Today's Stock Market: Analyzing Dow Futures And China's Economic Response To Tariffs

Table of Contents

Understanding Dow Futures and Their Sensitivity to Global Events

Dow Futures contracts are derivative instruments that track the predicted performance of the Dow Jones Industrial Average. They serve as a powerful indicator of market sentiment, reflecting investor expectations regarding the future direction of the index. While US-China trade tensions significantly influence Dow Futures, several other factors contribute to their volatility. Interest rate adjustments by the Federal Reserve, inflation rates, and geopolitical instability all play crucial roles in shaping the price movements of Dow Futures contracts.

- Mechanism of Dow Futures Trading: Dow Futures trading involves buying or selling contracts representing a specific number of DJIA index points at a predetermined price for a future date. This allows investors to hedge against potential losses or speculate on price movements.

- Interpreting Dow Futures Charts: Analyzing charts displaying Dow Futures prices helps investors understand the prevailing market sentiment. Upward trends generally signal bullish sentiment, while downward trends reflect bearish expectations.

- Past Events Impacting Dow Futures: Significant events such as the 2008 financial crisis and the COVID-19 pandemic have historically caused dramatic swings in Dow Futures prices, reflecting widespread market uncertainty.

China's Economic Response to Tariffs: A Multifaceted Analysis

China's response to US tariffs has been multifaceted, encompassing a range of economic strategies designed to mitigate the negative impacts on its economy. These strategies include retaliatory tariffs on US goods, increased domestic investment and stimulus packages, and efforts to diversify its trading partners. However, the effectiveness of these measures remains a subject of ongoing debate.

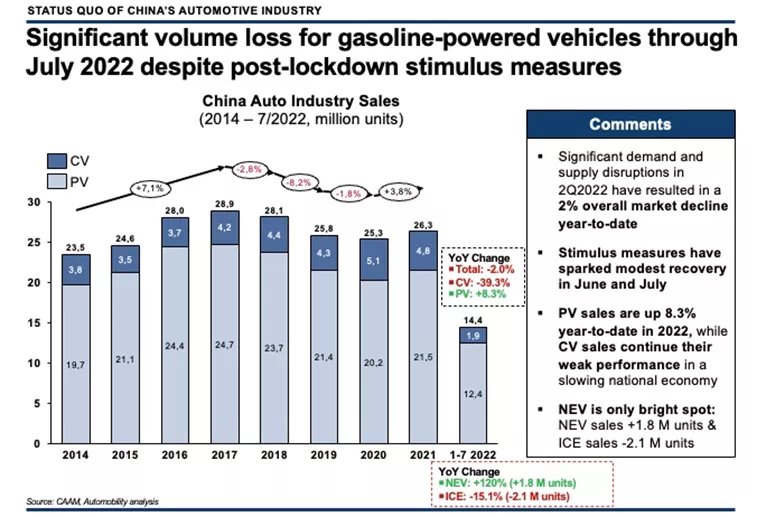

- Examples of Countermeasures: China imposed retaliatory tariffs on various US agricultural and manufactured goods, impacting industries like soybeans and automobiles. Simultaneously, it launched substantial stimulus packages to bolster its domestic economy and support affected industries.

- Impact on the Chinese Economy: While some argue that China's countermeasures have successfully cushioned the blow of US tariffs, others point to challenges in sustaining economic growth amidst trade uncertainty. The long-term effects on China's economic trajectory are yet to be fully understood.

- Long-Term Consequences: The US-China trade war has created long-term uncertainty for businesses and investors globally. The consequences for both economies are complex and likely to play out over several years, shaping the global economic landscape.

The Interplay Between Dow Futures and China's Economic Response

The causal relationship between China's economic actions and Dow Futures fluctuations is undeniable. Investor perceptions of the trade war's outcome directly influence market sentiment, leading to changes in Dow Futures prices. Positive news regarding trade negotiations often translates to bullish trends in Dow Futures, while negative news or escalating tensions tend to have the opposite effect.

- Correlation Between Policies and Dow Futures Prices: For instance, announcements of new tariffs or trade agreements immediately impact Dow Futures prices, reflecting market response to the perceived risks and opportunities.

- Investor Behavior and Risk Assessment: Investors carefully evaluate the potential impacts of trade disputes on corporate earnings and overall market stability, adjusting their investment strategies accordingly. Risk aversion tends to increase during periods of heightened trade tension.

- Market Scenarios Based on Trade War Resolution: Different resolutions to the trade war will significantly impact Dow Futures. A peaceful resolution leading to reduced tariffs could trigger a bullish market response, while an escalation could lead to significant losses.

Predicting Future Market Trends Based on Current Indicators

Predicting future market behavior is inherently challenging, but analyzing current indicators provides a basis for cautious forecasting. Several scenarios are possible, each with its own implications for Dow Futures and the broader stock market. It's crucial to remember that these are just potential scenarios, not guarantees.

- Potential Positive Scenarios: A de-escalation of trade tensions, coupled with strong economic growth in both the US and China, could lead to a significant surge in Dow Futures and broader market optimism.

- Potential Negative Scenarios: A prolonged trade war or unexpected geopolitical events could result in significant market corrections and a decline in Dow Futures prices.

- Investment Considerations and Diversification: Investors should maintain a diversified portfolio to mitigate risks associated with trade uncertainties. Strategic asset allocation and risk management are crucial during times of market volatility.

Conclusion: Today's Stock Market: Understanding Dow Futures and China's Trade Response

This analysis highlights the critical interconnectedness between Dow Futures, China's economic response to tariffs, and the overall health of the stock market. Understanding this relationship is essential for making informed investment decisions. The interplay of these factors creates a complex and dynamic market environment that requires continuous monitoring and careful assessment. Stay updated on Dow Futures and their implications for the stock market by following reputable financial news sources and conducting thorough research. Learn more about analyzing Dow Futures and China's economic response to make informed investment decisions and navigate the complexities of today's market effectively.

Featured Posts

-

Chinas Auto Market Difficulties For Luxury Brands Like Bmw And Porsche

Apr 26, 2025

Chinas Auto Market Difficulties For Luxury Brands Like Bmw And Porsche

Apr 26, 2025 -

California Overtakes Japan A New Global Economic Powerhouse

Apr 26, 2025

California Overtakes Japan A New Global Economic Powerhouse

Apr 26, 2025 -

The Los Angeles Wildfires And The Growing Market For Disaster Bets

Apr 26, 2025

The Los Angeles Wildfires And The Growing Market For Disaster Bets

Apr 26, 2025 -

Lab Owners Guilty Plea Faked Covid 19 Test Results During Pandemic

Apr 26, 2025

Lab Owners Guilty Plea Faked Covid 19 Test Results During Pandemic

Apr 26, 2025 -

Abb Vie Abbv Raises Profit Outlook Strong Sales Growth From New Drugs

Apr 26, 2025

Abb Vie Abbv Raises Profit Outlook Strong Sales Growth From New Drugs

Apr 26, 2025