India Market Buzz: Nifty's Bullish Run Fueled By Positive Trends

Table of Contents

Strong Macroeconomic Fundamentals Boosting Nifty's Performance

India's strong macroeconomic fundamentals are a major catalyst behind the Nifty's bullish run. Several key indicators point to a healthy and growing economy, bolstering investor confidence and fueling market gains.

Robust GDP Growth

India's GDP growth figures have consistently exceeded expectations, signaling a strong economic expansion. This robust growth is a key driver of the Nifty's performance. Compared to previous years, the current growth rate is significantly higher, reflecting increased economic activity across various sectors.

- Increased consumer spending: Rising disposable incomes have led to a surge in consumer spending, boosting demand for goods and services.

- Government infrastructure projects: Massive government investments in infrastructure development, such as roads, railways, and power, are creating significant economic opportunities and driving growth.

- Positive industrial output: Industrial production is expanding, indicating strong manufacturing activity and overall economic health.

This robust GDP growth translates into increased corporate earnings, making Indian equities more attractive to investors. Higher earnings lead to higher stock prices, directly contributing to the Nifty's bullish trend. The positive growth outlook encourages further investment, creating a self-reinforcing cycle of economic expansion and market growth.

Positive Inflation Outlook

While inflation remains a concern globally, India's inflation rate has shown signs of easing, providing a more stable investment environment. The Reserve Bank of India (RBI)'s monetary policy plays a crucial role in managing inflation.

- Easing inflationary pressures: A moderation in inflation allows the RBI to maintain a more accommodative monetary policy.

- Reserve Bank of India (RBI) monetary policy: The RBI's careful management of interest rates helps to balance economic growth with price stability.

- Impact on interest rates: Stable inflation reduces the need for aggressive interest rate hikes, benefiting businesses and investors.

Controlled inflation fosters a stable investment environment, attracting both domestic and foreign investors. A predictable inflation rate reduces uncertainty, making it easier for businesses to plan for the future and for investors to make long-term investment decisions, contributing directly to the Nifty's upward trajectory.

Foreign Institutional Investor (FII) Inflows

Significant Foreign Institutional Investor (FII) inflows have played a substantial role in driving the Nifty's upward momentum. Increased foreign investment signifies strong confidence in the Indian economy and its growth potential.

- Recent FII investment figures: Data shows a considerable increase in FII investment in recent months.

- Reasons behind increased inflow: Factors such as robust economic growth, a favorable regulatory environment, and attractive valuations are attracting foreign investment.

- Impact on market liquidity: FII inflows enhance market liquidity, making it easier for investors to buy and sell stocks.

The influx of foreign capital boosts market liquidity, reduces volatility, and pushes stock prices higher. This demonstrates strong international confidence in the Indian market, strengthening the Nifty's bullish run.

Sector-Specific Growth Catalysts Fueling the Nifty Bullish Run

Beyond macroeconomic factors, specific sectors are experiencing significant growth, further fueling the Nifty's bullish run.

IT Sector Boom

The Indian IT sector has been a major contributor to the overall market rally. Global demand for IT services, strong earnings reports, and a positive industry outlook are all driving its growth.

- Global demand for IT services: Increased global demand for IT services, particularly from North America and Europe, is boosting revenue for Indian IT companies.

- Strong earnings reports: Many Indian IT companies have reported strong earnings, further solidifying investor confidence in the sector.

- Positive industry outlook: Analysts predict continued growth for the Indian IT sector, fueled by technological advancements and globalization.

The IT sector's performance is a key driver of the Nifty's upward trend, reflecting the increasing importance of technology in the global economy.

FMCG Sector Resilience

Despite inflationary pressures, the Fast-Moving Consumer Goods (FMCG) sector has shown remarkable resilience, contributing to the Nifty's bullish run.

- Consumer spending patterns: While consumer spending has been impacted by inflation, the FMCG sector has shown remarkable resilience.

- Resilience despite inflation: FMCG companies have managed to maintain their market share and profitability despite rising prices.

- Market share gains by major players: Leading FMCG companies have strategically adapted to the market conditions, securing market share gains.

The FMCG sector's consistent performance highlights the enduring demand for essential goods and the adaptability of Indian businesses.

Infrastructure and Construction Sector Growth

Significant government spending on infrastructure projects is fueling growth in the infrastructure and construction sector, positively impacting the Nifty.

- Government spending on infrastructure: The government's focus on infrastructure development is creating substantial investment opportunities.

- Private sector participation: Increased private sector participation is further boosting investment and development in this crucial sector.

- Job creation: The expansion of the infrastructure sector leads to substantial job creation, stimulating overall economic activity.

This sector's growth has a ripple effect, benefiting related industries and contributing positively to the overall economic landscape and the Nifty's performance.

Investor Sentiment and Market Confidence Driving the Nifty Bullish Run

Positive investor sentiment and reduced market volatility are playing a crucial role in sustaining the Nifty's bullish run.

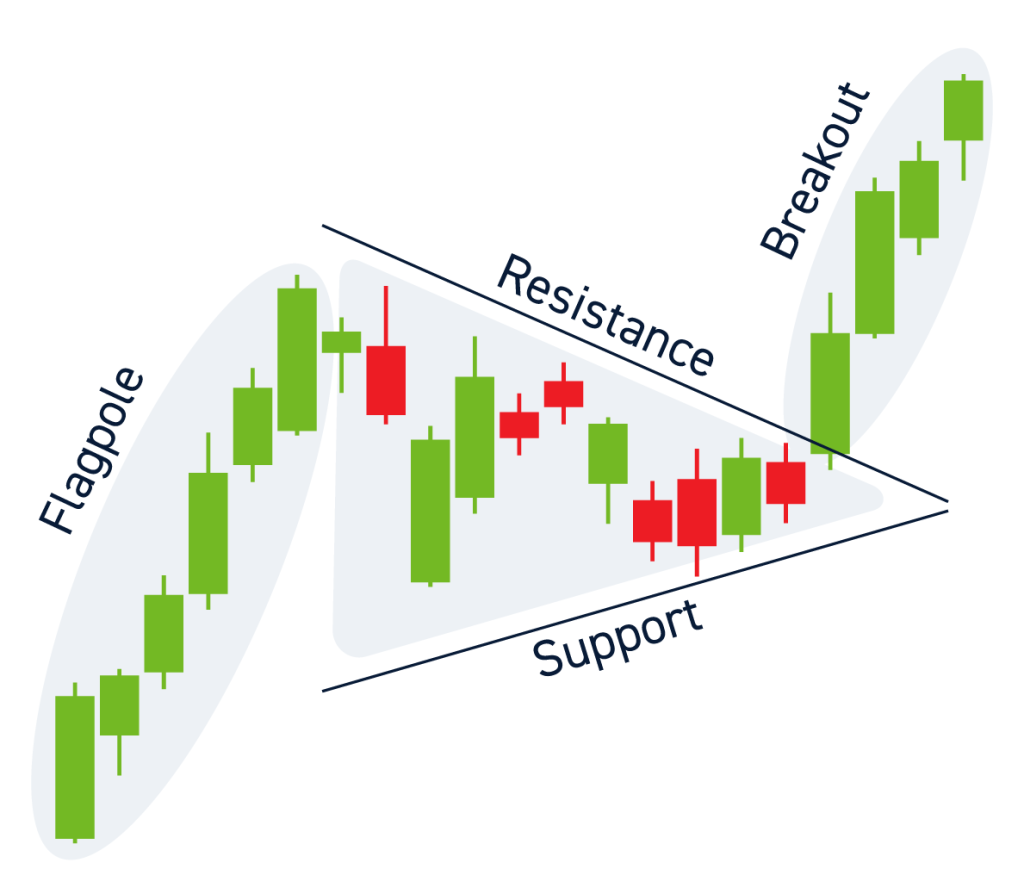

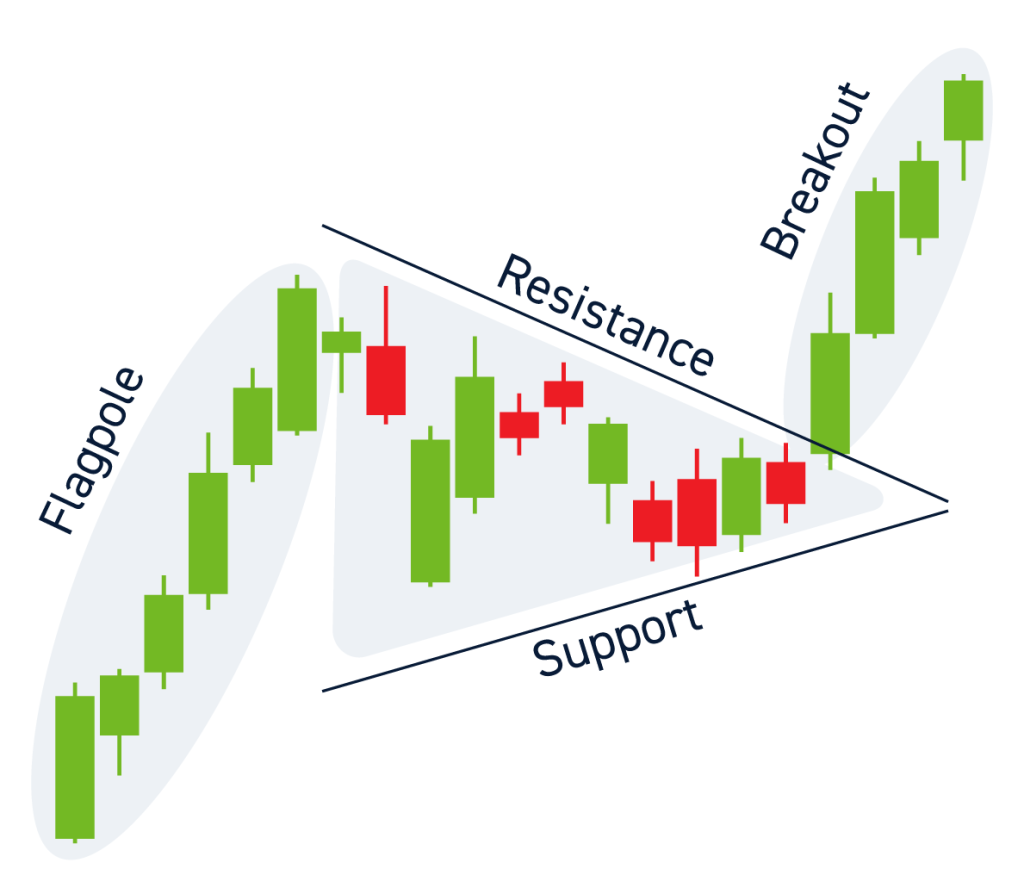

Positive Investor Sentiment

Increased retail investor participation, bullish analyst forecasts, and positive media coverage all contribute to a positive market sentiment.

- Increased retail investor participation: More retail investors are entering the market, driven by positive economic indicators and rising stock prices.

- Bullish analyst forecasts: Analysts are generally bullish on the Indian market, further bolstering investor confidence.

- Positive media coverage: Positive media coverage of the Indian economy and the stock market is contributing to a generally optimistic outlook.

Positive sentiment drives trading volume and overall market dynamics, creating a self-reinforcing cycle of growth.

Reduced Volatility

Lower volatility indicates increased investor confidence and reduced risk aversion, contributing significantly to the Nifty's steady upward trend.

- Lower volatility indices: Market volatility indices have decreased, indicating a more stable market environment.

- Increased investor confidence: Reduced volatility attracts investors seeking less risky investment opportunities.

- Reduced risk aversion: Lower volatility encourages investors to take on more risk, further driving market growth.

A less volatile market attracts a broader range of investors, further contributing to the Nifty's sustained bullish run.

Conclusion

The Nifty's recent bullish run is a testament to India's strengthening macroeconomic fundamentals, robust sector-specific growth, and positive investor sentiment. Factors like strong GDP growth, controlled inflation, substantial FII inflows, and the resilience of key sectors like IT and FMCG have all contributed to this impressive market performance. Understanding these underlying trends is crucial for investors seeking to capitalize on the ongoing Nifty bullish run. Stay informed about these positive economic trends and continue to monitor the India market to make well-informed investment decisions regarding the Nifty's future trajectory. For continued insights into the Nifty's performance and the broader Indian market, follow our updates on the Nifty Bullish Run and its future prospects.

Featured Posts

-

Creating Voice Assistants Made Easy Open Ais Latest Announcement

Apr 24, 2025

Creating Voice Assistants Made Easy Open Ais Latest Announcement

Apr 24, 2025 -

Investing In Middle Management A Strategy For Improved Business Outcomes And Employee Development

Apr 24, 2025

Investing In Middle Management A Strategy For Improved Business Outcomes And Employee Development

Apr 24, 2025 -

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Robot Development

Apr 24, 2025

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Robot Development

Apr 24, 2025 -

Open Ais New Tools For Effortless Voice Assistant Development

Apr 24, 2025

Open Ais New Tools For Effortless Voice Assistant Development

Apr 24, 2025 -

Faa Study Focuses On Las Vegas Airport Collision Risks

Apr 24, 2025

Faa Study Focuses On Las Vegas Airport Collision Risks

Apr 24, 2025