US Stock Futures Surge: Trump's Powell Remarks Boost Markets

Table of Contents

Trump's Positive Assessment of Powell and the Fed's Actions

President Trump's recent statements about Chairman Powell marked a notable departure from his previous criticisms. Instead of his usual harsh rhetoric, Trump offered a more conciliatory tone, praising the Fed's actions and expressing confidence in Powell's leadership. While specific quotes are still emerging, the general sentiment conveyed was one of approval and collaboration. This shift in rhetoric is particularly significant considering the history of tense relations between the two. The previous discord had created considerable uncertainty in the markets, leading to periods of volatility. This newfound harmony, however subtle, significantly impacted investor confidence, leading to the observed market surge.

- Specific quote from Trump about Powell: (Insert actual quote here once available. Example: "I have great respect for Chairman Powell and the work the Fed is doing to support our economy." )

- Mention of any policy changes indicated or implied by Trump's remarks: (Insert details on any implied policy shifts. Example: Trump's comments may suggest a lessened likelihood of future interest rate cuts or other significant policy changes.)

- Analysis of the market's reaction to the statement: The market responded almost immediately, with futures contracts exhibiting a sharp upward trajectory, reflecting a significant boost in investor confidence.

Market Reaction and Impact on Key Sectors

The positive sentiment fueled by Trump's remarks translated into substantial gains across major stock indices. The Dow Jones Industrial Average saw a significant percentage increase ( Insert percentage here, e.g., a 2% jump), followed by similar gains in the S&P 500 (Insert percentage here) and the Nasdaq (Insert percentage here). This widespread positive reaction demonstrates the pervasive influence of the President's statements on market sentiment.

Different sectors reacted with varying degrees of enthusiasm. The technology sector, often a bellwether for market performance, experienced particularly strong gains (Insert percentage and reasoning here). Financial stocks also saw significant increases (Insert percentage and reasoning here), reflecting investor optimism about future economic growth. However, not all sectors fared equally well. (Mention any underperforming sectors and provide reasons.)

- Percentage change in major indices: (Insert specific percentage changes for Dow, S&P 500, and Nasdaq)

- Top performing sectors and reasons for their gains: (Detail top performing sectors and the rationale behind their gains.)

- Potential risks and future outlook for various sectors: (Discuss potential risks and uncertainties that could impact various sectors.)

Expert Analysis and Future Predictions for US Stock Futures

Financial analysts and economists have offered mixed perspectives on the longevity of this market surge. While some view this as a temporary boost driven primarily by Trump's comments, others believe it reflects a more fundamental shift in investor confidence. (Insert quotes from renowned financial experts here, attributing them properly.)

The long-term implications remain uncertain, dependent on numerous factors, including upcoming economic data releases and geopolitical developments. The continuing trade negotiations and the overall global economic climate will play crucial roles in shaping future market trends.

- Quotes from key financial experts: (Include quotes from at least two prominent financial experts, providing context and attribution.)

- Predictions for short-term and long-term market trends: (Summarize expert predictions for short-term and long-term market trends.)

- Potential risks and uncertainties that could affect future market performance: (Outline potential risks and uncertainties that could influence future market performance.)

Conclusion: Understanding the US Stock Futures Surge and Future Outlook

This significant "US Stock Futures Surge" underscores the profound impact of political statements on market sentiment. President Trump's unexpectedly positive assessment of Chairman Powell and the Fed's actions injected a much-needed dose of optimism into the markets, leading to substantial gains across major indices. While the long-term effects remain to be seen, the immediate reaction highlights the interconnectedness of political rhetoric, investor confidence, and market performance. The sustained growth will depend on multiple factors, and continued monitoring is crucial.

Stay tuned for more updates on US stock futures and how Trump's comments continue to impact markets. Follow us for the latest analysis on this evolving situation and to gain insights into navigating the complexities of the US stock market. Understanding US stock futures requires staying informed about political developments and economic indicators.

Featured Posts

-

The Bold And The Beautiful April 3 Recap Liams Collapse After Exploding Argument With Bill

Apr 24, 2025

The Bold And The Beautiful April 3 Recap Liams Collapse After Exploding Argument With Bill

Apr 24, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 24, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

Apr 24, 2025 -

Credit Card Companies Feel The Pinch Consumers Cut Back On Nonessential Spending

Apr 24, 2025

Credit Card Companies Feel The Pinch Consumers Cut Back On Nonessential Spending

Apr 24, 2025 -

Fundraising Intensifies As Elite Universities Navigate Trump Era Funding Cuts

Apr 24, 2025

Fundraising Intensifies As Elite Universities Navigate Trump Era Funding Cuts

Apr 24, 2025 -

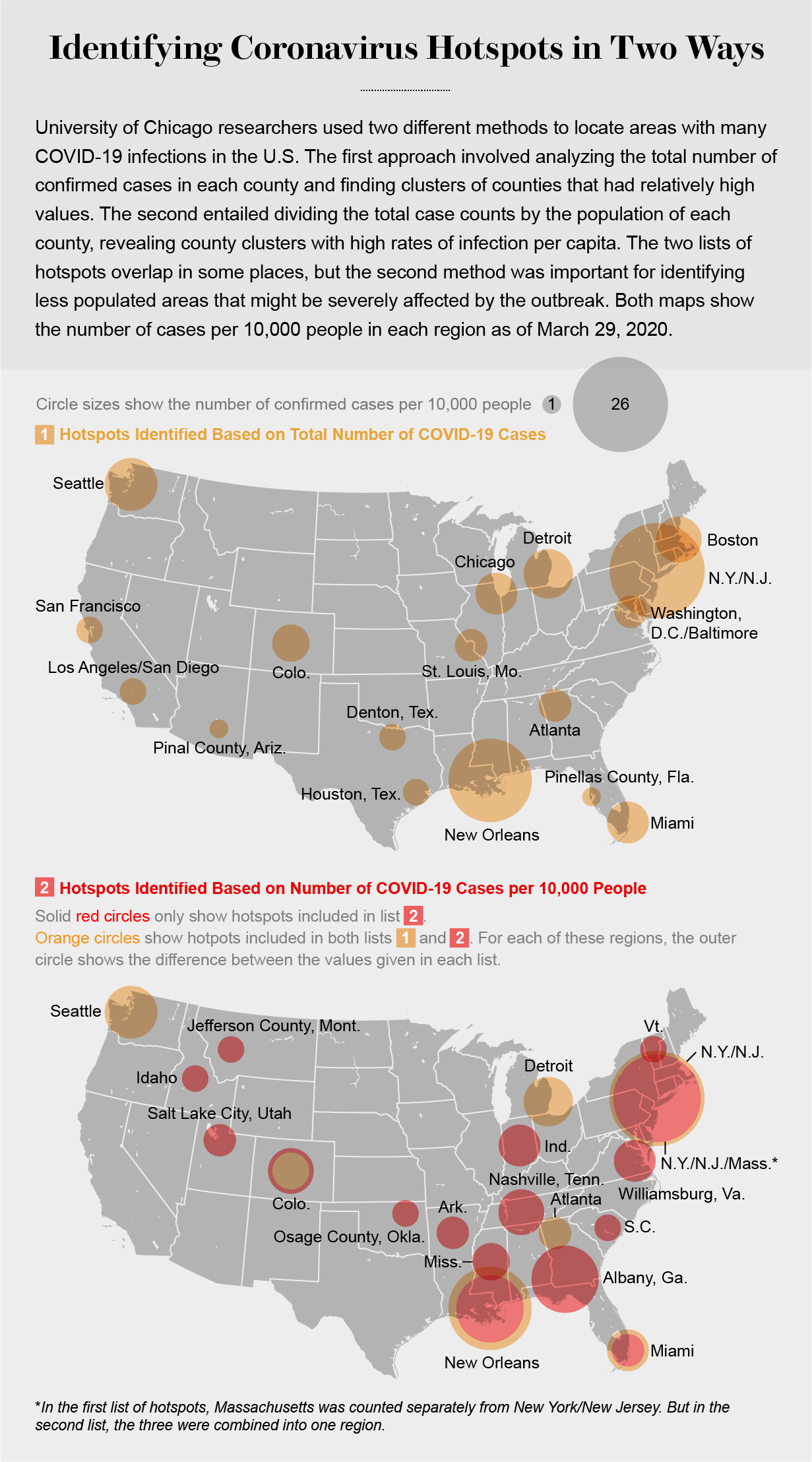

Mapping The Rise Of New Business Hot Spots Across The Nation

Apr 24, 2025

Mapping The Rise Of New Business Hot Spots Across The Nation

Apr 24, 2025