Will Increased Film Tax Credits Revitalize Minnesota's Production Sector?

Table of Contents

The Current State of Minnesota's Film Industry

Challenges Faced by Minnesota Production Companies

Minnesota's film production companies grapple with several hurdles hindering their growth and competitiveness. These include:

- Limited Funding Opportunities: Compared to neighboring states with more generous film tax credit programs, Minnesota has historically offered less competitive incentives, making it difficult to secure funding for large-scale projects. This lack of funding directly impacts the ability to attract big-budget productions.

- Difficulty Attracting Large-Scale Productions: The lower tax incentives in Minnesota make it less attractive to major studios and production companies compared to states offering more substantial benefits. This translates to fewer opportunities for local talent and businesses.

- Brain Drain of Talented Film Professionals: As talented filmmakers, crew members, and support staff seek better opportunities and higher pay in states with robust incentive programs, Minnesota experiences a significant "brain drain," weakening its existing infrastructure.

- Fewer Opportunities for Crew and Support Staff: The scarcity of large-scale productions directly reduces the number of available jobs for local crew members, from camera operators and editors to gaffers and grips, impacting the overall economic health of the industry.

Existing Film Tax Credit Program in Minnesota

Minnesota currently has a film tax credit program, but its structure and limitations restrict its effectiveness. While some successes have been achieved, facilitating smaller-scale productions and supporting local talent, the program falls short in several key areas:

- Current Structure and Limitations: The current program may have limitations on the types of productions eligible for tax credits, the percentage of eligible costs covered, or the overall cap on the amount of tax credits issued annually.

- Success Stories and Projects Facilitated: While the program has supported successful projects, these are often smaller in scale and budget compared to those attracted by more generous incentive programs in other states. Examples of these successful projects and their impact on the local economy should be cited here if publicly available.

- Areas Where the Current Program Falls Short: The program needs to address the competitiveness of its incentives compared to surrounding states. This includes considering aspects such as the percentage of eligible expenses covered, the types of productions eligible, and overall program caps.

The Proposed Increase in Film Tax Credits

Details of the Proposed Changes

The proposed increase in film tax credits aims to address the shortcomings of the existing program. Key details of the proposed changes could include:

- Specific Increase in Percentage Offered: A specific percentage increase in the tax credit offered to productions filming in Minnesota, potentially making it more competitive with neighboring states.

- Expansion of Eligible Production Types: Expanding the range of eligible productions, potentially including independent films, documentaries, commercials, and animation, to attract a wider range of projects.

- Changes to Qualification Criteria: Simplifying or clarifying qualification criteria to make the application process more streamlined and accessible to production companies.

- Projected Cost to the State and Potential Economic Benefits: An economic impact analysis evaluating the projected cost of the increased incentives and the potential return on investment in terms of job creation, economic activity, and increased tourism.

Arguments for Increased Incentives

Proponents of the increased film tax credits argue that the economic benefits far outweigh the costs. Key arguments include:

- Attracting Major Film and Television Productions: Increased incentives will make Minnesota a more attractive filming location, attracting major productions that bring significant economic activity and high-paying jobs.

- Creating High-Paying Jobs: The influx of major productions will create a multitude of high-paying jobs for local film crews, support staff, and related industries.

- Boosting Related Industries: The film industry has a significant ripple effect, boosting related industries like hospitality, transportation, catering, and equipment rentals, creating even more jobs and economic opportunities.

- Enhancing Minnesota's Reputation: A successful film incentive program will enhance Minnesota's reputation as a desirable filming location, attracting future productions and further boosting the industry's growth.

Potential Drawbacks and Concerns

Despite the potential benefits, concerns exist regarding the proposed increase in film tax credits:

- Concerns About Budget Allocation and Potential for Misuse of Funds: Careful oversight and transparent accountability measures are crucial to ensure that the increased funds are used efficiently and effectively.

- Ensuring the Tax Credits Benefit Local Businesses and Residents: Mechanisms should be in place to ensure that local businesses and residents benefit from the increased film production activity, rather than seeing profits primarily going to out-of-state companies.

- Evaluating the Long-Term Economic Impact: A thorough cost-benefit analysis is needed to assess the long-term economic impact and the return on investment of the increased tax credits.

Comparative Analysis of Other States' Film Incentive Programs

Successful Models from Other States

Examining successful film incentive programs in other states provides valuable insights:

- Case Studies of States with Thriving Film Industries: Analyzing states like Georgia, New York, and California, which have experienced significant growth in their film industries due to robust incentive programs, offers valuable lessons.

- Examples of Best Practices: Identifying best practices in designing, implementing, and administering film tax credit programs, including criteria for eligibility, application processes, and oversight mechanisms.

- Lessons Learned from States that have Experienced Both Successes and Failures: Learning from the successes and failures of other states' incentive programs helps Minnesota avoid pitfalls and maximize the effectiveness of its program.

Benchmarking Minnesota Against Competitor States

To assess the competitiveness of the proposed Minnesota film tax credits, a comparison with neighboring states is vital:

- Comparison of Minnesota's Proposed Incentives to Those Offered by Neighboring States: A direct comparison of the proposed incentives with those offered in states like Wisconsin, Iowa, and North Dakota reveals the competitiveness of Minnesota's proposed program.

- Assessing the Competitiveness of Minnesota's Proposed Program: Analyzing the competitiveness of the proposed program in attracting productions based on factors such as the percentage of tax credits offered, eligibility criteria, and overall program structure.

Conclusion

This article examined the potential of increased film tax credits to revitalize Minnesota's film production sector. While concerns about budget allocation and ensuring local benefits are valid and require careful consideration, the potential economic benefits and job creation are significant. The success of increased Minnesota film tax credits hinges on the careful design, implementation, and ongoing monitoring of the expanded program. A thoughtfully structured incentive program, benchmarked against successful models and addressing potential drawbacks, could dramatically enhance Minnesota's ability to compete with other states, attracting major productions and establishing a thriving hub for creative professionals.

Call to Action: Learn more about the proposed changes to Minnesota film tax credits and how you can support the growth of the state's film industry. Let's work together to revitalize Minnesota's film production sector and make it a thriving hub for creative professionals!

Featured Posts

-

Fn Abwzby Dlyl Shaml Llzayryn Ybda 19 Nwfmbr

Apr 29, 2025

Fn Abwzby Dlyl Shaml Llzayryn Ybda 19 Nwfmbr

Apr 29, 2025 -

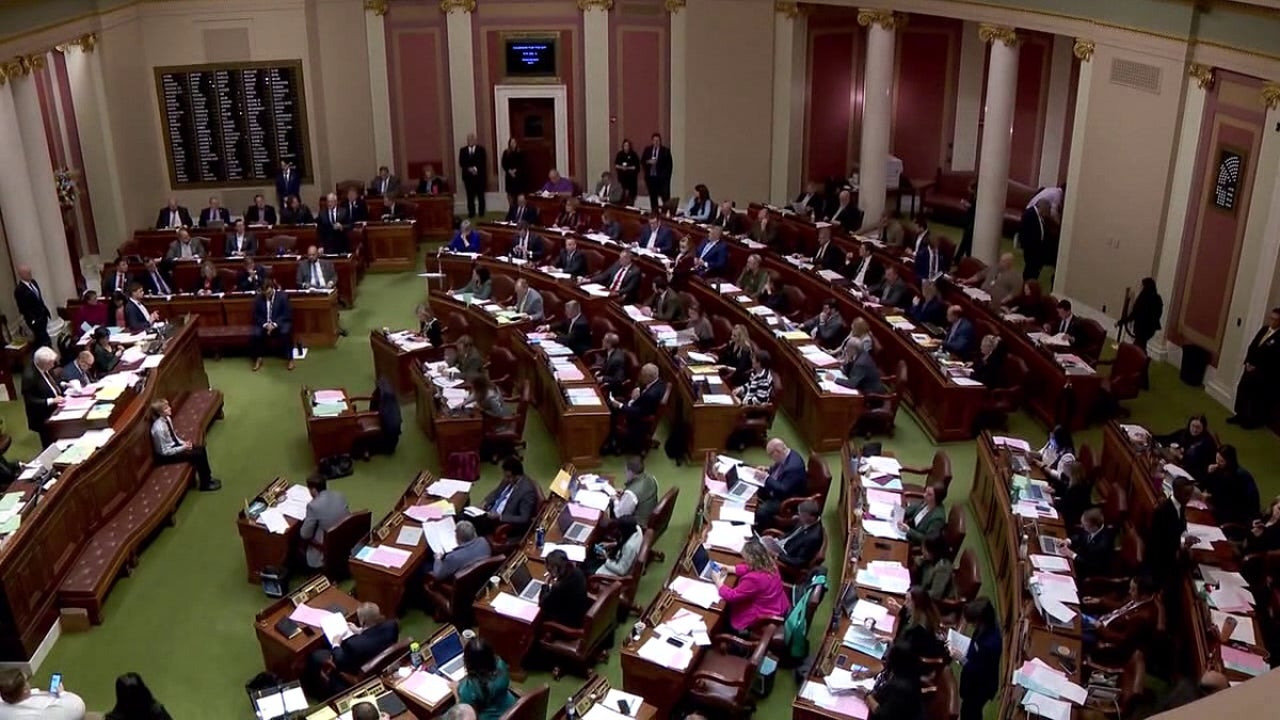

Trumps Transgender Athlete Ban Us Attorney General Issues Warning To Minnesota

Apr 29, 2025

Trumps Transgender Athlete Ban Us Attorney General Issues Warning To Minnesota

Apr 29, 2025 -

160km Mlb

Apr 29, 2025

160km Mlb

Apr 29, 2025 -

Fatal Wrong Way Crash Claims Life Of Texas Woman Near Border

Apr 29, 2025

Fatal Wrong Way Crash Claims Life Of Texas Woman Near Border

Apr 29, 2025 -

Us Attorney Generals Warning To Minnesota Compliance With Transgender Athlete Ban

Apr 29, 2025

Us Attorney Generals Warning To Minnesota Compliance With Transgender Athlete Ban

Apr 29, 2025