (EPS): EPS stood at [insert actual Q1 2024 EPS figures]. [Compare this to previous quarters and expectations – add percentage increase/decrease].

Key Financial Metrics:

- Revenue: [Insert figures and YoY change]

- Net Income: [Insert figures and YoY change]

- EPS: [Insert figures and YoY change]

- Gross Margin: [Insert figures and YoY change]

Production and Delivery Figures

Tesla delivered a record number of vehicles in Q1 2024, demonstrating robust demand despite challenges.

- Total Deliveries: [Insert actual Q1 2024 delivery figures]. [Compare this to previous quarters and expectations – add percentage increase/decrease].

- Model-wise Breakdown: [Provide a breakdown of deliveries for each vehicle model – Model 3, Model Y, Model S, Model X, Cybertruck (if applicable)].

- Production Output: Tesla's production output reached [insert actual Q1 2024 production figures]. [Compare this to previous quarters and expectations – add percentage increase/decrease].

Vehicle Deliveries:

- Model 3: [Insert figures]

- Model Y: [Insert figures]

- Model S: [Insert figures]

- Model X: [Insert figures]

Future Outlook and Investment Strategies

Despite the challenges, Tesla remains optimistic about its future.

- Expansion Plans: Tesla continues to expand its manufacturing capacity globally, with ongoing construction of new Gigafactories.

- New Product Launches: Tesla plans to launch new vehicles and expand its product portfolio, including potential entry into new market segments.

- Investment in New Technologies: Tesla is investing heavily in battery technology, autonomous driving capabilities, and other cutting-edge technologies.

Upcoming Projects and Challenges:

- Gigafactory expansion in [location]

- Launch of new vehicle model [model name]

- Continued development of Full Self-Driving technology

Conclusion: Understanding the Impact of Politics on Tesla's Q1 Earnings

Tesla's Q1 2024 earnings clearly demonstrated the significant impact of political factors on its financial performance. Government regulations, geopolitical instability, and public relations controversies all played a role in shaping the company's results. While record deliveries showcased strong consumer demand, navigating these political headwinds will be crucial for Tesla's continued success. Understanding the interplay between these political forces and Tesla's financial health is essential for investors and industry observers alike.

Stay tuned for further analysis of Tesla's performance and the ongoing impact of political events on their financial results. Follow us for future updates on Tesla's earnings and the evolving political landscape affecting the electric vehicle sector.

Featured Posts

-

Blue Origin Scraps Rocket Launch Due To Subsystem Issue

Apr 24, 2025

Blue Origin Scraps Rocket Launch Due To Subsystem Issue

Apr 24, 2025 -

John Travoltas Heartfelt Tribute A Moving Photo Marks Jett Travoltas 33rd Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute A Moving Photo Marks Jett Travoltas 33rd Birthday

Apr 24, 2025 -

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025 -

Trump Immigration Policies Meet Significant Legal Resistance

Apr 24, 2025

Trump Immigration Policies Meet Significant Legal Resistance

Apr 24, 2025 -

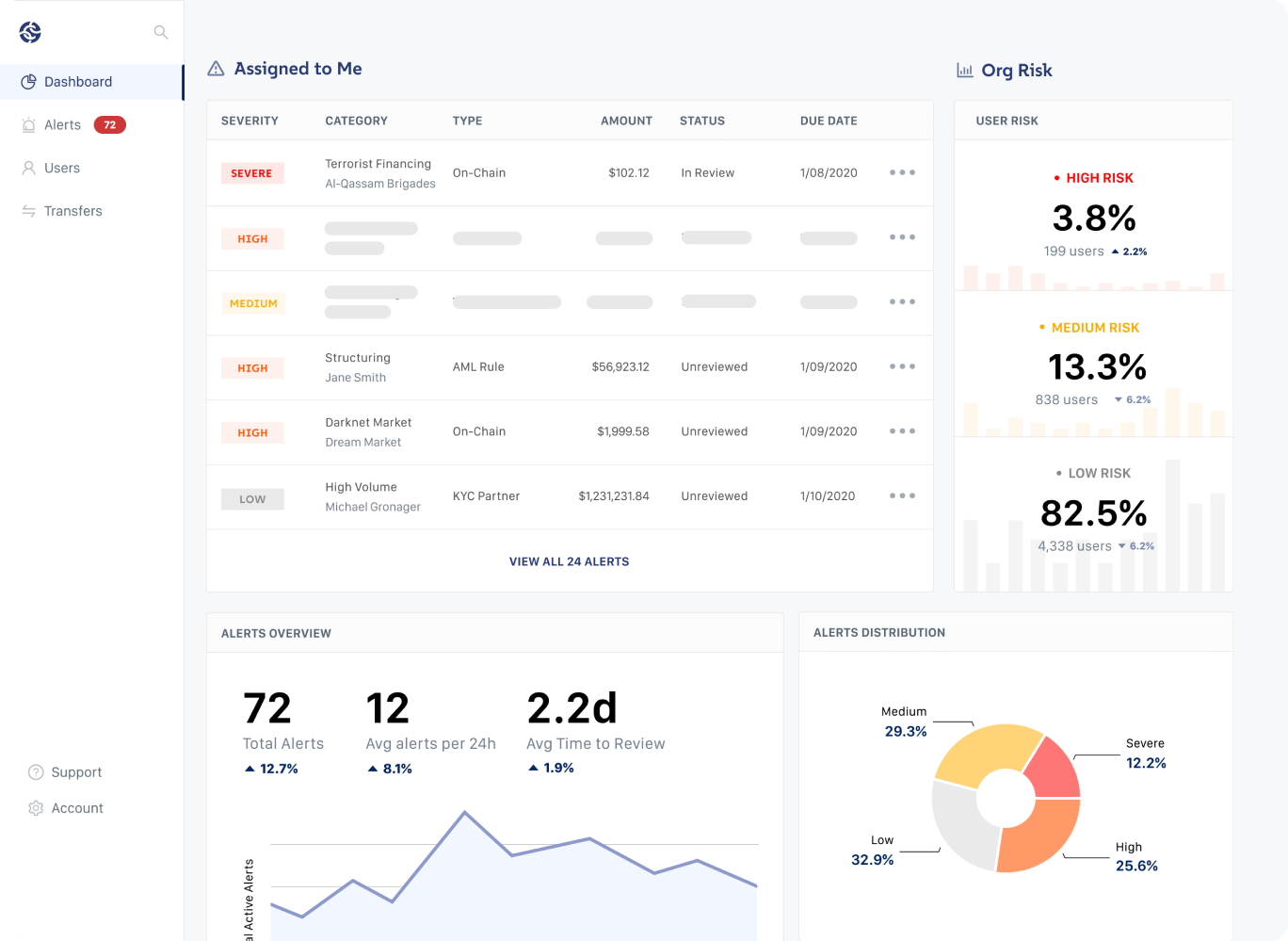

Chainalysis Bolsters Ai Expertise With Alterya Acquisition

Apr 24, 2025

Chainalysis Bolsters Ai Expertise With Alterya Acquisition

Apr 24, 2025