Higher Stock Prices, Higher Risks: What Investors Should Know

Table of Contents

Understanding the Correlation Between Higher Stock Prices and Risk

A fundamental principle of investing is the inverse relationship between current price and future return. Higher stock prices today often imply lower potential returns in the future. This is because the higher the price you pay for a stock, the less room there is for future growth. The concept of market valuation is key here. When a stock's price rises significantly beyond its intrinsic value – its actual worth based on its assets, earnings, and future prospects – it becomes overvalued. Overvalued stocks are inherently more susceptible to significant price corrections, meaning a sharp and sudden decline.

- Higher stock prices can indicate market overvaluation, leading to inflated expectations.

- Overvalued stocks are more vulnerable to sharp declines, potentially leading to substantial losses.

- Past performance, even with high current prices, is not indicative of future results. Remember that market trends are cyclical.

- Increased investor speculation, driven by hype or FOMO (fear of missing out), can inflate prices beyond fundamental value.

Identifying Red Flags in High-Priced Stocks

Identifying potentially overvalued companies requires careful analysis. Key financial metrics can help reveal red flags. The Price-to-Earnings ratio (P/E), for instance, compares a company's stock price to its earnings per share. A high P/E ratio, significantly above the industry average, often suggests overvaluation. Similarly, the Price-to-Sales ratio (P/S) compares the stock price to the company's revenue. High P/S ratios can also be indicative of inflated prices. Furthermore, consider the Debt-to-Equity ratio, which shows the proportion of a company's financing from debt compared to equity. High debt levels can significantly increase risk. Fundamental analysis, comparing a company's performance to its industry peers, is crucial.

- High P/E ratios compared to industry averages can signal overvaluation and higher risk.

- Rapid price increases without corresponding fundamental improvement (like increased earnings or market share) are a warning sign of a speculative bubble.

- High debt levels relative to equity can increase financial risk and make the company more vulnerable during economic downturns.

- Negative cash flow despite high stock prices is a major red flag, suggesting unsustainable growth.

Risk Mitigation Strategies for High-Priced Stocks

Several strategies can mitigate the risks associated with higher stock prices. Diversification is paramount. Spreading your investments across different sectors and asset classes reduces the impact of losses in any single sector. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, helps mitigate the risk of buying high. By investing consistently, you buy fewer shares when prices are high and more when they're low, averaging out your purchase price over time. Stop-loss orders automatically sell your shares when they reach a predetermined price, limiting potential losses.

- Diversify your portfolio across different stocks, sectors (technology, healthcare, energy, etc.), and asset classes (bonds, real estate, etc.).

- Employ a dollar-cost averaging strategy to reduce the impact of buying at potentially inflated prices.

- Use stop-loss orders to automatically sell shares if they fall below a certain price, protecting against significant losses.

- Consider investing in undervalued or less volatile stocks to balance your portfolio and reduce overall risk.

The Importance of Due Diligence

Thorough research is crucial before investing in any stock, regardless of price. Understanding a company's financials, business model, competitive landscape, and management team is essential. This includes analyzing financial statements, understanding their revenue streams, and assessing their long-term growth potential. Consulting with a qualified financial advisor can provide valuable insights and personalized guidance.

Conclusion

Higher stock prices often come with higher risks. Understanding valuation metrics like P/E and P/S ratios, employing risk mitigation strategies such as diversification and dollar-cost averaging, and conducting thorough due diligence are essential for navigating this challenge. By carefully considering the risks associated with higher stock prices and employing effective risk management strategies, you can make more informed investment decisions and protect your portfolio. Learn more about navigating the challenges of higher stock prices and protecting your portfolio today!

Featured Posts

-

High Stock Market Valuations A Bof A Analysis For Investors

Apr 22, 2025

High Stock Market Valuations A Bof A Analysis For Investors

Apr 22, 2025 -

Trumps Economic Agenda Who Pays The Price

Apr 22, 2025

Trumps Economic Agenda Who Pays The Price

Apr 22, 2025 -

500 Million Bread Price Fixing Settlement Canadian Hearing Set For May

Apr 22, 2025

500 Million Bread Price Fixing Settlement Canadian Hearing Set For May

Apr 22, 2025 -

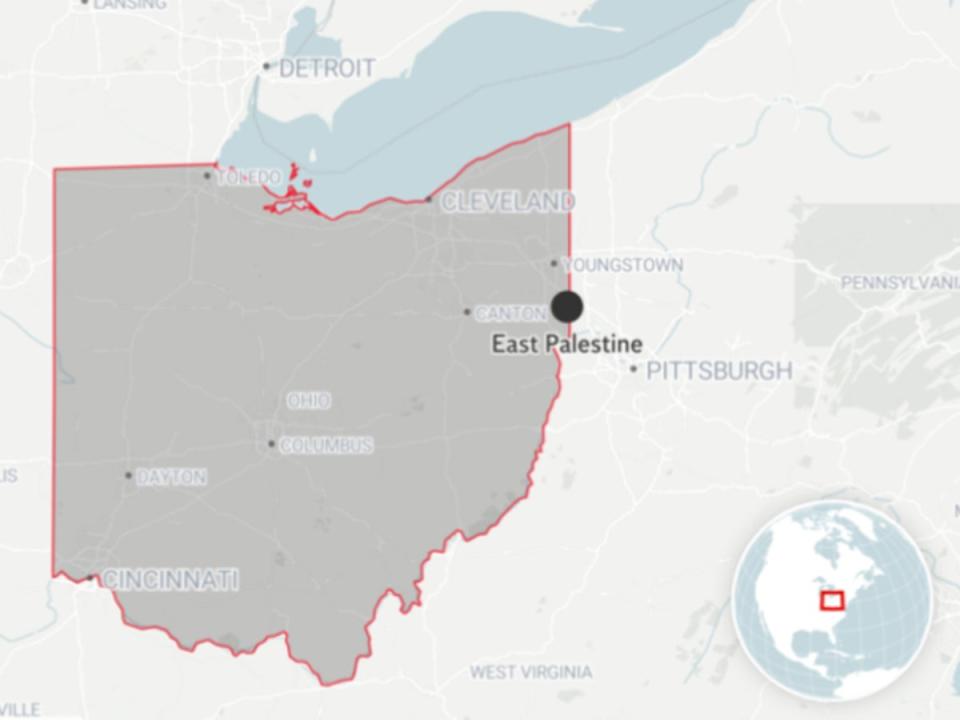

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 22, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 22, 2025 -

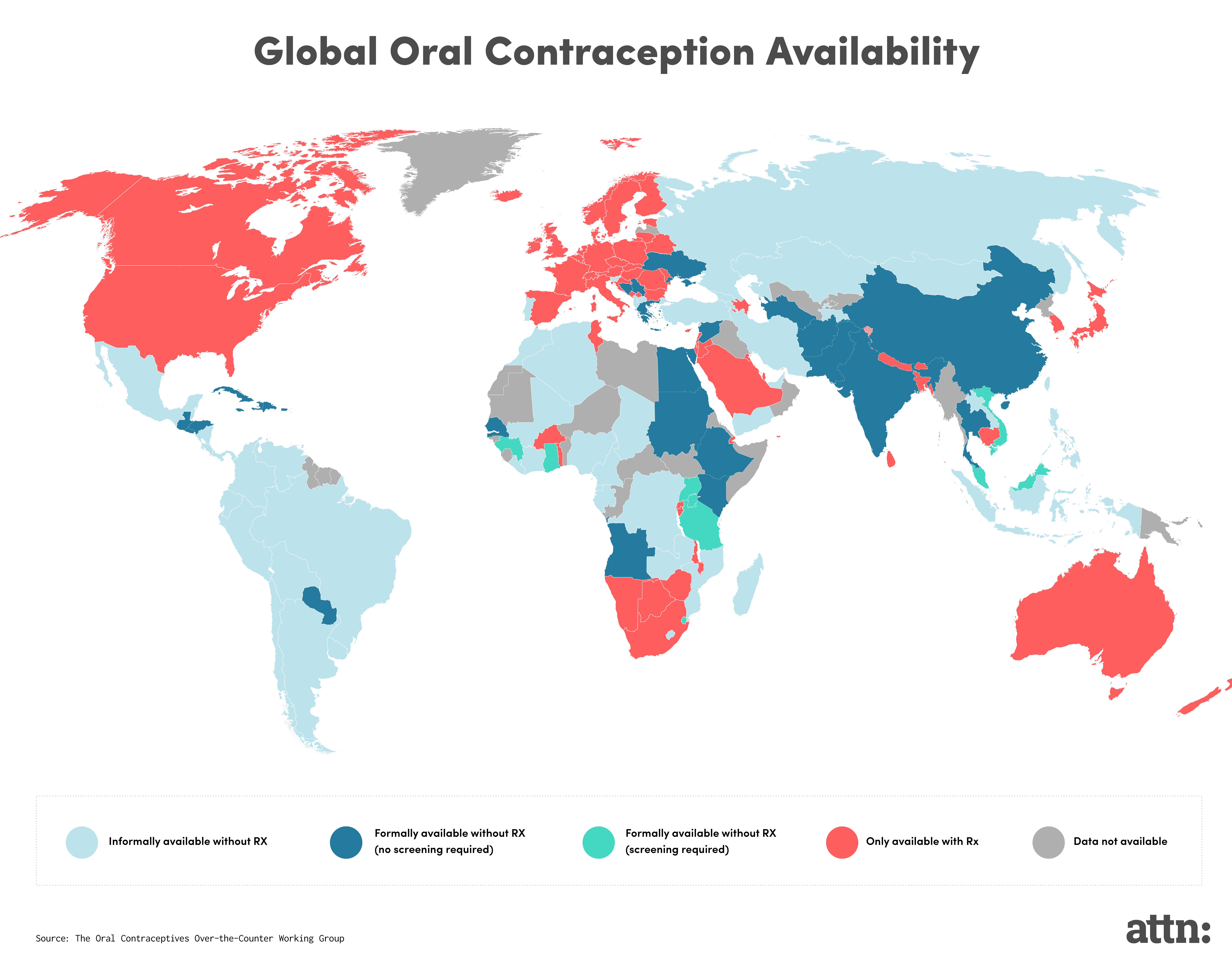

Access To Birth Control The Impact Of Over The Counter Options Post Roe

Apr 22, 2025

Access To Birth Control The Impact Of Over The Counter Options Post Roe

Apr 22, 2025