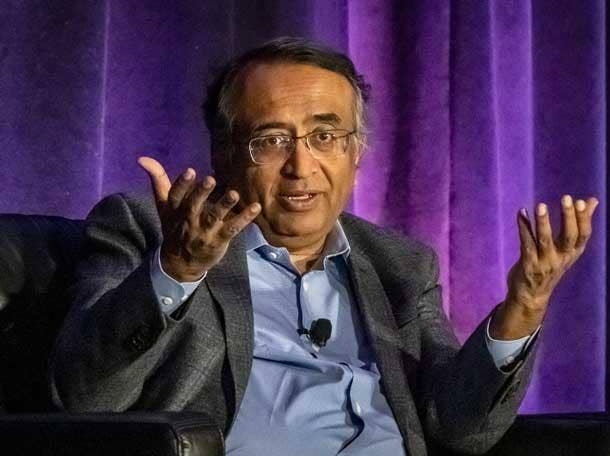

Extreme Price Hike: Broadcom's VMware Proposal Faces Backlash From AT&T

Table of Contents

The Controversial Price Hike: A Deep Dive into Broadcom's Valuation

Broadcom's offer to acquire VMware has sparked significant debate due to its perceived high valuation. Let's dissect the financial details and analyze whether the price is justified.

Broadcom's Offer: Examining the Financial Details

- Price per share: Broadcom offered $142.50 per share for VMware.

- VMware's previous market valuation: Before the offer, VMware's stock traded significantly lower, making Broadcom's offer a substantial premium.

- Premium offered: The premium offered reflects a significant increase over VMware's pre-announcement share price, leading to questions about its justification. Broadcom cites potential synergies and future growth as justifications, but these remain debated within the financial community.

- Investor reactions: Initial investor reactions were mixed, with some celebrating the high valuation while others expressed concerns about potential overpayment and future returns.

Market Analysis and Expert Opinions: Is the Price Justified?

Analyzing the deal requires a careful consideration of market trends and comparable acquisitions within the tech sector. Several recent acquisitions offer a basis for comparison, although direct parallels are difficult to draw due to the unique nature of VMware's business. Financial analysts remain divided. Some suggest the price is justified given VMware's strong market position and future potential, while others highlight the significant risk associated with such a large premium. The uncertainty underscores the complexities of evaluating the deal’s success.

AT&T's Concerns and the Antitrust Debate

AT&T's public opposition to the Broadcom's VMware acquisition is a significant factor driving the controversy. Their concerns center on potential antitrust issues and the impact on market competition.

AT&T's Public Statement: Key Arguments Against the Acquisition

AT&T argues that the acquisition could stifle competition and lead to higher prices for telecommunication services, ultimately harming consumers. They've voiced concerns about reduced choice and innovation within the market, suggesting Broadcom's control over VMware could lead to anti-competitive practices. They specifically mention potential restrictions on access to vital technologies and less favorable pricing structures.

Antitrust Scrutiny and Regulatory Hurdles: Potential Roadblocks for Broadcom

Given AT&T's concerns and the sheer size of the acquisition, regulatory scrutiny is inevitable. Antitrust authorities in the US and other regions will thoroughly investigate the deal, potentially delaying or even blocking its completion. The potential for lengthy investigations and legal challenges adds significant uncertainty to the deal's timeline and outcome. Similar past acquisitions, which faced antitrust concerns, have either been blocked or required significant concessions.

Impact on the Tech Industry and Consumers

The outcome of Broadcom's bid to acquire VMware will have far-reaching implications for the tech industry and its consumers.

Potential Consequences of a Successful Acquisition

- Impact on VMware's products and services: A successful acquisition could lead to changes in VMware's product roadmap, potentially impacting the availability and pricing of its existing software solutions.

- Increased prices or reduced innovation: Concerns exist that Broadcom's control could lead to higher prices and reduced innovation for consumers reliant on VMware’s technologies.

- Broader implications for the tech industry: The deal could set a precedent for future acquisitions in the technology sector, influencing valuations and competition dynamics.

Potential Consequences of a Rejected Acquisition

- Impact on Broadcom's strategic goals: A rejected bid would be a significant setback for Broadcom, potentially impacting their market position and strategic plans.

- Alternative acquisition offers for VMware: VMware might attract other potential buyers, triggering a bidding war and potentially leading to a different outcome.

- Impact on investor confidence: A failed acquisition could negatively impact investor confidence in the technology sector, creating instability.

Conclusion: The Future of Broadcom's VMware Acquisition and the Price Hike Controversy

The Broadcom's VMware acquisition, fraught with controversy due to its extreme price hike, faces a significant challenge from AT&T's vocal opposition and potential antitrust scrutiny. The high price tag, coupled with concerns about anti-competitive practices, raises serious questions about the long-term consequences for the tech industry and its consumers. The outcome will depend heavily on regulatory approvals and the ability of Broadcom to address antitrust concerns effectively.

What are your thoughts on Broadcom's VMware acquisition and its controversial price hike? Share your predictions in the comments below!

Featured Posts

-

Sharks And A Tragedy A Swimmers Disappearance And Body Found On Israeli Coast

Apr 24, 2025

Sharks And A Tragedy A Swimmers Disappearance And Body Found On Israeli Coast

Apr 24, 2025 -

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

Stock Market Gains Tariff Hopes Fuel Dow Nasdaq And S And P 500 Surge

Apr 24, 2025

Stock Market Gains Tariff Hopes Fuel Dow Nasdaq And S And P 500 Surge

Apr 24, 2025 -

The Bold And The Beautiful Thursday April 3rd Liam Bill And Hopes Story

Apr 24, 2025

The Bold And The Beautiful Thursday April 3rd Liam Bill And Hopes Story

Apr 24, 2025 -

Why This Startup Airline Uses Deportation Flights A Surprising Business Model

Apr 24, 2025

Why This Startup Airline Uses Deportation Flights A Surprising Business Model

Apr 24, 2025