Evaluating Stock Market Valuations: Insights From BofA For Investors

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

Bank of America's market outlook provides a crucial starting point for evaluating stock market valuations. Their analysts utilize a range of key valuation metrics to assess the overall market health and identify potential opportunities and risks. Understanding these metrics is vital for interpreting BofA's findings and applying them to your own investment strategy. Key metrics include:

-

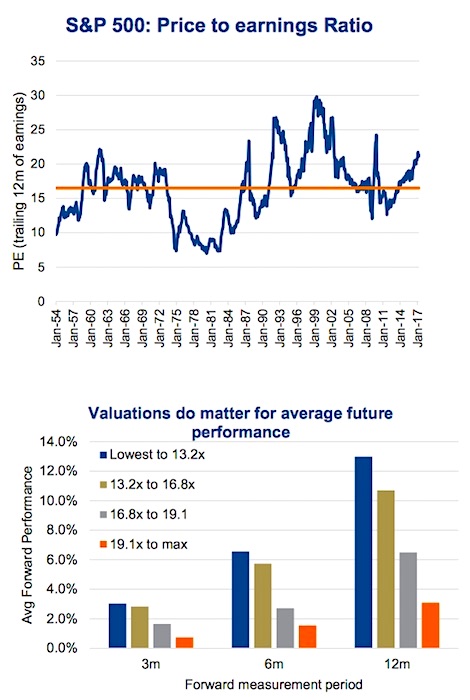

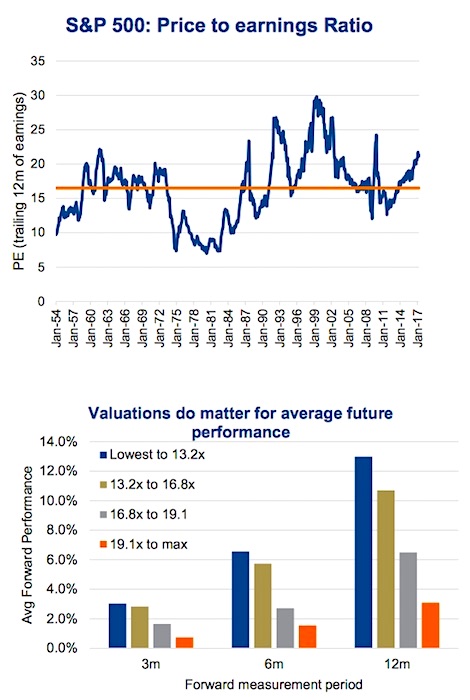

Price-to-Earnings Ratio (P/E): This ratio compares a company's stock price to its earnings per share (EPS). A high P/E ratio might suggest the stock is overvalued, while a low P/E ratio could indicate undervaluation. BofA uses P/E ratios to compare companies within the same sector and assess overall market valuation.

-

Price-to-Sales Ratio (P/S): This ratio compares a company's stock price to its revenue per share. It's particularly useful for evaluating companies with negative earnings, providing a broader perspective on valuation than P/E alone. BofA incorporates P/S ratios, particularly in high-growth sectors.

-

Price-to-Book Ratio (P/B): This ratio compares a company's market capitalization to its book value (assets minus liabilities). A lower P/B ratio can suggest undervaluation, particularly in value investing strategies. BofA uses P/B to analyze the tangible assets backing the stock price.

-

Dividend Yield: This represents the annual dividend per share relative to the stock price. A higher dividend yield can be attractive to income-focused investors, but it should be considered alongside other valuation metrics. BofA uses dividend yield as one component of its comprehensive valuation analysis.

BofA's Current Outlook: (Note: This section requires current data from BofA reports. Replace the bracketed information with actual data from recent BofA publications). [Insert summary of BofA's current market outlook – bullish, bearish, or neutral – and rationale.] They [mention specific strategies or sectors BofA recommends based on their current outlook].

Sector-Specific Valuation Analysis from BofA

BofA doesn't just provide a general market outlook; they delve into sector-specific valuation analyses. This granular approach allows investors to identify potential opportunities and risks within specific industries.

-

Technology Sector: [Insert BofA's assessment of the technology sector valuation, including rationale. Mention specific companies or trends if possible, referencing BofA reports].

-

Healthcare Sector: [Insert BofA's assessment of the healthcare sector valuation, including rationale. Mention specific companies or trends if possible, referencing BofA reports].

-

Financials Sector: [Insert BofA's assessment of the financials sector valuation, including rationale. Mention specific companies or trends if possible, referencing BofA reports].

By understanding BofA's sector-specific analysis, investors can make more informed decisions about portfolio allocation and sector-specific investment strategies.

Identifying Undervalued Stocks Based on BofA's Research

While BofA doesn't explicitly provide a list of "buy" recommendations, their research can be invaluable in identifying potentially undervalued stocks. Investors can use BofA's valuation metrics and sector analysis as a starting point for their own research.

-

Screening for Undervalued Stocks: Investors can use BofA's data to screen for stocks with low P/E, P/S, or P/B ratios relative to their peers or historical averages. However, this should be combined with fundamental analysis.

-

Fundamental Analysis: Don't solely rely on BofA's analysis. Conduct thorough due diligence, examining a company's financial statements, competitive landscape, and management team.

-

Examples: (Disclaimer: This section should not provide specific stock recommendations. The following is a placeholder.) [Insert cautionary statement about the limitations of relying on external analysis and the need for independent research].

Remember, any investment decision should be based on your own thorough research and risk tolerance.

Managing Risk in Stock Market Valuation

Relying solely on valuation metrics to make investment decisions is risky. Market volatility and unforeseen events can significantly impact stock prices.

-

Risks Associated with Valuation Metrics: Valuation metrics are just one piece of the puzzle. Economic downturns, changes in industry dynamics, and company-specific events can all impact stock valuations.

-

Diversification: Spread your investments across different sectors and asset classes to mitigate risk. Diversification is a cornerstone of sound investment strategy.

-

Long-Term Perspective: Invest with a long-term horizon, reducing the impact of short-term market fluctuations.

By combining BofA's insights with prudent risk management strategies, investors can enhance their investment decision-making process.

Conclusion

Bank of America's market analysis offers valuable insights into stock market valuations. By understanding and utilizing their assessments of overall market conditions, sector-specific valuations, and key valuation metrics like P/E, P/S, and P/B ratios, investors can refine their investment strategies. Remember, thorough due diligence and a diversified portfolio are essential components of effective risk management. Learn more about evaluating stock market valuations using BofA’s insights to optimize your investment strategy.

Featured Posts

-

The Bold And The Beautiful April 3 Full Recap Of Liam And Bills Fallout

Apr 24, 2025

The Bold And The Beautiful April 3 Full Recap Of Liam And Bills Fallout

Apr 24, 2025 -

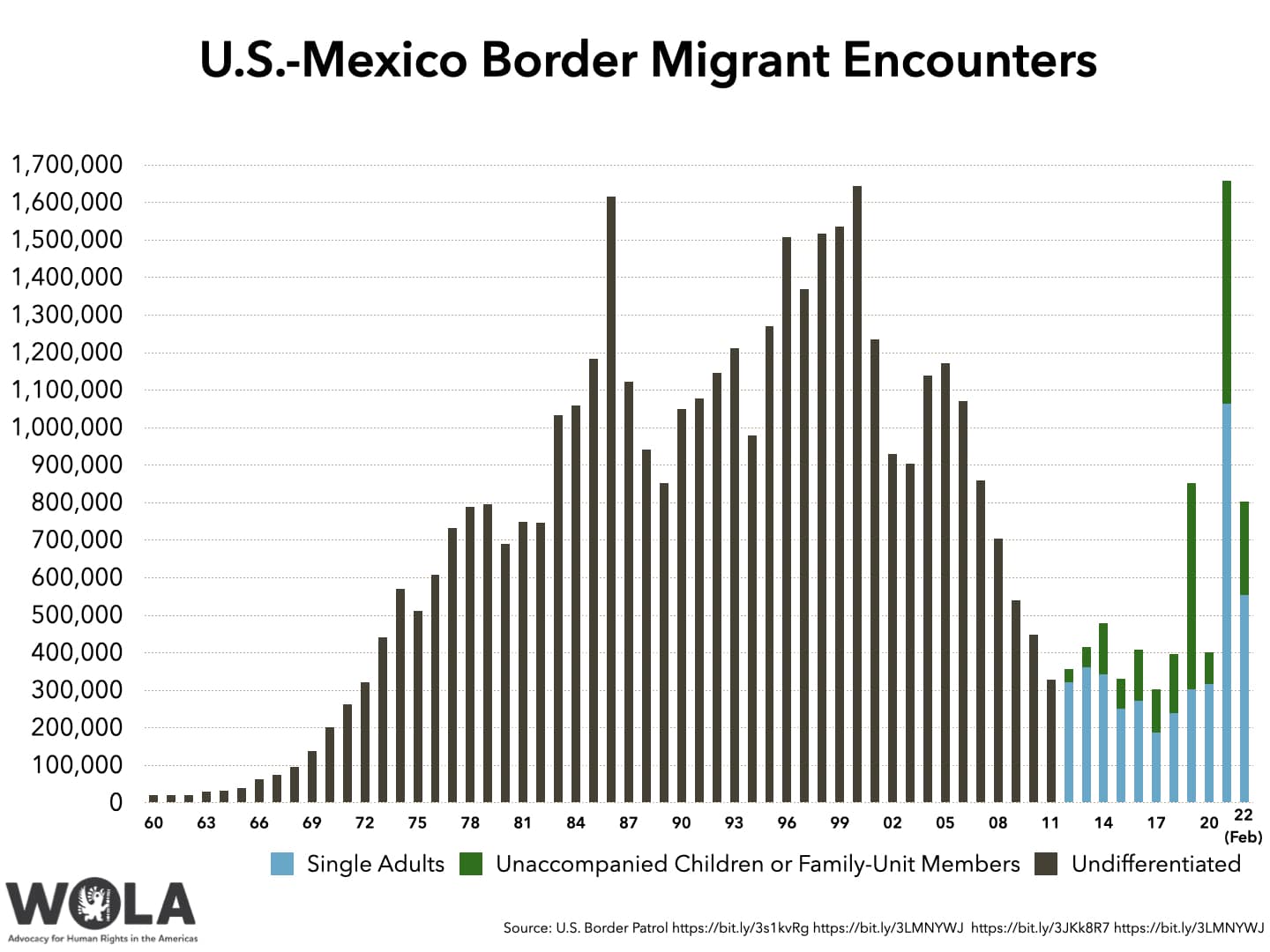

Fewer Border Crossings White House Reports Decline In Canada U S Border Apprehensions

Apr 24, 2025

Fewer Border Crossings White House Reports Decline In Canada U S Border Apprehensions

Apr 24, 2025 -

Secret Service Ends White House Cocaine Investigation

Apr 24, 2025

Secret Service Ends White House Cocaine Investigation

Apr 24, 2025 -

The Bold And The Beautiful Next 2 Weeks Hope Liam And Steffys Storylines

Apr 24, 2025

The Bold And The Beautiful Next 2 Weeks Hope Liam And Steffys Storylines

Apr 24, 2025 -

The Growing Trend Of Betting On Natural Disasters Examining The Los Angeles Wildfires Case

Apr 24, 2025

The Growing Trend Of Betting On Natural Disasters Examining The Los Angeles Wildfires Case

Apr 24, 2025