Dax Outlook: Post-Bundestag Election Market Predictions

Table of Contents

Coalition Government Formation and Market Stability

The formation of a stable coalition government is crucial for investor confidence and the DAX's performance. Different coalition scenarios will likely lead to variations in economic policy, impacting German businesses and, consequently, the stock market. The speed and smoothness of coalition negotiations are also key factors. A protracted and contentious process can create market volatility.

-

Impact of potential fiscal policies (spending, taxation) on DAX performance: A government focused on increased social spending might boost consumer confidence but could also lead to higher national debt and potentially dampen DAX growth. Conversely, tax cuts aimed at stimulating business investment could positively impact the DAX, but their effectiveness depends on the details of the policy.

-

Effect of regulatory changes on specific DAX sectors (e.g., automotive, energy): The automotive sector, a significant component of the DAX, is particularly vulnerable to regulatory shifts regarding emissions and environmental standards. Similarly, energy policies focusing on renewable energy sources will influence the performance of energy companies listed on the DAX.

-

Analysis of investor confidence under different coalition scenarios: A coalition perceived as stable and pro-business will likely boost investor confidence, leading to a positive DAX outlook. Conversely, a coalition perceived as unstable or implementing policies deemed harmful to business could trigger sell-offs and negatively impact the DAX.

Economic Growth Projections and DAX Performance

Post-election, forecasting German economic growth is paramount in predicting DAX performance. A strong correlation exists between Germany's GDP growth and the DAX index. Positive GDP growth typically translates to positive DAX performance, while negative or slow growth often leads to a decline in the DAX.

-

Impact of global economic factors (e.g., inflation, supply chain issues) on the German economy and DAX: Global inflation and ongoing supply chain disruptions pose significant risks to Germany's economic outlook and, consequently, the DAX. These factors could lead to downward revisions of DAX forecasts.

-

Expected performance of key DAX sectors based on economic growth predictions: Sectors like manufacturing and exports are particularly sensitive to economic growth. Strong economic growth could boost the performance of these sectors and positively affect the DAX. Conversely, sluggish growth could lead to underperformance.

-

Potential for upward or downward revisions of DAX forecasts: The actual economic performance in the coming years will dictate whether initial DAX forecasts need upward or downward revisions. Close monitoring of economic indicators is crucial for accurate predictions.

Key Sectors to Watch in the Post-Election DAX

The post-election DAX outlook will be significantly shaped by the performance of certain key sectors. Understanding their sensitivity to political and economic changes is critical for investors.

-

In-depth analysis of 2-3 key sectors within the DAX: The automotive sector, facing significant transformation due to electric vehicle adoption and stricter emissions regulations, warrants close monitoring. The technology sector, known for its innovation and growth potential, will be influenced by government support for digitalization initiatives. Finally, the energy sector's performance is directly linked to government policies on renewable energy and energy transition.

-

Specific examples of companies within these sectors and their sensitivity to political changes: Volkswagen, a major player in the automotive industry, is highly sensitive to regulatory changes. Similarly, SAP, a leading technology company, will benefit from policies promoting digitalization. Energy companies like RWE will be directly impacted by government strategies on renewable energy.

-

Potential for sector-specific investment opportunities or risks: The post-election environment might present sector-specific investment opportunities. For example, companies focusing on sustainable technologies within the automotive or energy sectors could see significant growth. However, certain sectors might face increased regulatory burdens, leading to increased investment risk.

Risks and Uncertainties Affecting the DAX Outlook

Despite positive projections, several risks and uncertainties could negatively impact the DAX.

-

Assessment of geopolitical risks (e.g., relations with Russia, EU policies): Germany's geopolitical relations, particularly with Russia and its position within the EU, will significantly influence the DAX. Geopolitical instability can negatively impact investor confidence and lead to market volatility.

-

Inflationary pressures and their impact on German businesses: Persistently high inflation can erode consumer spending and impact business profitability, negatively impacting the DAX.

-

Potential negative consequences of specific government policies: Poorly designed or implemented government policies, particularly those impacting business regulations or taxation, can harm the economy and the DAX.

Conclusion

The Dax Outlook: Post-Bundestag Election Market Predictions remains complex and depends on various interconnected factors. The formation of a stable government, economic growth projections, the performance of key sectors, and geopolitical stability all play critical roles in shaping the DAX's trajectory. Investors should carefully consider these factors when developing their investment strategies. Remember that accurately predicting the DAX requires constant monitoring of economic indicators and political developments. Stay updated on the latest DAX outlook and post-Bundestag election market predictions by following reputable financial news sources. Make informed investment decisions based on a comprehensive understanding of the DAX.

Featured Posts

-

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025

Werner Herzogs Bucking Fastard Casting News And Sisterly Leads

Apr 27, 2025 -

La Garantia De Gol De Alberto Ardila Olivares Un Analisis

Apr 27, 2025

La Garantia De Gol De Alberto Ardila Olivares Un Analisis

Apr 27, 2025 -

Ramiro Helmeyer And The Pursuit Of Blaugrana Glory

Apr 27, 2025

Ramiro Helmeyer And The Pursuit Of Blaugrana Glory

Apr 27, 2025 -

Us China Trade War Bill Ackmans Perspective On Times Impact

Apr 27, 2025

Us China Trade War Bill Ackmans Perspective On Times Impact

Apr 27, 2025 -

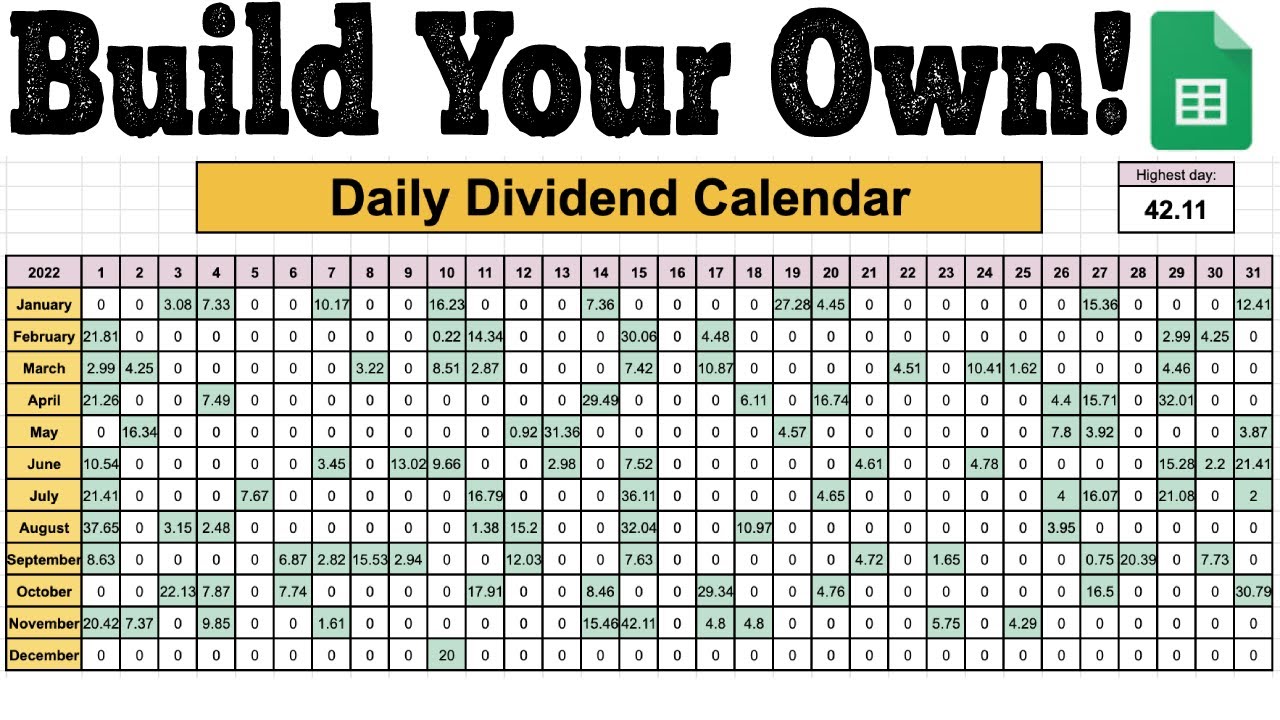

Pfc Dividend 2025 March 12th Announcement Of Fourth Cash Reward For Fy 25

Apr 27, 2025

Pfc Dividend 2025 March 12th Announcement Of Fourth Cash Reward For Fy 25

Apr 27, 2025