USD Gains Momentum: Trump's Change In Tone Impacts Dollar's Performance Against Major Currencies

Table of Contents

Trump's Shift in Tone and its Market Impact

President Trump's recent public statements regarding trade deals, tariffs, and the Federal Reserve have undergone a noticeable transformation. This change in tone has significantly impacted market sentiment and the value of the USD.

-

Reduced aggressive rhetoric on trade wars: Trump's previous pronouncements on imposing significant tariffs and engaging in aggressive trade disputes created considerable uncertainty in the markets. The recent reduction in this aggressive rhetoric has been interpreted as a move towards greater stability and predictability.

-

More conciliatory approach towards international negotiations: A shift towards more diplomatic and cooperative negotiations with key trading partners has eased concerns about potential disruptions to global supply chains and economic activity. This improved outlook has boosted investor confidence in the USD.

-

Less criticism of the Federal Reserve's monetary policy: Trump's past criticism of the Federal Reserve and its chair, Jerome Powell, had introduced an element of political uncertainty into monetary policy decisions. A more restrained approach in this area has lessened market anxieties and contributed to a more stable environment for the USD.

These shifts are perceived by the market as signs of increased stability and reduced political risk. This increased confidence translates directly into higher demand for the USD, driving its value upwards against other major currencies. As noted by analysts at Goldman Sachs, "The reduced uncertainty surrounding US trade policy has been a key driver of the recent USD strength." The impact on investor sentiment is undeniable; risk appetite has increased, further fueling the demand for the safe-haven asset that is the US Dollar.

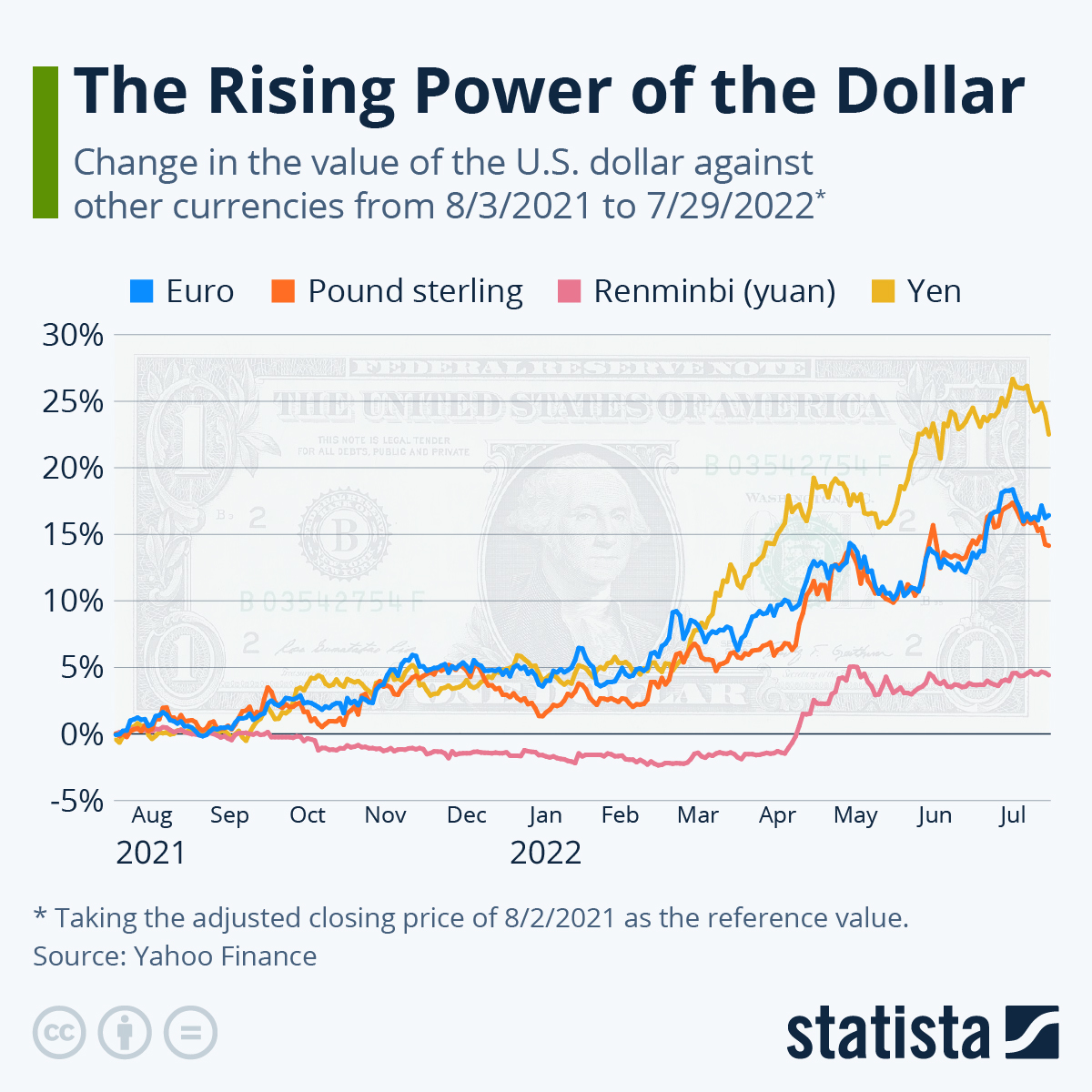

USD Strength Against Major Currencies

Since the noticeable change in Trump's tone, the USD has strengthened considerably against several major currencies.

-

USD/EUR exchange rate: The USD has appreciated against the Euro, reflecting a shift in investor confidence towards the US economy and away from the Eurozone's economic challenges.

-

USD/GBP exchange rate: The USD has also gained ground against the British Pound, partly influenced by Brexit-related uncertainties continuing to weigh on the GBP.

-

USD/JPY exchange rate: While the USD/JPY exchange rate is influenced by various factors, including interest rate differentials, the increased stability in US policy has contributed to its upward trend.

-

Comparison with previous periods of instability: Comparing the current USD performance with periods of heightened trade tensions reveals a stark contrast. The calmer geopolitical environment has fostered a more stable and predictable exchange rate environment for the USD.

It is crucial to note, however, that factors beyond Trump's statements contribute to USD strength. Interest rate differentials between the US and other countries, as well as global economic conditions, play significant roles. The relative strength of the US economy compared to others also contributes to the appeal of the USD.

Implications for Investors

The strengthening USD has significant implications for various investor groups:

-

Impact on US exporters' competitiveness: A stronger USD makes US exports more expensive in foreign markets, potentially impacting the competitiveness of US companies in global trade.

-

Impact on import costs for US consumers: Conversely, a stronger USD makes imports cheaper for US consumers, potentially leading to lower prices for certain goods.

-

Opportunities and risks for currency traders: Currency traders can leverage the USD's volatility to generate profits through strategic trading positions, but it's essential to manage risk effectively.

Investors should carefully consider the implications of a stronger USD for their portfolios. Hedging strategies and diversification are crucial to mitigate potential risks associated with currency fluctuations.

Long-Term Outlook and Uncertainties

The sustainability of the current USD strength remains uncertain. Several factors could potentially reverse the trend:

-

Potential for renewed trade tensions: A resurgence of trade disputes or protectionist measures could quickly erode investor confidence and weaken the USD.

-

Impact of future economic data releases: Disappointing economic data from the US could trigger a sell-off in the USD, as investors reassess their outlook for the US economy.

-

Unpredictability of political developments: Unexpected political events, both domestically and internationally, can significantly impact the USD's value.

The long-term outlook for the USD requires a balanced perspective. While the recent strengthening is notable, it's essential to acknowledge the inherent uncertainties in predicting currency movements.

Conclusion

In summary, President Trump's shift in tone regarding trade and economic policy has undeniably contributed to the recent surge in the USD's value against major currencies. This has brought about significant implications for investors, exporters, importers, and currency traders. While the current strength of the USD offers opportunities, uncertainties remain, highlighting the need for careful risk management and a keen awareness of the many factors influencing the USD's future trajectory. Stay informed about the latest developments impacting the USD and global currency markets. Regularly monitor exchange rates and consult financial experts to make informed decisions about your investments in this volatile landscape of the USD and other major currencies. Understand the factors driving USD strength and its long-term implications to navigate the complexities of the Forex market effectively.

Featured Posts

-

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Strategic Responses

Apr 24, 2025

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Strategic Responses

Apr 24, 2025 -

California Gas Prices Governor Newsom Seeks Industry Collaboration To Lower Costs

Apr 24, 2025

California Gas Prices Governor Newsom Seeks Industry Collaboration To Lower Costs

Apr 24, 2025 -

Ella Bleu Travoltas Dazzling Makeover At 24

Apr 24, 2025

Ella Bleu Travoltas Dazzling Makeover At 24

Apr 24, 2025 -

Ftc To Appeal Activision Blizzard Merger Decision Implications For The Gaming Industry

Apr 24, 2025

Ftc To Appeal Activision Blizzard Merger Decision Implications For The Gaming Industry

Apr 24, 2025 -

Creating Voice Assistants Made Easy Open Ais Latest Announcement

Apr 24, 2025

Creating Voice Assistants Made Easy Open Ais Latest Announcement

Apr 24, 2025