Canada Election: Conservatives Pledge Lower Taxes, Balanced Budget

Table of Contents

The upcoming Canadian election is shaping up to be a crucial one, with the Conservative Party making bold promises regarding fiscal policy. Their central platform revolves around delivering lower taxes for Canadians and achieving a balanced federal budget. This article will delve into the specifics of their plan, examining its potential impact and feasibility. The Conservatives believe this approach will stimulate economic growth and improve the lives of Canadians. Let's examine the details.

Tax Cuts: Details of the Conservative Tax Plan

The Conservative Party's proposed tax cuts form a cornerstone of their election platform. They aim to reduce the tax burden on individuals and businesses, stimulating economic activity and boosting disposable income.

Individual Income Tax Reductions

The Conservatives' plan includes several measures to reduce individual income taxes:

- Reduce the individual income tax rate for middle-income earners by 10%: This aims to provide direct relief to a significant portion of the Canadian population, increasing their disposable income and potentially boosting consumer spending.

- Eliminate the tax on income earned from eligible investments: This measure seeks to encourage saving and investment, further stimulating economic growth. While the specifics of "eligible investments" would need clarification, the aim is to incentivize long-term financial planning.

- Increase the basic personal amount: This would reduce the tax burden for lower-income earners, providing more relief for those who need it most.

The projected impact on household disposable income is significant, with estimates suggesting an average increase of [insert percentage or dollar amount, citing source if available]. However, critics argue that these cuts disproportionately benefit higher-income earners, leading to increased income inequality. Concerns also exist regarding potential loopholes that could allow wealthy individuals to minimize their tax liability. The debate surrounding Canadian tax rates and their impact on various income brackets is central to this policy proposal.

Corporate Tax Cuts & Business Incentives

To encourage business investment and job creation, the Conservatives propose:

- Reduce the federal corporate income tax rate by 2%: This reduction aims to make Canada more competitive globally, attracting foreign investment and encouraging domestic businesses to expand.

- Implement accelerated capital cost allowance: This measure will allow businesses to write off investments more quickly, freeing up capital for further expansion and job creation. Accelerated depreciation is often cited as a key incentive to increase business investment.

- Increase tax credits for research and development: This will incentivize businesses to invest in innovation and technology, fostering economic growth in the long term.

While these corporate tax cuts and business incentives are intended to stimulate the economy and create jobs, critics raise concerns about their effectiveness and potential unintended consequences. Some argue that the benefits may primarily accrue to large corporations rather than small and medium-sized enterprises (SMEs), and that the impact on job creation may be limited. The potential impact on corporate tax rates and their effects on various sized businesses will be an area to watch carefully.

Path to a Balanced Budget: Fiscal Responsibility Measures

Achieving a balanced budget is a central promise of the Conservative platform. This requires both spending cuts and, potentially, revenue generation strategies.

Spending Cuts & Government Efficiency

The Conservatives plan to reduce government spending through:

- Streamlining government operations and eliminating duplication: This aims to improve government efficiency and reduce administrative costs, freeing up funds for other priorities.

- Targeted cuts to specific government programs: The Conservatives have yet to clearly define which programs they would cut, leading to uncertainty and criticism. The level of detail on planned austerity measures is currently lacking.

- Improving procurement processes to reduce waste: This measure aims to ensure value for money in government spending.

The projected savings from these measures are estimated at [insert dollar amount or percentage, citing source if available]. However, critics question the feasibility of achieving such significant savings without negatively impacting essential public services. The Conservatives will need to provide greater transparency about their plans to reduce government spending to address these concerns.

Revenue Generation Strategies

While the Conservatives' focus is on tax cuts, they haven't ruled out exploring additional revenue generation strategies. These could potentially include:

- Increased focus on tax compliance and enforcement: Strengthening tax enforcement could help recover lost revenue and reduce tax evasion.

- Reforming certain tax credits or deductions: This could involve streamlining or limiting certain tax benefits to improve efficiency and fairness.

The projected increase in revenue from these strategies is not yet clearly outlined. Any such measures would need to be carefully designed to avoid undermining the overall goal of lower taxes.

Economic Impact & Analysis

The economic impact of the Conservative plan is a subject of ongoing debate.

Potential Economic Growth

The Conservatives argue that their plan will lead to significant economic growth through increased consumer spending and business investment. They project an increase in GDP of [insert percentage or dollar amount, citing source if available] within [timeframe]. This growth would be fueled by increased job market activity and improved confidence in the economy leading to an economic recovery.

Criticism & Counterarguments

Critics argue that the proposed tax cuts will exacerbate income inequality and increase the national debt, potentially jeopardizing Canada's long-term fiscal health. They point to the potential economic risks associated with significant cuts to government spending. Concerns also exist about the potential for increased inflation and the sustainability of these fiscal proposals. Furthermore, the lack of detail on specific spending cuts raises concerns about the feasibility of achieving a balanced budget without impacting essential services. The economic challenges facing Canada require careful consideration of all aspects of the plan.

Conclusion

The Conservative Party's election platform centers around a promise of lower taxes and a balanced budget, achieved through a combination of tax cuts and responsible spending measures. While the plan promises economic growth and tax relief for Canadians, its feasibility and potential impact remain subjects of ongoing debate. The specifics of certain proposals remain unclear, leaving room for further scrutiny and analysis.

Call to Action: Stay informed about the upcoming Canadian election and the various parties' plans. Learn more about the Conservative Party's proposals regarding lower taxes and a balanced budget to make an informed decision during the election. Understanding the nuances of the Canada election and each party’s stance on lower taxes and a balanced budget is crucial for every Canadian voter. Consider the potential implications for your personal finances and the overall Canadian economy when making your choice.

Featured Posts

-

Legal Implications Of Selling Banned Chemicals On E Bay Section 230 Under Scrutiny

Apr 24, 2025

Legal Implications Of Selling Banned Chemicals On E Bay Section 230 Under Scrutiny

Apr 24, 2025 -

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Allegations

Apr 24, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Allegations

Apr 24, 2025 -

Blockchain Security Enhanced Chainalysis Acquisition Of Alterya

Apr 24, 2025

Blockchain Security Enhanced Chainalysis Acquisition Of Alterya

Apr 24, 2025 -

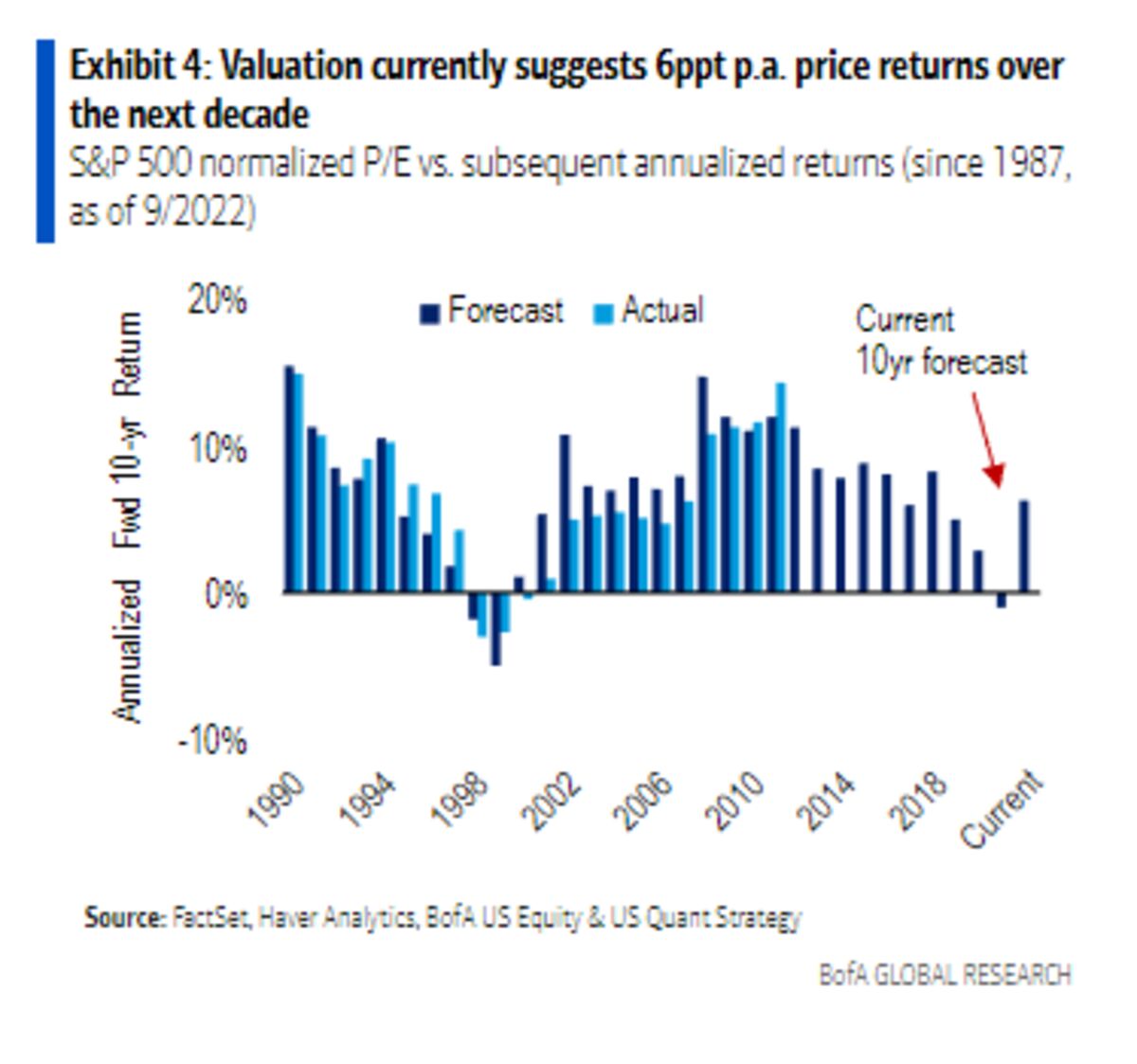

Are High Stock Market Valuations A Concern Bof A Weighs In

Apr 24, 2025

Are High Stock Market Valuations A Concern Bof A Weighs In

Apr 24, 2025 -

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025