Understanding The Canadian Dollar's Divergent Performance In The Forex Market

Table of Contents

The Impact of Commodity Prices on the CAD

Canada's economy is heavily reliant on the export of natural resources. Fluctuations in global commodity prices, therefore, directly and significantly impact the CAD's value. The country's robust energy sector, particularly oil and gas production, plays a pivotal role. Higher commodity prices generally strengthen the CAD, attracting foreign investment and increasing demand, while lower prices weaken it.

-

Oil price volatility: The USD/CAD exchange rate often moves inversely with oil prices. A surge in crude oil prices typically boosts the CAD, while a decline weakens it. This strong correlation makes oil a key factor to watch for anyone trading the Canadian dollar.

-

Other commodities: Canada's exports extend beyond oil. Fluctuations in the prices of lumber, potash (a crucial fertilizer), and various metals also influence the CAD. For instance, a global increase in demand for lumber will positively affect the Canadian dollar.

-

Global demand: Changes in global demand for Canadian commodities directly influence their prices and, consequently, the CAD's value. A global recession, for example, could dampen demand, leading to lower commodity prices and a weaker CAD.

The Role of Interest Rate Differentials

The Bank of Canada's monetary policy decisions significantly influence the CAD's value in the forex market. Higher interest rates in Canada compared to other major economies, such as the US, attract foreign investment. This increased demand for the CAD strengthens its value against other currencies, particularly the USD. Conversely, interest rate cuts can weaken the Canadian dollar.

-

Comparison with US interest rates: The interest rate differential between Canada and the US is particularly crucial for the USD/CAD exchange rate. If Canadian interest rates are higher, the USD/CAD pair will likely decrease (CAD strengthens).

-

Impact of interest rate announcements: Market reactions to Bank of Canada interest rate announcements are swift and substantial. Unexpected changes in the policy rate can cause significant short-term volatility in the CAD.

-

Long-term interest rate trends: Sustained high or low interest rate trends have a profound impact on the long-term value of the CAD. A period of consistently high rates can attract substantial foreign investment, boosting the CAD's value over time.

Geopolitical Factors and their Influence

Geopolitical events and political stability within Canada and globally can significantly influence investor sentiment and the CAD's value. Periods of global uncertainty, such as trade wars or political instability, often lead to a weakening of the Canadian dollar as investors seek safer havens.

-

Impact of trade agreements: Trade agreements like the United States-Mexico-Canada Agreement (USMCA) have a direct impact on the CAD. Positive developments and smooth trade relations usually support the currency's value.

-

Global economic crises: Global economic downturns, such as the 2008 financial crisis, generally weaken the CAD as investor confidence diminishes and demand for Canadian assets falls.

-

Political risk in Canada: Domestic political instability or uncertainty can also negatively affect investor confidence, leading to a weaker CAD.

Analyzing the CAD's Performance Against Other Major Currencies

Understanding the CAD's performance against other major currencies (EUR/CAD, GBP/CAD, JPY/CAD) provides a more comprehensive picture of its overall strength or weakness. Comparing these currency pairs helps traders and investors identify potential trading opportunities and diversify their portfolios.

-

Comparing USD/CAD, EUR/CAD, and GBP/CAD: Analyzing the relative strength of the CAD against these major currencies provides a broader context for assessing its overall value.

-

Using technical and fundamental analysis: Employing technical analysis (chart patterns, indicators) and fundamental analysis (economic data, interest rates) helps predict CAD movements and make informed trading decisions.

-

Diversification strategies for CAD trading: Diversifying investments across various currency pairs can help mitigate the risks associated with the CAD's volatility.

Conclusion

The Canadian dollar's performance in the forex market is a complex interplay of commodity prices, interest rate differentials, and geopolitical factors. Understanding these key drivers is crucial for anyone involved in forex trading or investing in Canadian assets. By carefully analyzing these factors and employing sound trading strategies, you can improve your ability to predict and potentially profit from the Canadian dollar's divergent performance. Learn more about successfully trading the Canadian Dollar by exploring our resources on currency trading strategies and risk management.

Featured Posts

-

Exclusive Preview Posters And Photos From John Travoltas High Rollers

Apr 24, 2025

Exclusive Preview Posters And Photos From John Travoltas High Rollers

Apr 24, 2025 -

Lg C3 77 Inch Oled A Detailed Buyers Guide

Apr 24, 2025

Lg C3 77 Inch Oled A Detailed Buyers Guide

Apr 24, 2025 -

1 050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

Apr 24, 2025

1 050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

Apr 24, 2025 -

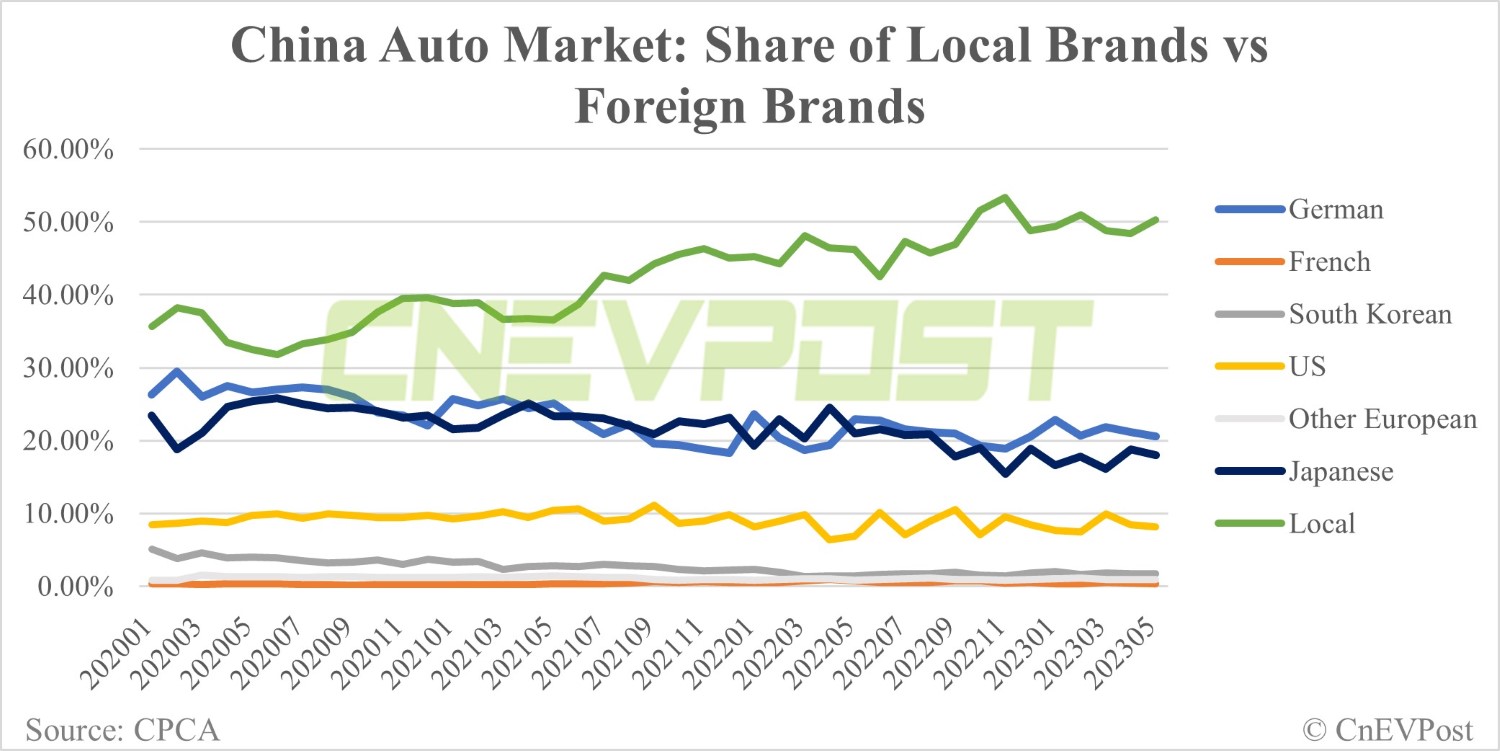

The Chinese Auto Market A Critical Assessment Of Bmw And Porsches Performance

Apr 24, 2025

The Chinese Auto Market A Critical Assessment Of Bmw And Porsches Performance

Apr 24, 2025 -

Market Analysis How Trump And The Fed Are Affecting The Bitcoin Price Btc

Apr 24, 2025

Market Analysis How Trump And The Fed Are Affecting The Bitcoin Price Btc

Apr 24, 2025