Bitcoin Price Surge: Trump's Actions And Fed Policy Impact

Table of Contents

Trump's Economic Policies and Bitcoin's Volatility

Trump's presidency was marked by bold economic policies that significantly impacted the global financial landscape, consequently influencing Bitcoin's price.

Fiscal Stimulus and Inflation

Trump's administration implemented significant fiscal stimulus measures, including substantial tax cuts and increased government spending. These policies, while aiming to boost economic growth, also led to concerns about rising inflation. This inflationary environment inadvertently propelled Bitcoin's appeal as a potential inflation hedge.

- Bitcoin as a Store of Value: Bitcoin's limited supply of 21 million coins contrasts sharply with the potentially unlimited supply of fiat currencies. This scarcity makes it attractive to investors seeking to protect their purchasing power against inflation.

- Inflation Rates During Trump's Presidency: During parts of Trump's term, inflation rates in the US experienced an upward trend, although it remained below the Federal Reserve's target in many periods. These periods often coincided with increased Bitcoin trading volume and price appreciation.

- Expert Opinions: Many financial analysts have pointed to a correlation between inflationary pressures and increased demand for Bitcoin, suggesting that investors viewed it as a safe haven asset in times of economic uncertainty. For example, [cite a relevant expert or report].

Trade Wars and Geopolitical Uncertainty

Trump's trade policies, marked by tariffs and trade disputes with various countries, created significant geopolitical uncertainty. This uncertainty often drives investors towards alternative assets perceived as less susceptible to political risks, like Bitcoin.

- Uncertainty Drives Crypto Investment: Geopolitical instability tends to increase volatility in traditional markets, pushing investors to seek refuge in assets perceived as less correlated with these events.

- Examples of Trade Disputes: The trade war with China, for instance, created significant market turmoil, which some argue led to increased capital flows into the cryptocurrency market, including Bitcoin.

- Bitcoin Price Movements: Analyzing Bitcoin's price charts during periods of heightened trade tensions reveals a noticeable correlation between increased uncertainty and price fluctuations, often upward in nature.

Regulatory Uncertainty

The Trump administration's approach to cryptocurrency regulation was characterized by a lack of clear and consistent policy. This regulatory uncertainty, while not necessarily negative, contributed to Bitcoin's price volatility.

- Implications of Regulatory Environments: Both overly restrictive and overly lax regulatory environments can negatively affect investor confidence. Clear and predictable regulatory frameworks are usually preferable for market stability.

- Significant Regulatory Announcements: While no sweeping regulatory changes were implemented during his term, the absence of clear guidelines created an environment of speculation, impacting Bitcoin's price.

Federal Reserve Policy and Bitcoin Price Fluctuations

The Federal Reserve's monetary policy plays a crucial role in shaping the overall economic landscape, and its decisions have a demonstrable impact on Bitcoin's price.

Interest Rate Hikes and Bitcoin's Inverse Correlation

The Federal Reserve's decisions regarding interest rates often have an inverse correlation with Bitcoin's price. Higher interest rates make traditional investments like bonds more attractive, potentially reducing investment in riskier assets such as Bitcoin. Conversely, lower rates can encourage investment in higher-risk, higher-reward assets.

- Data on Interest Rate Changes: A comparison of Federal Reserve interest rate adjustments with Bitcoin price movements reveals a potential inverse relationship. [Cite data source here and include a relevant chart or graph].

- Interest Rate Changes and Dollar Value: Interest rate increases can strengthen the dollar, potentially reducing the demand for alternative assets like Bitcoin.

- Visual Representation: Charts illustrating the correlation between interest rate changes and Bitcoin price movements would be extremely useful for understanding the connection.

Quantitative Easing and Monetary Policy

The Federal Reserve's use of quantitative easing (QE), a monetary policy tool involving injecting liquidity into the market, can indirectly influence Bitcoin's price. QE can lead to increased money supply and potentially higher inflation, which, as discussed earlier, may increase Bitcoin's appeal as an inflation hedge.

- Quantitative Easing Explained: QE involves the central bank buying government bonds or other assets to increase the money supply.

- Impact on Inflation and Investor Behavior: Increased money supply can fuel inflation, leading some investors to seek alternative stores of value, such as Bitcoin.

- Alternative Perspectives: Some argue that the effects of QE on Bitcoin are indirect and complex, influenced by various other market factors.

Conclusion: Navigating the Bitcoin Market in Light of Political and Economic Factors

In conclusion, the Bitcoin price surge isn't solely driven by internal cryptocurrency market dynamics. Understanding the interplay between Trump's economic policies, Federal Reserve monetary policy decisions, and their influence on inflation, geopolitical uncertainty, and investor sentiment is crucial to comprehending Bitcoin's price volatility. While correlations exist, it's essential to remember that Bitcoin is a highly volatile asset, and these relationships are not deterministic predictors of future price movements. To successfully navigate the Bitcoin market, it's vital to stay informed about these macroeconomic factors and the broader geopolitical landscape. Stay updated on the latest developments affecting Bitcoin price surges and learn how to navigate the market effectively.

Featured Posts

-

Chinas Shift To Middle Eastern Lpg Replacing Us Imports Amid Tariffs

Apr 24, 2025

Chinas Shift To Middle Eastern Lpg Replacing Us Imports Amid Tariffs

Apr 24, 2025 -

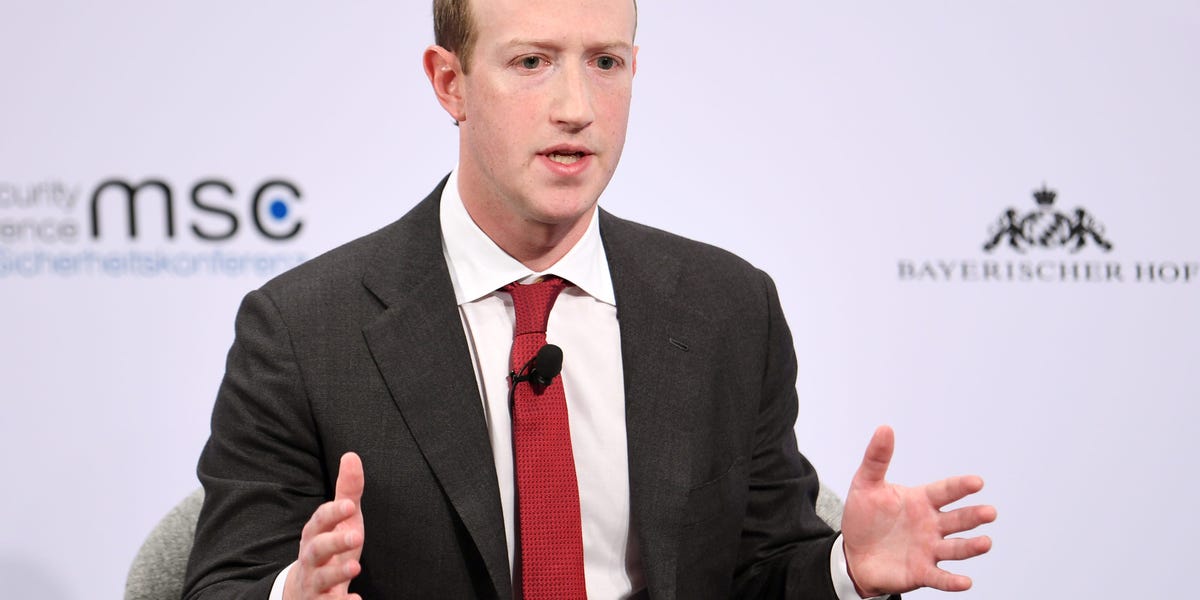

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

Apr 24, 2025

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

Apr 24, 2025 -

John Travolta Reassures Fans Following Controversial Bedroom Photo

Apr 24, 2025

John Travolta Reassures Fans Following Controversial Bedroom Photo

Apr 24, 2025 -

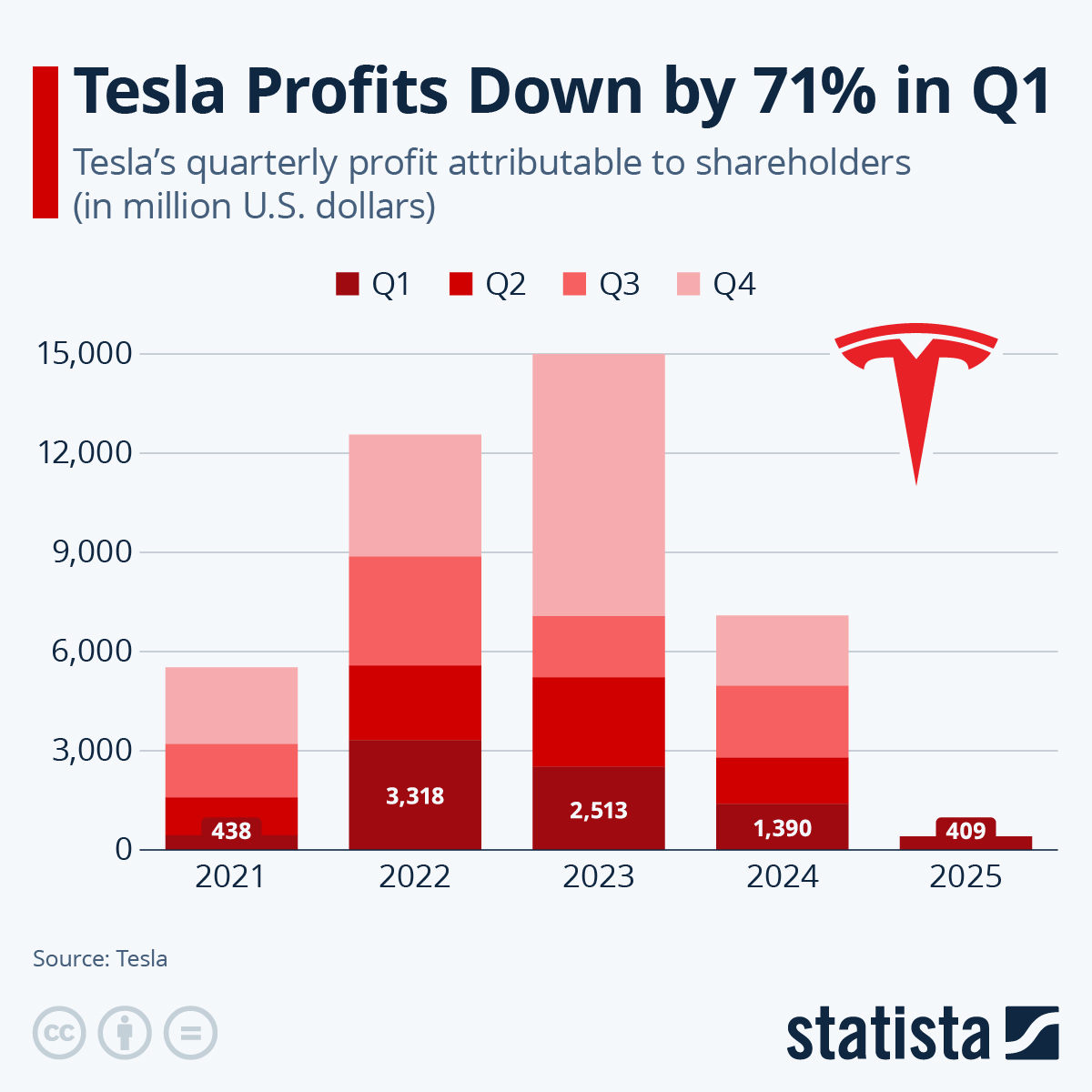

Tesla Q1 Financial Report Analyzing The Impact Of Public Relations

Apr 24, 2025

Tesla Q1 Financial Report Analyzing The Impact Of Public Relations

Apr 24, 2025 -

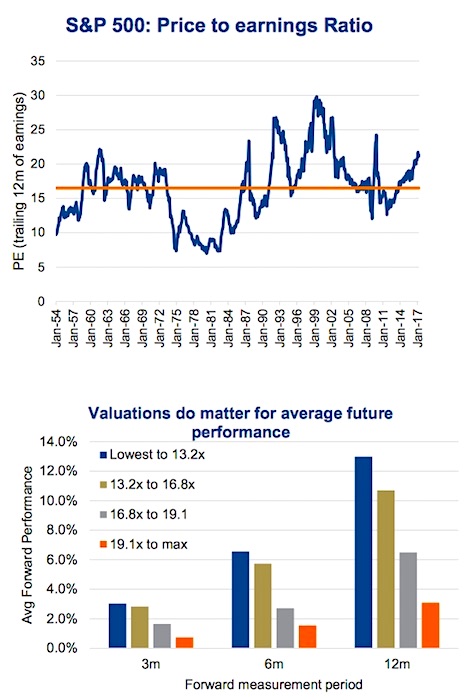

Evaluating Stock Market Valuations Insights From Bof A For Investors

Apr 24, 2025

Evaluating Stock Market Valuations Insights From Bof A For Investors

Apr 24, 2025