Trump's Economic Agenda: Who Pays The Price?

Table of Contents

Tax Cuts and Their Impact

Trump's signature tax cuts, enacted in 2017, significantly altered the American tax landscape. While proponents lauded the potential for economic growth through "trickle-down economics," the reality was far more nuanced, revealing a clear disparity in who benefited most.

Beneficiaries of the Tax Cuts

The most significant beneficiaries of the tax cuts were high-income earners and corporations. Specific provisions heavily favored these groups:

- Corporate Tax Rate Reduction: The reduction of the corporate tax rate from 35% to 21% resulted in substantial savings for large corporations.

- Individual Income Tax Bracket Changes: Reductions in individual income tax rates, particularly in higher brackets, disproportionately benefited wealthy individuals.

- Pass-Through Business Deduction: This deduction allowed many small business owners, often high-income earners, to significantly reduce their tax liability.

Analysis of the tax cuts' impact reveals a stark reality: the wealthiest 1% saw the largest percentage decrease in their tax burden, while the benefits for lower and middle-income households were comparatively modest. The promised "trickle-down" effect, where corporate tax cuts would lead to increased wages and job creation, failed to materialize significantly for many.

Those Left Behind by the Tax Cuts

While corporations and the wealthy experienced substantial tax relief, many low- and middle-income earners saw minimal or even negative consequences:

- Sunsetting of Certain Tax Credits: Several tax credits benefiting lower-income families, such as the Child Tax Credit expansion, were temporary, leaving many facing higher tax burdens in subsequent years.

- Increased National Debt: The significant tax cuts contributed to a substantial increase in the national debt, raising concerns about future economic stability and potentially impacting future government spending on social programs.

The widening income inequality following the tax cuts further highlights the uneven distribution of benefits, showcasing the considerable disparities created by Trump's economic policies.

Trade Policies and Their Consequences

Trump's trade policies, characterized by aggressive tariffs and trade disputes, significantly impacted various sectors of the American economy. The consequences were far-reaching and resulted in both winners and losers.

Winners and Losers of the Trade War

The "trade war," primarily with China, led to significant consequences for specific industries:

- Agriculture: Farmers faced retaliatory tariffs on agricultural exports, leading to substantial losses and government bailout programs.

- Steel and Aluminum: While domestic steel and aluminum producers initially benefited from tariffs, increased input costs for other industries offset some of these gains.

- Manufacturing: Many manufacturing sectors faced increased costs due to tariffs on imported goods, impacting their competitiveness and potentially leading to job losses.

The overall impact on employment was complex, with job losses in some sectors offset by potential gains in others, but the distribution of these effects was highly uneven.

The Impact on Global Trade Relations

Trump's trade policies had a significant impact on global trade relations:

- Increased Trade Tensions: The tariffs sparked trade disputes with numerous countries, disrupting global supply chains and fostering economic uncertainty.

- Damage to International Cooperation: The confrontational approach to trade negotiations damaged relationships with key trading partners, undermining international cooperation on various economic issues.

Deregulation and Its Ramifications

The Trump administration pursued a significant deregulation agenda, impacting various sectors of the economy. While proponents argued that deregulation would stimulate economic growth, the consequences were far-reaching and often debated.

Industries Benefiting from Deregulation

Several industries benefited from reduced regulatory burdens:

- Environmental Regulations: Rollbacks of environmental regulations eased compliance costs for businesses, particularly in the energy and manufacturing sectors.

- Financial Regulations: Relaxing financial regulations reduced compliance burdens for banks and financial institutions.

The immediate economic benefits of deregulation for specific industries were often touted, but long-term consequences required further consideration.

Environmental and Social Costs of Deregulation

The deregulation agenda resulted in significant concerns about potential negative consequences:

- Environmental Damage: Relaxed environmental standards led to increased pollution and concerns about long-term environmental damage.

- Worker Safety Concerns: Reduced workplace safety regulations potentially increased risks for workers.

- Public Health Risks: Weakened public health regulations could have negative consequences for public health and safety.

The trade-offs between short-term economic gains and potential long-term environmental and social costs remain a subject of ongoing debate.

Conclusion

Trump's Economic Agenda had a profound and uneven impact on the American economy. While some sectors and individuals benefited significantly from tax cuts and deregulation, others faced considerable hardship due to trade wars and the erosion of social safety nets. Understanding the complexities of these policies is vital for assessing their long-term consequences. The uneven distribution of benefits and burdens highlights the need for careful consideration of the social and environmental impacts alongside purely economic goals. Continue your research on the lasting effects of Trump's Economic Agenda and engage in thoughtful discussions to ensure a more equitable economic future.

Featured Posts

-

Price Gouging Allegations Surface In La Following Devastating Fires

Apr 22, 2025

Price Gouging Allegations Surface In La Following Devastating Fires

Apr 22, 2025 -

Dojs Renewed Legal Challenge Against Googles Search Monopoly

Apr 22, 2025

Dojs Renewed Legal Challenge Against Googles Search Monopoly

Apr 22, 2025 -

Fsu Security Breach Swift Police Response Fails To Alleviate Student Fears

Apr 22, 2025

Fsu Security Breach Swift Police Response Fails To Alleviate Student Fears

Apr 22, 2025 -

Swedens Tanks Finlands Troops A Look At The Pan Nordic Defense Force

Apr 22, 2025

Swedens Tanks Finlands Troops A Look At The Pan Nordic Defense Force

Apr 22, 2025 -

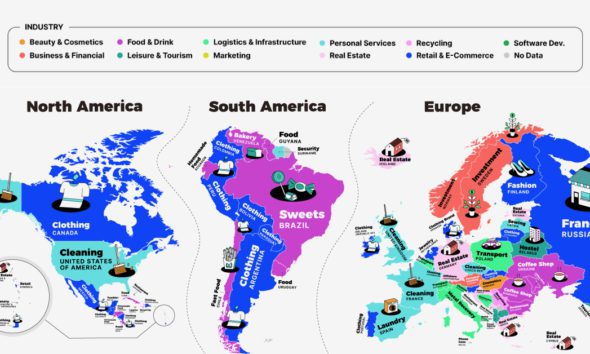

Identifying The Countrys Fastest Growing Business Areas

Apr 22, 2025

Identifying The Countrys Fastest Growing Business Areas

Apr 22, 2025