BofA's Take: Why Current Stock Market Valuations Shouldn't Scare You

Table of Contents

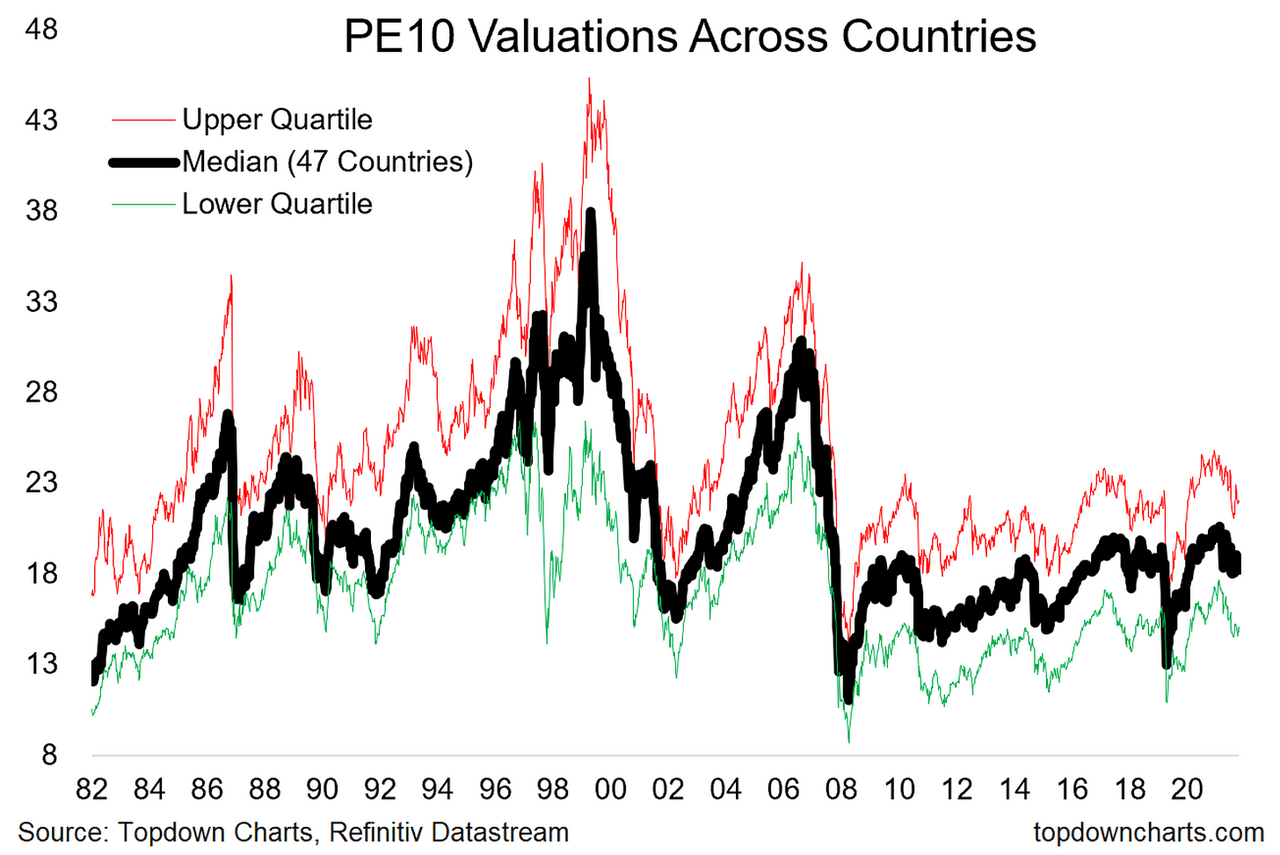

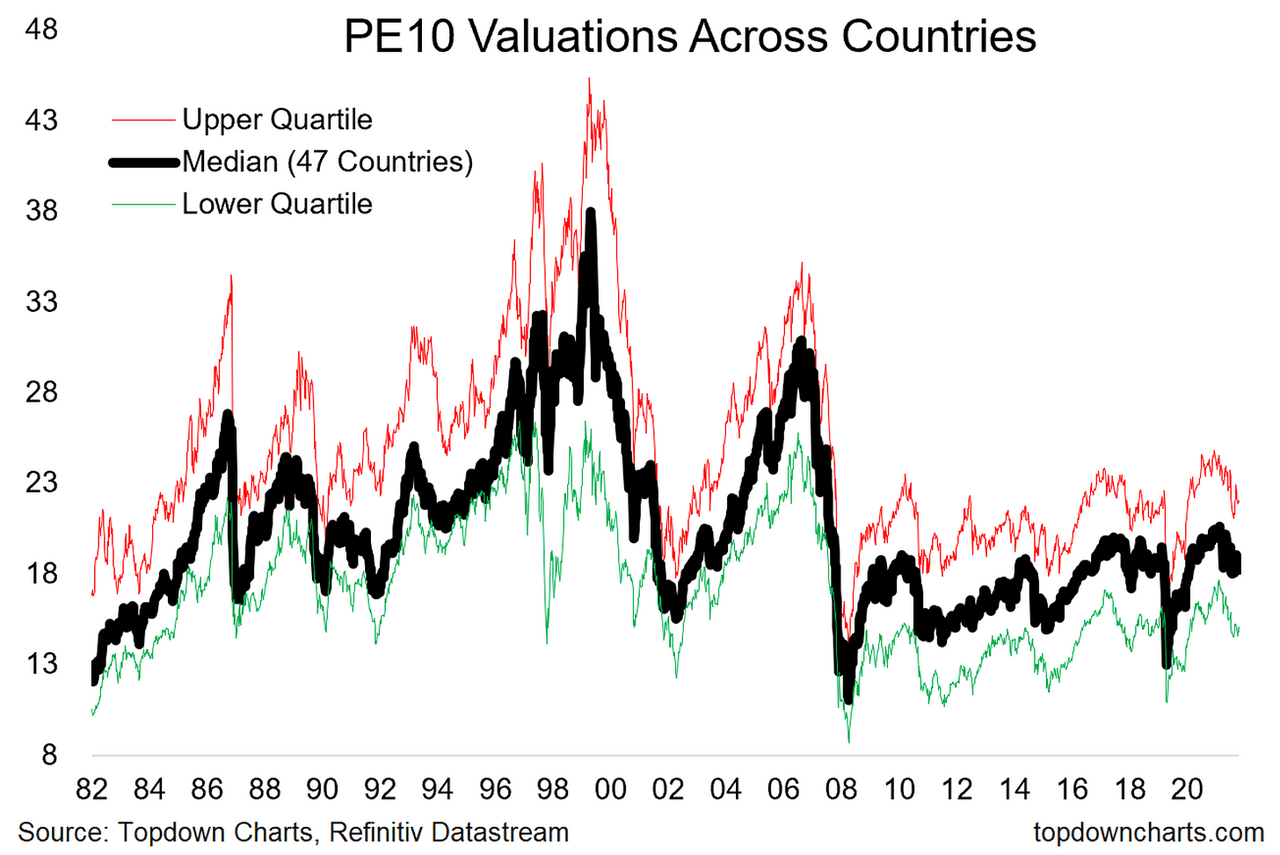

Understanding Current Market Valuations

The stock market is a complex beast, and understanding its current valuation is crucial for making sound investment decisions. Key metrics like Price-to-Earnings (P/E) ratios are often used to gauge whether the market is overvalued or undervalued. While some P/E ratios might appear high compared to historical averages, a nuanced view, informed by BofA's research, reveals a more complex picture. BofA's recent reports haven't issued a blanket warning; instead, they offer a more considered assessment of the market's state, taking into account various macroeconomic factors.

The Impact of Inflation

Inflation significantly impacts valuation metrics. High inflation erodes purchasing power, affecting earnings growth and increasing discount rates used in valuation models. BofA's analysis acknowledges this impact but also considers its potential long-term effects.

- Inflation's impact on earnings growth: High inflation can squeeze profit margins if companies struggle to pass on increased costs to consumers. However, BofA notes that some sectors demonstrate pricing power and can maintain profitability even in inflationary environments.

- Inflation's impact on discount rates: Higher inflation usually leads to higher interest rates, increasing the discount rate used in discounted cash flow (DCF) models. This reduces the present value of future earnings, potentially lowering valuations. BofA incorporates these adjustments into their models.

- Investor expectations: Investor expectations about future inflation significantly impact stock valuations. If investors expect high inflation to persist, they'll demand higher returns, leading to lower valuations. BofA's research incorporates varying inflation scenarios into their projections.

BofA's reports often highlight that while inflation is a concern, its impact on long-term growth is less significant than some might initially fear. They use data to show that strong corporate fundamentals can often outweigh the negative effects of moderate inflation.

Interest Rate Hikes and Their Effect

Interest rate hikes by central banks, like the Federal Reserve, influence stock valuations by affecting the attractiveness of bonds relative to equities. Higher interest rates boost bond yields, making bonds a more competitive investment.

- Interest rates and bond yields: Rising interest rates directly increase bond yields, making fixed-income securities more attractive to investors seeking safer returns.

- Interest rates and equity attractiveness: Higher bond yields can divert investment away from equities, potentially putting downward pressure on stock prices. BofA's analysis considers this dynamic, modeling various interest rate scenarios and their potential impacts.

- BofA's valuation models: BofA's analysts account for interest rate hikes in their valuation models by adjusting discount rates and forecasting potential changes in corporate earnings based on projected economic growth.

BofA acknowledges the short-term headwinds caused by interest rate increases but emphasizes that their long-term outlook remains positive, provided the increases are carefully managed.

BofA's Positive Outlook and Supporting Factors

Despite concerns, BofA maintains a relatively positive outlook on the stock market, supported by several key factors. Their analysts highlight strong corporate earnings and robust long-term growth potential as counterbalancing the effects of inflation and interest rate hikes.

Strong Corporate Earnings

BofA's analysis points to strong corporate earnings as a key factor supporting current valuations. Many sectors have demonstrated resilience and continued growth despite economic headwinds.

- Robust earnings growth: Sectors like technology and healthcare consistently show strong earnings growth, suggesting a healthy underlying economy.

- Earnings projections: BofA's analysts offer detailed earnings growth projections for various sectors, demonstrating a positive outlook for many companies. These projections often outpace inflation and interest rate increases.

- Comparison to previous years: BofA's reports compare current earnings growth to previous years, highlighting the ongoing strength of corporate performance.

This robust corporate performance helps counterbalance market anxieties surrounding inflation and interest rates, according to BofA's research.

Long-Term Growth Potential

BofA's analysts emphasize the long-term growth potential of the US economy and global markets, contributing to their optimistic view.

- Technological advancements: Continued innovation across numerous sectors fuels long-term growth and drives investor interest.

- Demographic shifts: Changing demographics, including a growing global middle class, contribute to increased consumer spending and economic expansion.

- BofA's economic forecasts: BofA's economic forecasts incorporate these factors, suggesting a sustained period of economic growth, supporting higher stock valuations over the long term.

Addressing Investor Concerns and Risks

It's essential to acknowledge that market volatility and potential risks remain. Investors should be aware of these potential challenges.

Managing Risk in a Volatile Market

Even with a positive outlook, risk management remains crucial. BofA often advises adopting strategies to mitigate potential losses.

- Diversification: Diversifying your investment portfolio across different asset classes reduces the impact of losses in any single sector.

- Asset allocation: Carefully allocating your assets based on your risk tolerance and investment horizon is crucial.

- Risk management techniques: Using stop-loss orders and other risk management techniques helps limit potential losses during market downturns. BofA's financial advisors can provide tailored advice based on individual needs.

Employing these techniques, as frequently suggested by BofA, can help investors navigate market uncertainties effectively.

The Importance of a Long-Term Investment Horizon

BofA consistently emphasizes the significance of maintaining a long-term investment horizon. Short-term market fluctuations are less impactful when viewed within a longer timeframe.

- Mitigating short-term volatility: A long-term perspective helps smooth out the impact of short-term market volatility.

- Historical market trends: Reviewing historical market trends reveals that long-term investors generally fare better than those focused on short-term gains.

- Long-term wealth creation: A long-term investment strategy allows compounding returns to significantly increase wealth over time.

Conclusion

BofA's perspective on current stock market valuations offers a nuanced view. While P/E ratios might seem high, various factors—strong corporate earnings, long-term growth potential, and BofA's comprehensive analysis—suggest that these valuations are not necessarily alarming. Their analysis emphasizes a long-term investment strategy and effective risk management as critical elements of successful investing. Don't let current stock market valuations scare you away from investing. Consider BofA's insights and develop a well-informed investment strategy that aligns with your long-term financial goals. Learn more about BofA's market analysis and discover how you can navigate current valuations to achieve your investment objectives.

Featured Posts

-

William Watsons Advice A Pre Election Examination Of The Liberal Platform

Apr 24, 2025

William Watsons Advice A Pre Election Examination Of The Liberal Platform

Apr 24, 2025 -

Herro Edges Hield In Thrilling Nba 3 Point Contest

Apr 24, 2025

Herro Edges Hield In Thrilling Nba 3 Point Contest

Apr 24, 2025 -

Bitcoin Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025

Bitcoin Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025 -

Land Your Dream Private Credit Job 5 Crucial Dos And Don Ts

Apr 24, 2025

Land Your Dream Private Credit Job 5 Crucial Dos And Don Ts

Apr 24, 2025 -

Remembering Jett Travolta John Travolta Shares Emotional Photo On What Would Have Been His Sons 33rd Birthday

Apr 24, 2025

Remembering Jett Travolta John Travolta Shares Emotional Photo On What Would Have Been His Sons 33rd Birthday

Apr 24, 2025