Why Stretched Stock Market Valuations Shouldn't Deter Investors: BofA

Table of Contents

BofA's Arguments Against Valuation Concerns

BofA's analysis suggests that several factors justify, at least partially, the current elevated valuations. These factors need to be considered by investors carefully weighing the potential risks and rewards of the current market conditions.

The Role of Low Interest Rates

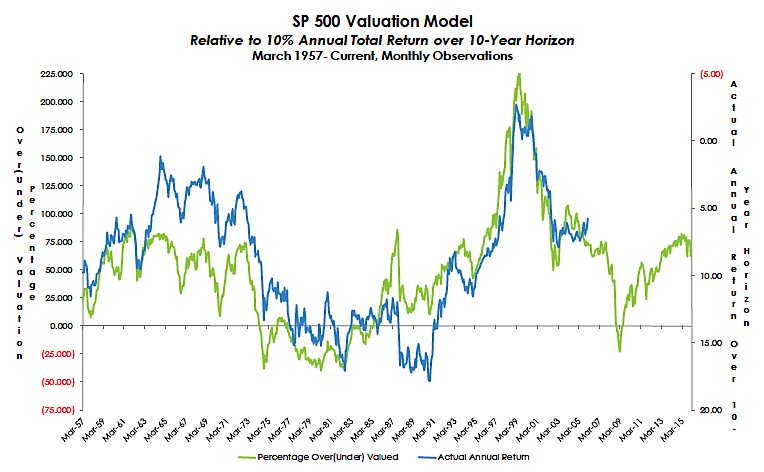

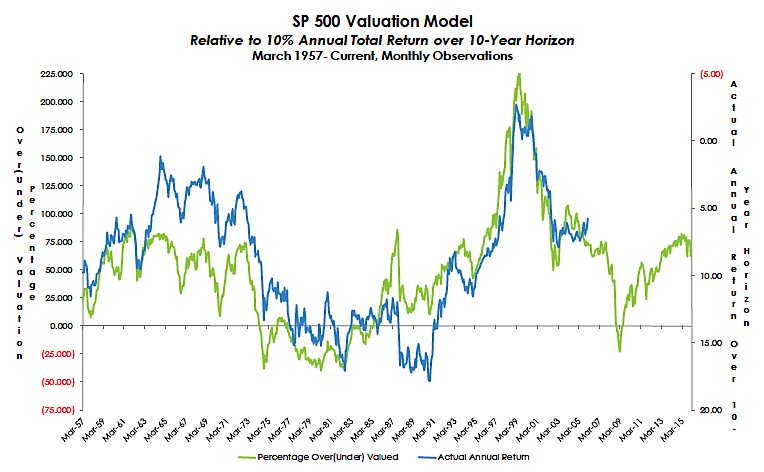

Historically low interest rates play a significant role in supporting higher valuations. The low interest rate environment significantly impacts the discount rate used in standard valuation models like the Discounted Cash Flow (DCF) model.

- Lower discount rates increase the present value of future earnings, thus justifying higher current stock prices.

- BofA's reports often highlight this relationship, showing how even with seemingly high price-to-earnings (P/E) ratios, the present value calculations remain reasonable in a low interest rate environment.

- This means that the cost of capital for companies is lower, allowing them to justify higher valuations based on future earnings potential. Lower interest rates increase demand for higher-yielding assets, including equities.

Strong Corporate Earnings Growth

Robust corporate earnings growth provides another strong justification for current valuations. Many sectors are experiencing exceptional profitability.

- Examples include technology companies benefiting from digital transformation and healthcare companies capitalizing on an aging population.

- BofA's forecasts consistently predict continued strong earnings growth for several key sectors, supporting the argument that current valuations aren't necessarily overblown.

- This sustained revenue growth and increasing profitability are key factors that help support higher valuation multiples.

Long-Term Growth Potential

Beyond current earnings, BofA emphasizes the substantial long-term growth potential of the market. Several powerful secular trends are driving this growth.

- Technological innovation continues to disrupt industries and create new growth opportunities.

- Demographic shifts, such as the growth of the global middle class, are fueling demand for various goods and services.

- Global economic expansion, albeit at a varying pace, contributes to overall market growth.

- BofA's long-term forecasts often reflect optimistic projections for these factors, indicating sustained market growth despite current valuations.

Addressing the Risks of High Valuations

While BofA presents a compelling case for current valuations, acknowledging the inherent risks is crucial.

Market Volatility

Highly valued markets are naturally more susceptible to market corrections. Any negative news or economic shocks could trigger a sharp decline in asset prices.

- Investors need to be prepared for increased market volatility and potential short-term losses.

- Effective risk management strategies, such as portfolio diversification and stop-loss orders, are essential to mitigate potential losses.

Potential for Overvaluation

Despite BofA's optimistic outlook, the possibility of overvaluation in specific sectors or individual stocks remains.

- Thorough fundamental analysis and due diligence are crucial to identify potentially overvalued stocks.

- BofA's own reports often include caveats and warnings about specific sectors or companies, emphasizing the importance of careful stock selection.

- Investors should focus on understanding the intrinsic value of companies rather than relying solely on market sentiment.

BofA's Recommended Investment Strategy

Based on their analysis, BofA suggests a considered approach to investing in the current market.

Sector-Specific Opportunities

Despite overall high valuations, BofA identifies several sectors with strong growth potential.

- These sectors often benefit from the long-term trends mentioned earlier, such as technological innovation or demographic changes.

- BofA’s reports often highlight these sectors as attractive investment opportunities, providing detailed rationale for their recommendations. These could include, for example, specific technology sub-sectors or healthcare segments.

Long-Term Perspective

BofA consistently emphasizes the importance of adopting a long-term investment horizon.

- Short-term market fluctuations are less significant in a long-term strategy focused on consistent growth.

- Patience and discipline are key to weathering market corrections and realizing long-term returns.

Conclusion: Navigating Stretched Stock Market Valuations

BofA's perspective on stretched stock market valuations provides a nuanced view for investors. While acknowledging the inherent risks of high valuations, their analysis emphasizes the positive impact of low interest rates, strong corporate earnings growth, and the significant long-term growth potential. Key takeaways include the need for careful risk management, sector-specific analysis, and a long-term investment approach. Don't let concerns about stretched stock market valuations deter you. Review BofA's analysis and develop a robust investment strategy based on long-term growth prospects. Understanding the interplay between these factors is crucial for navigating the current market successfully. Consider diversifying your portfolio, conducting thorough due diligence, and maintaining a long-term investment horizon to effectively manage the risks associated with high valuations.

Featured Posts

-

Switch 2 Preorder Success My Game Stop Experience

Apr 26, 2025

Switch 2 Preorder Success My Game Stop Experience

Apr 26, 2025 -

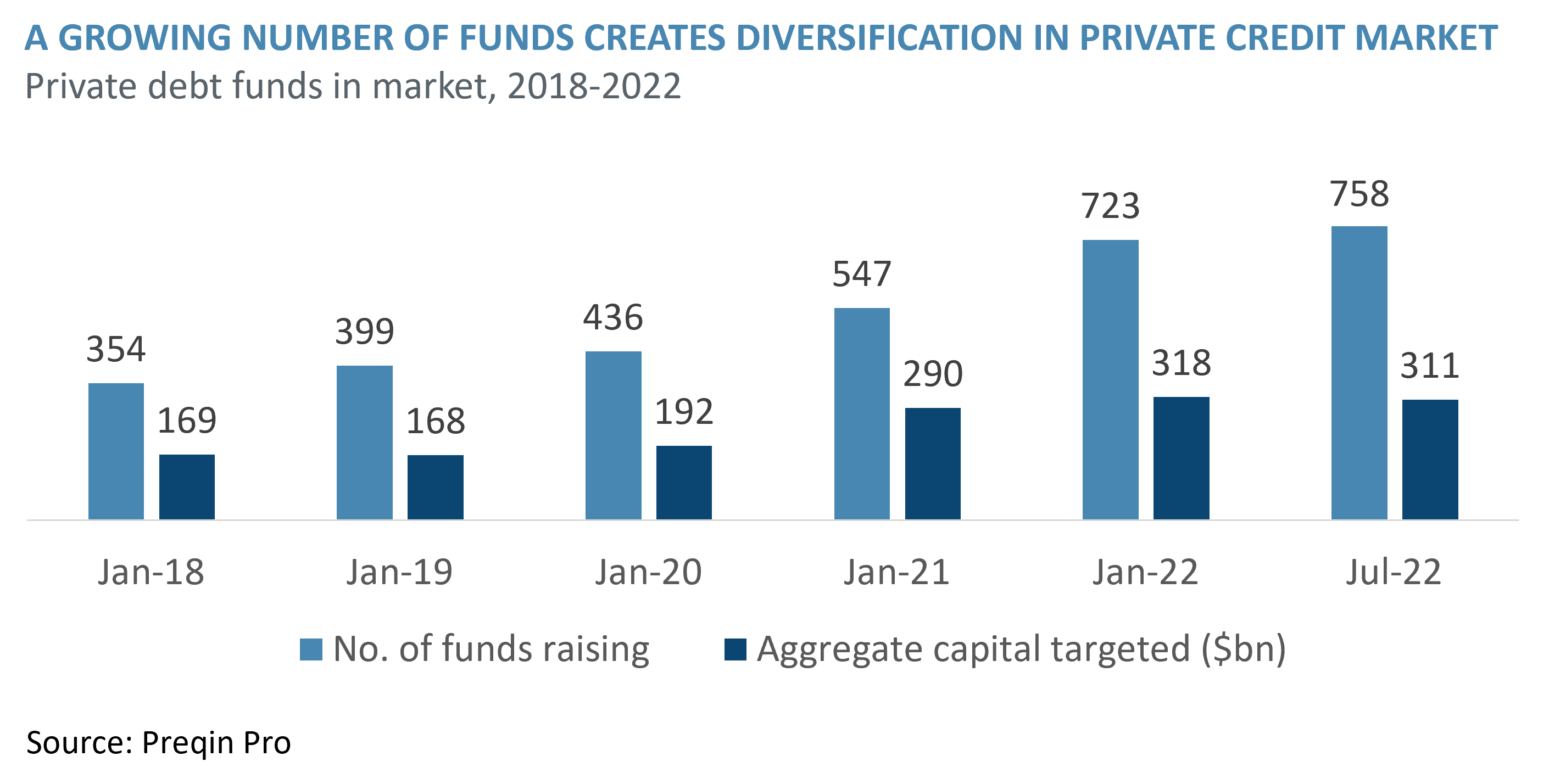

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 26, 2025

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 26, 2025 -

Sinners Cinematographer Captures The Mississippi Deltas Immensity

Apr 26, 2025

Sinners Cinematographer Captures The Mississippi Deltas Immensity

Apr 26, 2025 -

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025

Can Harvard Be Saved A Conservative Professors Perspective

Apr 26, 2025 -

The Growing Presence Of Chinese Cars A Global Perspective

Apr 26, 2025

The Growing Presence Of Chinese Cars A Global Perspective

Apr 26, 2025