Dollar Rises: Trump's Softer Tone On Fed Boosts USD Value Against Major Peers

Table of Contents

Trump's Shift in Fed Policy Criticism

For years, President Trump frequently criticized the Fed's monetary policy, particularly under Chairman Jerome Powell. His pronouncements, often characterized as pressure tactics, were widely seen as undermining the Fed's independence and creating uncertainty in the markets. These criticisms, frequently expressed as calls for lower interest rates ("too slow to cut rates"), often coincided with periods of USD weakness.

However, recently, Trump's tone has noticeably softened. His attacks on the Fed have become less frequent and less intense, marking a significant departure from his previous approach. This shift in rhetoric is noteworthy, potentially signaling a change in his overall economic strategy.

- Examples of past criticisms: Statements from 2018-2019 directly criticizing Powell's interest rate decisions, labeling them as detrimental to the US economy. Specific news articles and dates referencing these statements should be included here (this requires referencing specific news sources).

- Examples of recent subdued comments: Highlight instances where Trump has either refrained from criticizing the Fed or has offered more conciliatory statements, again referencing specific dates and sources.

- Market Reaction: The market reacted positively to this change, interpreting it as a reduction in political uncertainty surrounding monetary policy. This increased investor confidence, leading to a flow of capital into USD-denominated assets.

Impact on Investor Sentiment and USD Value

Reduced political uncertainty is a major driver of investor confidence. When investors perceive less risk associated with a particular currency or market, they are more likely to invest in assets denominated in that currency. This increased demand subsequently pushes up the value of the currency. In the case of the USD, Trump's less antagonistic stance towards the Fed has demonstrably calmed market anxieties.

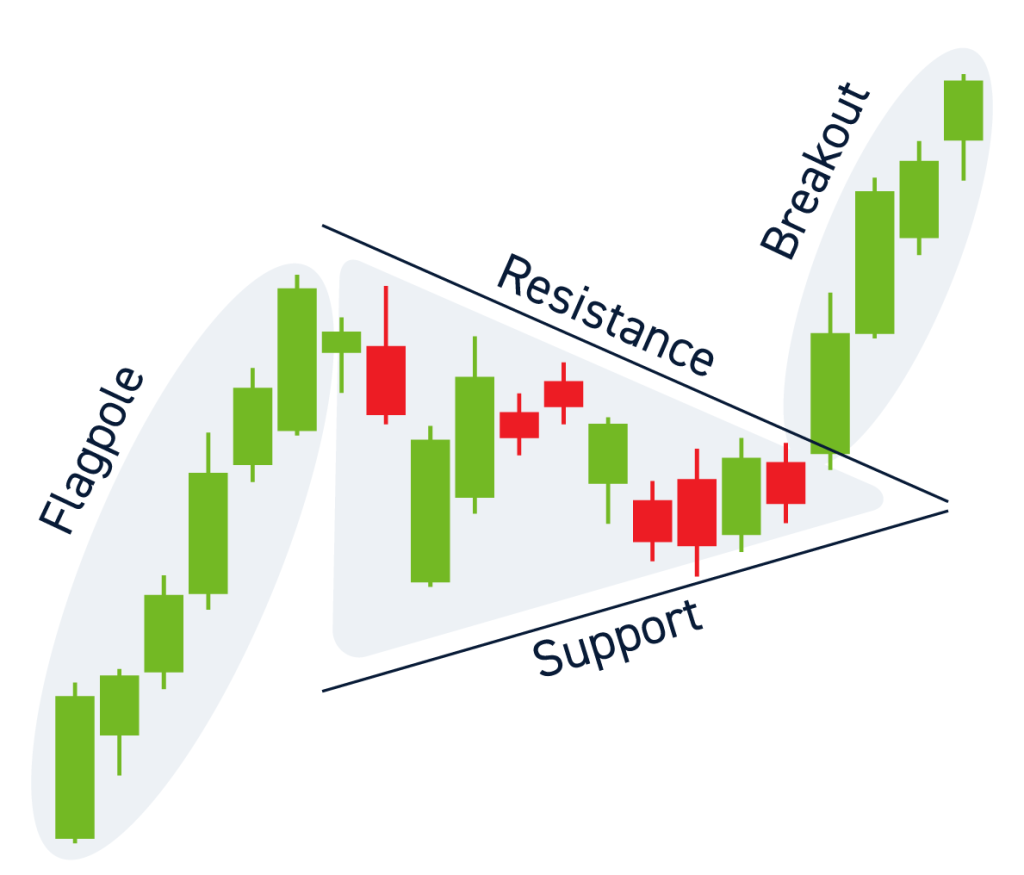

- Statistics showing USD appreciation: Include specific data points illustrating the percentage increase of the USD against major currencies (e.g., EUR/USD, USD/JPY, GBP/USD) since the shift in Trump's rhetoric. Visual representations like charts and graphs would enhance this section.

- Analysis of capital flows: Data on capital inflows into US Treasury bonds and other dollar-denominated assets would further solidify this connection between Trump's changed approach and the strengthening USD.

- Correlation between Trump's comments and USD fluctuations: A clear graphical representation illustrating the correlation between significant statements made by Trump and subsequent movements in the USD exchange rate would be highly impactful.

Analysis of Other Contributing Factors

While Trump's altered approach to the Fed is a significant factor in the "Dollar Rises" trend, it's crucial to acknowledge that other macroeconomic factors influence the USD's value. Global economic growth, interest rate differentials between the US and other countries, and risk aversion play a crucial role.

- Global economic indicators: Discuss relevant indicators like global GDP growth, trade balances, and commodity prices that can impact the USD's strength.

- Interest rate differentials: Explain the relationship between US interest rates and those in other major economies. Higher interest rates in the US typically attract foreign investment, increasing demand for the USD.

- Interaction of factors: Analyze how these factors interact with Trump's influence, acknowledging that the USD's movement is a complex interplay of multiple forces.

The Role of Geopolitical Uncertainty

Geopolitical events significantly influence investor confidence and currency values. Increased global uncertainty often leads to a "flight to safety," with investors seeking refuge in the perceived stability of the US dollar. Trump's less confrontational approach to the Fed might contribute to a reduction in perceived geopolitical risk surrounding the USD.

- Examples of global events: Cite examples of geopolitical events (e.g., trade wars, political instability in other countries) that can impact the USD.

- Trump's actions and investor perception: Analyze how Trump's actions (or lack thereof) affect investor perception of geopolitical risk associated with the US economy and, consequently, the USD.

Dollar Rises: A Look Ahead

In summary, President Trump's noticeable shift in his rhetoric towards the Fed has significantly contributed to the recent "Dollar Rises" trend. This change in tone has reduced market uncertainty, boosted investor confidence, and led to increased demand for the USD. However, it's crucial to remember that the strength of the USD is subject to a multitude of factors. Changes in global economic conditions, future policy decisions, and unforeseen geopolitical events could all influence its future trajectory.

The appreciation of the USD, while partly attributable to Trump's softer stance on the Fed, remains a dynamic situation. To fully understand the future direction of the USD, continuous monitoring of various economic and political factors is vital. Stay tuned for updates on dollar rises and follow our analysis for insights into the future of the USD. Understanding the interplay of these factors is key to navigating the complexities of the foreign exchange market.

Featured Posts

-

Anchor Brewing Company To Close After 127 Years The End Of An Era

Apr 24, 2025

Anchor Brewing Company To Close After 127 Years The End Of An Era

Apr 24, 2025 -

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025 -

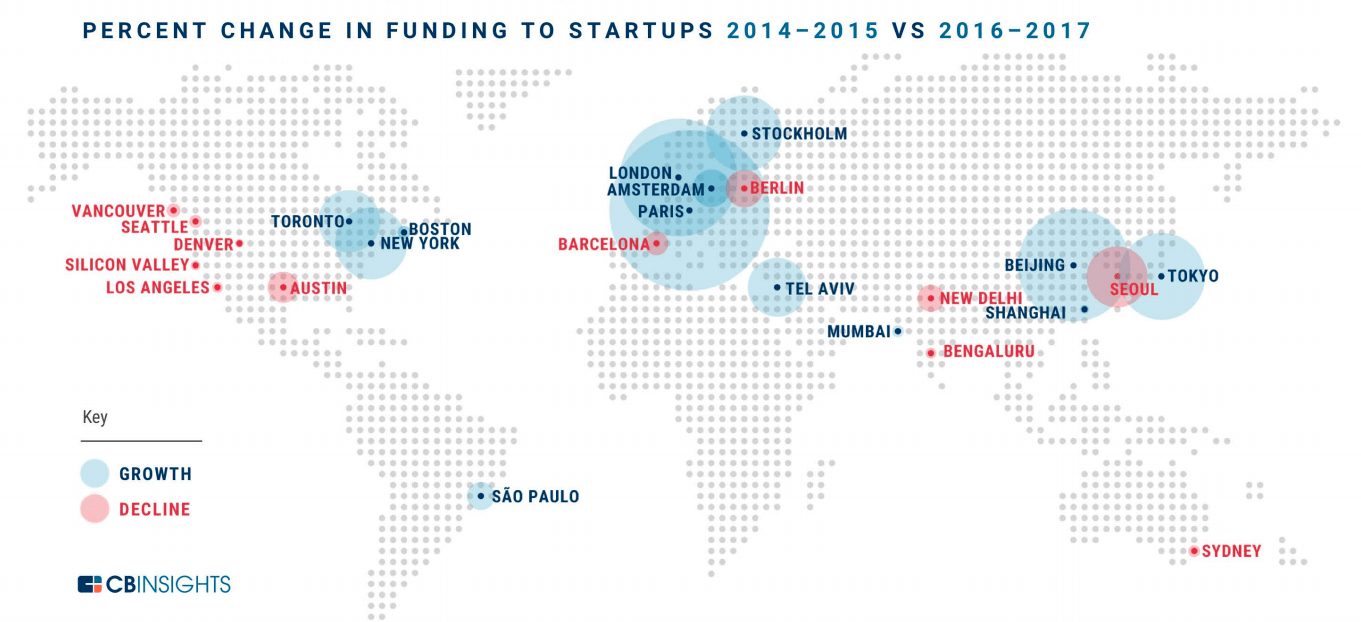

Identifying Emerging Business Hubs A National Map Of Opportunity

Apr 24, 2025

Identifying Emerging Business Hubs A National Map Of Opportunity

Apr 24, 2025 -

Teslas Q1 2024 Financial Results 71 Decline In Net Income Explained

Apr 24, 2025

Teslas Q1 2024 Financial Results 71 Decline In Net Income Explained

Apr 24, 2025 -

Ftc To Appeal Activision Blizzard Merger Decision Implications For The Gaming Industry

Apr 24, 2025

Ftc To Appeal Activision Blizzard Merger Decision Implications For The Gaming Industry

Apr 24, 2025