Trump Affirms Powell's Continued Role As Fed Chair

Table of Contents

President Trump's Rationale Behind the Decision

Despite past public criticisms of Powell's monetary policy decisions, President Trump's reaffirmation suggests a complex calculation. While the President frequently expressed dissatisfaction with interest rate hikes and the Fed's approach to combating inflation, several factors likely contributed to this decision.

-

Lack of Suitable Alternatives: Finding a replacement for the Fed Chair is a significant undertaking, requiring extensive vetting and Senate confirmation. The potential disruption and uncertainty associated with a transition may have outweighed the perceived benefits of a change.

-

Political Considerations: Maintaining continuity at the helm of the Federal Reserve could be seen as politically advantageous, particularly given the upcoming presidential election. A sudden shift in leadership could introduce unforeseen economic volatility.

-

Recognition of Powell's Expertise: Despite their disagreements, the President may have ultimately recognized Powell's expertise and experience in navigating complex economic landscapes. Powell's tenure has coincided with periods of both economic growth and challenges.

Statements from the White House emphasized the importance of stability within the Federal Reserve system, hinting at a pragmatic approach to the decision. The political climate surrounding this decision is undeniably intricate, reflecting the delicate balance between political pressure and economic considerations.

Market Reactions to Powell's Continued Tenure

The news of Powell’s continued tenure elicited a mixed but largely positive response from financial markets.

-

Stock Market Indices: The Dow Jones Industrial Average, S&P 500, and Nasdaq experienced a moderate increase following the announcement, suggesting investor relief at the avoidance of further uncertainty.

-

Bond Yields: Treasury bond yields initially saw a slight dip, reflecting a reduction in perceived risk. This indicates increased investor confidence in the Fed's continued, albeit potentially controversial, approach to monetary policy under Powell's leadership.

-

Impact on the US Dollar: The US dollar experienced only minor fluctuations. The relative stability suggests that the market largely anticipated the outcome, factoring in the President's prior comments and the potential for both continuation and change within the Federal Reserve.

The short-term impact appears to be a calming of market anxieties, but the long-term effects will depend on the Fed's future actions under Powell’s guidance. Volatility remains a possibility, particularly if the Fed's policies diverge significantly from the President's stated preferences.

Implications for Monetary Policy and Economic Outlook

Powell's continued leadership will significantly shape future monetary policy decisions, potentially impacting various economic indicators.

-

Potential Interest Rate Adjustments: The ongoing trade war and global economic uncertainties could influence the Fed's approach to interest rate adjustments. Lower interest rates are often a tool to stimulate economic growth.

-

Inflation Targets: The Federal Reserve's mandate includes maintaining price stability. Powell's approach to achieving the inflation target remains crucial in guiding monetary policy.

-

Quantitative Easing (QE) Strategies: The possibility of further QE or a continuation of tapering will be a key focus. QE involves injecting liquidity into the financial system, while tapering is the gradual reduction of such stimulus.

The ongoing trade war significantly impacts the Fed's approach, requiring careful balancing of domestic concerns with global economic pressures. Powell’s experience in navigating these challenges will be essential to maintaining economic stability and growth.

Comparison to Previous Fed Chairs and Their Approaches

Comparing Powell's approach to previous Federal Reserve Chairs reveals both similarities and differences. While Janet Yellen and Ben Bernanke also faced economic challenges, their policy approaches had subtle distinctions.

-

Key Differences in Policy Approaches: Yellen's tenure, for instance, was characterized by a gradual increase in interest rates following the 2008 financial crisis. Bernanke's leadership involved aggressive QE measures in response to the same crisis. Powell's approach, marked by both rate hikes and a recognition of the limitations of QE, represents a distinct strategy.

-

Similarities in Economic Challenges Faced: All three Chairs faced significant economic challenges, including periods of economic recovery, inflation concerns, and global market volatility. Navigating these complexities required diverse policy instruments and skillful adjustments.

The continuities and departures in the Federal Reserve's strategy under Powell's continued leadership remain a key area of observation and analysis for economists and market watchers alike.

Conclusion: The Future of the Federal Reserve Under Powell's Leadership

Trump Affirms Powell's Continued Role as Fed Chair, creating a path of relative certainty for the US economy, at least in the short term. The decision impacts future monetary policy, influencing interest rates, inflation targets, and the overall economic outlook. Market reactions were initially positive, demonstrating a reduction in uncertainty. However, the long-term effects will depend on how the Fed navigates the challenges posed by the ongoing trade war and global economic conditions. Staying informed about future Federal Reserve decisions is crucial for understanding their impact on the US economy. To stay updated on further developments regarding "Trump Affirms Powell's Continued Role as Fed Chair," subscribe to our newsletter, follow reputable financial news sources, and continue researching topics like "Federal Reserve policy," "monetary policy," "US economy," and "Jerome Powell."

Featured Posts

-

The Impact Of Chinas Rare Earth Restrictions On Teslas Optimus Robot

Apr 24, 2025

The Impact Of Chinas Rare Earth Restrictions On Teslas Optimus Robot

Apr 24, 2025 -

John Travoltas Daughter Ella Bleu Unveils New Look In Fashion Spread

Apr 24, 2025

John Travoltas Daughter Ella Bleu Unveils New Look In Fashion Spread

Apr 24, 2025 -

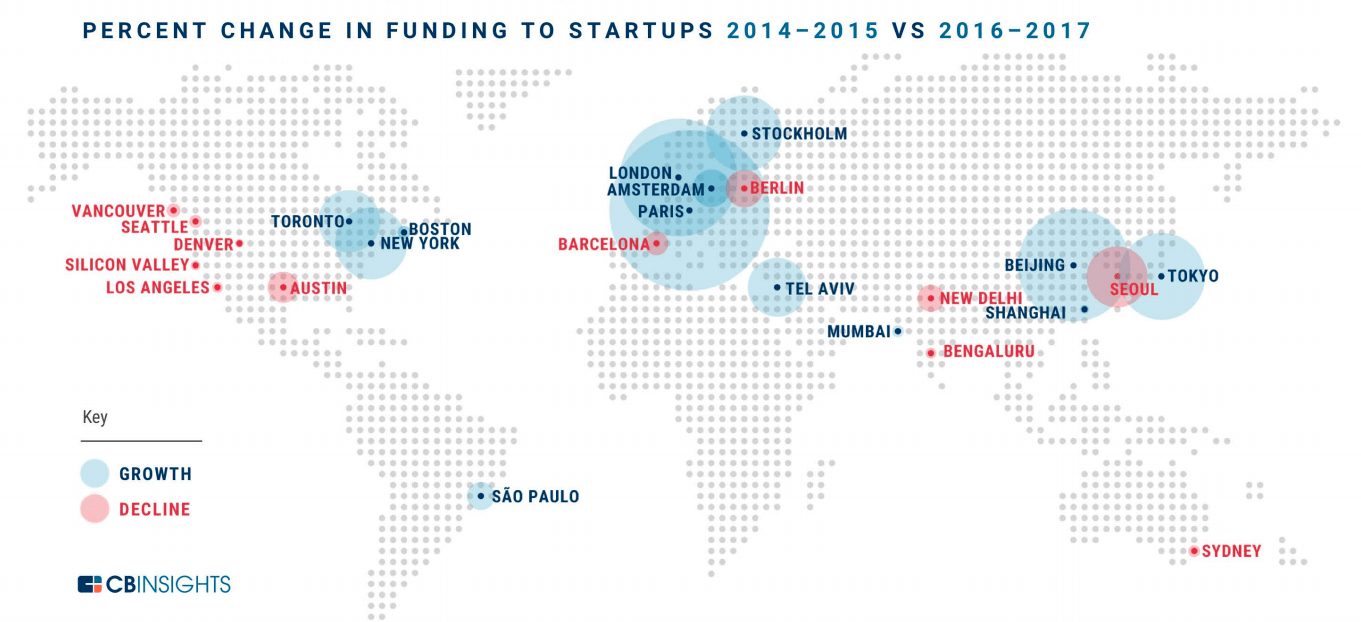

Identifying Emerging Business Hubs A National Map Of Opportunity

Apr 24, 2025

Identifying Emerging Business Hubs A National Map Of Opportunity

Apr 24, 2025 -

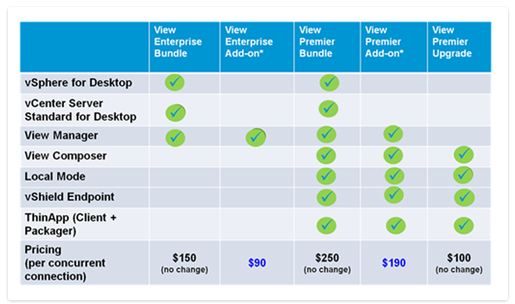

Broadcoms Extreme V Mware Price Increase At And T Sounds The Alarm

Apr 24, 2025

Broadcoms Extreme V Mware Price Increase At And T Sounds The Alarm

Apr 24, 2025 -

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 24, 2025

Vehicle Subsystem Issue Forces Blue Origin Launch Cancellation

Apr 24, 2025