Where To Invest: A Map Of Emerging Business Opportunities

Table of Contents

The Tech Sector: A Hub of Emerging Business Opportunities

The technology sector consistently presents a wealth of investment opportunities. From Artificial Intelligence (AI) and Software as a Service (SaaS) to cybersecurity and fintech, the possibilities are vast. This sector is characterized by rapid innovation, high growth potential, and significant returns for savvy investors. Understanding the nuances of different tech investment options is key to success.

-

AI-driven solutions: Artificial intelligence is transforming industries, from healthcare and finance to manufacturing and transportation. Investing in AI startups or established companies leveraging AI technologies offers high-growth potential, particularly in areas like machine learning and deep learning. Look for companies with strong intellectual property and a proven track record of innovation.

-

SaaS businesses: Software as a Service (SaaS) businesses benefit from recurring revenue streams and scalability. This predictable revenue model makes them attractive investments, especially for those seeking lower-risk, steady returns. Consider factors such as customer acquisition cost, churn rate, and market share when evaluating SaaS investment opportunities.

-

Cybersecurity investments: With cyber threats increasing in frequency and severity, cybersecurity is a critical need. Investing in cybersecurity companies that offer solutions for data protection, threat detection, and incident response can yield significant returns. Look for companies with a strong reputation and a robust security posture of their own.

-

Fintech innovations: Fintech is disrupting traditional financial services with innovative solutions in areas such as mobile payments, peer-to-peer lending, and blockchain technology. Investing in promising fintech startups or established players in this space can provide access to high-growth potential. However, careful due diligence is essential given the regulatory complexities of the financial sector.

Sustainable and Green Investments: A Growing Sector for Profit and Planet

The growing awareness of climate change is driving significant investment in sustainable and green technologies. Emerging business opportunities abound in this sector, offering both financial returns and positive environmental impact. This represents a powerful combination for socially conscious investors seeking both profitability and positive societal contribution.

-

Renewable energy investments: Renewable energy sources like solar and wind power are experiencing exponential growth, driven by government policies and increasing consumer demand. Investing in renewable energy companies, projects, or funds can provide exposure to this rapidly expanding market.

-

Green building materials and sustainable construction: The construction industry is undergoing a significant shift towards sustainable practices. Investing in companies developing and supplying green building materials, or those specializing in sustainable construction techniques, offers promising returns.

-

Eco-friendly consumer goods: Consumer demand for eco-friendly products is growing rapidly. Investing in companies producing sustainable consumer goods, such as organic food, recycled clothing, and biodegradable packaging, can tap into this expanding market.

-

Carbon capture and storage technologies: Investments in companies developing and deploying carbon capture and storage technologies are attracting considerable interest, as these solutions address the urgent need to mitigate climate change.

The Healthcare Sector: Meeting Evolving Needs with Innovative Solutions

An aging global population and advances in medical technology are fueling the growth of the healthcare sector. Profitable investments can be found in diverse areas, from biotechnology and medical devices to telehealth and pharmaceutical research. This sector offers a mix of high-growth potential and relative stability, making it attractive to diverse investor profiles.

-

Biotech investments: Biotech companies focused on gene therapy, personalized medicine, and other cutting-edge therapies are attracting significant investment. This area offers high reward but also significant risk, requiring careful assessment of clinical trial progress and regulatory hurdles.

-

Telehealth investments: Telehealth platforms are experiencing rapid adoption, creating new market opportunities. Investing in telehealth companies can provide exposure to a sector experiencing rapid growth and transforming healthcare delivery.

-

Medical device innovation: Medical device innovation is constantly evolving, offering promising investment prospects. Investing in companies developing innovative medical devices can provide significant returns, but requires a deep understanding of the regulatory landscape and clinical trial success rates.

-

Pharmaceutical investments: Pharmaceutical companies developing innovative treatments for chronic diseases and emerging health challenges are key players in this space. Investing in this area offers potential for strong returns but requires consideration of patent expiration dates and the competitive dynamics of the pharmaceutical industry.

Due Diligence and Risk Management: Essential Steps for Successful Investment

Before investing in any emerging business opportunity, thorough due diligence and careful risk management are crucial. Conduct comprehensive research, analyze financial statements, understand the potential risks involved, and consider seeking professional financial advice before making any investment decisions. Diversification is also a key strategy to mitigate risk.

Conclusion

The landscape of emerging business opportunities is dynamic and presents both exciting prospects and inherent risks. By carefully considering the trends discussed above—the tech sector, sustainable investments, and the healthcare industry—and conducting thorough due diligence, investors can position themselves for success. Remember to continuously research and adapt your investment strategy to stay ahead in this ever-evolving market. Start exploring lucrative investment opportunities today and build a portfolio aligned with your risk tolerance and financial goals. Don't miss out on the potential of profitable investments in emerging business opportunities.

Featured Posts

-

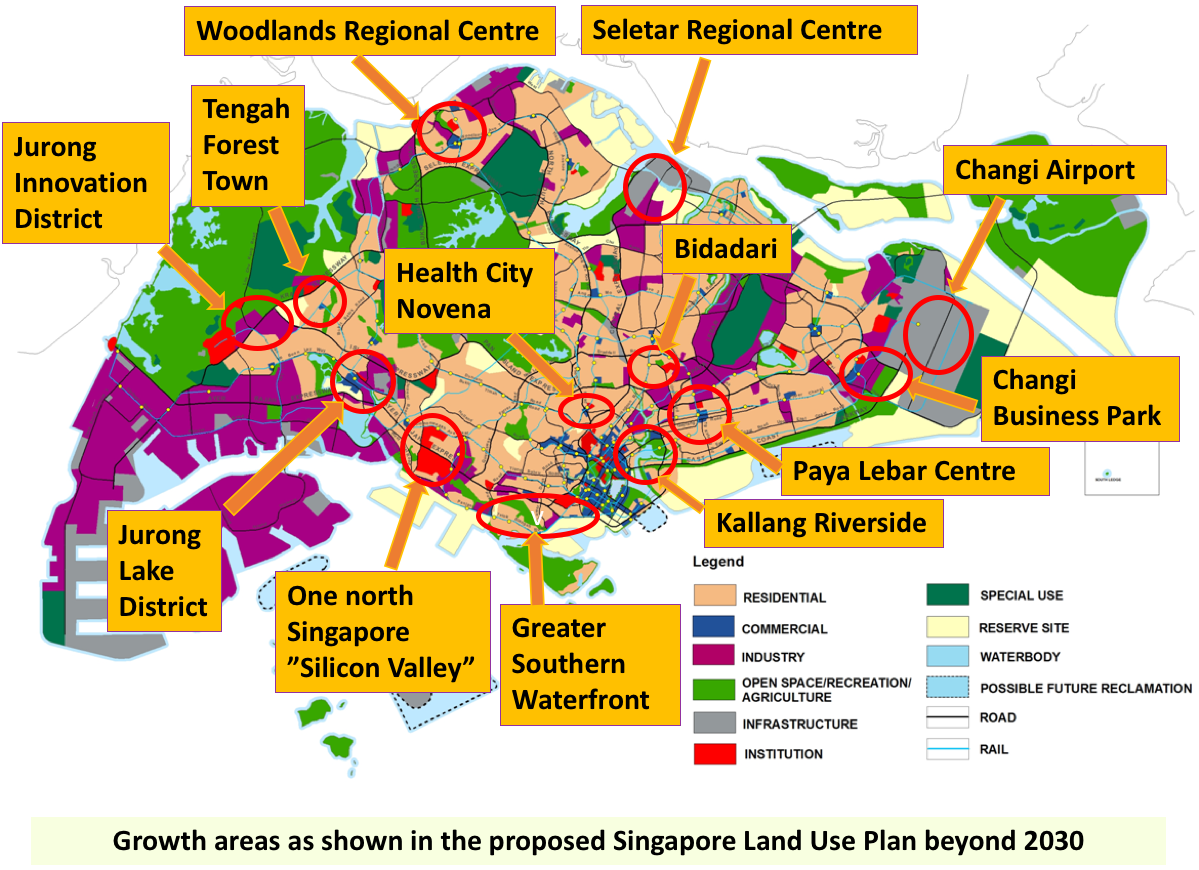

New Business Hot Spots Identifying Key Growth Areas In Country Name

Apr 26, 2025

New Business Hot Spots Identifying Key Growth Areas In Country Name

Apr 26, 2025 -

Ai Powered Podcast Creation Turning Repetitive Scatological Documents Into Engaging Content

Apr 26, 2025

Ai Powered Podcast Creation Turning Repetitive Scatological Documents Into Engaging Content

Apr 26, 2025 -

Us Port Fees To Hit Auto Carrier With 70 Million

Apr 26, 2025

Us Port Fees To Hit Auto Carrier With 70 Million

Apr 26, 2025 -

Discover 7 Exciting Restaurants In Orlando Beyond The Theme Parks 2025

Apr 26, 2025

Discover 7 Exciting Restaurants In Orlando Beyond The Theme Parks 2025

Apr 26, 2025 -

Exclusive Report Internal Conflict And Polygraph Tests Rock The Pentagon Hegseths Response

Apr 26, 2025

Exclusive Report Internal Conflict And Polygraph Tests Rock The Pentagon Hegseths Response

Apr 26, 2025