The Growing Trend Of Betting On Natural Disasters: Examining The Los Angeles Wildfires Case

Table of Contents

H2: The Mechanics of Disaster Betting

Disaster betting isn't simply about placing a wager on whether a hurricane will hit land. It's a multifaceted market involving a range of sophisticated financial instruments designed to manage and transfer risk associated with catastrophic events.

H3: Types of Bets

Several methods facilitate betting on natural disasters:

- Prediction Markets: These platforms allow individuals to bet on the likelihood of specific events, such as the intensity of a wildfire (measured by acres burned) or the total insured losses from a hurricane. The accuracy of these predictions is often based on complex algorithms and data analysis.

- Derivatives Linked to Disaster Relief Funds: These financial instruments derive their value from the payouts of disaster relief funds. Investors can essentially bet on the scale of a disaster by investing in these derivatives. Their returns are directly tied to the amount of money needed for disaster relief.

- Insurance-Linked Securities (ILS): These are securities whose payouts are triggered by specific insured losses from catastrophic events. Catastrophe bonds are a prominent example, transferring risk from insurance companies to investors. Essentially, investors bet against the occurrence of a large-scale disaster.

Bullet Points:

- Placing a bet might involve predicting the severity of a wildfire, measured by the total acres burned, or the estimated cost of damages in millions of dollars. These parameters are usually clearly defined within the betting contract.

- Data from various sources – meteorological data, historical wildfire records, satellite imagery – feeds complex predictive models used to assess risk and inform betting odds. AI and machine learning play an increasingly significant role here.

- Catastrophe bonds are a prime example of how sophisticated financial instruments are used. These bonds pay out only if a pre-defined catastrophic event occurs, allowing insurers to offload risk while investors receive a potentially lucrative return.

H2: The Los Angeles Wildfires Case Study

The recent Los Angeles wildfires offer a prime example of how disaster betting plays out in the real world. Analyzing the betting activity surrounding these devastating events reveals several key aspects of this evolving market.

H3: Analyzing the Betting Activity

While specific betting data on the Los Angeles wildfires might be difficult to obtain due to the private nature of many markets, it's possible to speculate on the types of bets that were likely placed.

Bullet Points:

- Media coverage significantly influenced betting activity. As the fires intensified, garnering widespread attention, the odds and volume of bets likely shifted, reflecting changing perceptions of the disaster's potential scale.

- The accuracy of pre-fire predictions concerning the extent of the damage, the number of structures destroyed, and the overall cost is crucial. Comparing these predictions to the actual outcome reveals the effectiveness (or lack thereof) of predictive models used in these markets.

- The outcome of wildfire betting could significantly impact insurance markets and disaster relief efforts. If predictions were accurate, insurers might see reduced payouts, but if they were significantly off the mark, the financial burden could be exacerbated.

H2: Ethical and Societal Implications of Disaster Betting

The practice of betting on natural disasters raises significant ethical and societal concerns.

H3: Concerns about Profiteering from Disaster

The most prominent concern is the potential for profiteering from human suffering.

Bullet Points:

- The act of profiting financially from the devastation caused by a natural disaster can be perceived as deeply insensitive and exploitative, especially for those directly impacted by the event.

- The potential for exacerbating social inequalities is significant. Those with the financial resources to engage in this type of speculation could potentially profit at the expense of vulnerable communities disproportionately affected by disasters.

- The influence of these betting markets on disaster preparedness and response needs careful consideration. Could the pursuit of profit overshadow genuine efforts towards mitigation and relief? This requires further investigation.

- Regulatory challenges abound. The complexity of these financial instruments and the international nature of many markets make oversight incredibly difficult.

H2: The Future of Disaster Betting

Technological advancements are likely to significantly impact the future of disaster betting.

H3: Technological Advancements and Their Role

Advances in various fields are poised to reshape this market.

Bullet Points:

- Improved prediction accuracy through advanced data analytics, AI, and climate modeling will refine risk assessment, making these markets more efficient, but also potentially increasing the potential for both profit and loss.

- There's potential to use betting markets to incentivize disaster mitigation efforts. By rewarding accurate predictions and effective preparedness strategies, these markets could indirectly contribute to safer communities.

- New forms of disaster betting are likely to emerge. As our understanding of natural disasters evolves, so will the types of events and parameters used for speculation.

3. Conclusion

The growing trend of betting on natural disasters, exemplified by the Los Angeles wildfires case, presents a complex and multifaceted issue. While sophisticated financial instruments like catastrophe bonds and prediction markets offer innovative ways to manage risk, the ethical implications of profiting from human suffering are undeniable. The future of this market hinges on technological advancements, improved prediction accuracy, and robust regulatory frameworks. The potential for both positive and negative impacts underscores the importance of careful consideration and responsible development of this emerging field. To learn more about the ethical, financial, and societal dimensions of betting on natural disasters and to explore the potential for future regulation, we encourage further research into this critical area. Further investigation into the implications of disaster prediction markets and the role of wildfire betting is vital for responsible development and regulation of this emerging sector.

Featured Posts

-

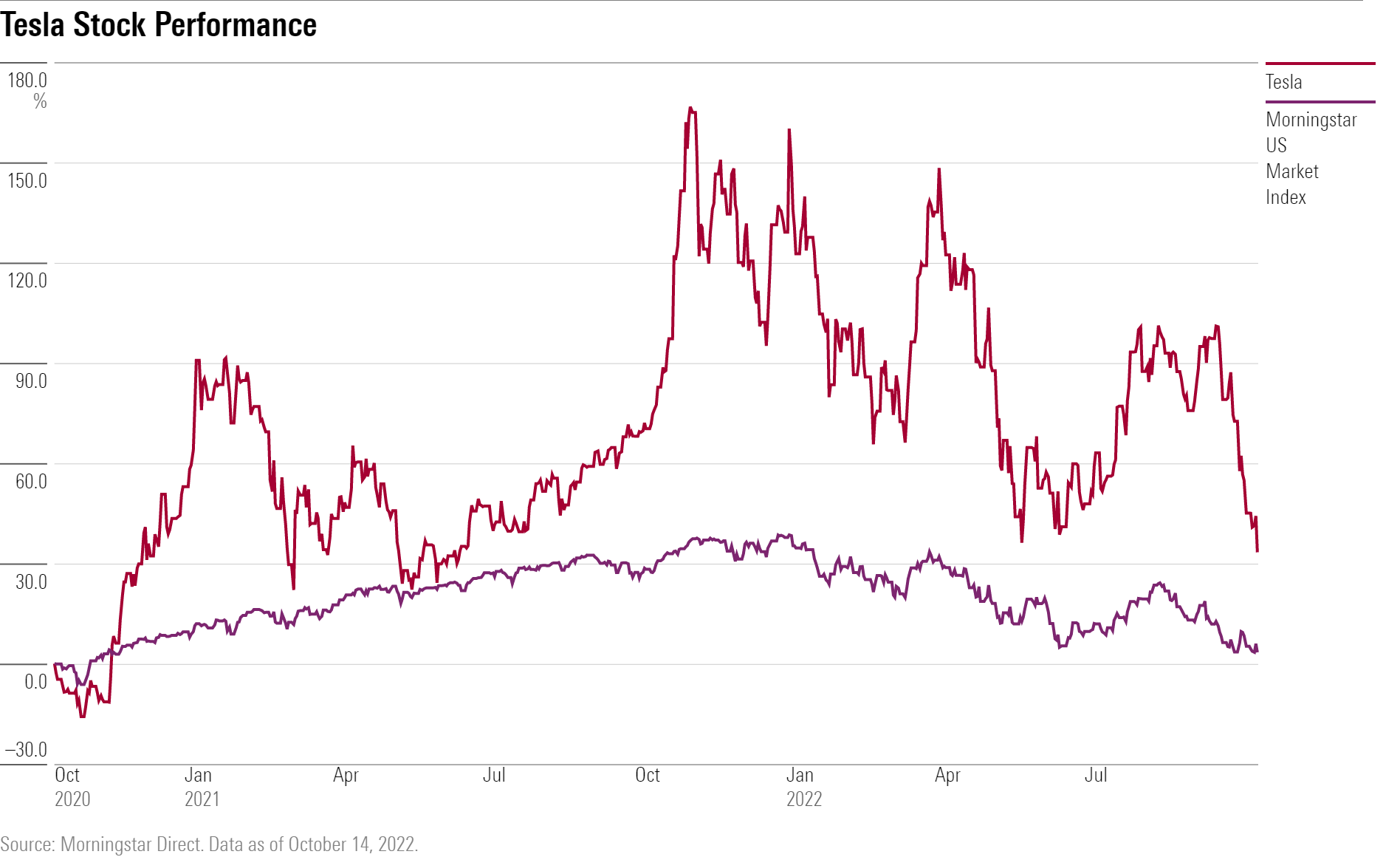

Tesla Stock Performance Q1 Profit Decline And Political Fallout

Apr 24, 2025

Tesla Stock Performance Q1 Profit Decline And Political Fallout

Apr 24, 2025 -

Why Pope Francis Ring Will Be Destroyed After His Death The Papal Protocol Explained

Apr 24, 2025

Why Pope Francis Ring Will Be Destroyed After His Death The Papal Protocol Explained

Apr 24, 2025 -

Elite Universities Adapting To Shifting Political Landscapes And Funding Models

Apr 24, 2025

Elite Universities Adapting To Shifting Political Landscapes And Funding Models

Apr 24, 2025 -

Ella Bleu Travoltas Stunning Transformation A Fashion Magazine Debut

Apr 24, 2025

Ella Bleu Travoltas Stunning Transformation A Fashion Magazine Debut

Apr 24, 2025 -

Tesla Earnings Plunge 71 In Q1 Impact Of Political Backlash

Apr 24, 2025

Tesla Earnings Plunge 71 In Q1 Impact Of Political Backlash

Apr 24, 2025