The "Just Contact Us" Approach: A Case Study Of Tariff Avoidance On TikTok

Table of Contents

Understanding the Mechanics of the "Just Contact Us" Approach

The "Just Contact Us" approach leverages the informal communication channels often available on e-commerce platforms like TikTok. Instead of following formal import procedures, some sellers use the "Contact Us" feature to potentially misrepresent their products or undervalue their shipments to avoid paying the correct tariffs. This method often exploits ambiguities within platform guidelines and relies on a lack of rigorous verification by either the platform or customs authorities.

Here's how it might be implemented:

- Mislabeling Products: Describing a product inaccurately to fall under a lower tariff category. For example, listing a high-value item as a lower-cost generic product.

- Underreporting Value: Declaring a lower value for the product than its actual price to reduce the amount of duty owed.

- Exploiting Ambiguous Shipping Descriptions: Using vague descriptions to confuse customs agents about the product's true nature and value.

- Ignoring Official Import Channels: Bypassing official customs declarations and relying solely on informal communication with the buyer or platform.

TikTok's seller guidelines, while generally aiming for compliance, may not always explicitly address these nuanced methods of tariff avoidance, creating opportunities for exploitation.

A Case Study: Analyzing a Specific Instance of Alleged Tariff Avoidance

Let's examine a hypothetical case. A seller on TikTok, "TrendyThreads," based in China, was selling designer-inspired handbags. Instead of accurately declaring the handbags as luxury goods, subject to significant tariffs in the US (their target market), they listed them as "fashion accessories" with a significantly lower declared value. They used the "Contact Us" feature to respond to buyer inquiries and handle shipping, sidestepping formal import documentation.

- Product: Designer-inspired handbag (Actual Cost: $150, Declared Value: $20)

- Origin Country: China

- Destination Country: USA

- Potential Tariff Savings: Substantial, potentially exceeding $100 per bag, representing a significant increase in profit margin.

- Red Flags: Inconsistencies between product images and description, unusually low pricing compared to market value.

While this is a hypothetical example, it highlights the potential for significant financial gains through tariff avoidance and the subtle ways in which the "Contact Us" feature might be exploited.

The Legal and Ethical Implications of Tariff Evasion via TikTok

The legal consequences of mislabeling or undervaluing goods can be severe. Sellers engaging in tariff evasion face substantial penalties, including:

- Fines: Significant monetary penalties for each instance of violation.

- Seizure of Goods: Confiscation of the goods involved in the illegal activity.

- Legal Action: Criminal prosecution in some cases, leading to further fines and imprisonment.

Furthermore, this behavior undermines legitimate businesses that comply with import regulations. It creates unfair competition and erodes trust in the e-commerce ecosystem. TikTok, as the platform hosting these sales, also bears some responsibility in addressing this issue and ensuring compliance with relevant laws and regulations. Their potential liability could include fines or legal action if they are found to be complicit in enabling such activities.

- Potential Legal Consequences for Sellers: Fines, imprisonment, seizure of goods, business closure.

- Potential Legal Consequences for TikTok: Fines, legal action for negligence or complicity.

Best Practices for Sellers on TikTok to Avoid Tariff Issues

To avoid tariff-related issues, TikTok sellers should prioritize transparency and compliance:

- Accurate Labeling and Documentation: Ensure all product descriptions and declarations accurately reflect the goods being shipped.

- Understanding Tariff Regulations: Thoroughly research and understand the tariff regulations applicable to their specific products and destination countries.

- Utilize Reputable Shipping and Customs Brokers: Leverage professionals experienced in handling international shipping and customs procedures.

- Proactive Communication: Maintain open communication with customs authorities to resolve any potential issues promptly.

By following these best practices, sellers can minimize risks and ensure compliance with import regulations.

Navigating the Complexities of Tariffs and the "Just Contact Us" Approach on TikTok

This case study highlights the potential for tariff avoidance through the exploitation of the seemingly innocuous "Just Contact Us" feature on TikTok. The legal and ethical implications are significant, with sellers facing substantial fines, seizures, and even legal action. Moreover, this behavior creates unfair competition and damages the integrity of the e-commerce landscape. Therefore, responsible selling practices and strict adherence to import regulations are paramount for avoiding the pitfalls of this approach.

To learn more about navigating the complexities of tariffs and ensuring compliance on TikTok, we encourage you to research resources from your country's customs agency and seek professional advice on international trade regulations. Avoid the risks associated with the "Just Contact Us" approach and engage in ethical and legal e-commerce practices.

Featured Posts

-

How Middle Management Drives Company Productivity And Employee Engagement

Apr 22, 2025

How Middle Management Drives Company Productivity And Employee Engagement

Apr 22, 2025 -

Assessing The Synergies Between Swedish And Finnish Military Capabilities

Apr 22, 2025

Assessing The Synergies Between Swedish And Finnish Military Capabilities

Apr 22, 2025 -

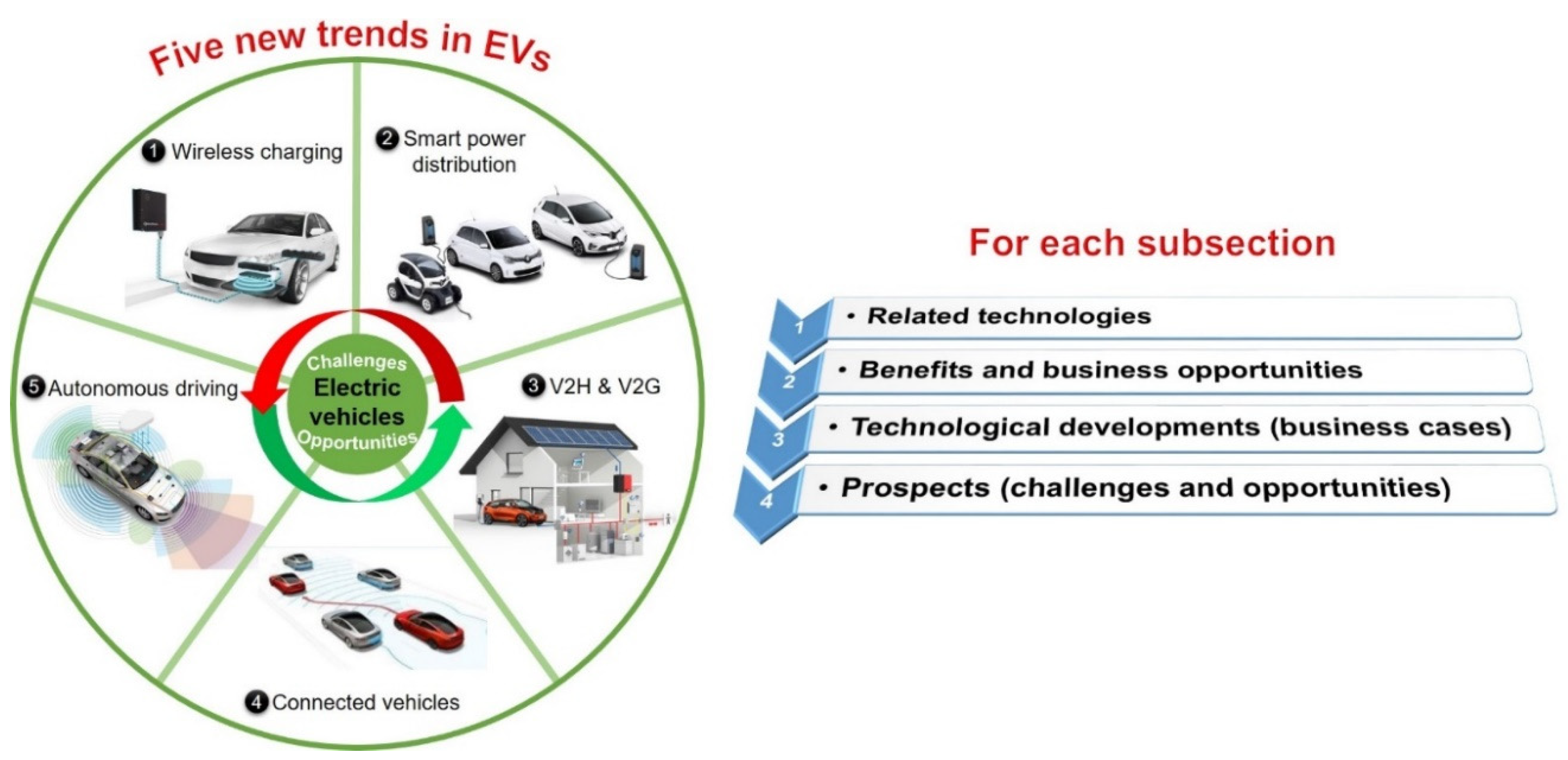

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 22, 2025

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 22, 2025 -

Investor Concerns About Stock Market Valuations Bof As Response

Apr 22, 2025

Investor Concerns About Stock Market Valuations Bof As Response

Apr 22, 2025 -

Sweden And Finland A Unified Defense Strategy For The Nordic Region

Apr 22, 2025

Sweden And Finland A Unified Defense Strategy For The Nordic Region

Apr 22, 2025