The First 100 Days: Assessing The U.S. Dollar's Performance Against Historical Precedents (Nixon Era)

Table of Contents

The Bretton Woods System and its Collapse

Understanding the Bretton Woods Agreement

The Bretton Woods System, established in 1944, aimed to create a stable international monetary system after the chaos of World War II. Its core principle was a fixed exchange rate system, pegging most currencies to the U.S. dollar, which was in turn convertible to gold at a fixed rate of $35 per ounce. This system, while promoting stability in the short term, contained inherent weaknesses.

- Fixed exchange rates pegged to the U.S. dollar: This created a hierarchical system with the dollar at its apex.

- The role of gold reserves: Countries held gold reserves to back their currencies and maintain the fixed exchange rates.

- Growing strains on the system due to the Vietnam War and expanding US trade deficit: The U.S. government's spending on the Vietnam War and burgeoning trade deficit put immense pressure on its gold reserves, eroding confidence in the dollar's convertibility.

The increasing demand for dollars to finance international trade, coupled with the growing U.S. trade deficit, led to a substantial outflow of gold from U.S. reserves. This fueled speculation about the dollar's future, undermining the credibility of the Bretton Woods system and ultimately leading to its demise. The US monetary policy of the time, focused on domestic economic growth, exacerbated the issue, contributing to inflation and further weakening the dollar's position globally.

The Nixon Shock and its Immediate Impact on the U.S. Dollar

August 15, 1971: The Announcement

President Nixon's announcement on August 15, 1971, marked a watershed moment in global finance. Facing immense pressure, he took the drastic step of unilaterally abandoning the Bretton Woods system.

- Closure of the gold window: The U.S. ended the convertibility of the dollar to gold, effectively ending the gold standard.

- Temporary suspension of dollar convertibility to gold: This severed the direct link between the dollar and gold, allowing its value to float freely in the foreign exchange market.

- Implementation of a 10% import surcharge: This temporary tariff aimed to protect American industries and reduce the trade deficit.

The immediate reaction in global currency markets was one of shock and volatility. Uncertainty reigned supreme as the world adjusted to a new reality without the anchor of a gold-backed dollar. The exchange rate of the dollar against major currencies began to fluctuate wildly, marking the beginning of the era of floating exchange rates.

The U.S. Dollar's Performance in the First 100 Days Post-Nixon Shock

Analyzing Exchange Rate Fluctuations

The first 100 days following the Nixon Shock witnessed significant volatility in the U.S. dollar's exchange rate. Analyzing the fluctuations against major currencies like the British pound, German mark, and Japanese yen reveals a complex interplay of speculation and shifting economic fundamentals.

- Specific exchange rate data for the first 100 days: Detailed data from this period shows sharp declines against several major currencies.

- Factors influencing exchange rate movements (e.g., speculation, international trade): Speculation played a major role, as investors reacted to the uncertainty of the new system. Changes in international trade flows also influenced the dollar's value.

- Comparison with pre-shock exchange rates: The dollar experienced a significant devaluation against many currencies compared to its fixed pre-shock value.

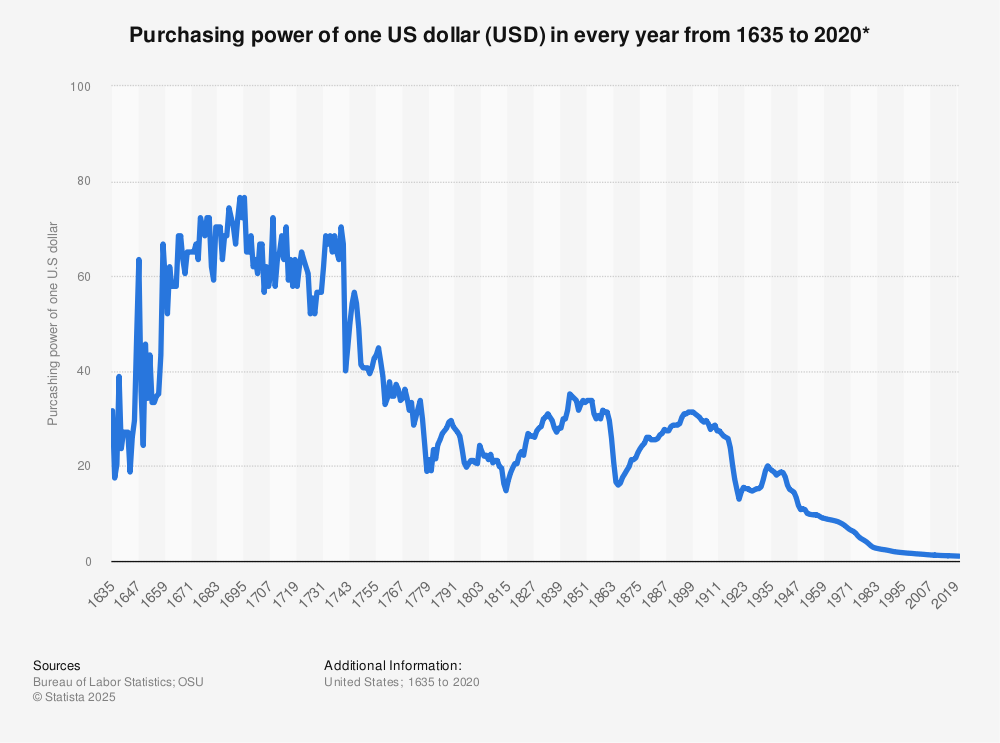

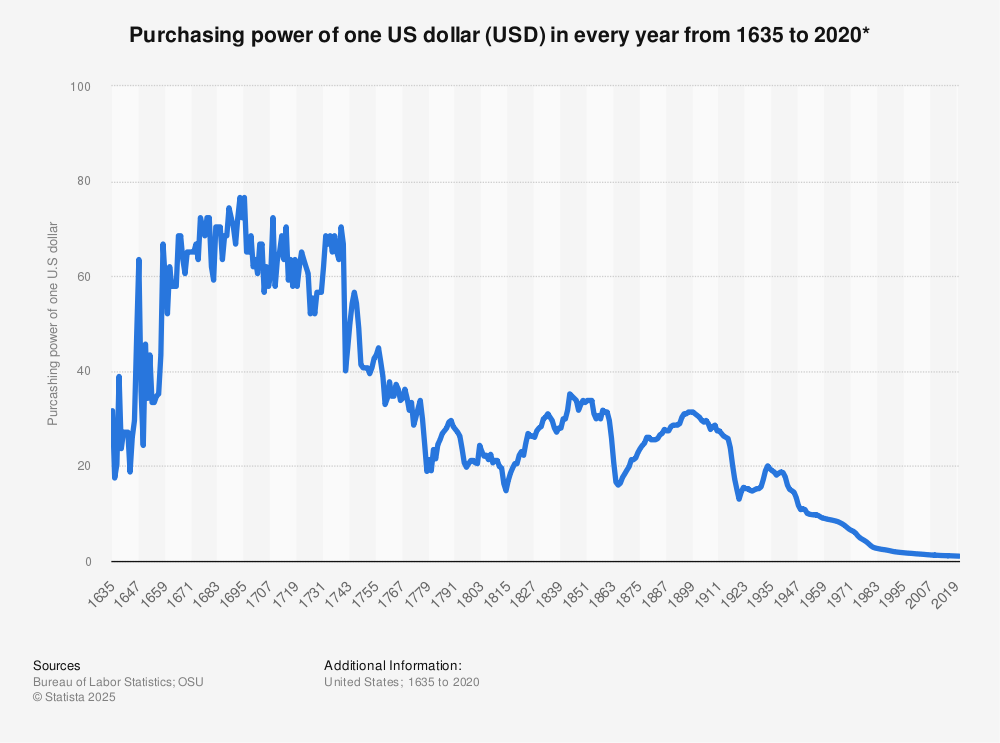

Charts and graphs illustrating these fluctuations would provide a visual representation of the tumultuous period. The rising inflation rate in the U.S. further pressured the dollar's value, as investors sought refuge in currencies of countries with more stable economies.

Comparing the Nixon Era to Other Periods of U.S. Dollar Volatility

Identifying Historical Parallels

While the Nixon Shock stands as a unique event, it's beneficial to compare it to other periods of significant U.S. dollar instability.

- Similarities and differences in underlying causes: The Great Depression and the early 1980s, for example, also saw periods of substantial dollar volatility, albeit with different underlying causes. The Nixon Shock was driven by a combination of unsustainable domestic policies and loss of confidence in the dollar, while other periods involved distinct factors like global economic crises or changing monetary policies.

- Comparison of the speed and magnitude of exchange rate changes: The Nixon Shock's impact was relatively swift and substantial, leading to a rapid shift in the global monetary order. Other periods witnessed more gradual changes.

- Long-term consequences of these events: The long-term consequence of the Nixon Shock was the move towards a floating exchange rate system, a system that remains in place today.

The transition to a floating exchange rate system marked a fundamental shift in how global currencies are valued and traded, leaving a lasting legacy on international finance.

Conclusion

The U.S. dollar's performance in the first 100 days following the Nixon Shock was characterized by significant volatility and devaluation against major currencies. This period marked the end of the Bretton Woods system and the beginning of the era of floating exchange rates, a fundamental change in the global monetary order. Comparing this period to other historical instances of U.S. dollar instability highlights both the unique circumstances surrounding the Nixon Shock and the enduring lessons about the fragility of fixed exchange rate systems. Understanding these historical precedents is critical to appreciating the complexities of current global currency markets and the ever-evolving role of the U.S. dollar. Learn more about U.S. dollar performance and its impact on the global economy by exploring resources on international finance and monetary policy.

Featured Posts

-

Yankees Series Win A Testament To Judge And Goldschmidts Skills

Apr 28, 2025

Yankees Series Win A Testament To Judge And Goldschmidts Skills

Apr 28, 2025 -

Red Sox Offseason Strategy Filling The Gap Left By Tyler O Neill

Apr 28, 2025

Red Sox Offseason Strategy Filling The Gap Left By Tyler O Neill

Apr 28, 2025 -

2000 Mlb Season Posadas Homer Steals Victory From The Royals

Apr 28, 2025

2000 Mlb Season Posadas Homer Steals Victory From The Royals

Apr 28, 2025 -

Alnskht Althanyt Waleshrwn Mn Mhrjan Abwzby Brnamj Hafl Balnjwm

Apr 28, 2025

Alnskht Althanyt Waleshrwn Mn Mhrjan Abwzby Brnamj Hafl Balnjwm

Apr 28, 2025 -

Us Citizen 2 Faces Deportation Federal Judge Sets Hearing

Apr 28, 2025

Us Citizen 2 Faces Deportation Federal Judge Sets Hearing

Apr 28, 2025