Brace For More Market Volatility: Stock Investors Facing Challenges

Table of Contents

Rising Inflation and Interest Rate Hikes

Inflation's relentless rise is significantly impacting stock valuations and investor confidence. The erosion of purchasing power and the uncertainty surrounding future price levels make it difficult for businesses to plan and for investors to project returns. The Federal Reserve's response – increasing interest rates – aims to curb inflation but introduces its own set of challenges. These rate hikes impact both businesses and consumers.

- Increased borrowing costs: Higher interest rates make it more expensive for businesses to borrow money, hindering expansion plans and potentially impacting profitability.

- Reduced consumer spending: As borrowing costs rise, consumers cut back on spending, leading to decreased demand and affecting company revenues.

- Potential for recessionary pressures: Aggressive interest rate hikes increase the risk of a recession, a period of significant economic decline.

- Strategies for navigating high-interest rate environments: While stocks might suffer, fixed-income investments like bonds can become more attractive in a high-interest-rate environment. Careful consideration of your investment strategy and asset allocation is crucial. Diversifying into assets less sensitive to interest rate changes can help mitigate some of the risks associated with high interest rates.

Geopolitical Uncertainty and Global Conflicts

Geopolitical instability and global conflicts inject significant uncertainty into the markets. These events trigger unpredictable market reactions and significantly influence investment decisions. The consequences ripple through the global economy.

- Supply chain disruptions: Conflicts and political instability often disrupt global supply chains, leading to shortages, price increases, and impacting business operations.

- Increased energy prices: Geopolitical tensions frequently translate to increased energy prices, further fueling inflation and impacting consumer spending.

- Refugee crises: Large-scale migration resulting from conflicts creates economic and social burdens, impacting the financial markets in various ways.

- Diversification strategies to mitigate geopolitical risks: International diversification – spreading investments across different countries and regions – can help reduce the impact of events concentrated in a specific geographic area. Thorough due diligence and understanding the political landscape of your investments is essential for mitigating geopolitical risk.

Technological Disruption and Industry Shifts

Rapid technological advancements are reshaping industries at an unprecedented pace. This presents both exciting opportunities and significant risks for investors. Adapting to these changes is crucial for success.

- The rise of AI and its impact on various sectors: Artificial intelligence is transforming numerous sectors, creating new opportunities while rendering some existing businesses obsolete. Understanding the transformative power of AI and its potential influence on different industries is paramount for smart investing.

- The shift towards renewable energy and its implications for fossil fuel companies: The global transition towards renewable energy sources poses challenges to the traditional fossil fuel industry, creating both winners and losers in the investment space.

- The importance of adapting to technological advancements: Staying informed about emerging technologies and their potential impact on established industries is essential for long-term investment success. Understanding disruptive innovation and its implications is key.

- Strategies for investing in emerging technologies: Investing in emerging technologies like AI, renewable energy, and biotechnology can offer significant growth potential, though it also involves higher risks. Careful research and risk assessment are essential.

Managing Risk in a Volatile Market

Effective risk management is paramount in navigating market volatility. A well-defined investment strategy incorporating appropriate risk management techniques is non-negotiable.

- Diversifying across different asset classes: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) helps reduce the overall portfolio's vulnerability to market fluctuations. This portfolio diversification is crucial.

- Utilizing hedging strategies: Hedging strategies, such as options or futures contracts, can help protect against potential losses in a volatile market.

- Regularly rebalancing the portfolio: Periodically rebalancing your portfolio to maintain your desired asset allocation helps to manage risk and capitalize on market opportunities.

- Seeking professional financial advice: Consulting a qualified financial advisor can provide valuable guidance and support in developing a personalized investment strategy that aligns with your risk tolerance and financial goals.

Conclusion: Preparing for Continued Market Volatility

The challenges facing stock investors are multifaceted, encompassing inflation, geopolitical uncertainty, and technological disruption. Proactive risk management, including diversification and a well-defined investment strategy, is crucial for navigating this volatile market. Informed decision-making, staying updated on market trends, and potentially seeking professional advice are vital steps.

Prepare yourself for continued market volatility by implementing a robust investment strategy. Learn more about effective risk management and portfolio diversification techniques to navigate the challenges of today's stock market. [Link to relevant resource 1] [Link to relevant resource 2]

Featured Posts

-

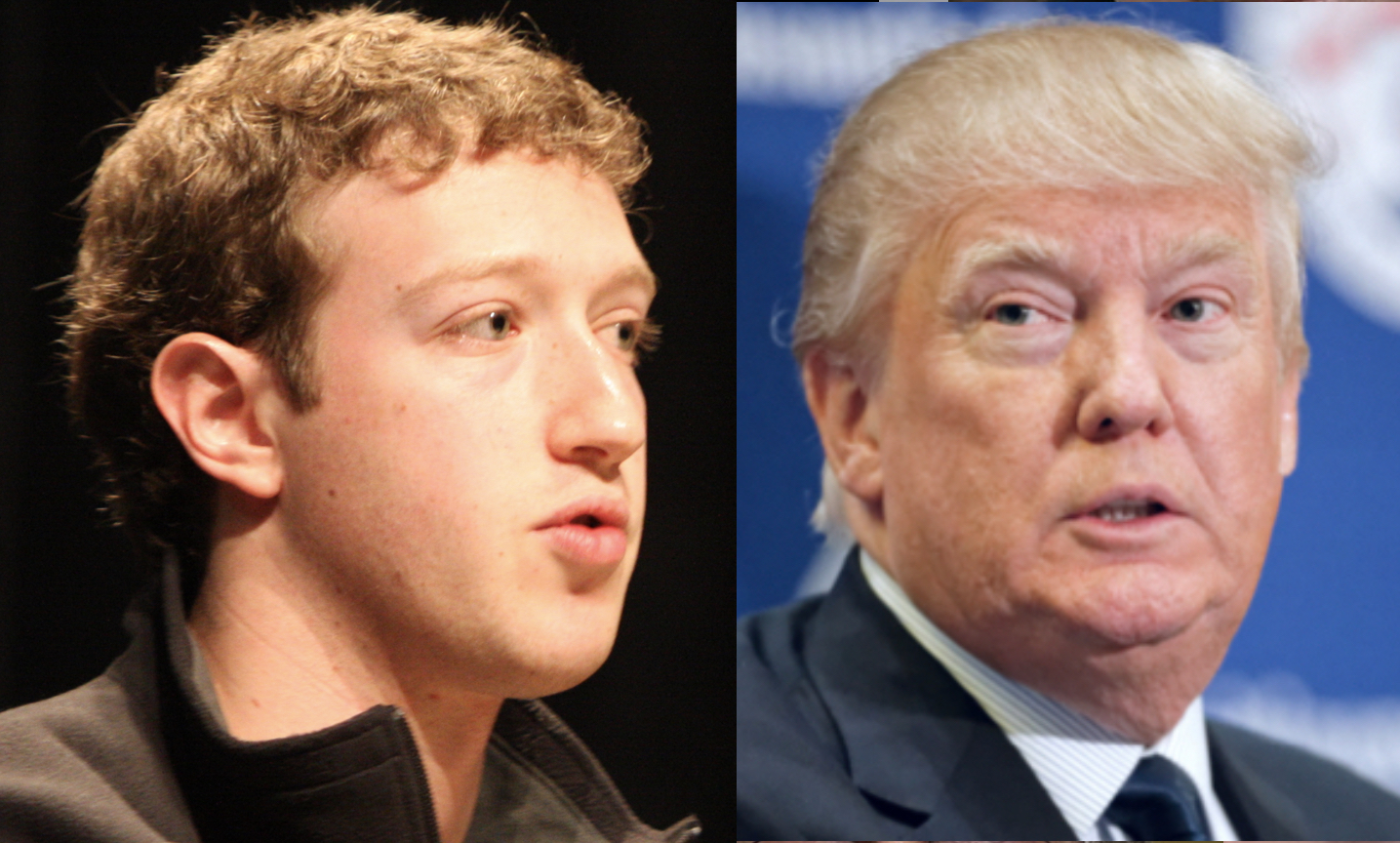

Zuckerbergs Leadership In The Age Of Trump

Apr 22, 2025

Zuckerbergs Leadership In The Age Of Trump

Apr 22, 2025 -

Hollywood Strike Actors Join Writers Bringing Industry To A Standstill

Apr 22, 2025

Hollywood Strike Actors Join Writers Bringing Industry To A Standstill

Apr 22, 2025 -

The Just Contact Us Approach A Case Study Of Tariff Avoidance On Tik Tok

Apr 22, 2025

The Just Contact Us Approach A Case Study Of Tariff Avoidance On Tik Tok

Apr 22, 2025 -

The Future Of The Catholic Church Pope Francis Legacy And The Election Of His Successor

Apr 22, 2025

The Future Of The Catholic Church Pope Francis Legacy And The Election Of His Successor

Apr 22, 2025 -

Cassidy Hutchinson Key Witness To January 6th Announces Memoir

Apr 22, 2025

Cassidy Hutchinson Key Witness To January 6th Announces Memoir

Apr 22, 2025