Trump's Ongoing Feud With Jerome Powell Intensifies: Termination Demand

Table of Contents

The Roots of the Conflict: Differing Economic Philosophies

The Trump-Powell feud stems from fundamentally different economic philosophies. While Trump championed policies aimed at rapid economic growth, often prioritizing short-term gains, Powell focused on maintaining long-term economic stability, even if it meant slower growth in the short term. This core disagreement manifested in several key areas:

- Trump's preference for lower interest rates: Trump repeatedly pressured Powell to lower interest rates, believing this would stimulate economic growth and boost the stock market. He viewed higher interest rates as hindering his "America First" economic agenda.

- Powell's focus on combating inflation: Powell, however, prioritized controlling inflation, arguing that excessively low interest rates could lead to unsustainable price increases and long-term economic instability. This stance often clashed directly with Trump's desire for immediate economic expansion.

- Disagreements over fiscal policy: The conflict extended beyond monetary policy. Trump's significant tax cuts, while aiming to boost economic growth, also contributed to a widening national debt, a concern that Powell frequently highlighted. Trade wars initiated by the Trump administration further complicated the economic landscape, creating uncertainty and adding another layer to their disagreement. These fiscal policy differences fuelled the already existing tensions regarding monetary policy, creating a perfect storm for conflict.

Keywords: monetary policy, interest rates, economic growth, inflation, fiscal policy, economic expansion, tax cuts, trade wars.

Trump's Public Criticism and Attacks on Powell

Trump's dissatisfaction with Powell's monetary policy wasn't expressed privately; it was a consistent theme in his public pronouncements. His criticism was often sharp, personal, and highly visible, leveraging his powerful platform to exert considerable political pressure.

- Examples of direct criticism: Trump frequently labelled Powell's decisions as "terrible" or "disastrous," often using social media platforms like Twitter to amplify his disapproval. His public statements frequently questioned Powell's competence and loyalty.

- Analysis of the tone and intensity: The tone of Trump's attacks consistently bordered on the aggressive, bordering on personal attacks against the Federal Reserve Chair, creating an unprecedented level of political pressure on an independent institution.

- Political implications: Trump's rhetoric had clear political ramifications, undermining confidence in the Federal Reserve's independence and potentially impacting investor confidence in the US economy. This politicization of the central bank raised concerns about the long-term health of democratic institutions.

Keywords: public criticism, Trump's tweets, media appearances, political pressure, Federal Reserve Chair, investor confidence, politicization of the central bank.

The Threat of Termination and its Constitutional Implications

While the President has the power to appoint the Federal Reserve Chair, the ability to remove them is less clear-cut. Trump's repeated threats to remove Powell raised significant constitutional questions.

- Analysis of the legal basis for removal: The Federal Reserve Act doesn't explicitly grant the President the power to remove the Chair for policy disagreements. While the President can remove the Chair for "cause," defining "cause" remains a matter of legal interpretation, subject to potential judicial review.

- Historical precedents of presidential influence over the Fed: While Presidents have historically exerted influence over the Federal Reserve, Trump's level of direct public criticism and pressure was unprecedented, raising concerns about the independence of the central bank and its ability to make decisions free from political pressure.

- Potential consequences of removing Powell: Removing Powell would have likely sent shockwaves through financial markets, increasing economic uncertainty and potentially triggering market volatility. Such a move would raise profound questions about the Fed's independence and its ability to effectively manage the US economy.

Keywords: presidential power, removal of Federal Reserve Chair, constitutional implications, economic uncertainty, market volatility, independence of the central bank.

The Impact on the Economy and Financial Markets

The Trump-Powell feud undeniably impacted economic sentiment and market stability. The ongoing conflict injected uncertainty into an already complex economic environment.

- Impact on interest rates and bond yields: Trump's public pressure campaigns created uncertainty around interest rate decisions and influenced bond yields. The markets reacted to the political climate as much as to economic indicators.

- Effect on the stock market: The constant tension had a noticeable effect on stock market volatility. Investors were unsure how the conflict would resolve, leading to fluctuations and uncertainty.

- Potential impact on international trade and investment: The overall uncertainty caused by the feud undoubtedly influenced international trade and investment decisions. Investors are inherently risk-averse, and this situation created an environment of increased risk perception.

Keywords: investor confidence, market stability, economic outlook, interest rates, stock market, financial markets, international trade, investment.

Conclusion: The Future of Trump's Feud with Jerome Powell

The ongoing feud between Donald Trump and Jerome Powell represents a significant challenge to the stability of the US economy and the independence of the Federal Reserve. The differing economic philosophies, Trump's public attacks, and the threat of termination have all contributed to increased economic uncertainty and market volatility. Understanding the nuances of this Trump-Powell feud is critical for assessing the current economic landscape and making informed financial decisions. Stay tuned for further updates on this crucial development in the Trump-Powell feud, and its impact on the nation's economy. Understanding this ongoing conflict is vital for navigating the complexities of US financial policy.

Featured Posts

-

Record Breaking 9 Homeruns Yankees Dominant Win Judge Leads The Charge

Apr 23, 2025

Record Breaking 9 Homeruns Yankees Dominant Win Judge Leads The Charge

Apr 23, 2025 -

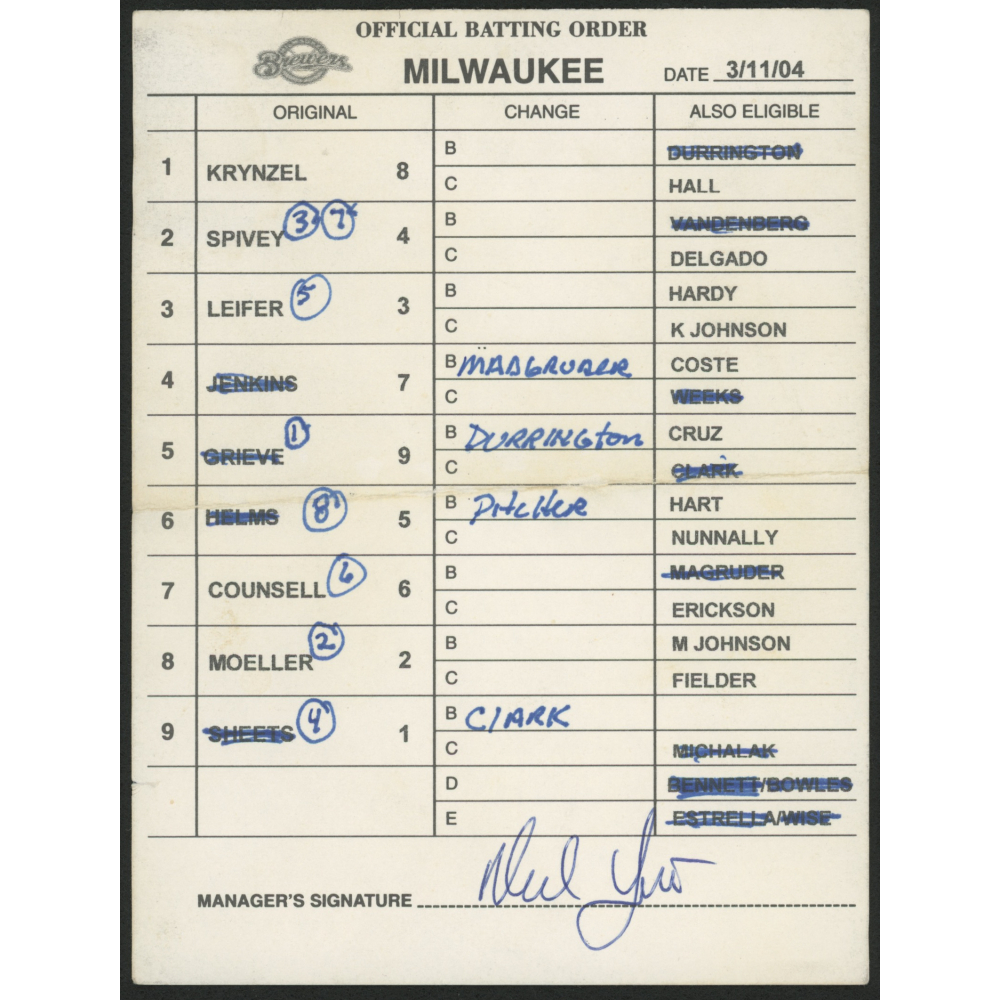

Brewers Batting Order Shakeup Addressing Offensive Inconsistency

Apr 23, 2025

Brewers Batting Order Shakeup Addressing Offensive Inconsistency

Apr 23, 2025 -

Brewers Surprise Unexpected Clutch Hitting In 2025 Season

Apr 23, 2025

Brewers Surprise Unexpected Clutch Hitting In 2025 Season

Apr 23, 2025 -

Fan Graphs Power Rankings March 27th April 6th Update

Apr 23, 2025

Fan Graphs Power Rankings March 27th April 6th Update

Apr 23, 2025 -

Mlb Umpiring Controversy Tigers Manager Hinch Demands Replay Evidence

Apr 23, 2025

Mlb Umpiring Controversy Tigers Manager Hinch Demands Replay Evidence

Apr 23, 2025