Gold Price Record Rally: Bullion As A Safe Haven During Trade Wars

Table of Contents

The current global economic climate is characterized by significant uncertainty. Trade wars between major economic powers are disrupting supply chains, impacting global growth forecasts, and creating a volatile investment environment. This uncertainty fuels demand for assets perceived as safe havens, leading directly to the significant Gold Price Record Rally we're witnessing.

Understanding the Gold Price Record Rally

Several factors contribute to the recent surge in gold prices. The price of gold, often expressed as the "bullion price," is influenced by a complex interplay of global economic events and investor sentiment. This Gold Price Record Rally is fueled by:

-

Weakening US Dollar: A weaker dollar generally makes gold more affordable for buyers using other currencies, increasing demand and pushing prices higher. This is reflected in the inverse relationship often observed between the gold price chart and the US Dollar Index.

-

Increased Investor Demand for Safe-Haven Assets: In times of economic and geopolitical uncertainty, investors often flock to safe-haven assets like gold, perceived as a store of value that holds its worth even during market downturns. This increased demand directly impacts the gold market trends.

-

Central Bank Gold Purchases: Many central banks worldwide are increasing their gold reserves, further bolstering demand and supporting the price.

-

Geopolitical Instability: The ongoing trade disputes between the US and China, along with other geopolitical tensions, have significantly contributed to the gold price rally. These uncertainties fuel investor anxieties and drive demand for safe-haven assets like gold.

-

Inflationary Pressures: Concerns about rising inflation also drive investment in gold, as it's often seen as a hedge against inflation, preserving purchasing power.

[Insert a chart or graph illustrating the recent gold price increase here. Clearly label the chart "Gold Price Chart" and include relevant dates and price information.]

Gold as a Safe Haven Asset During Trade Wars

A "safe haven" asset is an investment that tends to hold or increase in value during times of market turmoil or economic uncertainty. Gold has consistently demonstrated its role as a safe haven asset, particularly during periods of trade conflict. Its appeal stems from several key characteristics:

-

Tangible Asset, Not Subject to Counterparty Risk: Unlike many financial instruments, physical gold is a tangible asset, not subject to the risk of a counterparty defaulting.

-

Historically Proven Hedge Against Inflation and Economic Uncertainty: Throughout history, gold has acted as a reliable hedge against inflation and economic uncertainty, preserving its value during periods of market instability.

-

Negative Correlation with the Stock Market During Times of Stress: Gold often moves inversely to the stock market, meaning that when stock prices fall (as they often do during periods of stress), gold prices tend to rise, offering portfolio diversification benefits.

-

Portfolio Diversification Benefit: Including gold in a well-diversified portfolio can help reduce overall risk and improve returns by mitigating losses in other asset classes during periods of market volatility.

Gold's historical performance during periods of trade conflict and economic crisis further supports its status as a reliable safe haven. Its price tends to appreciate during such times, offering investors protection against significant losses in other asset classes.

Investing in Gold During a Gold Price Record Rally: Strategies and Considerations

There are several ways to invest in gold, each with its own advantages and disadvantages:

-

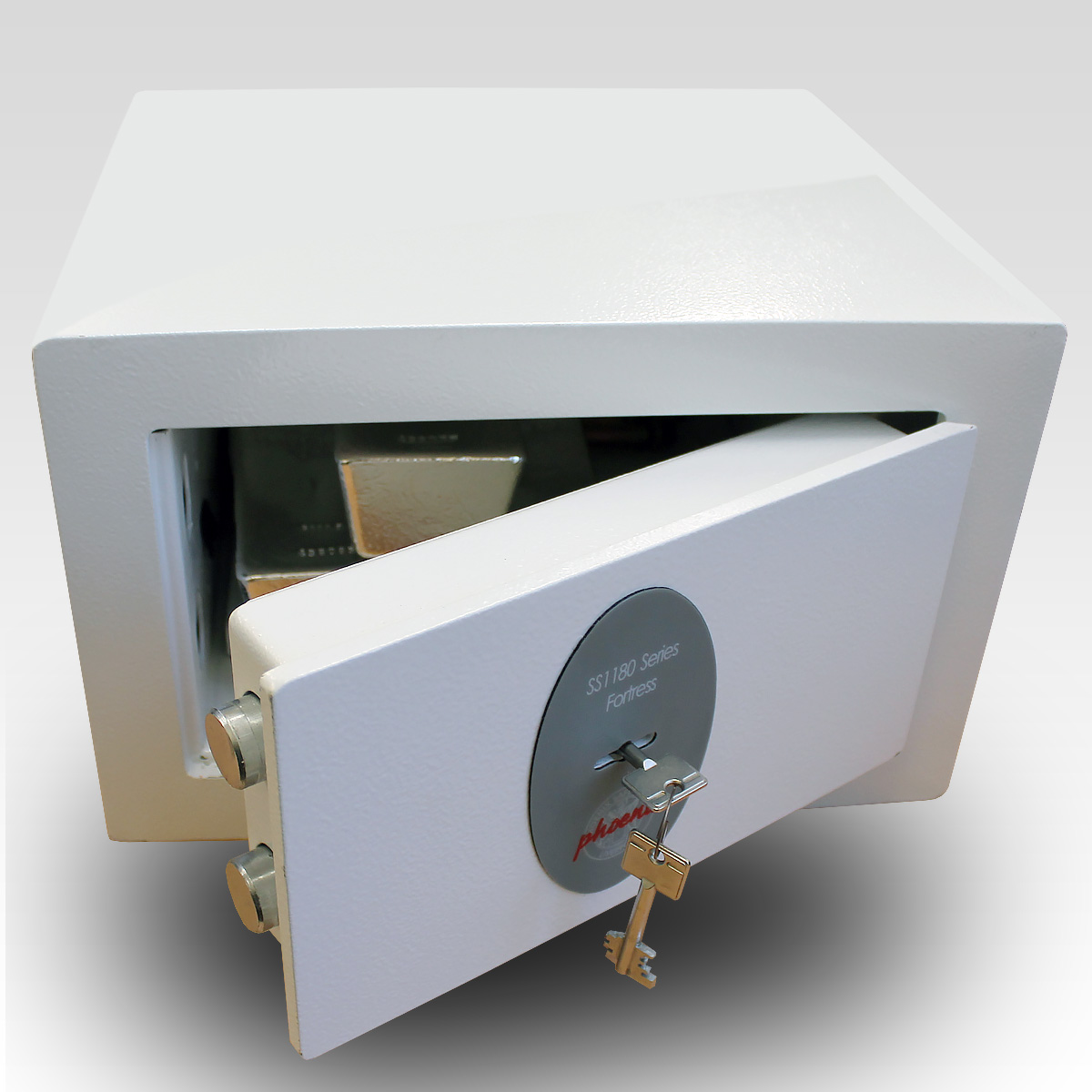

Physical Gold: Buying physical gold bars or coins offers direct ownership but requires secure storage.

-

Gold ETFs (Exchange-Traded Funds): Gold ETFs provide exposure to gold prices without the need for physical storage, offering easy trading on stock exchanges.

-

Gold Mining Stocks: Investing in companies that mine gold can offer leveraged exposure to gold price movements, but these stocks can be more volatile than gold itself.

-

Gold IRA: Investing in gold within a retirement account offers tax advantages.

Risk Assessment:

Each investment method carries varying degrees of risk. Physical gold has storage and security risks, while ETFs and gold mining stocks have market risks associated with price fluctuations.

Diversification: Gold should be considered as part of a diversified investment strategy, not as a standalone investment.

Long-Term Investment: A long-term investment strategy is crucial for maximizing potential gains and minimizing the impact of short-term market volatility.

Capitalizing on the Gold Price Record Rally

The current Gold Price Record Rally is primarily driven by global trade wars and gold's enduring status as a safe haven asset. The weakening US dollar, increased investor demand, and central bank purchases further contribute to the price surge. Given the ongoing economic uncertainty and geopolitical instability, considering gold as part of a diversified investment portfolio can offer important risk mitigation and potential for growth. To fully capitalize on this Gold Price Record Rally, or future opportunities, learn more about different gold investment strategies and how to incorporate gold into your investment plan. Consider consulting a financial advisor for personalized guidance. Explore resources like [Link to reputable resource about gold investment] to further your knowledge and make informed investment decisions.

Featured Posts

-

Getting My Hands On A Switch 2 The Game Stop Method

Apr 26, 2025

Getting My Hands On A Switch 2 The Game Stop Method

Apr 26, 2025 -

Denmark Accuses Russia Of Spreading False Greenland News To Fuel Us Tensions

Apr 26, 2025

Denmark Accuses Russia Of Spreading False Greenland News To Fuel Us Tensions

Apr 26, 2025 -

Where To Invest A Map Of Emerging Business Opportunities

Apr 26, 2025

Where To Invest A Map Of Emerging Business Opportunities

Apr 26, 2025 -

Stock Market Today Dow Futures Fluctuate Chinas Economic Support Amid Tariffs

Apr 26, 2025

Stock Market Today Dow Futures Fluctuate Chinas Economic Support Amid Tariffs

Apr 26, 2025 -

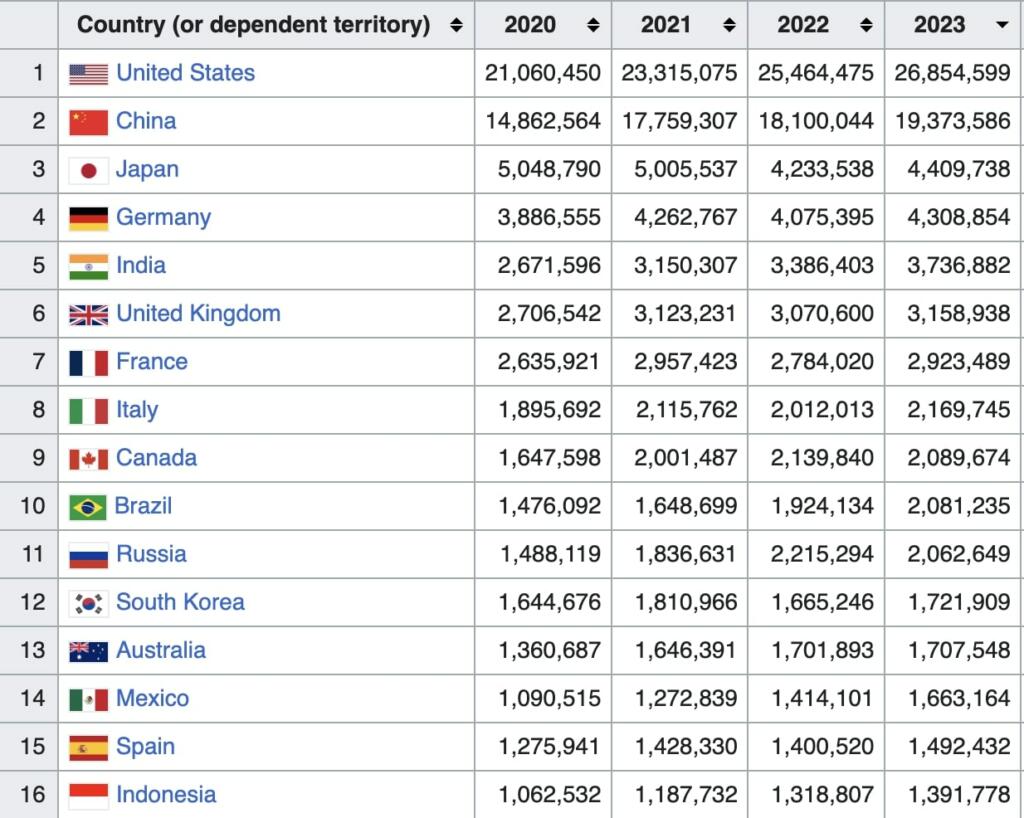

Californias Economic Rise Now The Worlds Fourth Largest Economy

Apr 26, 2025

Californias Economic Rise Now The Worlds Fourth Largest Economy

Apr 26, 2025