Analysis Of Tesla's Q1 Earnings: 71% Net Income Decrease And Political Factors

Table of Contents

Tesla's Q1 2024 Financial Performance: A Deep Dive

Net Income Decline

The headline figure—a 71% decrease in net income—is undeniably alarming. Comparing this to Q1 2023's figures reveals the severity of the downturn. While precise figures will vary depending on the final audited report, preliminary reports indicated a substantial fall from profitability to a significant net loss. Tesla attributed this in part to increased production costs and the impact of their pricing strategy.

- Net Income: [Insert exact figure from the official report, e.g., -$X billion] compared to [Insert Q1 2023 net income, e.g., $Y billion].

- Revenue: [Insert exact figure from the official report, e.g., $Z billion], showing [percentage change compared to Q1 2023].

- EPS (Earnings Per Share): [Insert exact figure from the official report], representing a [percentage change] from Q1 2023.

- Tesla's cited reasons: [Summarize the explanations provided by Tesla in their official earnings call and press release, linking to the official source].

Using keywords like "Tesla Q1 results," "Tesla financial performance," and "Tesla earnings report" throughout this section helps improve SEO.

Vehicle Deliveries and Production

Despite the significant net income decrease, Tesla's vehicle deliveries weren't as dramatically affected. However, a closer examination reveals some concerning trends. While the number of vehicles delivered still represented significant growth compared to previous years, it fell short of initial projections.

- Number of vehicles delivered: [Insert exact figure from the official report].

- Production capacity: [Discuss Tesla's current production capacity and any bottlenecks impacting output].

- Impact of supply chain issues: [Analyze the role of supply chain disruptions in affecting production and deliveries].

- Regional sales performance: [Highlight variations in sales performance across different geographic regions, mentioning any key markets experiencing stronger or weaker performance].

This section utilizes keywords such as "Tesla vehicle deliveries," "Tesla production output," and "Tesla sales figures" to boost organic search ranking.

Impact of Price Cuts

Tesla's aggressive price cuts implemented in Q1 undoubtedly impacted profitability, although the long-term strategic goal was to increase sales volume and market share. The trade-off between profit margin and sales volume is a central aspect of this strategy.

- Magnitude of price reductions: [Quantify the percentage or dollar amount of price cuts across different Tesla models].

- Impact on margins: [Discuss the effect of price cuts on Tesla's profit margins].

- Consumer response to price changes: [Analyze the consumer response to the price cuts, noting increased demand or other significant changes].

- Long-term strategy: [Discuss Tesla's long-term strategy behind these price cuts, whether it is about market penetration, competition, or other factors].

We integrate keywords like "Tesla price cuts," "Tesla pricing strategy," and "Tesla sales volume" to improve organic searchability.

Geopolitical and Regulatory Headwinds Impacting Tesla's Q1 Earnings

Geopolitical Instability

Geopolitical instability significantly affected Tesla's operations and supply chains during Q1 2024. The ongoing war in Ukraine and global inflationary pressures created significant challenges.

- Specific geopolitical events and their impact: [Clearly outline specific events and their direct impact on Tesla's operations, for example, increased material costs or supply chain disruptions].

- Disruption to supply chains: [Detail how the geopolitical situation disrupted Tesla's access to raw materials or components].

- Increased material costs: [Quantify the increase in material costs due to global events].

Keywords like "Tesla geopolitical risks," "Tesla supply chain disruptions," and "Global economic impact on Tesla" are strategically included here.

Regulatory Scrutiny and Changes

Regulatory changes and government policies in key markets, particularly China and the US, presented additional hurdles for Tesla in Q1.

- Specific regulations: [Identify and explain specific regulations impacting Tesla's operations in these key markets].

- Their impact on Tesla's operations: [Detail how these regulations affected Tesla’s production, sales, or other operational aspects].

- Potential future regulatory challenges: [Discuss any foreseeable regulatory challenges that might affect Tesla's future performance].

This section utilizes keywords such as "Tesla regulatory challenges," "Tesla government policies," and "Tesla China market."

Competition and Market Dynamics

The increasingly competitive electric vehicle (EV) market also impacted Tesla's performance. New entrants and established automakers are aggressively pursuing market share.

- Key competitors: [List and discuss Tesla's main competitors in the EV market].

- Market share analysis: [Analyze Tesla's market share in relation to its competitors].

- Competitive pricing strategies: [Discuss how competitive pricing strategies influenced Tesla's own pricing decisions].

Keywords included here are "Tesla competition," "EV market share," and "Tesla market analysis."

Conclusion

The significant drop in Tesla's Q1 earnings—a 71% decrease in net income—was a multifaceted issue. Internal decisions like price cuts, alongside external pressures such as geopolitical instability, regulatory changes, and intensifying competition, all contributed to this downturn. Monitoring future Tesla Q1 earnings reports and conducting further analysis is crucial to understanding the long-term implications of these factors. The evolving landscape of the electric vehicle industry and Tesla's position within it will continue to be a subject of intense scrutiny.

Call to Action: Stay informed about the evolving landscape of the electric vehicle industry and Tesla's financial performance by following our regular updates on Tesla Q1 earnings and other key financial indicators. Subscribe to our newsletter for in-depth analyses of Tesla's performance.

Featured Posts

-

Bold And The Beautiful April 23rd Spoilers Finns Commitment To Liam

Apr 24, 2025

Bold And The Beautiful April 23rd Spoilers Finns Commitment To Liam

Apr 24, 2025 -

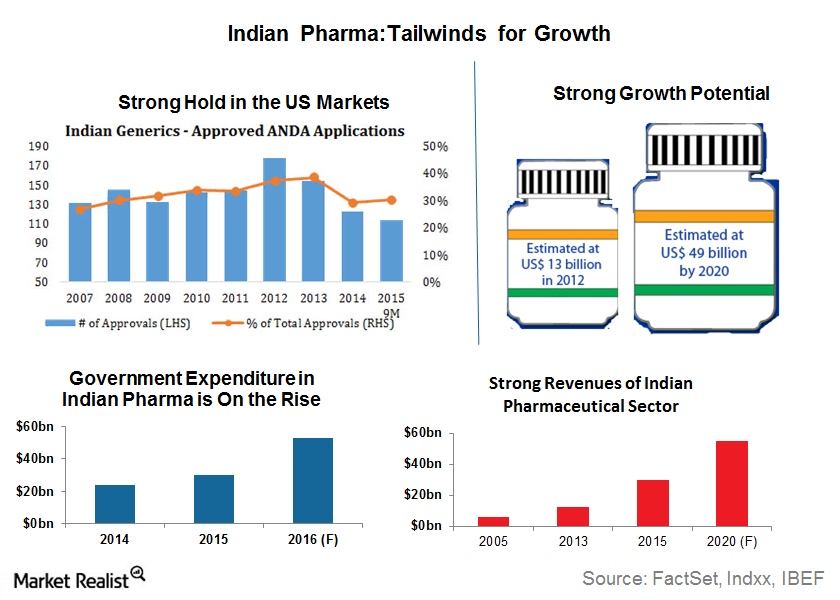

India Market Update Tailwinds Driving Niftys Strong Performance

Apr 24, 2025

India Market Update Tailwinds Driving Niftys Strong Performance

Apr 24, 2025 -

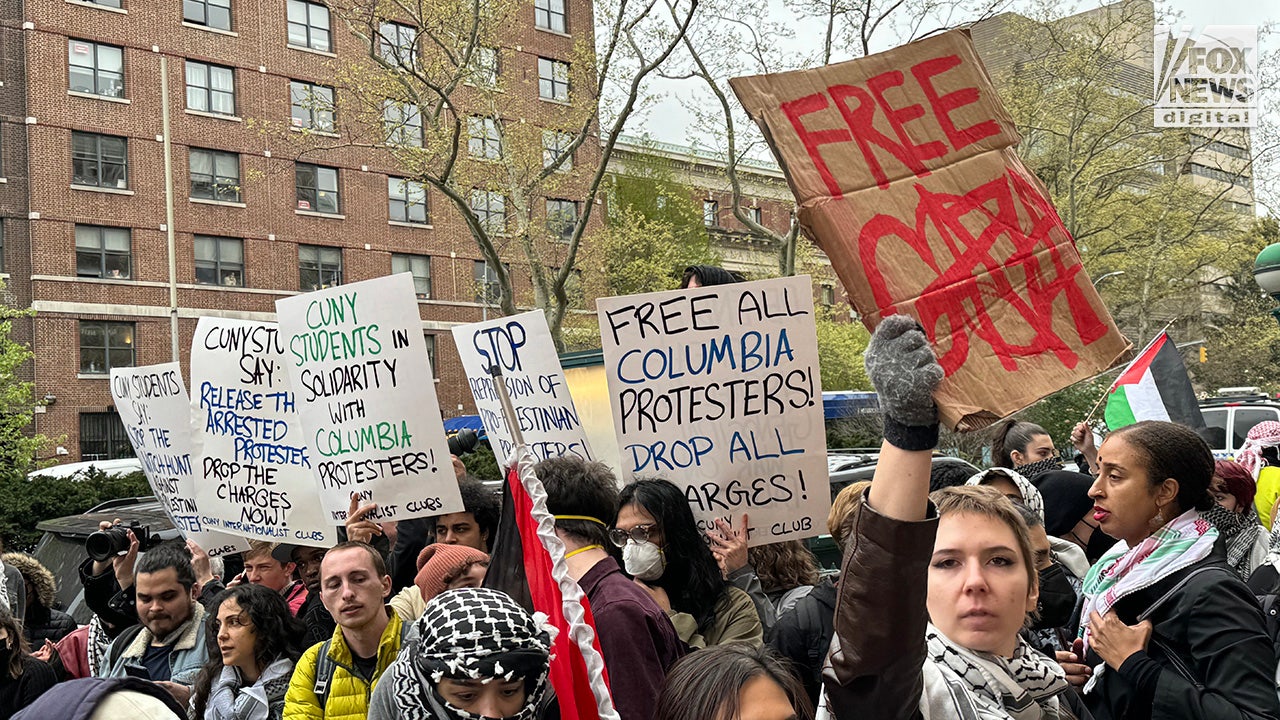

Elite Universities And The Trump Administration Funding Battles And Fundraising Strategies

Apr 24, 2025

Elite Universities And The Trump Administration Funding Battles And Fundraising Strategies

Apr 24, 2025 -

Transgender Sports Ban Minnesota Attorney General Files Lawsuit Against Trump

Apr 24, 2025

Transgender Sports Ban Minnesota Attorney General Files Lawsuit Against Trump

Apr 24, 2025 -

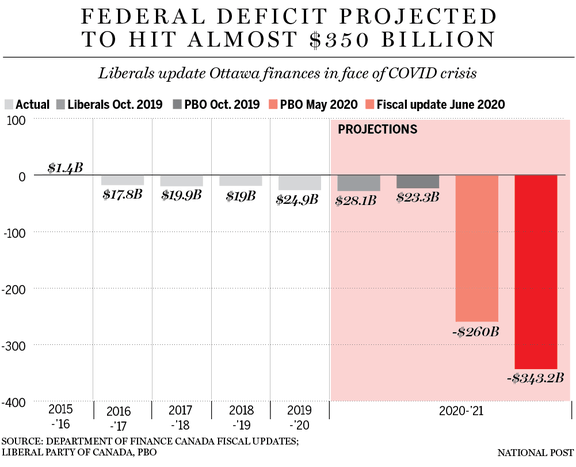

Is Canadas Fiscal Future At Risk Examining The Liberals Spending

Apr 24, 2025

Is Canadas Fiscal Future At Risk Examining The Liberals Spending

Apr 24, 2025