Canadian Dollar's Mixed Performance: Gains Against US Dollar, Losses Against Others

Table of Contents

Strengthening CAD Against the USD: Factors Contributing to the Rise

The Canadian dollar has shown relative strength against its southern neighbour, the US dollar. Several key factors contribute to this rise:

Increased Commodity Prices

Canada's economy is heavily reliant on commodity exports. Rising prices for oil, lumber, and various metals significantly boost the CAD's value.

- Correlation between commodity exports and CAD strength: As global demand for Canadian commodities increases, so does the demand for the Canadian dollar, driving up its exchange rate.

- Specific commodity impacts: The recent surge in oil prices (e.g., a 15% increase in the past quarter) has had a particularly noticeable positive impact on the CAD. Similarly, strong lumber and metal exports have contributed to this trend. For example, increased demand for Canadian lumber has led to a X% rise in exports.

Bank of Canada's Monetary Policy

The Bank of Canada's monetary policy plays a crucial role in influencing the CAD's value. Recent interest rate hikes have attracted foreign investment, strengthening the currency.

- Higher interest rates attract foreign investment: Increased interest rates make Canadian assets more attractive to international investors, leading to increased demand for the CAD.

- Comparison with other major economies: Compared to some other major economies with lower interest rates, Canada's relatively higher rates make it a more appealing investment destination. For instance, Canada's current interest rate of X% is higher than the Y% rate in the Eurozone.

Relative Economic Strength

Canada's robust economic performance compared to the US also contributes to the CAD's strength against the USD.

- Key economic indicator comparisons: While both economies are experiencing inflation, Canada's GDP growth rate (e.g., X%) and unemployment rate (e.g., Y%) compare favorably to those of the US. These indicators suggest a relatively healthier Canadian economy, boosting investor confidence and strengthening the CAD. (Source: Statistics Canada)

Weakening CAD Against Other Currencies: Understanding the Losses

Despite its relative strength against the USD, the CAD has weakened against other major currencies. Several factors explain these losses:

Global Economic Slowdown

Global economic uncertainty and the potential for recessions in major economies negatively impact the CAD.

- Reduced demand for Canadian exports: A global economic slowdown diminishes the demand for Canadian goods and services, reducing the demand for the CAD and weakening its value against other currencies like the Euro and the Japanese Yen.

- Global economic indicators: Data showing declining global trade volumes and manufacturing output point towards a weakening global economy, affecting the CAD's value. (Source: IMF World Economic Outlook)

Strength of Other Currencies

The strength of other major currencies, such as the Euro and the US dollar, also influences the CAD's exchange rate.

- Factors behind the strength of other currencies: The Euro's strength, for instance, might be attributed to factors such as strong European Union economic growth or increased investor confidence in the region. Similarly, a strong USD might be related to the US Federal Reserve's monetary policy.

- Relative strength impacts the CAD: When other currencies strengthen, the CAD might appear comparatively weaker, leading to a decline in its exchange rate against these currencies.

Geopolitical Risks

Geopolitical events and uncertainties significantly influence investor sentiment and the CAD's value.

- Impact of specific geopolitical events: The ongoing war in Ukraine, for example, creates global uncertainty, impacting investor confidence and weakening the CAD. Similarly, escalating trade tensions between major economies can negatively impact the CAD.

- Effect on investor sentiment: Negative geopolitical developments often lead to investors seeking safer havens, reducing demand for riskier currencies like the CAD. (Source: Reuters, Bloomberg)

Strategies for Navigating CAD Volatility

Navigating the volatility of the Canadian dollar requires proactive strategies:

Hedging Strategies

Businesses and individuals can utilize hedging strategies to mitigate the risks associated with CAD fluctuations. These include currency forwards and options contracts.

Diversification

Diversifying investments across different currencies and asset classes is crucial to reduce the impact of CAD volatility on overall portfolios.

Monitoring Market Trends

Staying informed about economic and geopolitical factors influencing the CAD is essential. Regularly consulting financial news and expert analysis is vital.

Conclusion: Understanding the Canadian Dollar's Mixed Performance – A Path Forward

The Canadian Dollar's Mixed Performance reflects a complex interplay of factors, including commodity prices, monetary policy, relative economic strength, global economic conditions, and geopolitical events. Understanding these factors is paramount for effective financial planning and investment strategies. To successfully navigate this dynamic landscape, stay informed about the Canadian dollar's fluctuations by regularly consulting reputable financial news sources and expert analysis. For managing significant currency risks, consider seeking professional financial advice tailored to your specific needs.

Featured Posts

-

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025 -

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025 -

Update John Travolta Comments On Shared Photo From Luxurious Family Home

Apr 24, 2025

Update John Travolta Comments On Shared Photo From Luxurious Family Home

Apr 24, 2025 -

Stock Market Gains Tariff Hopes Fuel Dow Nasdaq And S And P 500 Surge

Apr 24, 2025

Stock Market Gains Tariff Hopes Fuel Dow Nasdaq And S And P 500 Surge

Apr 24, 2025 -

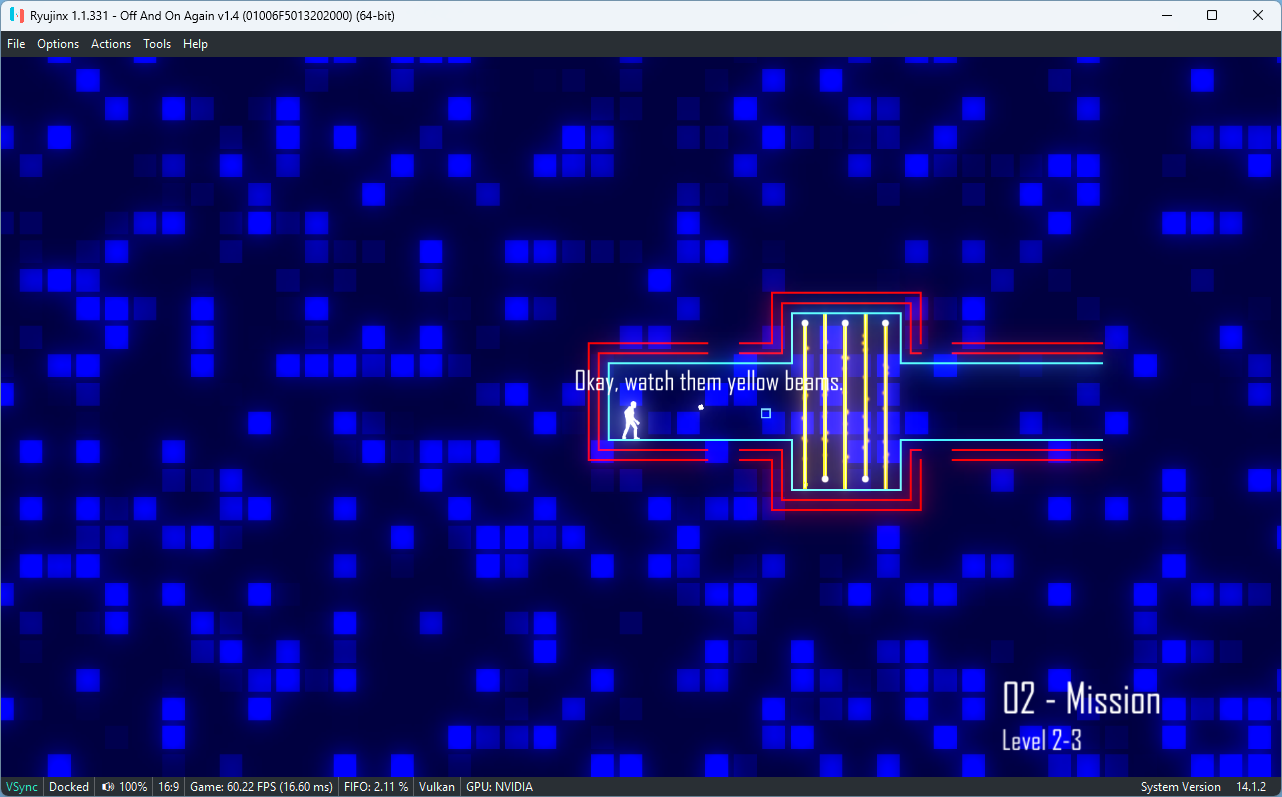

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 24, 2025

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 24, 2025