Exclusive Access: A Business Model For Trading Elon Musk's Private Company Shares

Table of Contents

Understanding the Challenges of Trading Private Company Shares

Trading shares in private companies, especially those associated with high-profile entrepreneurs like Elon Musk, presents unique challenges compared to the public markets. Securing exclusive access to these opportunities requires navigating several hurdles.

Liquidity Issues

Private markets inherently lack the liquidity of public exchanges. This means:

- Difficulty buying and selling quickly: Finding buyers or sellers for private shares can be time-consuming and difficult, potentially limiting your ability to access your capital when needed.

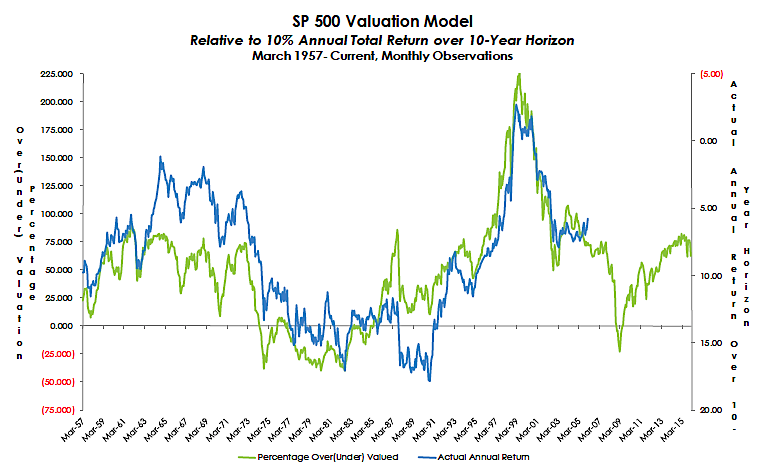

- Significant price volatility: Limited trading volume contributes to potentially dramatic price swings, making accurate valuation and risk assessment crucial.

- Higher transaction costs: Brokerage fees and other transaction costs associated with private share trading are often higher than those in public markets.

Valuation Complexity

Accurately valuing private companies is complex, especially those with rapidly evolving business models like SpaceX or Neuralink.

- Reliance on private valuations: Valuations are often based on internal assessments, making them subjective and potentially less reliable than publicly available market data.

- Lack of readily available market data: The absence of readily available information makes independent verification and comparison more difficult.

- Discrepancies between valuation methods: Different valuation approaches can lead to significant discrepancies in the estimated value of a private company.

Regulatory Hurdles

Trading private securities is subject to various legal and regulatory constraints.

- Accredited investor requirements: Investing in private companies often requires meeting specific net worth or income criteria, limiting access to a select group of investors.

- SEC regulations: The Securities and Exchange Commission (SEC) regulates the offering and trading of private securities, imposing various compliance requirements.

- Potential for legal complexities: Private placements and subsequent trading of shares can involve complex legal considerations that require careful attention.

Business Models for Accessing Elon Musk's Private Company Shares

Several business models offer routes to accessing shares in Elon Musk's private companies, although each comes with its own set of challenges and requirements. Gaining exclusive access often hinges on factors beyond simple financial resources.

Private Equity and Venture Capital Funds

These institutions specialize in investing in private companies and possess the resources and expertise to navigate the complexities involved.

- High investment thresholds: Minimum investment amounts are typically substantial, making them accessible only to high-net-worth individuals and institutional investors.

- Professional management: Experienced professionals manage the investments, conducting due diligence and managing portfolio risk.

- Diversification benefits: Investing through a fund allows for diversification across multiple private companies, reducing overall portfolio risk.

- Potential for high returns (and losses): While private equity and venture capital can generate significant returns, investments carry inherent risks, and losses are possible.

Secondary Market Trading Platforms

While less common for companies like SpaceX, some platforms facilitate the trading of privately held shares among accredited investors. However, access to these platforms and successful participation depend heavily on established networks and pre-existing relationships.

- Examples of platforms (if any exist): The availability of such platforms is limited and varies depending on the specific company and regulatory environment.

- Due diligence requirements: Rigorous due diligence is necessary to assess the legitimacy of both the platform and the offered shares.

- Risk assessment: Understanding the risks associated with investing in illiquid private securities is paramount.

- Liquidity limitations: Even on secondary trading platforms, liquidity may still be significantly lower than in public markets.

Direct Investment Opportunities

Direct investment opportunities in Elon Musk's private companies are extremely rare and require exceptional circumstances.

- Networking: Strong connections within the entrepreneurial and investment communities are often essential.

- Connections with insiders: Relationships with company executives or early investors might provide access to private investment rounds.

- High net worth requirements: Significant capital is usually required to participate in such opportunities.

- Extreme due diligence: Independent verification of all information and a comprehensive understanding of the company's business are critical.

Risk Mitigation Strategies when Trading Private Company Shares

Investing in private companies, especially those associated with Elon Musk's ventures, is inherently risky. Employing effective risk mitigation strategies is crucial.

Diversification

Never put all your eggs in one basket. Diversification is key to reducing overall portfolio risk.

- Spread investments: Allocate investments across different asset classes (stocks, bonds, real estate, etc.) and companies to reduce the impact of any single investment's underperformance.

Due Diligence

Thorough research and analysis are crucial before investing in any private company.

- Independent verification: Verify information from multiple sources to avoid relying solely on company-provided data.

- Understanding financials and business model: Gain a comprehensive understanding of the company's financial position, its business model, and its competitive landscape.

- Evaluating management team: Assess the experience and capabilities of the management team and their track record.

Risk Tolerance Assessment

Understanding your own risk tolerance is paramount before investing in high-risk ventures.

- Personal financial situation: Consider your current financial situation, including assets, liabilities, and income.

- Long-term investment goals: Align your investment choices with your long-term financial goals.

- Comfort level with potential losses: Honestly assess your ability to withstand potential losses without jeopardizing your financial stability.

Conclusion: Securing Exclusive Access to Elon Musk's Investments

Securing exclusive access to trading Elon Musk's private company shares presents significant challenges, including liquidity issues, valuation complexities, and regulatory hurdles. While various business models offer potential access, from private equity funds to (rare) direct investment opportunities, the inherent risks are substantial. Thorough due diligence, risk assessment, and diversification are crucial for mitigating these risks. Before pursuing opportunities to gain exclusive access to trading Elon Musk’s private company shares, conduct thorough research and consider consulting with financial professionals experienced in private equity or alternative investments. Remember, these investments represent a high-risk, high-reward proposition. Understanding the landscape of exclusive access to these opportunities is the first step towards making informed investment decisions.

Featured Posts

-

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025 -

Trumps First 100 Days A Rural Schools Perspective 2700 Miles From Dc

Apr 26, 2025

Trumps First 100 Days A Rural Schools Perspective 2700 Miles From Dc

Apr 26, 2025 -

My Switch 2 Preorder Waiting In Line At Game Stop

Apr 26, 2025

My Switch 2 Preorder Waiting In Line At Game Stop

Apr 26, 2025 -

Why Stretched Stock Market Valuations Shouldnt Deter Investors Bof A

Apr 26, 2025

Why Stretched Stock Market Valuations Shouldnt Deter Investors Bof A

Apr 26, 2025 -

End Of An Era Ryujinx Switch Emulator Ceases Development After Nintendo Contact

Apr 26, 2025

End Of An Era Ryujinx Switch Emulator Ceases Development After Nintendo Contact

Apr 26, 2025