Are High Stock Market Valuations A Concern? BofA Weighs In

Table of Contents

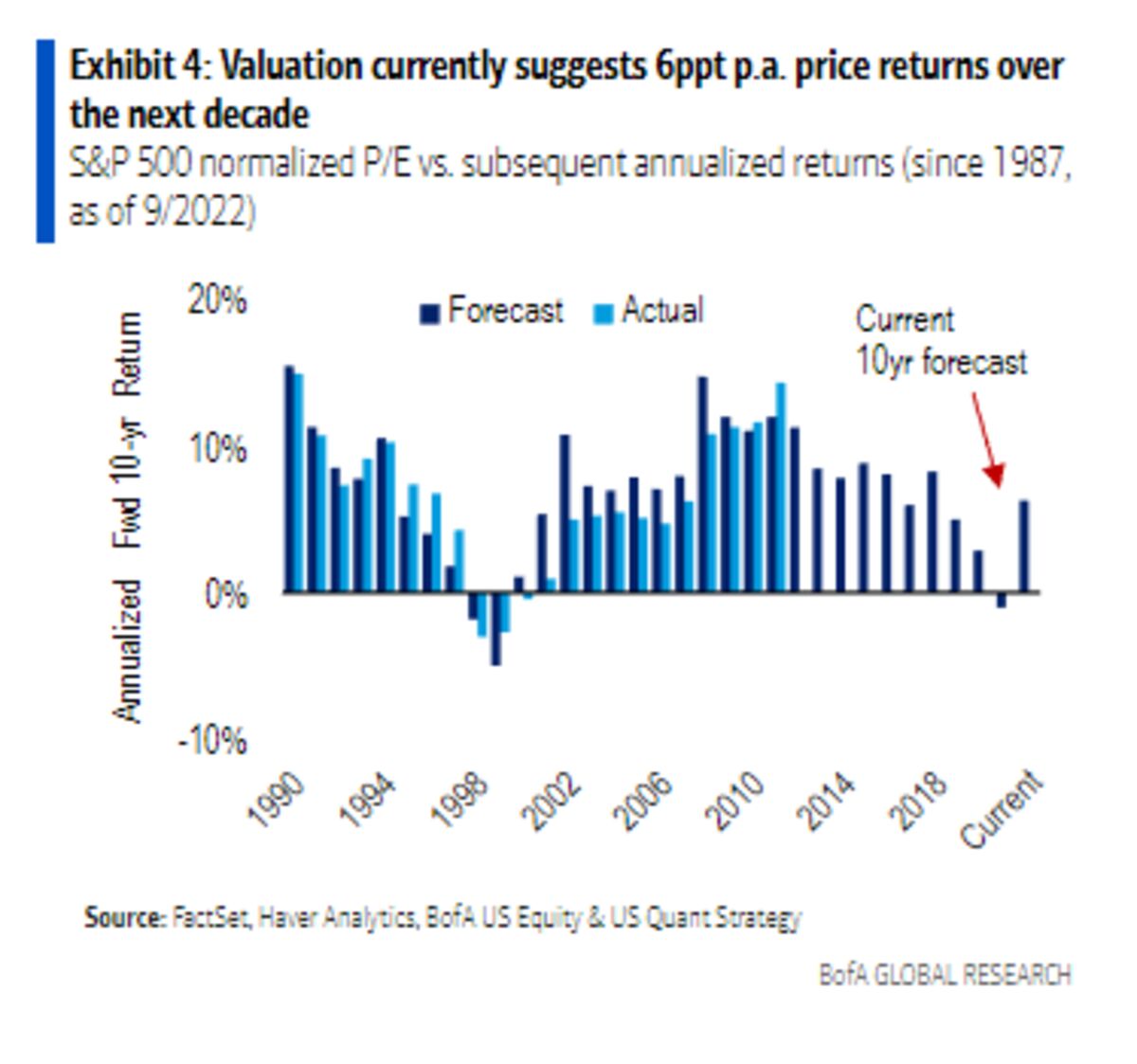

BofA's Current Assessment of Stock Market Valuations

Bank of America regularly publishes reports and commentary on the state of the market. Their analysis incorporates various metrics to assess valuations, providing investors with a comprehensive view. While specific statements change with market conditions, BofA generally uses key indicators such as the price-to-earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE), and dividend yield to gauge market valuation levels.

Key findings from BofA's analyses often include:

- Current valuation levels compared to historical averages: BofA's research frequently compares current P/E and CAPE ratios to their historical averages to determine if current valuations are significantly above or below the norm. This historical context helps assess whether valuations are justified by current economic conditions or represent potential overvaluation.

- BofA's assessment of potential overvaluation or undervaluation: Based on its quantitative and qualitative analysis, BofA expresses a view on whether the market is currently overvalued, fairly valued, or undervalued. This assessment is crucial for investors developing their investment strategy.

- Specific sectors or industries identified as particularly high or low valued: BofA often highlights specific sectors that appear overvalued or undervalued based on their analysis. This granular perspective enables investors to make more informed sector allocation decisions. For example, at certain points, BofA might flag technology stocks as overvalued while highlighting value opportunities in the energy sector.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the elevated stock market valuations we've seen. Understanding these factors is key to interpreting BofA's assessments and formulating your own investment strategy.

-

Macroeconomic factors: Low interest rates for an extended period have fueled borrowing and investment, driving up asset prices, including stocks. Inflation, while posing a risk, can also, in some circumstances, lead to higher corporate earnings, supporting higher stock prices. Strong economic growth projections can also boost investor confidence and valuations.

-

Investor sentiment and market psychology: Periods of optimism and bullish sentiment can push valuations higher regardless of fundamental economic factors. Market psychology plays a significant role, with herding behavior and fear of missing out (FOMO) contributing to upward pressure on prices.

-

Specific events and trends: Technological advancements, such as breakthroughs in artificial intelligence and renewable energy, can propel growth in certain sectors, contributing to higher valuations within those industries. Geopolitical events and global economic uncertainty can also influence investor behavior and market valuations.

-

Further contributing factors:

- The impact of quantitative easing (QE) and other monetary policies on liquidity and asset prices.

- The role of technological innovation in driving growth and higher valuations in specific sectors like technology and biotechnology.

- The influence of global economic uncertainty, trade wars, and geopolitical tensions on investor risk appetite and market valuations.

Potential Risks Associated with High Valuations

Investing in a potentially overvalued market presents significant risks. Understanding these risks is crucial for effective risk management.

-

Market corrections and crashes: High valuations often precede market corrections or crashes. A sharp decline in stock prices can lead to significant capital losses for investors.

-

Increased vulnerability to negative economic news: When valuations are high, even minor negative economic news can trigger disproportionately large market reactions.

-

Importance of risk management and diversification: Diversification across asset classes and sectors is essential to mitigate the risk of significant losses in a potentially overvalued market. Appropriate risk management strategies, such as hedging and stop-loss orders, become particularly important.

-

Specific risks associated with high valuations:

- Increased vulnerability to negative economic news or shifts in investor sentiment, leading to sharp price corrections.

- Higher potential for capital losses if the market experiences a correction or crash.

- The necessity of a well-diversified investment portfolio to mitigate risks and reduce the impact of potential losses in any single sector.

BofA's Recommendations for Investors

BofA's recommendations for investors in a high-valuation environment typically emphasize cautious optimism and a focus on risk management. They often suggest:

-

Sector rotation: Shifting investment focus from overvalued sectors to potentially undervalued ones.

-

Defensive investing: Favoring companies with stable earnings and strong balance sheets that are less susceptible to market volatility.

-

Value investing: Seeking out undervalued companies with strong fundamentals but lower current valuations.

-

Specific recommendations from BofA analysts: These recommendations can vary depending on the specific market conditions but often include sector-specific advice.

-

Strategies for mitigating risk: This includes diversification, hedging, and understanding personal risk tolerance.

-

Sectors BofA might recommend (and those to avoid): This changes frequently, so staying current on their reports is vital.

-

Advice on adjusting investment portfolios: This will involve considering time horizons, risk tolerance, and individual financial goals.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's analysis of high stock market valuations provides valuable insights for investors. Their use of metrics like P/E and CAPE ratios, combined with their assessment of macroeconomic factors and investor sentiment, offers a comprehensive perspective. While the potential for growth remains, the risks associated with high valuations necessitate a cautious approach and effective risk management strategies. It's crucial to carefully consider BofA's (and other experts') advice when making investment decisions. Stay informed about high stock market valuations, carefully consider your investment strategy in light of high stock market valuations, and learn more about managing risk in high stock market valuation environments. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Canadian Dollars Complex Forex Performance A Current Overview

Apr 24, 2025

Canadian Dollars Complex Forex Performance A Current Overview

Apr 24, 2025 -

Ella Travolta Kci Johna Travolte Ocarava Ljepotom

Apr 24, 2025

Ella Travolta Kci Johna Travolte Ocarava Ljepotom

Apr 24, 2025 -

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025

Consumers Curb Spending Impact On Credit Card Companies

Apr 24, 2025 -

Ella Travolta Ljepota Nasljedena Od Poznatog Oca

Apr 24, 2025

Ella Travolta Ljepota Nasljedena Od Poznatog Oca

Apr 24, 2025 -

Positive Market Sentiment Fueling The Niftys Bullish Charge In India

Apr 24, 2025

Positive Market Sentiment Fueling The Niftys Bullish Charge In India

Apr 24, 2025