Ackman's Trade War Prediction: US Vs. China

Table of Contents

Ackman's Stance on US-China Relations

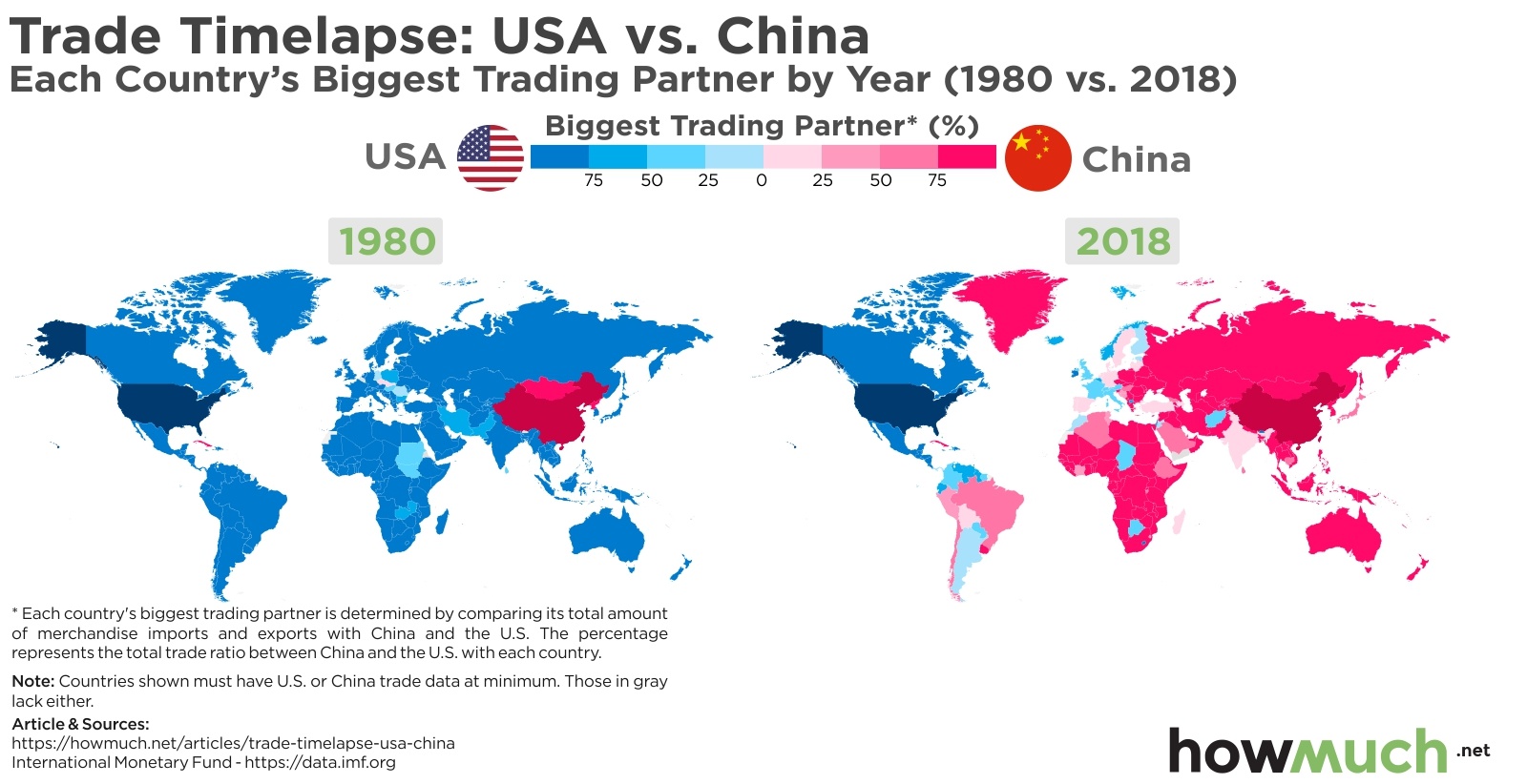

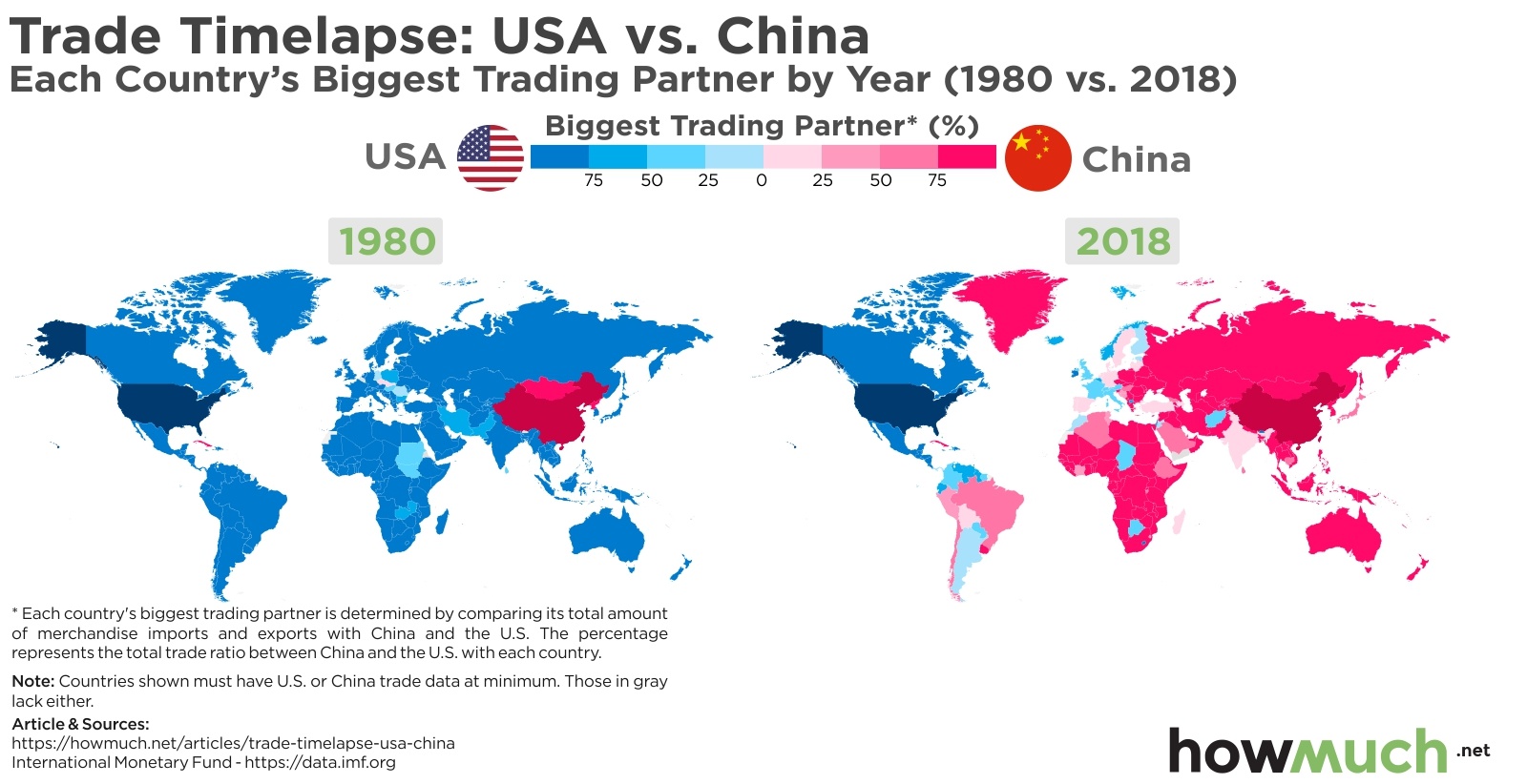

Ackman hasn't explicitly predicted an all-out trade war, but his statements consistently express deep concern about the deteriorating relationship between the US and China. He frequently highlights the increasing tensions stemming from technological competition, differing geopolitical ideologies, and persistent trade imbalances. While he hasn't pinpointed a specific date for a major escalation, his warnings emphasize the potential for sudden and significant disruptions.

- Summary of his main arguments: Ackman argues that the current state of US-China relations is unsustainable, with the potential for a significant deterioration impacting global markets. He points to a lack of trust and cooperation as key factors.

- Potential triggers for escalation: He suggests several triggers for escalation, including further restrictions on Chinese technology companies, increased tariffs, or unexpected geopolitical events involving Taiwan.

- Economic indicators he's basing his predictions on: Ackman bases his concerns on macroeconomic trends, including slowing global growth, rising inflation, and increasing geopolitical uncertainty. He frequently references data points reflecting these concerns during his public appearances.

- Specific sectors affected: He believes technology, manufacturing, and supply chain-reliant industries will bear the brunt of any escalation. The semiconductor industry, in particular, is highlighted as a key area of vulnerability.

Analyzing the Economic Impact of a Trade War Escalation

A significant escalation of the US-China trade war, as Ackman suggests is possible, would have far-reaching consequences. The interconnected nature of global supply chains would be severely tested, leading to potential shortages and price increases.

- Impact on global supply chains: Disruptions to global supply chains could lead to production delays, shortages of goods, and increased costs for businesses and consumers.

- Effects on inflation: Increased tariffs and supply chain disruptions would likely contribute to inflation in both the US and China, potentially fueling further economic instability.

- Potential consequences for global stock markets: Global stock markets would likely experience significant volatility, with declines in sectors heavily reliant on trade with either country.

- Impact on consumer prices: Consumers would feel the pinch through higher prices for goods affected by tariffs and supply chain issues. This could significantly impact consumer spending and economic growth.

- Alternative scenarios: While a full-blown trade war is a serious possibility, other scenarios are also plausible, including a period of sustained tension, or even a negotiated de-escalation.

Investment Strategies in Light of Ackman's Prediction

Navigating the potential ramifications of Ackman's trade war prediction requires a cautious and adaptable investment strategy. Diversification and risk mitigation are paramount.

- Strategies for mitigating risks: Diversification across asset classes (stocks, bonds, real estate, commodities) is crucial. Hedging strategies, like using options or futures contracts, can help protect against potential losses.

- Sectors that may benefit or suffer: Defensive sectors, such as consumer staples and healthcare, may offer relative stability during times of economic uncertainty. However, certain technology companies heavily reliant on the Chinese market might face significant headwinds.

- Geopolitical risk assessment: A thorough geopolitical risk assessment should inform all investment decisions. This includes monitoring political developments and understanding the potential impact on specific markets and sectors.

- Potential opportunities for savvy investors: While risks are substantial, opportunities may exist for investors who can identify undervalued assets or sectors poised to benefit from strategic shifts in the global economy.

Safe Haven Assets and Defensive Strategies

In a climate of heightened geopolitical uncertainty, investors often turn to "safe haven" assets.

- Why these assets are considered safe havens: Gold, government bonds, and certain currencies (like the US dollar or Swiss franc) are typically viewed as safe havens because they tend to hold or appreciate in value during times of economic or political instability.

- Potential returns and risks: While safe haven assets offer stability, their returns are often lower than riskier investments. Investors should carefully weigh the trade-off between risk and return.

Conclusion

Bill Ackman's concerns regarding a potential escalation of the US-China trade war highlight the increasing geopolitical risks facing global investors. The potential consequences—from disrupted supply chains to increased inflation and market volatility—are substantial. To navigate this uncertain environment, investors must prioritize diversification, risk mitigation, and a thorough understanding of geopolitical factors. By carefully considering Ackman's prediction and its potential impacts, investors can build more resilient and adaptable investment portfolios. Stay informed about the evolving US-China trade landscape and develop a robust investment strategy to navigate Ackman's trade war prediction and its potential impacts.

Featured Posts

-

Ariana Grandes Hair And Tattoo Changes A Professional Stylists Perspective

Apr 27, 2025

Ariana Grandes Hair And Tattoo Changes A Professional Stylists Perspective

Apr 27, 2025 -

Power Finance Corporation Pfc Dividend 2025 4th Cash Reward Announcement On March 12th

Apr 27, 2025

Power Finance Corporation Pfc Dividend 2025 4th Cash Reward Announcement On March 12th

Apr 27, 2025 -

The Daxs Response To Bundestag Elections A Historical Perspective

Apr 27, 2025

The Daxs Response To Bundestag Elections A Historical Perspective

Apr 27, 2025 -

Ariana Grandes New Hair And Tattoos Seeking Professional Help

Apr 27, 2025

Ariana Grandes New Hair And Tattoos Seeking Professional Help

Apr 27, 2025 -

Paolini Y Pegula Sorpresa En Dubai Eliminadas De Wta 1000

Apr 27, 2025

Paolini Y Pegula Sorpresa En Dubai Eliminadas De Wta 1000

Apr 27, 2025