Trump's Trade War: A Threat To US Financial Leadership

Table of Contents

Increased Uncertainty and Market Volatility

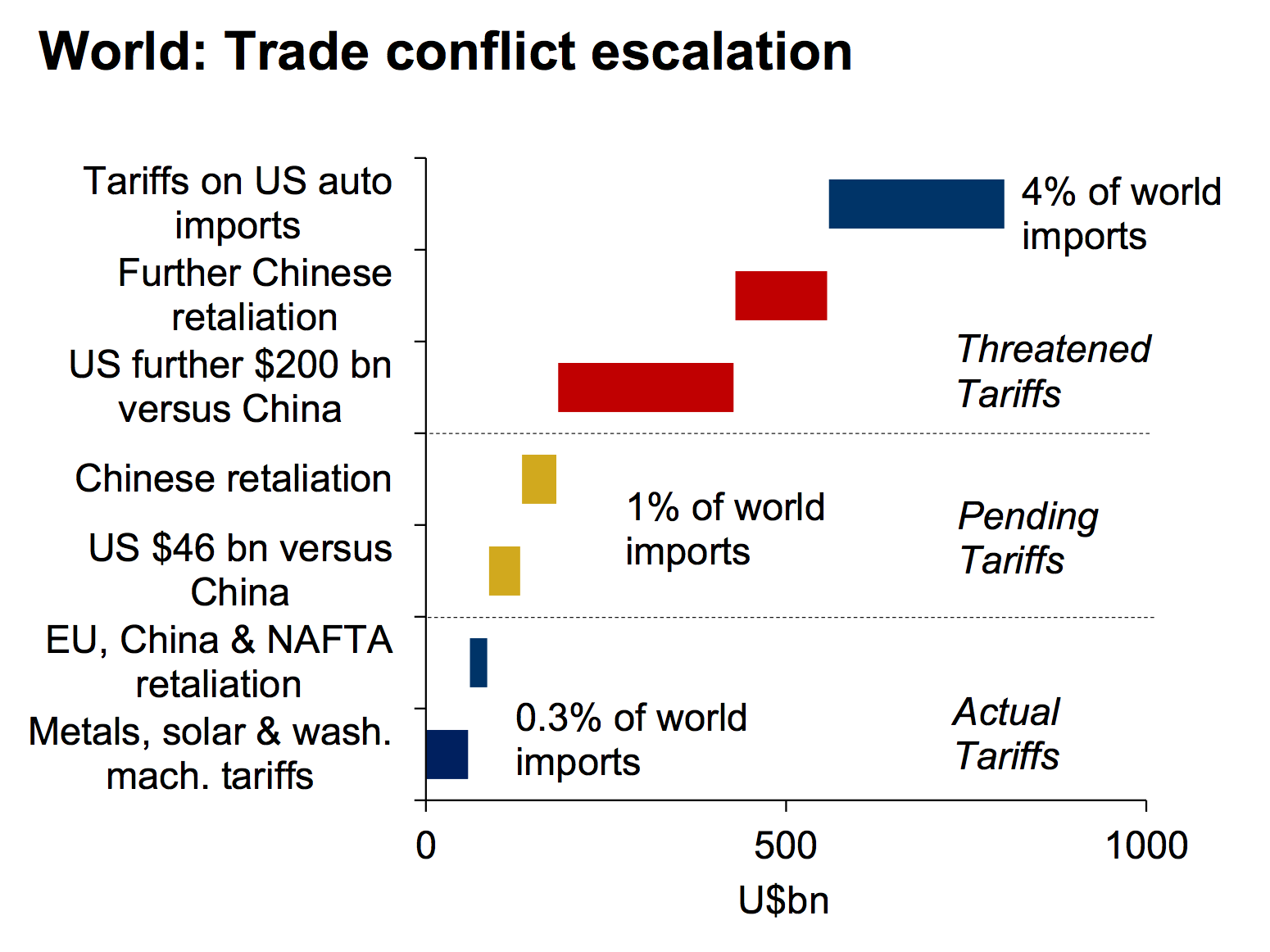

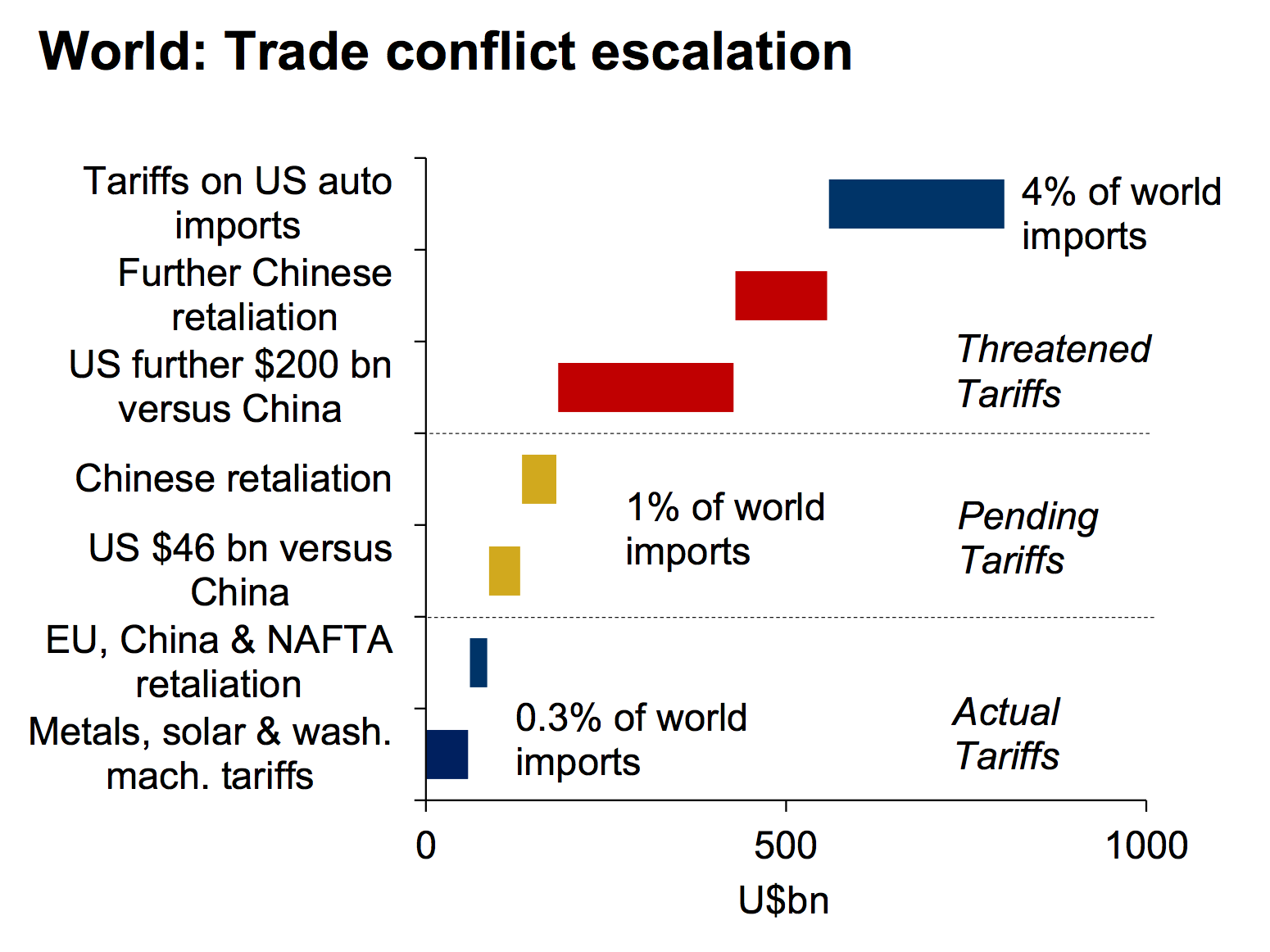

Trump's trade war unleashed a wave of uncertainty across global markets, significantly impacting investor confidence. The unpredictable nature of tariff announcements and retaliatory measures created a volatile environment, hindering long-term investment planning and dampening economic growth.

- Increased tariffs: These led to higher prices for consumers and businesses, reducing purchasing power and increasing the cost of production.

- Disrupted supply chains: Trade disputes caused significant disruptions to global supply chains, leading to production delays, shortages, and increased costs for businesses reliant on international trade.

- Decreased investment: Investor uncertainty, fueled by trade tensions, resulted in decreased investment in both domestic and international markets, contributing to an overall economic slowdown.

- Dollar fluctuations: The value of the dollar experienced significant fluctuations due to the trade war, reflecting the increased uncertainty surrounding the US economy and its global role.

This market volatility led to a flight of capital towards safer havens, such as government bonds in countries perceived as more stable, further eroding confidence in the US economy and impacting its financial leadership. The increased uncertainty undermined the very foundation of stable, predictable markets, crucial for the long-term health of the US financial system.

Damage to US International Relations and Alliances

The trade war inflicted considerable damage on US relationships with key trading partners, undermining decades of built trust and cooperation. The aggressive imposition of tariffs and the frequent use of protectionist measures alienated many nations.

- Strained relationships: The trade war severely strained relationships with China, the European Union, Canada, Mexico, and other important trading partners.

- Erosion of trust: The unilateral approach to trade negotiations eroded trust in US economic leadership and commitment to multilateral trade agreements, like the World Trade Organization (WTO).

- Retaliatory tariffs: Retaliatory tariffs imposed by other countries harmed US businesses and farmers, leading to job losses and reduced agricultural exports.

- Weakened alliances: The trade war weakened key alliances and diminished international cooperation on critical economic issues, hindering efforts to address global challenges collaboratively.

These damaged relationships have long-term consequences for US economic influence. A less collaborative and more confrontational approach to trade undermines the very foundations of a strong global economic order, in which the US has historically played a leading role.

Impact on the Dollar's Global Reserve Currency Status

The trade war's potential to diminish the dollar's dominance as the world's primary reserve currency cannot be ignored. The increased uncertainty surrounding US trade policy and the growing reliance on alternative payment systems pose a significant challenge to the dollar's hegemony.

- Increased reliance on other currencies: Countries increasingly sought to diversify their foreign exchange reserves and reduce their dependence on the dollar for international trade, leading to a rise in the use of the Euro, the Yuan, and other currencies.

- Shift in global power dynamics: The trade war accelerated the development of alternative payment systems, potentially challenging the dollar's central role in global finance.

- Decreased demand for US Treasury bonds: Uncertainty surrounding US trade policy and the overall economic outlook led to a decreased demand for US Treasury bonds, impacting the dollar's value and its attractiveness as a safe haven asset.

- Erosion of the dollar's perceived stability: The volatile nature of the US economy, fueled by trade disputes, contributed to an erosion of the dollar's perceived stability and value.

A decline in the dollar's global dominance would have profound implications for the US economy, impacting its ability to borrow at low interest rates, influencing its ability to finance its national debt, and potentially leading to a loss of economic influence on the world stage.

Long-Term Consequences for US Economic Leadership

Trump's trade war has left lasting scars on the US economy and its global financial position. The short-sighted focus on protectionism undermined long-term economic growth and weakened the country's global competitiveness.

- Slower economic growth: Reduced trade and investment due to the trade war contributed to slower economic growth, impacting job creation and overall prosperity.

- Loss of competitiveness: The trade war harmed the competitiveness of US businesses, especially those reliant on global supply chains, hindering their ability to compete in international markets.

- Increased vulnerability: The trade war increased the US economy's vulnerability to economic shocks, as it became more isolated and less integrated into the global economy.

- Damaged reputation: The erratic and protectionist approach to trade damaged the US reputation as a reliable and predictable trading partner, undermining its credibility in the global economic community.

These long-term consequences demand a reassessment of US economic policy and its role in the global economy. A more balanced and collaborative approach to trade is essential for restoring US economic leadership and securing its future prosperity.

Conclusion: Trump's Trade War and the Future of US Financial Leadership

Trump's trade war presented a clear and present danger to US financial leadership. The consequences – increased market volatility, severely damaged international relations, and a potential decline in the dollar's dominance – underscore the high costs of protectionist trade policies. The unpredictable nature of the trade war significantly undermined investor confidence and hampered economic growth, both domestically and globally. To secure and strengthen US financial leadership, a renewed commitment to multilateralism, a predictable and transparent trade policy, and a collaborative approach to global economic challenges are vital. We urge readers to engage with relevant organizations, such as the Peterson Institute for International Economics and the Brookings Institution, and contact your elected officials to advocate for sound trade policies that prioritize sustainable global economic growth and US global financial dominance. The future of US economic leadership depends on it.

Featured Posts

-

Joint Nordic Defense The Role Of Sweden And Finlands Military Assets

Apr 22, 2025

Joint Nordic Defense The Role Of Sweden And Finlands Military Assets

Apr 22, 2025 -

Strengthening Bilateral Security Recent Developments Between China And Indonesia

Apr 22, 2025

Strengthening Bilateral Security Recent Developments Between China And Indonesia

Apr 22, 2025 -

The Difficulties Of Automating Nike Sneaker Assembly

Apr 22, 2025

The Difficulties Of Automating Nike Sneaker Assembly

Apr 22, 2025 -

How Is A New Pope Chosen A Comprehensive Guide To Papal Conclaves

Apr 22, 2025

How Is A New Pope Chosen A Comprehensive Guide To Papal Conclaves

Apr 22, 2025 -

Strengthening Nordic Security The Potential Of A Swedish Finnish Partnership

Apr 22, 2025

Strengthening Nordic Security The Potential Of A Swedish Finnish Partnership

Apr 22, 2025