Trade War Impact: Today's Stock Market Analysis And Dow Futures

Table of Contents

Understanding the Current Trade War Landscape

The global economic landscape is significantly shaped by ongoing trade disputes, most notably the US-China trade war. These trade wars, characterized by the imposition of tariffs and trade restrictions, create significant geopolitical risks and uncertainty.

-

Major Ongoing Disputes: The US-China trade war, while experiencing periods of détente, remains a major source of market volatility. Other disputes involving various countries further complicate the global trade environment. These disagreements frequently involve accusations of unfair trade practices, intellectual property theft, and imbalances in trade deficits.

-

Impact of Tariffs: Tariffs imposed by different countries directly impact specific industries and sectors. For instance, tariffs on steel and aluminum have affected manufacturing, while tariffs on consumer goods have impacted retail and other related sectors. This leads to increased prices for consumers and reduced competitiveness for affected businesses.

-

Global Supply Chain Disruptions: Trade uncertainties significantly disrupt global supply chains. Businesses face challenges in sourcing materials, manufacturing goods, and delivering products to market, leading to production delays and increased costs. This uncertainty forces companies to rethink their sourcing strategies, often leading to increased expenses and decreased efficiency.

-

Recent Developments: Keeping abreast of the latest news and developments regarding trade negotiations and agreements is paramount. Any new tariffs, trade deals, or agreements can significantly affect market sentiment and investor confidence. Closely monitoring official announcements from governmental bodies and reputable financial news sources is crucial.

Impact of Trade Wars on Stock Market Performance

Trade wars have a demonstrably negative impact on stock market performance, often leading to increased market volatility. Understanding this correlation is key to effective investment strategies.

-

Historical Correlation: Historically, escalations in trade wars have correlated with increased stock market fluctuations. Periods of heightened trade tensions often coincide with market corrections or downturns as investor confidence wanes.

-

Sectoral Impact: The impact of trade wars is not uniform across all market sectors. Sectors heavily reliant on international trade, such as technology and manufacturing, are generally more susceptible to negative impacts from trade disputes. Companies with significant international supply chains are particularly vulnerable to disruptions.

-

Investor Sentiment: Trade war news significantly affects investor sentiment and market confidence. Negative news often leads to a sell-off, while positive developments can trigger a market rally. This underscores the importance of monitoring news sources carefully and understanding their potential impact on market movements.

-

Market Corrections and Downturns: The potential for market corrections or sustained downturns due to prolonged trade tensions is a significant risk factor. Investors need to be prepared for periods of significant market volatility and potential losses. Charts illustrating the historical relationship between major trade events and the Dow Jones Industrial Average (DJIA) and S&P 500 indices would clearly demonstrate this correlation.

Analyzing Dow Futures and Predicting Market Trends

Dow futures, contracts representing the future value of the Dow Jones Industrial Average, offer valuable insights into market sentiment and potential future trends.

-

Understanding Dow Futures: Dow futures contracts allow investors to speculate on the future direction of the Dow Jones Industrial Average. They are a powerful tool for hedging against potential market declines or for profiting from anticipated price movements.

-

Predictive Analysis: Predicting Dow futures movements involves employing various analytical methods, including technical analysis (chart patterns, indicators) and fundamental analysis (economic indicators, company performance). Combining both approaches can offer a more comprehensive picture.

-

Economic Indicators and News Events: Key economic indicators, such as GDP growth, inflation rates, and unemployment figures, significantly influence Dow futures. Major news events, including trade war developments, political announcements, and central bank decisions, also play a crucial role in shaping market sentiment and impacting futures prices.

-

Current Dow Futures Trends: Analyzing current Dow futures trends provides valuable information about market expectations. A rising trend suggests bullish sentiment, while a falling trend indicates bearish sentiment. This information can be used to adjust investment strategies accordingly.

Developing a Robust Investment Strategy

Developing a resilient investment strategy to navigate the challenges presented by trade wars is essential for long-term success.

-

Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and geographic regions helps mitigate the risks associated with trade wars. Reducing reliance on any single sector or country diminishes the impact of sector-specific trade disruptions.

-

Hedging Strategies: Hedging techniques, such as using options or futures contracts, can protect investments during periods of market uncertainty. These strategies help offset potential losses from market declines caused by trade war anxieties.

-

Long-Term Perspective: Adopting a long-term investment perspective is crucial, reducing the influence of short-term market fluctuations caused by trade war news. Focus on the underlying value of your investments and avoid impulsive reactions to daily market noise.

-

Professional Advice: Seeking advice from a qualified financial advisor is highly recommended. A financial advisor can help you develop a personalized investment strategy that considers your risk tolerance, financial goals, and the specific challenges posed by the ongoing trade war environment.

Conclusion

Trade wars have a significant and undeniable influence on today's stock market and Dow futures. Understanding the current trade war landscape, analyzing market trends, and developing a robust investment strategy are critical for navigating this uncertain environment. The impact of trade wars on specific sectors, investor sentiment, and the overall market necessitates a proactive and informed approach.

Call to Action: Stay informed about the latest developments in the trade war landscape to make informed investment decisions concerning your stock market portfolio and Dow futures positions. Regularly analyze the impact of trade wars and adapt your investment strategy accordingly. Consider consulting with a financial advisor to create a personalized plan that addresses the ongoing impact of trade wars and helps you navigate the complexities of this volatile market.

Featured Posts

-

The Post Roe Landscape Examining The Role Of Over The Counter Birth Control

Apr 22, 2025

The Post Roe Landscape Examining The Role Of Over The Counter Birth Control

Apr 22, 2025 -

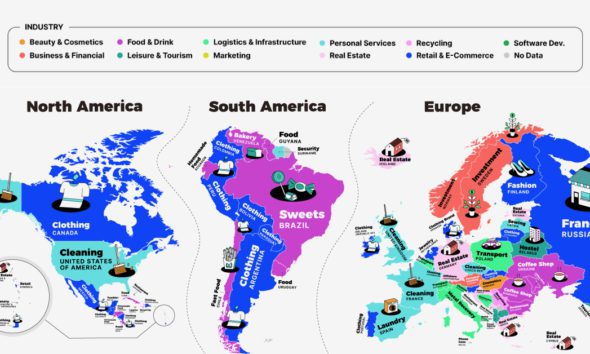

Identifying The Countrys Fastest Growing Business Areas

Apr 22, 2025

Identifying The Countrys Fastest Growing Business Areas

Apr 22, 2025 -

Trump Protests A Nationwide Uprising

Apr 22, 2025

Trump Protests A Nationwide Uprising

Apr 22, 2025 -

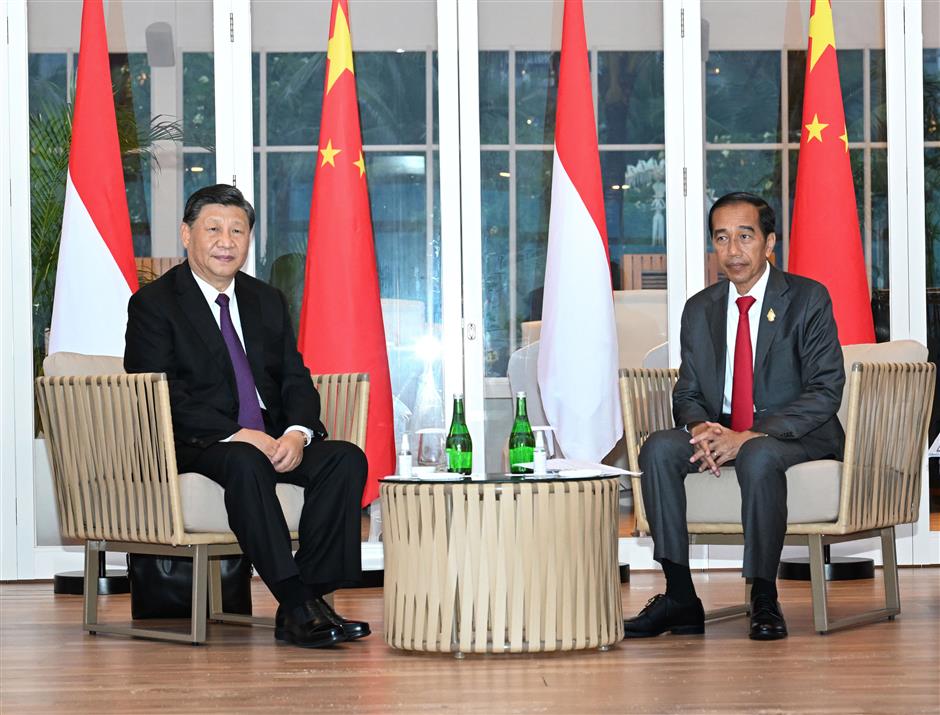

China And Indonesia Expand Security Cooperation

Apr 22, 2025

China And Indonesia Expand Security Cooperation

Apr 22, 2025 -

The Countrys Hottest New Business Markets Location Location Location

Apr 22, 2025

The Countrys Hottest New Business Markets Location Location Location

Apr 22, 2025