BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

BofA's Rationale Behind Downplaying Valuation Concerns

BofA's relatively sanguine view on stretched stock market valuations rests on several pillars. Their analysis suggests that current valuations, while seemingly high, are supported by several key macroeconomic and microeconomic factors.

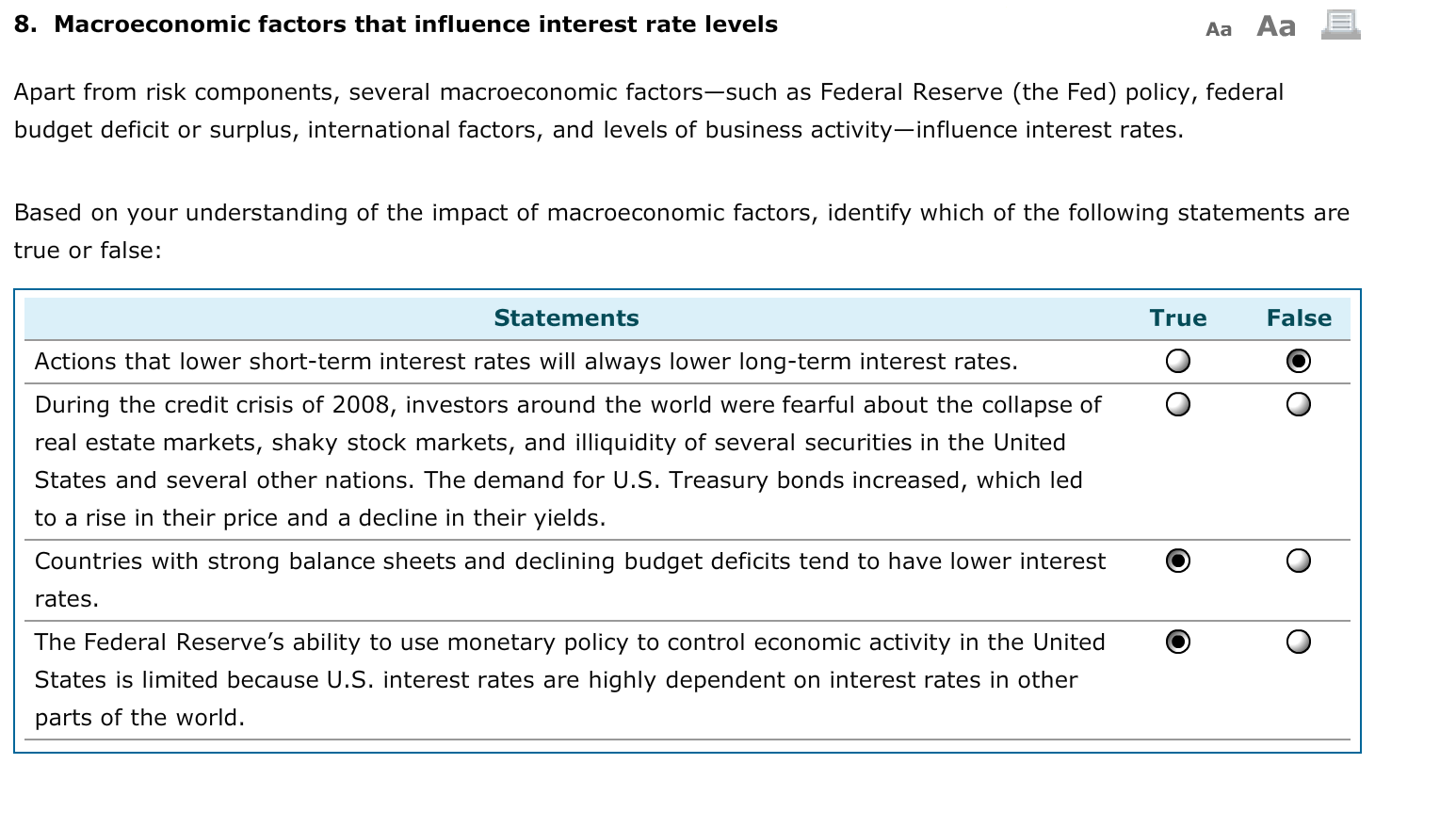

The Role of Low Interest Rates

Persistently low interest rates play a crucial role in justifying higher price-to-earnings (P/E) ratios. Low rates directly impact discounted cash flow (DCF) models, a cornerstone of stock valuation.

- Impact on DCF Models: Lower discount rates, a direct consequence of low interest rates, increase the present value of future earnings. This leads to higher valuations, even if future earnings growth remains constant.

- Investor Behavior: Low interest rates make bonds less attractive, pushing investors towards higher-yielding assets like equities, thereby increasing demand and driving up prices.

- Inverse Relationship: Historically, there's an inverse relationship between interest rates and stock valuations. As interest rates fall, stock valuations tend to rise, and vice-versa. While not always perfectly correlated, this trend is a significant factor in BofA's analysis. For example, during periods of quantitative easing, we've seen this relationship play out quite clearly.

Focus on Earnings Growth Potential

BofA's analysis heavily emphasizes the potential for future earnings growth as a key justification for current valuations. Their perspective suggests that focusing solely on current P/E ratios without considering future growth prospects provides an incomplete picture.

- Earnings Growth as a Valuation Driver: Companies with robust earnings growth trajectories can justify higher P/E multiples. Investors are willing to pay a premium for companies expected to generate significantly higher profits in the future.

- Sector-Specific Growth: BofA likely points to specific sectors poised for strong growth, such as technology, healthcare, or renewable energy, as key drivers of overall market valuation.

- Company-Specific Examples: BofA’s analysis might highlight specific companies with exceptional growth potential that support their overall positive outlook. These examples provide concrete evidence to support their broader claim.

Addressing Inflationary Pressures

While acknowledging the concerns surrounding inflationary pressures, BofA likely argues that their impact on valuations is manageable or potentially offset by other factors.

- Inflation's Impact on Corporate Profits: Inflation can erode corporate profits by increasing input costs. However, BofA might argue that companies can pass these increased costs onto consumers, mitigating the impact on profit margins.

- Offsetting Factors: Other economic factors, such as strong consumer demand or continued technological advancements, could offset the negative effects of inflation on corporate profitability.

- Monetary Policy Response: The potential response of central banks to inflation through monetary policy also plays a role. BofA might analyze the effectiveness and potential consequences of such actions on stock valuations.

Counterarguments and Potential Risks

While BofA's perspective offers a reassuring counterpoint to concerns about stretched valuations, it's crucial to acknowledge opposing viewpoints and potential market risks.

Valuation Metrics Beyond P/E Ratio

Relying solely on the P/E ratio can be misleading. Other valuation metrics provide a more comprehensive assessment.

- Price-to-Sales Ratio (P/S): This metric compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings.

- Price-to-Book Ratio (P/B): This ratio compares a company's market value to its book value (assets minus liabilities). It's often used to assess the intrinsic value of a company.

- Limitations of P/E Ratio: The P/E ratio can be easily manipulated by accounting practices and doesn't always reflect a company's true value. Using multiple valuation metrics provides a more balanced perspective.

Geopolitical and Economic Uncertainty

Geopolitical instability and economic uncertainty pose significant risks to stock valuations.

- Rising Interest Rates: An aggressive increase in interest rates by central banks to combat inflation could trigger a market downturn.

- Geopolitical Conflicts: Major geopolitical events can significantly impact market sentiment and investor confidence, leading to volatility and potential losses.

- Economic Slowdowns or Recessions: Economic downturns directly impact corporate profits and lead to lower stock valuations. These risks must be considered even with a positive long-term outlook.

Investor Implications and Strategic Considerations

BofA's analysis offers valuable insights for investors, but it shouldn't be interpreted as a guarantee of continued market growth.

Diversification and Risk Management

A well-diversified portfolio and sound risk management strategies remain crucial.

- Asset Allocation: Diversify across different asset classes (stocks, bonds, real estate, etc.) to reduce overall portfolio risk.

- Risk Tolerance: Understand your own risk tolerance before making any investment decisions.

- Regular Rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation.

Long-Term Investment Horizon

Maintaining a long-term investment horizon is critical for weathering short-term market fluctuations.

- Buy-and-Hold Strategy: A long-term buy-and-hold strategy minimizes the impact of short-term market volatility.

- Avoid Market Timing: Trying to time the market is often unsuccessful. Focusing on long-term growth is a more effective approach.

- Emotional Discipline: Maintain emotional discipline and avoid making impulsive decisions based on short-term market movements.

Conclusion

BofA's analysis suggests that while stock market valuations appear high, factors like low interest rates and future earnings growth potential offer mitigating circumstances. However, potential risks, including inflation, geopolitical uncertainty, and alternative valuation metrics, must be considered. While BofA suggests a less pessimistic outlook, prudent investors should remain aware of potential risks and maintain a well-diversified portfolio. Conduct thorough research and consider seeking professional financial advice before making any investment decisions based on BofA's analysis of stretched stock market valuations. Remember to continually monitor your investment strategy and adjust as needed. Don't ignore the potential risks, but also don't let fear paralyze you from taking advantage of potential opportunities in the market.

Featured Posts

-

Trumps Immigration Policies A Wave Of Legal Opposition

Apr 24, 2025

Trumps Immigration Policies A Wave Of Legal Opposition

Apr 24, 2025 -

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 24, 2025

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 24, 2025 -

Bitcoins Positive Movement Analyzing The Impact Of Trade And Federal Reserve Actions

Apr 24, 2025

Bitcoins Positive Movement Analyzing The Impact Of Trade And Federal Reserve Actions

Apr 24, 2025 -

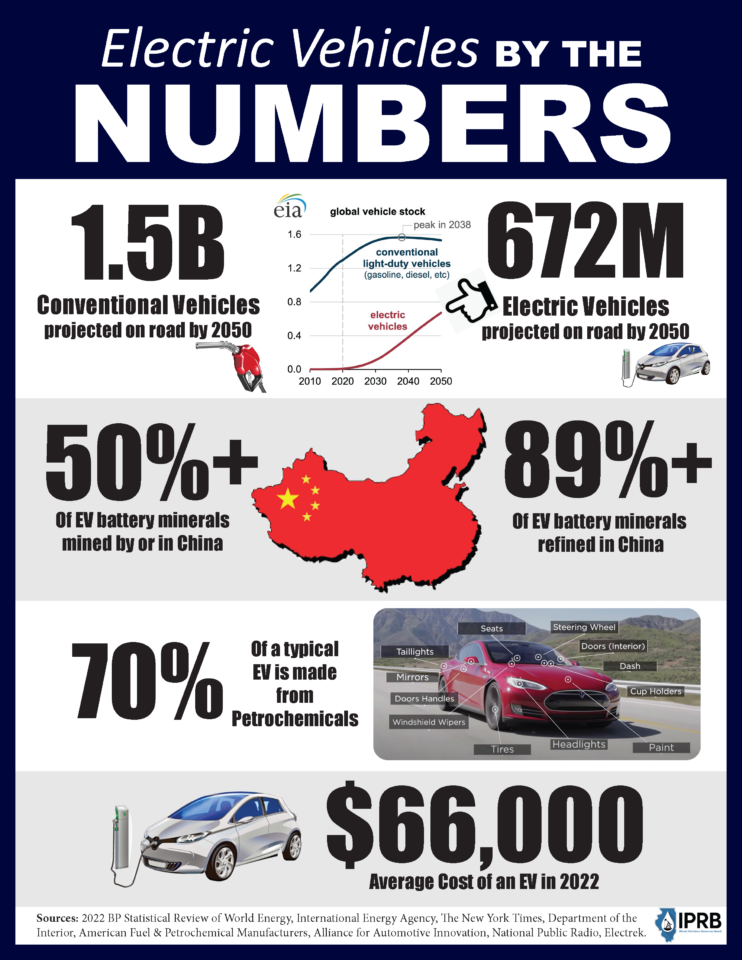

Auto Dealers Double Down On Opposition To Electric Vehicle Regulations

Apr 24, 2025

Auto Dealers Double Down On Opposition To Electric Vehicle Regulations

Apr 24, 2025 -

The Bold And The Beautiful April 16 Recap Hopes Concerns And Bridgets Revelation

Apr 24, 2025

The Bold And The Beautiful April 16 Recap Hopes Concerns And Bridgets Revelation

Apr 24, 2025