USD Strengthens: Dollar Gains Against Major Currencies As Trump Softens Stance On Fed

Table of Contents

Trump's Shift in Fed Policy Rhetoric and its Market Impact

President Trump's previous outspoken criticisms of the Federal Reserve, particularly regarding interest rate hikes, had created considerable uncertainty in the market and negatively impacted the US dollar. His frequent pronouncements, often via Twitter, painted the Fed as an obstacle to economic growth, leading to investor anxieties about policy inconsistency.

However, recently, President Trump has noticeably moderated his tone towards the central bank. This shift, observed in recent speeches and less frequent public rebukes, suggests a change in his approach. For example, [insert specific example of a recent speech or statement where Trump softened his stance on the Fed]. This altered rhetoric represents a significant departure from his past behavior.

- Immediate Market Reaction: Following this shift, the USD experienced an almost immediate surge against major currencies like the Euro and Yen.

- Investor and Analyst Response: Financial analysts largely interpreted this change as a positive sign, indicating less political interference in monetary policy. "[Insert quote from a reputable financial analyst about the market reaction to Trump's change in stance]," stated [Analyst's Name and Affiliation].

- Implications for Future Fed Policy: This change in tone could signal more predictable and consistent monetary policy decisions from the Fed, potentially fostering greater investor confidence and further strengthening the USD.

Global Economic Factors Contributing to USD Strength

The current global economic climate is playing a significant role in the USD's strength. Several factors are driving investors towards the perceived safety and stability of the US dollar:

- Geopolitical Uncertainties: Ongoing trade tensions and political instability in various parts of the world are making investors seek refuge in the historically safe-haven asset, the US dollar.

- Relative US Economic Strength: Compared to some major economies struggling with slower growth or economic uncertainty, the US economy, while facing its own challenges, is perceived as relatively robust.

- Interest Rate Differentials: Higher interest rates in the US compared to other developed nations make USD-denominated assets more attractive to international investors seeking higher returns.

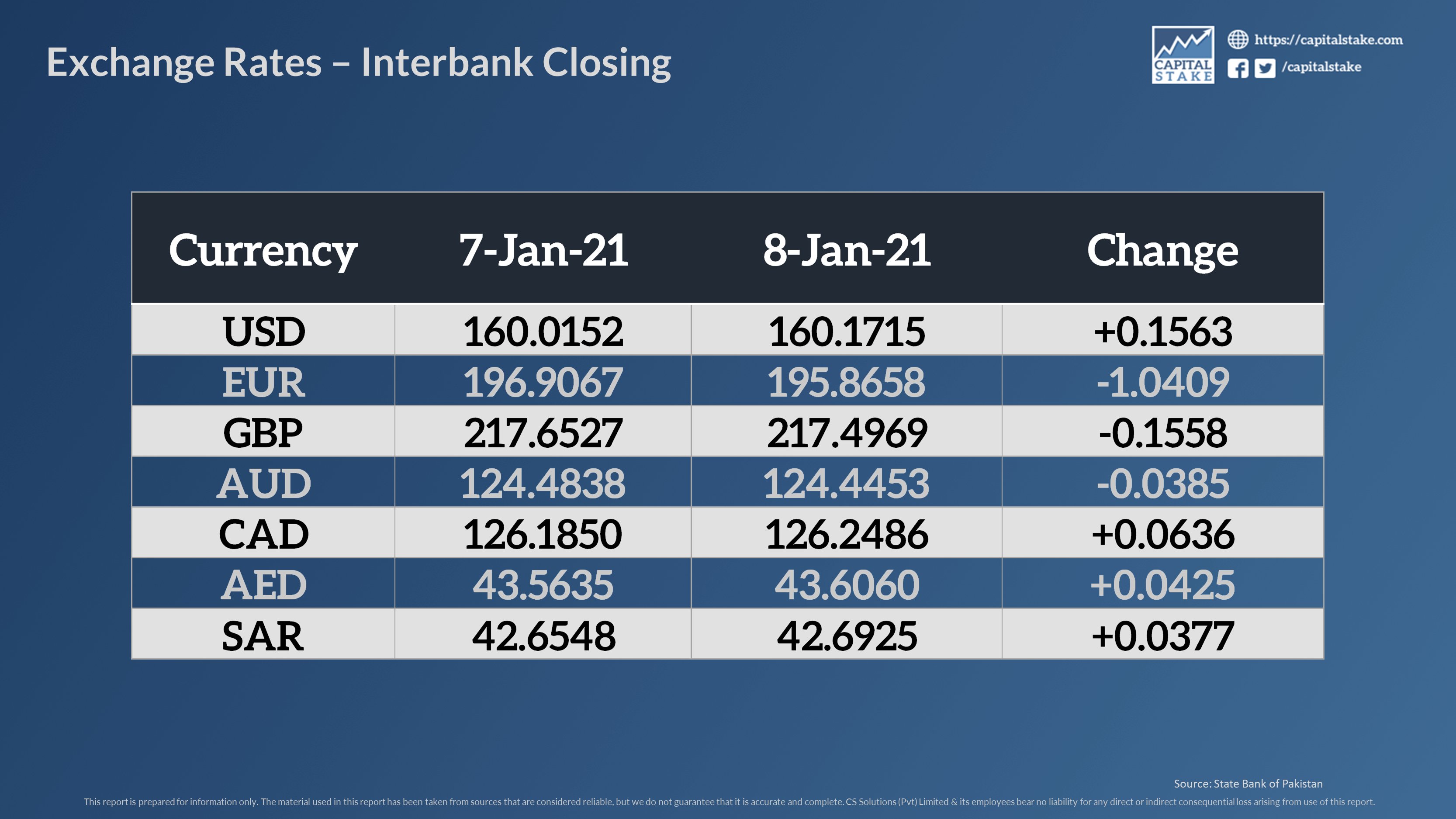

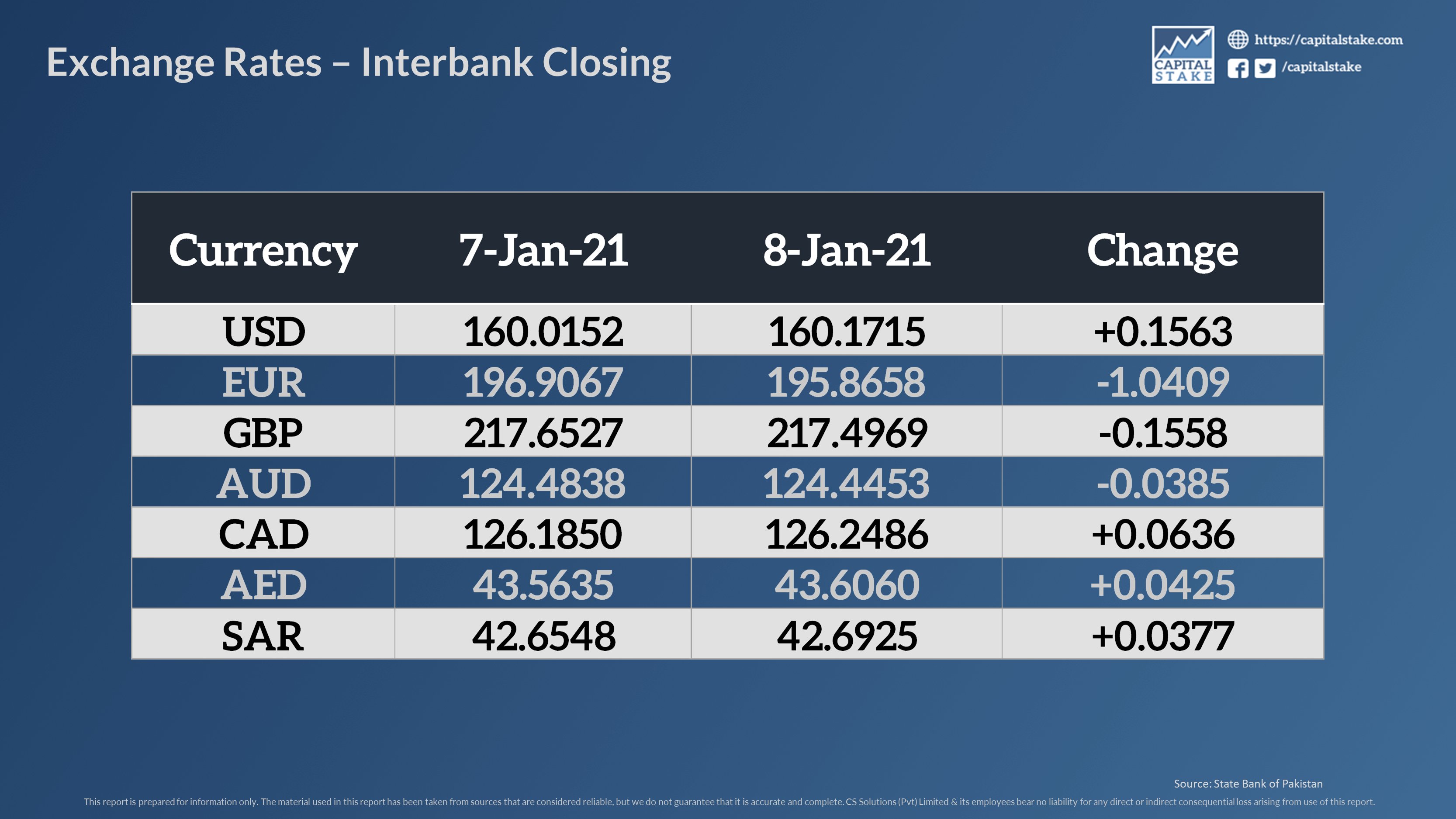

[Insert a chart or graph visually representing the USD's performance against other major currencies (EUR, JPY, GBP, etc.) over a relevant period. Clearly label the axes and provide a concise caption.]

Technical Analysis of USD Exchange Rates

Technical analysis suggests further potential for USD appreciation. Analyzing charts using indicators like moving averages, RSI, and MACD reveals:

- Support Levels: The USD has found support at [mention specific price levels], indicating potential resistance to significant downward movements.

- Resistance Levels: Resistance levels are observed around [mention specific price levels], which could temporarily halt further USD appreciation.

- Chart Patterns: [Mention any significant chart patterns, e.g., bullish flags, head and shoulders, etc., that may suggest future price movements]. These patterns, combined with trading signals, provide valuable insights into potential trends.

Disclaimer: Technical analysis is not an exact science and should be used in conjunction with fundamental analysis. Past performance is not indicative of future results.

Impact on Businesses and Investors

The strengthening USD has significant implications for various stakeholders:

- US Exporters: A strong dollar makes US exports more expensive in foreign markets, potentially impacting competitiveness and profitability.

- US Importers: Conversely, importers benefit from lower import costs as they can purchase goods from abroad at a cheaper price.

- Multinational Corporations: Companies with substantial foreign currency exposure face significant risks and opportunities related to currency fluctuations.

- Investors: Investors holding USD-denominated assets see their investments appreciate in value against other currencies.

Conclusion: Understanding the Strengthening USD and its Future Outlook

The recent strengthening of the US dollar is a multifaceted phenomenon driven by several key factors: President Trump's adjusted stance on Federal Reserve policy, favorable global economic conditions relative to other regions, and supportive technical indicators. This strength has significant implications for businesses and investors worldwide, impacting export competitiveness, import costs, and the value of investments.

While the current outlook seems positive for the USD, it's crucial to remember that the global economic landscape is inherently volatile and subject to unforeseen events. The future trajectory of the US dollar remains uncertain.

Stay informed about USD fluctuations and their implications by regularly checking our site for updates on the US Dollar and global economic trends. However, remember to consult with qualified financial professionals before making any investment decisions based on currency exchange rates and the US Dollar's future performance.

Featured Posts

-

Uil State Bound Hisd Mariachis Viral Whataburger Moment

Apr 24, 2025

Uil State Bound Hisd Mariachis Viral Whataburger Moment

Apr 24, 2025 -

Covid 19 Pandemic Lab Owner Admits To Faking Test Results

Apr 24, 2025

Covid 19 Pandemic Lab Owner Admits To Faking Test Results

Apr 24, 2025 -

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025 -

Selling Sunset Star Alleges Landlord Price Gouging Amidst La Fires

Apr 24, 2025

Selling Sunset Star Alleges Landlord Price Gouging Amidst La Fires

Apr 24, 2025 -

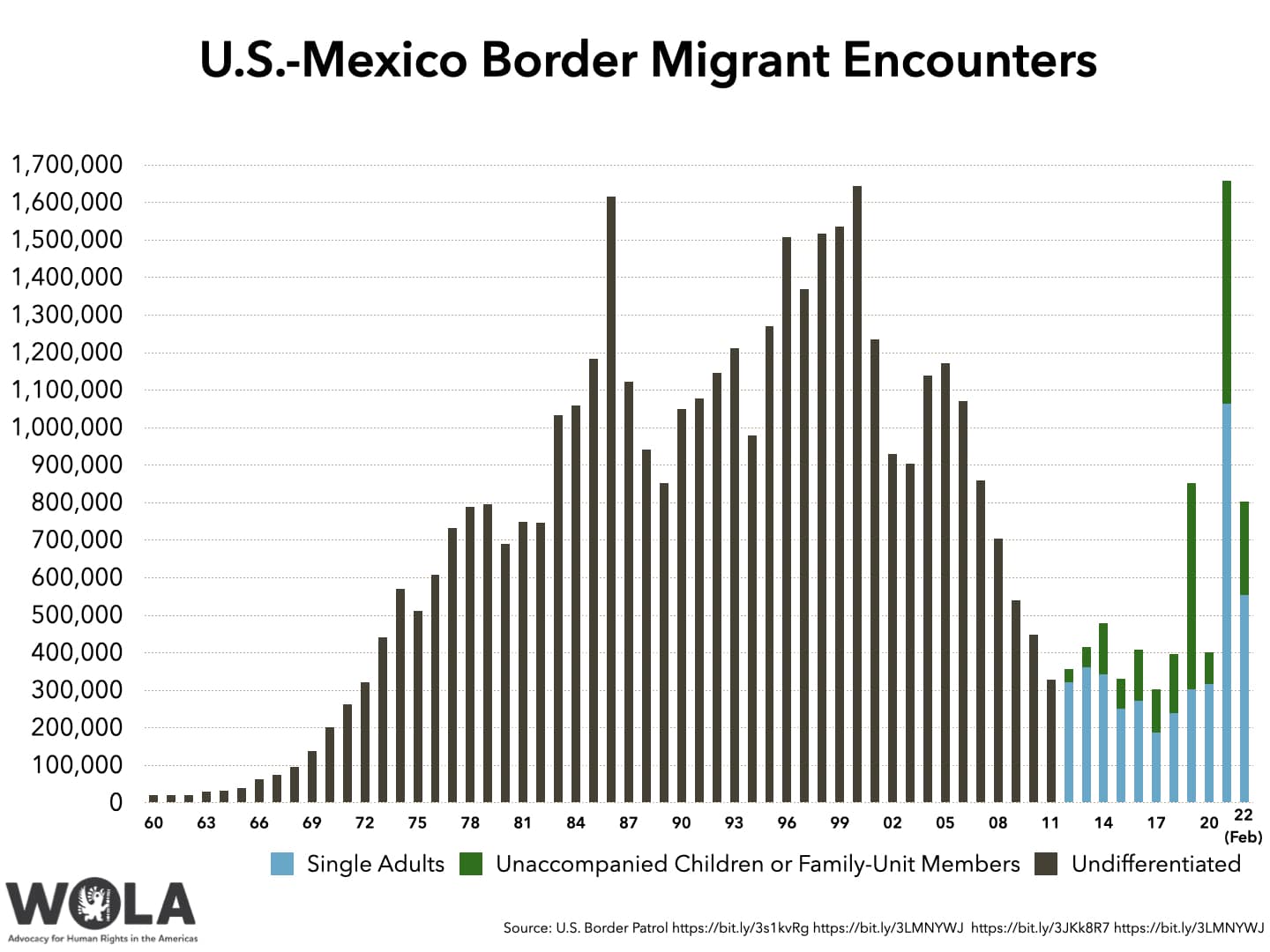

Fewer Border Crossings White House Reports Decline In Canada U S Border Apprehensions

Apr 24, 2025

Fewer Border Crossings White House Reports Decline In Canada U S Border Apprehensions

Apr 24, 2025