The Dax And German Politics: Understanding The Interplay Of Elections And Economic Data

Table of Contents

The Impact of Election Cycles on DAX Performance

Investor sentiment and market behavior surrounding German federal elections significantly impact DAX performance. Understanding these election cycles and their effects is key to navigating the German market.

Pre-Election Volatility

The period leading up to a German federal election is often characterized by increased volatility in the DAX. This uncertainty stems from several factors:

- Increased market speculation and hedging activities: Investors engage in more speculative trading and hedging strategies to protect their portfolios from potential negative outcomes. This increased trading activity can amplify price swings in either direction.

- Potential for both upward and downward swings depending on market sentiment and projected policy changes: Depending on the perceived economic platforms of different parties, the DAX can experience both bullish and bearish trends. Positive expectations about future economic growth might boost the DAX, while concerns about potential policy changes could lead to a decline.

- Analysis of historical DAX performance during pre-election periods: A review of past election cycles reveals a recurring pattern of heightened volatility in the weeks and months leading up to the election. Analyzing this historical data provides valuable insights for predicting future trends. For example, examining the DAX's behavior before the 2017 and 2021 elections reveals common characteristics.

Post-Election Market Reactions

The results of German elections significantly influence investor confidence and, consequently, the DAX.

- Analysis of DAX reactions to different election outcomes (e.g., coalition governments, clear majorities): A clear majority government often leads to greater stability and predictability, potentially fostering positive DAX performance. Coalition governments, on the other hand, can introduce uncertainty, depending on the composition of the coalition and potential policy disagreements.

- The role of market expectations vs. actual policy announcements: The DAX's reaction isn't solely determined by the election outcome itself; it’s also shaped by how the results align with prior market expectations. Surprising results can lead to sharper DAX movements. Similarly, the actual policy announcements made by the new government can either confirm or contradict market expectations, further influencing the DAX.

- Examples of specific policy promises and their impact on the DAX: Promises related to fiscal policy, such as tax cuts or increased government spending, can have a significant impact. Similarly, policies concerning environmental regulations or industrial subsidies can affect specific sectors and, in turn, the overall DAX performance. For instance, promises of increased investments in renewable energy might boost related sectors within the DAX.

Key Policy Areas Affecting the DAX

Government policies play a pivotal role in shaping the DAX's trajectory. Understanding these policy areas is crucial for predicting market movements.

Fiscal Policy and the DAX

Government spending, taxation, and budgetary decisions directly influence economic growth and, subsequently, the DAX.

- The impact of expansionary vs. contractionary fiscal policies: Expansionary fiscal policies, such as increased government spending or tax cuts, are typically associated with economic growth and a positive impact on the DAX. Conversely, contractionary policies can dampen economic activity and negatively affect the DAX.

- Examples of how specific fiscal policies (e.g., tax cuts, infrastructure spending) have affected the DAX: Historical data can illustrate how specific fiscal policies have influenced DAX performance. For example, significant infrastructure investments have often coincided with periods of increased DAX growth.

- Analysis of the relationship between government debt and DAX performance: While expansionary policies can boost growth, excessive government debt can raise concerns about long-term economic stability, impacting investor confidence and potentially influencing DAX performance.

Monetary Policy and the DAX

The European Central Bank's (ECB) monetary policy significantly influences the DAX through interest rate adjustments and other interventions.

- How interest rate changes influence borrowing costs and investment decisions impacting the DAX: Lower interest rates typically encourage borrowing and investment, leading to potential DAX growth. Higher interest rates can have the opposite effect.

- The role of quantitative easing (QE) and other monetary policy tools on the DAX: QE programs, where the ECB purchases assets to inject liquidity into the market, have often been associated with periods of DAX growth.

- The impact of ECB's decisions on inflation and its consequences for the DAX: The ECB's actions concerning inflation are crucial. High inflation can negatively impact investor confidence and harm the DAX, while controlled inflation can have a more positive impact.

Regulatory Changes and the DAX

New regulations can significantly impact specific DAX-listed companies and the overall index.

- Examples of regulatory changes impacting specific DAX-listed companies: Changes in environmental regulations might impact energy companies, while financial regulations can affect banks and insurance firms listed on the DAX.

- The role of regulatory uncertainty in creating DAX volatility: Uncertainty surrounding new regulations can create volatility as investors anticipate potential impacts on specific companies.

- Long-term implications of regulatory changes on the DAX's overall performance: Regulatory changes often have long-term consequences, either positively or negatively influencing DAX performance over time.

Analyzing the Correlation between DAX Performance and German Political Stability

Political stability in Germany is closely linked to DAX performance. Periods of political uncertainty tend to be reflected in the DAX.

Measuring Political Stability

Defining and quantifying political stability is crucial to understanding its relationship to the DAX.

- Using established political stability indices: Several indices exist to measure political stability. Analyzing these indices in conjunction with DAX performance can reveal correlations.

- Considering factors like government coalition strength, public opinion, and social cohesion: These factors contribute to overall political stability, which can have a bearing on investor confidence and the DAX.

- Analyzing historical data to correlate political stability with DAX performance: Historical data analysis can identify patterns between periods of high political stability and positive DAX performance, and vice versa.

The Impact of Political Crises

Major political events can cause significant DAX fluctuations.

- Examples of political crises and their impact on the DAX (e.g., government collapses, major policy disputes): Government collapses or major policy disagreements often lead to uncertainty and volatility in the DAX.

- The role of investor sentiment and risk aversion during political crises: During crises, investor sentiment turns negative, resulting in risk aversion and potential DAX declines.

- Analyzing the recovery period of the DAX after significant political events: Analyzing the DAX's recovery after significant political events can provide insights into the resilience of the German economy and its ability to overcome political challenges.

Conclusion

The DAX and German politics are inextricably linked. Understanding the interplay between election cycles, government policies, and the German stock market is vital for navigating the complexities of the German economy. Election outcomes, fiscal and monetary policies, and regulatory changes all exert significant influence on DAX performance. By carefully analyzing these interrelationships, investors can make more informed decisions and better predict potential market movements. To further deepen your understanding of the intricate relationship between the DAX and German politics, continue your research into specific historical events and policy implementations. Stay informed about upcoming elections and policy debates to effectively manage your investment strategies related to the German stock market.

Featured Posts

-

Canadas Tourism Boom Outpacing The Us As A Travel Destination

Apr 27, 2025

Canadas Tourism Boom Outpacing The Us As A Travel Destination

Apr 27, 2025 -

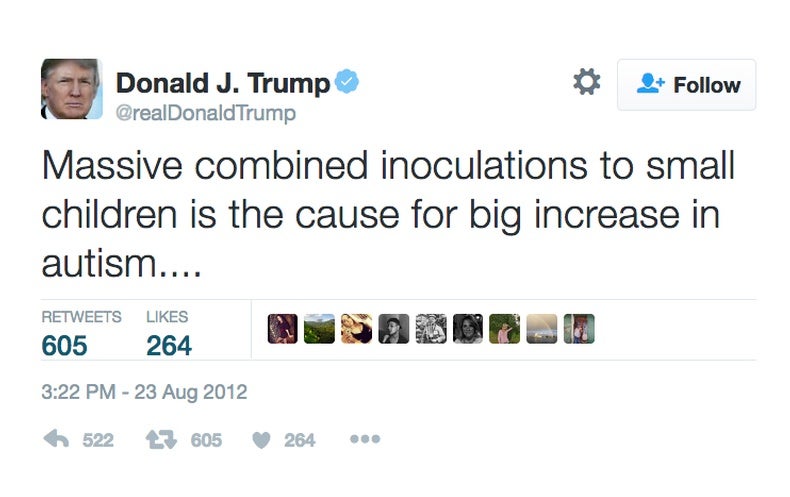

Federal Study On Autism And Vaccines Headed By Vaccine Skeptic

Apr 27, 2025

Federal Study On Autism And Vaccines Headed By Vaccine Skeptic

Apr 27, 2025 -

Pne Groups Wind Energy Portfolio Expansion Two New Projects Added

Apr 27, 2025

Pne Groups Wind Energy Portfolio Expansion Two New Projects Added

Apr 27, 2025 -

Paolini Y Pegula Fuera Del Wta 1000 De Dubai

Apr 27, 2025

Paolini Y Pegula Fuera Del Wta 1000 De Dubai

Apr 27, 2025 -

Ramiro Helmeyer And The Pursuit Of Blaugrana Glory

Apr 27, 2025

Ramiro Helmeyer And The Pursuit Of Blaugrana Glory

Apr 27, 2025