Capitalizing On Connections: Selling Stakes In Elon Musk's Private Ventures

Table of Contents

Understanding the Landscape of Elon Musk's Private Companies

Before considering selling stakes in Elon Musk's private ventures, it's crucial to understand the companies themselves. Investing in Musk's companies requires a deep understanding of their potential and inherent risks.

Identifying Key Ventures

Elon Musk's portfolio includes several groundbreaking private companies:

- SpaceX: Revolutionizing space exploration and aiming for Mars colonization. Recent achievements include successful Starship tests and numerous commercial launches, driving significant funding rounds and projected exponential growth.

- The Boring Company: Developing innovative tunnel-boring technology to alleviate traffic congestion. Securing contracts for infrastructure projects and continued innovation signal substantial future potential.

- Neuralink: Pioneering brain-computer interface technology with significant implications for medicine and beyond. Securing funding and progressing towards human trials positions it for massive future growth in the burgeoning neurotechnology sector.

- Tesla (partially private holdings): While publicly traded, Musk retains significant private holdings and influence, making it relevant in understanding his investment portfolio. Tesla's continued market dominance and expansion into new energy sectors further enhance its allure.

These ventures represent significant opportunities for investors, but careful due diligence regarding investing in Musk's companies is essential.

Assessing Risk and Reward

Investing in Elon Musk's private investments is inherently high-risk, high-reward. While the potential returns are enormous, several factors introduce significant risk:

- Market Fluctuations: The value of private equity can be highly volatile, sensitive to market sentiment and technological advancements.

- Regulatory Hurdles: Innovative ventures often face complex regulatory landscapes, potentially delaying progress or impacting profitability.

- Unpredictable Nature of Innovation: The success of these ventures hinges on continued innovation, which is inherently uncertain.

- Elon Musk's Leadership Style: Musk's unconventional leadership style, while often driving innovation, introduces an element of unpredictability.

Balancing these risks with the potential for enormous returns requires a thorough understanding of Elon Musk's investment portfolio and a robust risk management strategy.

Navigating the Sale Process: Strategies for Selling Stakes

Selling your stakes in these ventures requires a strategic approach. Understanding the process and employing effective strategies are crucial for maximizing your return.

Finding Potential Buyers

Identifying suitable buyers is the first step in selling private equity stakes. Potential buyers include:

- High-Net-Worth Individuals (HNWIs): Individuals with significant capital seeking high-growth investment opportunities. Networking within exclusive circles is key.

- Venture Capital (VC) Firms: Specialized firms investing in high-growth companies. Presenting a compelling investment thesis is crucial.

- Private Equity (PE) Groups: Larger firms actively seeking lucrative private equity opportunities. Demonstrating a strong ROI potential is key.

Utilizing specialized investment platforms and engaging financial advisors familiar with private equity can significantly improve your chances of finding a buyer.

Valuation and Negotiation

Valuing shares in private companies is complex and requires specialized expertise. Methods include:

- Discounted Cash Flow (DCF) Analysis: Projecting future cash flows and discounting them to present value.

- Comparable Company Analysis: Comparing the company's valuation to similar publicly traded companies.

Negotiating equity sales requires a strong legal team and a clear understanding of the company's value proposition. Due diligence from the buyer’s side will be thorough, so preparation is key.

Legal and Regulatory Considerations

Selling stakes in private companies involves significant legal and regulatory considerations:

- Securities Laws: Understanding and complying with relevant securities laws is crucial to avoid legal issues. Legal counsel specializing in private equity transactions is essential.

- Tax Implications: The sale will have tax implications that require careful planning and professional tax advice.

- Contractual Obligations: Thorough review of existing agreements and shareholder agreements is essential.

Ignoring these aspects can lead to significant legal and financial complications. Seeking expert legal advice is paramount.

Leveraging Your Network and Expertise

Success in selling stakes in Elon Musk's private ventures often hinges on leveraging your network and demonstrating the value of the investment.

Building Relationships

Networking is paramount in the private equity sector. Building strong relationships with:

- Investors: Attending industry events and leveraging existing professional contacts.

- Financial Advisors: Engaging professionals experienced in private equity transactions.

Provides access to potential buyers and invaluable market intelligence.

Demonstrating Value

Clearly showcasing the investment's potential is crucial. This involves:

- Compelling Presentations: Preparing detailed presentations highlighting the company's growth potential, strong management team, and market position.

- Thorough Due Diligence: Conducting rigorous due diligence to ensure the accuracy of all information presented.

- Strong Financial Projections: Developing robust financial projections to support claims of strong ROI.

A compelling presentation will significantly increase the chances of attracting potential buyers and achieving a favorable sale price.

Conclusion: Capitalizing on Your Connection to Elon Musk's Ventures

Selling stakes in Elon Musk's private ventures presents a unique opportunity with significant potential rewards, but it also involves considerable complexity and risk. Successful navigation requires a deep understanding of the investment landscape, a strategic approach to the sale process, and a strong network within the private equity sector. Thorough due diligence and expert legal advice are crucial. Explore selling stakes in Elon Musk’s companies carefully, understanding the high-risk, high-reward dynamics. Learn more about capitalizing on your connections in the private equity world of Elon Musk’s ventures, but remember to proceed with caution and seek professional guidance.

Featured Posts

-

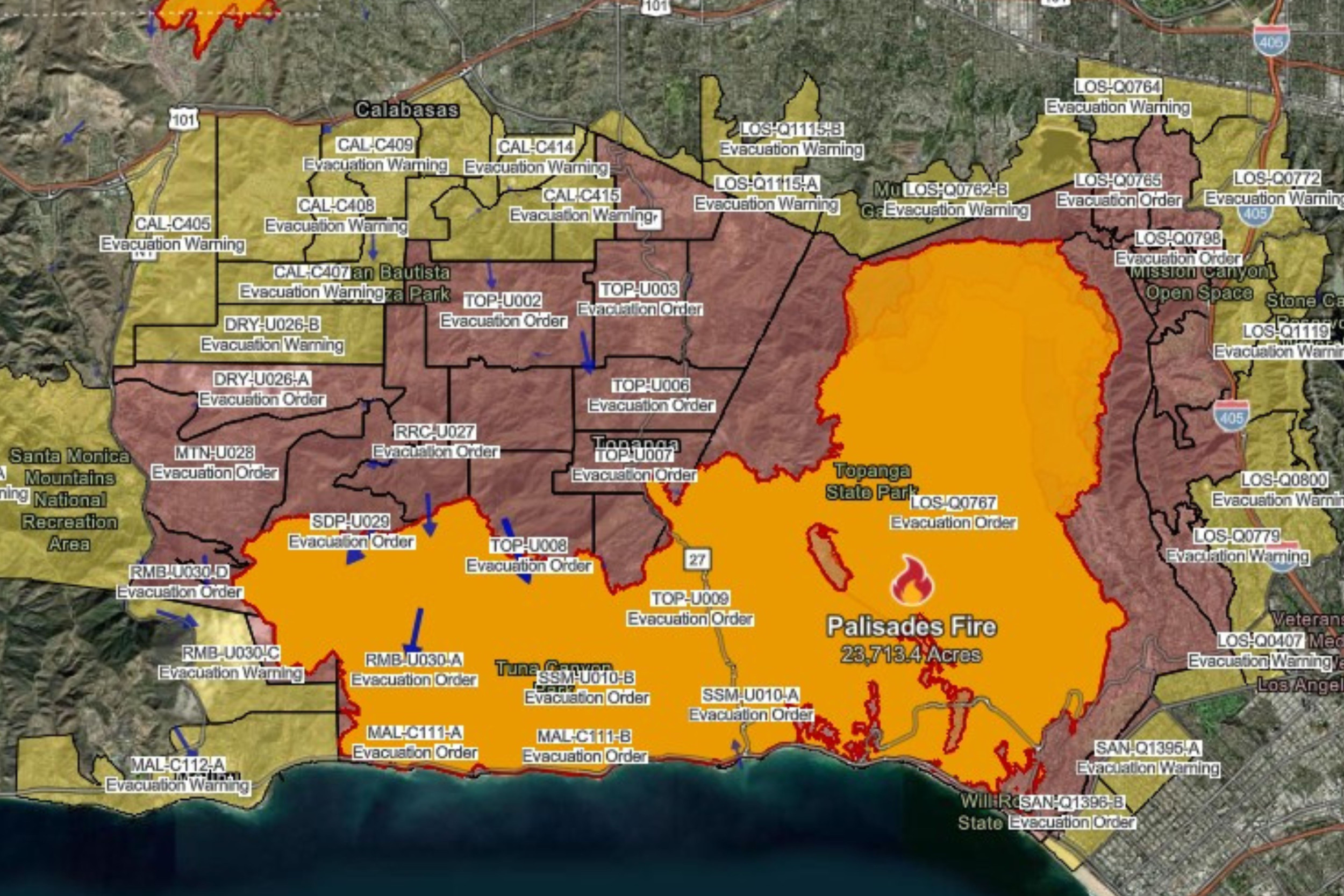

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 26, 2025

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 26, 2025 -

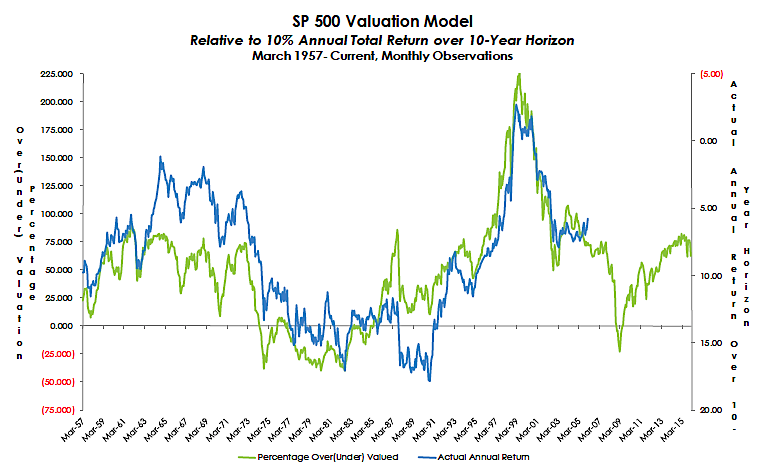

Why Stretched Stock Market Valuations Shouldnt Deter Investors Bof A

Apr 26, 2025

Why Stretched Stock Market Valuations Shouldnt Deter Investors Bof A

Apr 26, 2025 -

The Ripple Effect A Rural School 2700 Miles From Dc And Trumps Presidency

Apr 26, 2025

The Ripple Effect A Rural School 2700 Miles From Dc And Trumps Presidency

Apr 26, 2025 -

Discover 7 Exciting Restaurants In Orlando Beyond The Theme Parks 2025

Apr 26, 2025

Discover 7 Exciting Restaurants In Orlando Beyond The Theme Parks 2025

Apr 26, 2025 -

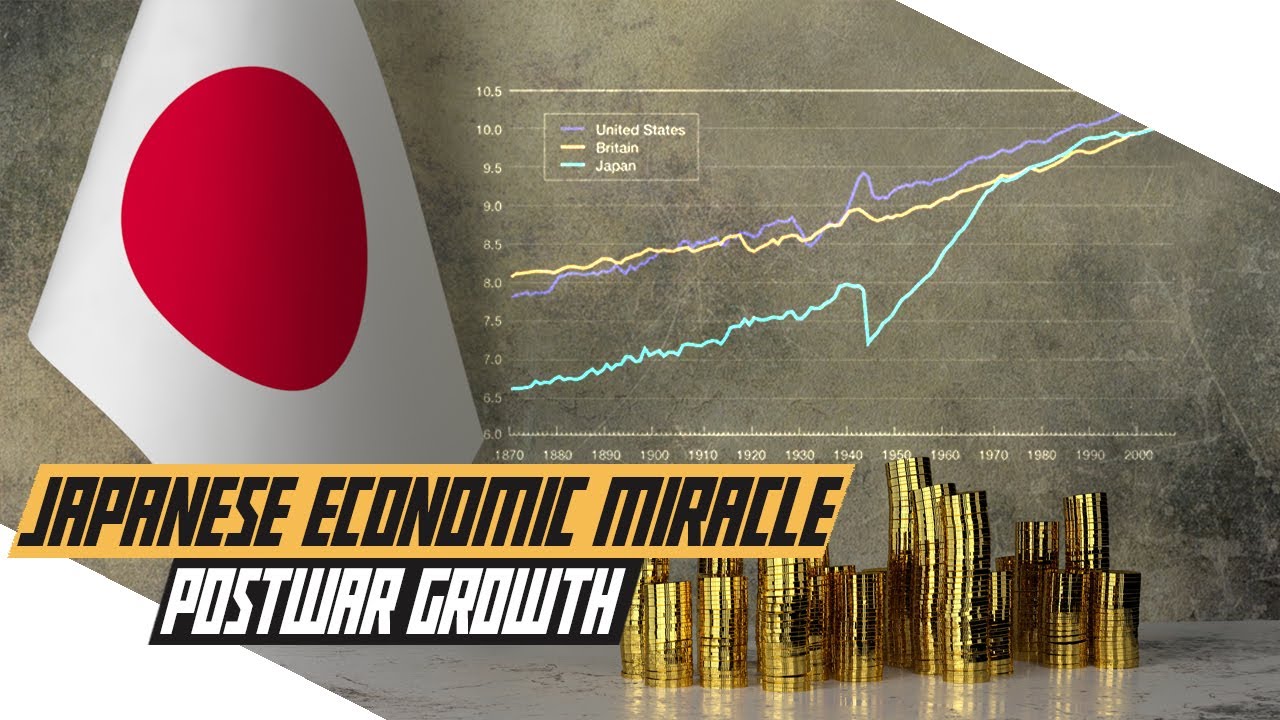

California Overtakes Japan A New Global Economic Powerhouse

Apr 26, 2025

California Overtakes Japan A New Global Economic Powerhouse

Apr 26, 2025