Understanding High Stock Market Valuations: A BofA Analysis

Table of Contents

BofA's Perspective on Current Market Conditions

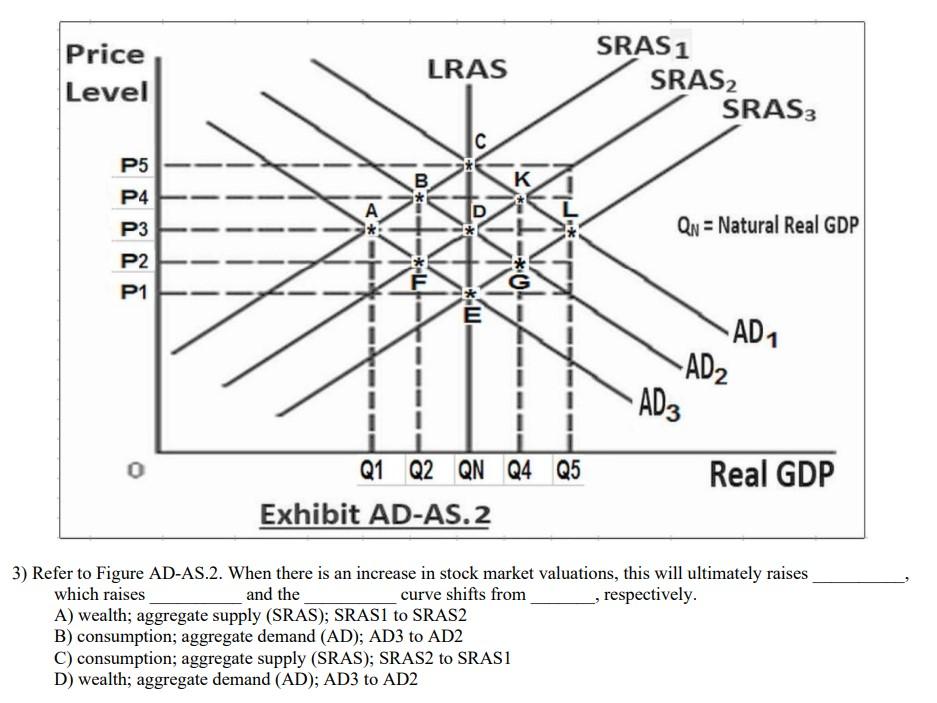

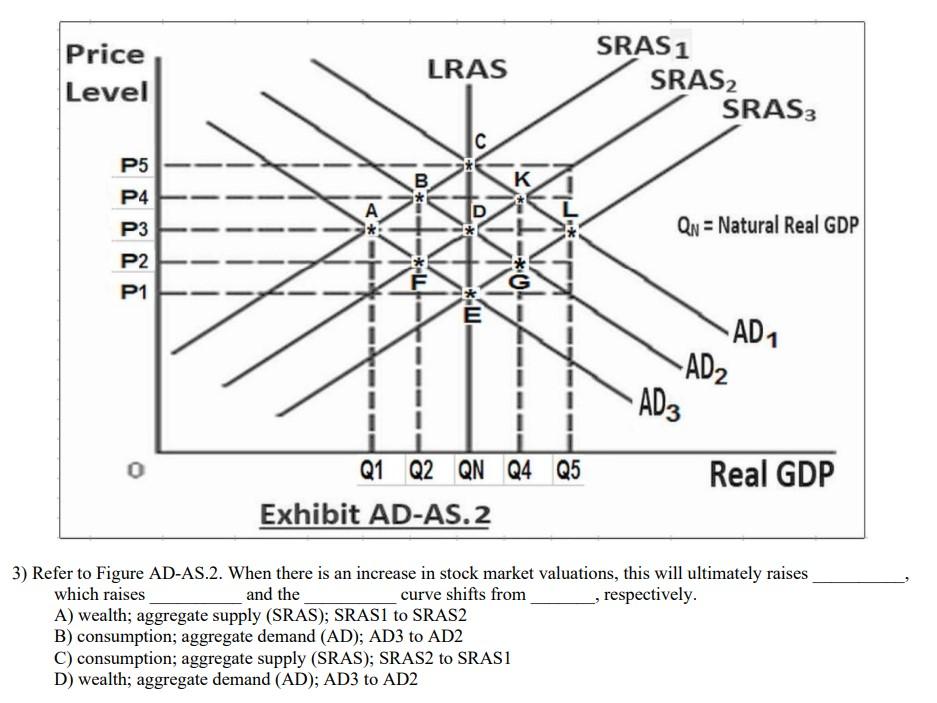

BofA's analysis considers a multitude of factors driving current market conditions and influencing high stock market valuations.

Macroeconomic Factors Influencing Valuations:

Several macroeconomic factors contribute significantly to the current market landscape. BofA's research highlights the following:

- Low Interest Rates: Historically low interest rates have fueled borrowing and investment, pushing up asset prices, including stocks. This makes alternative investments less attractive, increasing demand for equities.

- Inflation Expectations: While inflation has been a concern, BofA's analysis might indicate that moderate inflation, if managed effectively, can support economic growth and positively impact corporate earnings, justifying higher valuations. However, unexpectedly high inflation presents a significant risk.

- Economic Growth Forecasts: Positive economic growth forecasts, even if modest, can bolster investor confidence and drive stock prices higher. BofA's projections regarding future economic growth are crucial to understanding the sustainability of current valuations.

- Government Stimulus: Government spending and stimulus packages can inject liquidity into the market, boosting demand and contributing to higher valuations. BofA's assessment of the impact of these measures on market valuations is a key element.

- Geopolitical Risks: Geopolitical uncertainty, such as trade wars or international conflicts, can impact investor sentiment. BofA's analysis likely incorporates assessments of these risks and their potential impact on market stability and valuations.

These macroeconomic factors interact to influence market sentiment and investor confidence, ultimately affecting stock pricing and contributing to the current high valuations.

The Role of Central Bank Policies:

Central bank policies, particularly monetary policy and quantitative easing (QE), play a significant role in shaping stock market valuations. BofA's analysis likely emphasizes the following:

- Monetary Policy: Low interest rates and other accommodative monetary policies implemented by central banks globally have created a supportive environment for stock market growth. However, this can also fuel asset bubbles.

- Quantitative Easing (QE): The injection of liquidity into the financial system through QE programs can inflate asset prices, contributing to high valuations. BofA's research likely assesses the long-term effects of QE on market stability.

The risks associated with these policies, such as inflation and the potential for asset bubbles, are crucial considerations in understanding the sustainability of high stock market valuations. BofA's analysis would provide crucial insights into these risks.

Analyzing Valuation Metrics

Understanding the current market situation requires a thorough analysis of key valuation metrics.

Price-to-Earnings Ratio (P/E) Analysis:

The Price-to-Earnings ratio (P/E ratio) is a fundamental valuation metric that compares a company's stock price to its earnings per share. A high P/E ratio generally indicates that investors are willing to pay a premium for a company's earnings, reflecting high expectations for future growth. BofA's analysis would compare current P/E ratios across various sectors to historical averages to determine whether valuations are justified. However, it's crucial to remember that the P/E ratio alone cannot provide a complete picture of a company's valuation.

Other Key Valuation Metrics:

Beyond the P/E ratio, several other valuation metrics offer a more comprehensive assessment:

- Price-to-Sales Ratio (P/S Ratio): This compares a company's market capitalization to its revenue. It is useful for valuing companies with negative earnings.

- Price-to-Book Ratio (P/B Ratio): This compares a company's market capitalization to its book value (assets minus liabilities). It helps assess whether a company is undervalued or overvalued relative to its net asset value.

- Dividend Yield: This indicates the annual dividend payment relative to the stock price. It's a measure of income return for investors.

BofA's analysis likely incorporates a comparison of these metrics to provide a holistic view of market valuations and identify potential overvaluation or undervaluation in specific sectors.

Risks Associated with High Stock Market Valuations

Despite the factors supporting current high valuations, several risks remain.

Potential for Market Corrections:

High valuations inherently increase the potential for market corrections or even crashes. Overvalued assets are particularly vulnerable to sharp price declines when investor sentiment shifts. BofA's analysis likely incorporates scenarios outlining potential market corrections and their potential impact on different asset classes.

Impact of Interest Rate Hikes:

Central banks may increase interest rates to combat inflation, significantly impacting stock valuations. Higher interest rates reduce the attractiveness of stocks relative to bonds and can lead to decreased company profitability and reduced investor appetite for riskier assets. BofA's forecasts regarding interest rate hikes and their impact on the market are essential in assessing the long-term outlook.

Conclusion: Understanding High Stock Market Valuations: A BofA Analysis

This analysis, informed by BofA's research, has explored the multifaceted nature of high stock market valuations. While macroeconomic factors like low interest rates and government stimulus have contributed to the current environment, a careful examination of valuation metrics such as the P/E ratio, P/S ratio, and P/B ratio reveals potential vulnerabilities. The risks of market corrections and the impact of potential interest rate hikes necessitate a cautious approach. Investors need to carefully consider these factors and their own risk tolerance. To make informed investment decisions based on your understanding of high stock market valuations, conduct thorough research, consult with financial advisors, and consider further reading from BofA's research publications. Remember that understanding high stock market valuations is a continuous process requiring diligent monitoring of market trends and economic indicators.

Featured Posts

-

Nine Revelations From Times Trump Interview Canada Annexation Xis Calls And Presidential Term Limits

Apr 28, 2025

Nine Revelations From Times Trump Interview Canada Annexation Xis Calls And Presidential Term Limits

Apr 28, 2025 -

Yankees Aaron Judge And The 2025 Push Up Goal Symbolism And Speculation

Apr 28, 2025

Yankees Aaron Judge And The 2025 Push Up Goal Symbolism And Speculation

Apr 28, 2025 -

New York Yankees Star Aaron Judge Becomes A Father First Child Arrives

Apr 28, 2025

New York Yankees Star Aaron Judge Becomes A Father First Child Arrives

Apr 28, 2025 -

Predicting The Mets Opening Day Roster A Spring Training Week 1 Analysis

Apr 28, 2025

Predicting The Mets Opening Day Roster A Spring Training Week 1 Analysis

Apr 28, 2025 -

Nascar Phoenix Race Bubba Wallace Suffers Brake Failure Crashes

Apr 28, 2025

Nascar Phoenix Race Bubba Wallace Suffers Brake Failure Crashes

Apr 28, 2025