Analyzing The Canadian Dollar's Strength Against The USD And Weakness Elsewhere

Table of Contents

The CAD's Strength Against the USD

The Canadian dollar's value relative to the US dollar (USD) is a complex interplay of several factors. Let's examine the key drivers behind its recent strength.

Impact of Commodity Prices

Canada is a major exporter of commodities, particularly oil and natural gas. A strong correlation exists between commodity prices and the CAD/USD exchange rate. When commodity prices rise, so does the demand for the Canadian dollar, leading to its appreciation.

- Rise in oil prices boosting the CAD: Increases in the price of West Texas Intermediate (WTI) crude oil, a global benchmark, directly translate into increased revenue for Canadian energy companies, boosting demand for the CAD.

- Global demand for Canadian resources strengthening the currency: Higher global demand for Canadian resources, such as lumber, potash, and metals, further strengthens the Canadian dollar.

- Specific price indices: Monitoring indices like the WTI crude oil price, the natural gas price, and the Bloomberg Commodity Index provides valuable insights into the potential impact on the CAD/USD exchange rate.

Interest Rate Differentials

Interest rate decisions by the Bank of Canada (BoC) significantly influence the CAD's value. When the BoC increases interest rates, it makes Canadian investments more attractive to foreign investors seeking higher returns, leading to increased demand for the CAD and its appreciation. Conversely, lower interest rates can weaken the currency.

- BoC vs. Federal Reserve (Fed): Comparing the BoC's monetary policy decisions with those of the US Federal Reserve (Fed) is crucial. A higher BoC rate relative to the Fed rate can strengthen the CAD against the USD.

- Impact of higher interest rates: Higher interest rates attract foreign investment, increasing demand for the CAD and strengthening its value.

- Key interest rate announcements: Announcements of interest rate hikes or cuts by the BoC often trigger immediate reactions in the CAD/USD exchange rate.

Geopolitical Factors and Safe-Haven Status

Global geopolitical events play a significant role in determining the CAD's strength. While not always a primary safe-haven currency like the US dollar or the Japanese yen, the CAD can exhibit safe-haven characteristics during periods of global uncertainty.

- Global uncertainty and CAD strength: During times of geopolitical instability, investors might seek refuge in relatively stable currencies like the CAD, leading to increased demand.

- Examples of geopolitical events impacting CAD/USD: Major global conflicts or economic crises can impact the CAD's value, sometimes strengthening it as a relatively safe bet.

The CAD's Weakness Against Other Currencies

While the CAD may show strength against the USD, its performance against other major currencies can be weaker due to a variety of factors.

US Dollar Strength

A strong US dollar significantly impacts the CAD's value against other currencies. When the USD strengthens, it makes other currencies, including the CAD, relatively weaker.

- US economic performance: A robust US economy typically leads to a stronger USD, indirectly weakening the CAD against other currencies.

- Global demand for USD: The USD's role as the world's reserve currency maintains its global demand, often influencing its strength against other currencies like the CAD.

Eurozone and Other Global Economic Factors

Economic conditions in the Eurozone and other major economies influence the CAD's performance. Economic slowdowns or crises in these regions can negatively impact global trade and investment, leading to a weaker CAD.

- Economic indicators: Monitoring key economic indicators like GDP growth, inflation, and unemployment rates in major economies helps understand their potential impact on the CAD.

- Global economic shocks: Significant global economic events can create uncertainty and weaken the CAD against other currencies.

Trade Relations and Global Supply Chains

Trade agreements and disruptions in global supply chains significantly influence the CAD's exchange rates. Trade imbalances between Canada and other countries can also play a role.

- Trade agreements impact: New trade agreements or disruptions to existing ones can impact the flow of goods and services, influencing the CAD's value.

- Supply chain disruptions: Global supply chain disruptions can affect Canadian exports and imports, creating volatility in the CAD's exchange rates.

Conclusion: Navigating the Canadian Dollar's Future

Analyzing the Canadian dollar's strength and weakness requires considering the interplay of commodity prices, interest rate differentials, geopolitical events, and global economic conditions. The CAD's performance against the USD often differs from its performance against other currencies, highlighting the complexity of the global currency market. While predicting the future of any currency is inherently uncertain, staying informed about these key drivers is essential for navigating the complexities of the CAD's fluctuations. Stay informed on the latest developments influencing the Canadian dollar by regularly checking reputable financial news sources and consulting with financial advisors to effectively analyze the Canadian dollar's strength and weakness.

Featured Posts

-

Is Open Ai Buying Google Chrome A Look At The Chat Gpt Ceos Claim

Apr 24, 2025

Is Open Ai Buying Google Chrome A Look At The Chat Gpt Ceos Claim

Apr 24, 2025 -

Bitcoins Positive Movement Analyzing The Impact Of Trade And Federal Reserve Actions

Apr 24, 2025

Bitcoins Positive Movement Analyzing The Impact Of Trade And Federal Reserve Actions

Apr 24, 2025 -

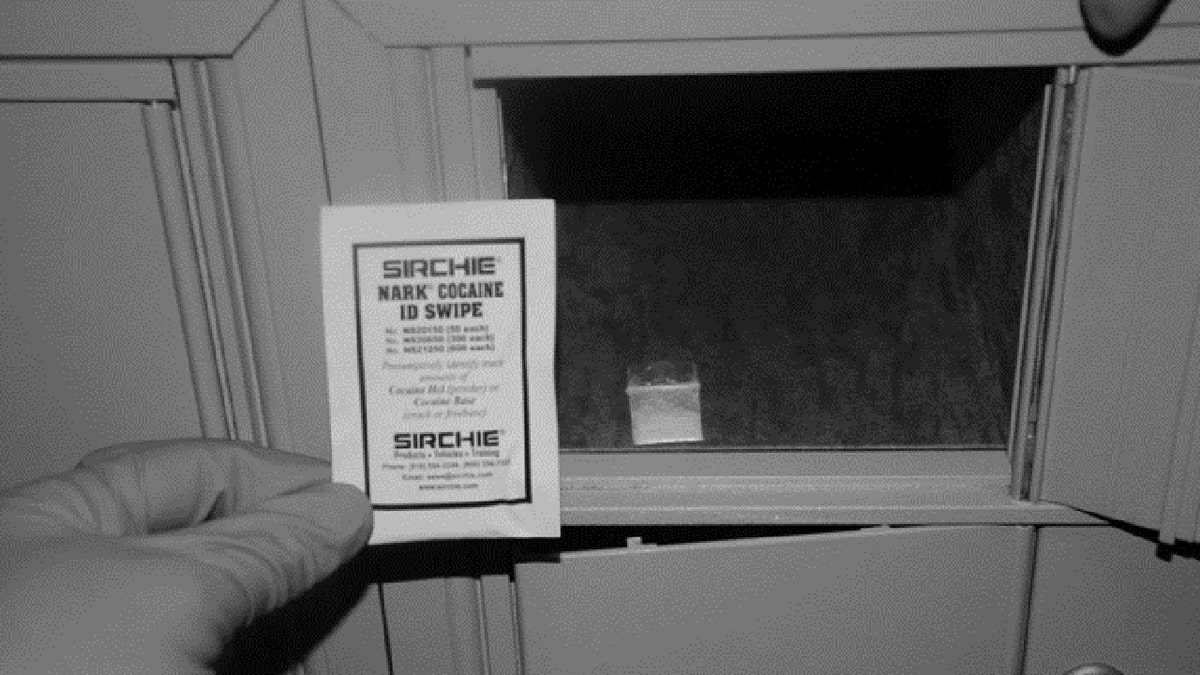

Cocaine Found At White House Secret Service Announces End Of Investigation

Apr 24, 2025

Cocaine Found At White House Secret Service Announces End Of Investigation

Apr 24, 2025 -

The Bold And The Beautiful April 3 Recap Liams Collapse After Exploding Argument With Bill

Apr 24, 2025

The Bold And The Beautiful April 3 Recap Liams Collapse After Exploding Argument With Bill

Apr 24, 2025 -

Hisd Mariachi Headed To Uil State Competition After Whataburger Video Goes Viral

Apr 24, 2025

Hisd Mariachi Headed To Uil State Competition After Whataburger Video Goes Viral

Apr 24, 2025