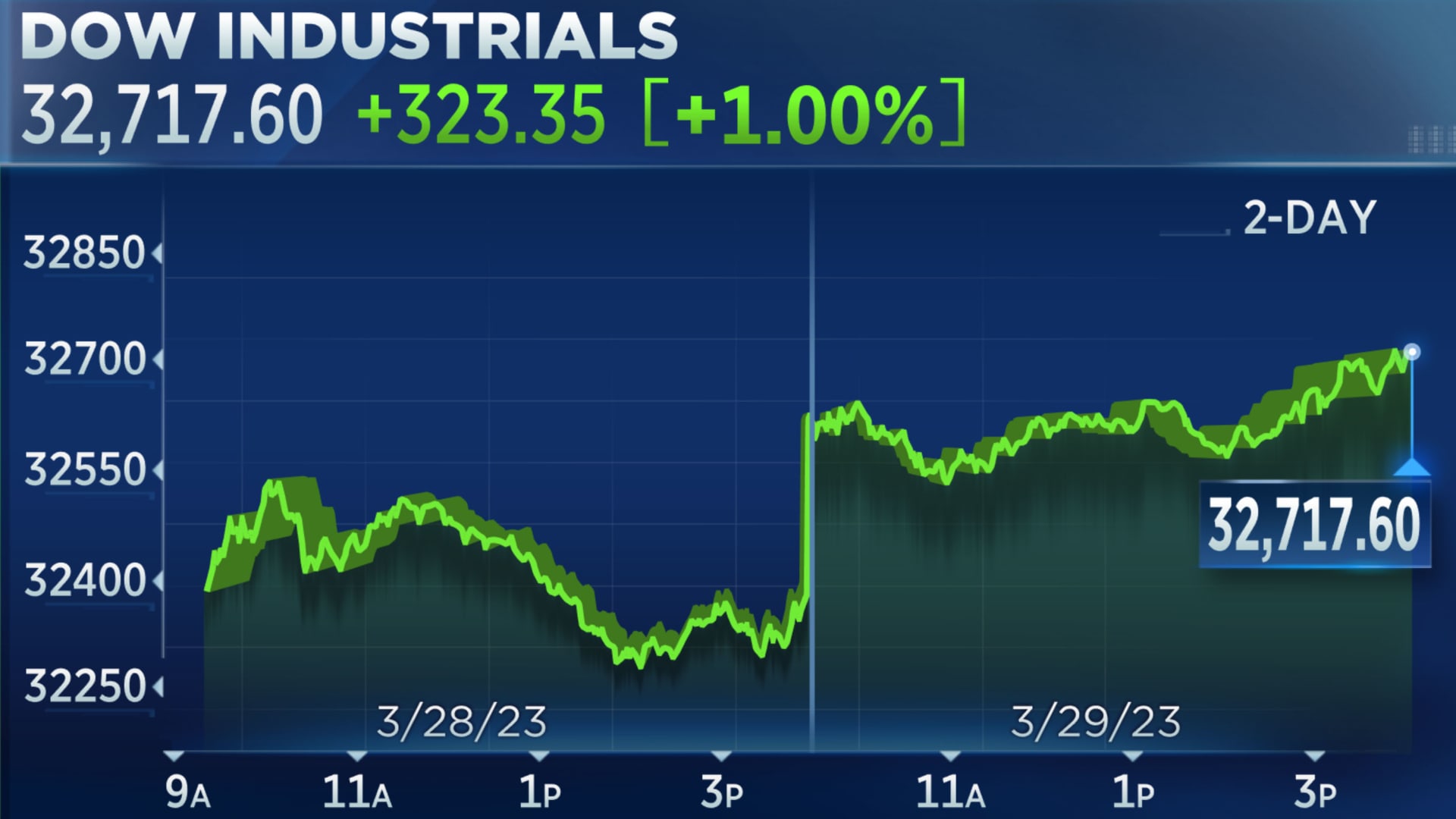

Dow Jones Rallies 1000 Points: Stock Market Update And Analysis

Table of Contents

Understanding the 1000-Point Dow Jones Rally

Key Drivers Behind the Surge

Several interconnected factors contributed to this remarkable Dow Jones stock market surge. The 1000-point rally wasn't a spontaneous event; it was the culmination of several positive developments:

-

Positive Economic Data Releases: Stronger-than-expected employment figures, exceeding analyst predictions, signaled a robust labor market. This, coupled with improved consumer confidence indicators, painted a picture of a healthy economy, boosting investor sentiment. For example, the latest jobs report showed a significant increase in non-farm payroll employment, significantly outpacing expectations. This positive economic data fueled the Dow Jones rally.

-

Easing Inflation Concerns: Signs of cooling inflation, perhaps due to the Federal Reserve's monetary policy tightening, eased fears of aggressive interest rate hikes. Lower inflation expectations generally lead to increased investor confidence and higher stock valuations. The recent CPI report showing a deceleration in inflation contributed significantly to this positive sentiment.

-

Strong Corporate Earnings Reports: Several major Dow Jones components reported better-than-expected earnings, showcasing resilience and strong financial performance. These positive earnings reports reinforced the narrative of a healthy corporate sector and further fueled the market's upward momentum. Companies like Apple and Microsoft exceeded expectations, providing a strong boost to the Dow.

-

Increased Investor Sentiment and Return of Risk Appetite: A combination of the factors mentioned above led to a notable shift in investor sentiment. Risk appetite increased, with investors becoming more willing to invest in equities, further driving up stock prices and contributing to the 1000-point Dow Jones rally.

Impact on Different Market Sectors

The 1000-point Dow Jones rally didn't impact all sectors equally.

-

Technology: The tech sector, often considered a bellwether of market sentiment, saw significant gains, with major tech companies contributing substantially to the overall market surge.

-

Energy: Energy stocks also experienced a considerable boost, likely driven by factors like ongoing geopolitical events and increasing demand.

-

Financials: The financial sector, sensitive to interest rate changes, saw mixed results, with some segments benefitting more than others depending on their specific exposure to interest rate movements.

-

Winners and Losers: While many sectors participated in the rally, some underperformed. For instance, certain defensive sectors that usually benefit during times of economic uncertainty saw less pronounced gains compared to the more cyclical sectors.

Analyzing the Sustainability of the Dow Jones Rally

Potential Short-Term and Long-Term Implications

The question on everyone's mind is: how long will this Dow Jones stock market rally last?

-

Short-Term: The short-term outlook remains uncertain. While the current positive momentum is significant, potential headwinds like unexpected geopolitical events or a resurgence of inflation could trigger a reversal.

-

Long-Term: The long-term implications depend on several factors, including the continued strength of the economy, the Federal Reserve's actions, and the overall global economic environment. Sustained economic growth and controlled inflation are crucial for a continued upward trajectory.

-

Market Predictions: Short-term predictions vary widely among analysts, with some predicting a continued rally while others foresee a potential correction. The consensus is that sustained, positive economic data and corporate earnings will be necessary to ensure the rally continues.

Expert Opinions and Market Forecasts

Leading financial analysts hold diverse views on the sustainability of the rally.

-

Bullish Views: Some analysts believe the rally is justified by the underlying economic strength and expect continued upward momentum.

-

Bearish Views: Others remain cautious, citing potential risks like inflation, geopolitical instability, and potential future interest rate hikes.

-

Neutral Views: Many analysts adopt a more neutral stance, emphasizing the need for continued monitoring of economic indicators and corporate earnings to gauge the future market trajectory. Their forecasts often include a range of possibilities, acknowledging the inherent uncertainty in market predictions.

Strategies for Investors Following the Dow Jones 1000-Point Rally

Risk Management and Portfolio Diversification

Following such a significant market movement, investors should reassess their portfolios and risk management strategies.

-

Risk Management: Investors should avoid impulsive decisions based solely on the recent rally and maintain a disciplined investment approach. This includes setting stop-loss orders and regularly reviewing their portfolio's risk exposure.

-

Portfolio Diversification: Maintaining a well-diversified portfolio across various asset classes and sectors is crucial to mitigate risk. This ensures that any losses in one sector are offset by gains in another.

Opportunities and Cautions for Investors

The 1000-point Dow Jones rally presents both opportunities and cautions for investors.

-

Opportunities: The rally offers opportunities to invest in undervalued companies or sectors that have lagged behind the market's overall performance. However, thorough research and due diligence are essential.

-

Cautions: Investors should avoid speculative trading based on short-term market fluctuations and instead focus on a long-term investment strategy aligned with their risk tolerance and financial goals. Emotional decision-making should be avoided at all costs.

Conclusion

The Dow Jones's 1000-point rally is a significant market event driven by positive economic data, easing inflation concerns, and strong corporate earnings. While the sustainability of this rally remains to be seen, understanding the underlying drivers and potential risks is crucial for investors. The market's volatility highlights the importance of careful risk management and portfolio diversification.

Call to Action: Stay informed about the evolving market situation and continue to monitor the Dow Jones and other key market indicators to make informed investment decisions. Learn more about navigating the complexities of the stock market and the implications of the recent Dow Jones rally by [link to relevant resource/further reading]. Understanding the Dow Jones and its fluctuations is crucial for success in today's dynamic market.

Featured Posts

-

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Allegations

Apr 24, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Jan 6th Falsehoods Allegations

Apr 24, 2025 -

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025

Miami Heats Herro Claims Nba 3 Point Contest Title

Apr 24, 2025 -

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025 -

The Bold And The Beautiful April 3rd Liam And Bills Explosive Confrontation And Liams Collapse

Apr 24, 2025

The Bold And The Beautiful April 3rd Liam And Bills Explosive Confrontation And Liams Collapse

Apr 24, 2025 -

Chinas Energy Strategy Increased Lpg Reliance On The Middle East

Apr 24, 2025

Chinas Energy Strategy Increased Lpg Reliance On The Middle East

Apr 24, 2025