Ignoring High Stock Valuations: A BofA-Supported Investment Strategy

Table of Contents

Many investors are paralyzed by fear when faced with high stock valuations. The instinct is to avoid "overvalued" stocks, believing they're ripe for a correction. However, a counter-intuitive strategy, supported by research from Bank of America (BofA), suggests that ignoring high stock valuations might actually be a smart approach under specific circumstances. This article will explore BofA's rationale, the risks involved, and how to identify stocks that fit this potentially lucrative investment strategy. We'll examine the market analysis supporting this approach and discuss how to mitigate the inherent risks.

BofA's Rationale for Ignoring High Valuations

Bank of America's research suggests that focusing solely on traditional valuation metrics like the Price-to-Earnings (P/E) ratio can be misleading, especially in a dynamic market environment characterized by strong earnings growth and technological disruption. Their analysis emphasizes that high valuations aren't necessarily indicative of an imminent crash. Instead, BofA argues that in certain sectors and for specific companies, long-term growth potential can justify – and even necessitate – higher valuations.

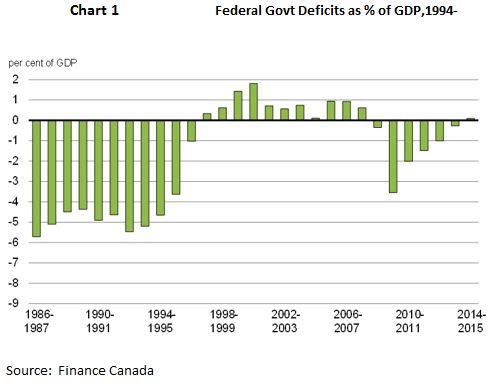

- Strong Economic Fundamentals: BofA's reasoning often points to robust economic fundamentals as a key justification. Periods of strong economic growth, low interest rates, and technological innovation can support higher valuations, even if they seem initially high compared to historical averages.

- Supporting Evidence: While specific reports are frequently updated, searching for BofA Global Research publications on market outlooks and sector-specific analyses can provide further insights. (Note: Links to specific BofA reports would be included here if publicly accessible.)

- Long-Term Growth Potential: The core of BofA's argument is that the focus should shift from short-term valuation concerns to long-term growth potential. Companies with disruptive technologies, strong competitive advantages, and significant expansion opportunities may justify higher valuations compared to more mature, slower-growing businesses.

- Earnings Growth Outpacing Valuation Concerns: BofA's analysis often highlights instances where exceptional earnings growth consistently surpasses the increase in stock prices, effectively mitigating the risks associated with high initial valuations.

Identifying Stocks with High Valuations but Strong Growth Potential

Identifying stocks that align with BofA's strategy requires a rigorous approach combining quantitative and qualitative analysis. While valuation metrics are considered, they are not the sole determinant.

- Fundamental Analysis is Key: Dive deep into a company's financials. Analyze revenue growth, profit margins, earnings per share (EPS) growth, and future projections. Consistent and accelerating growth is crucial.

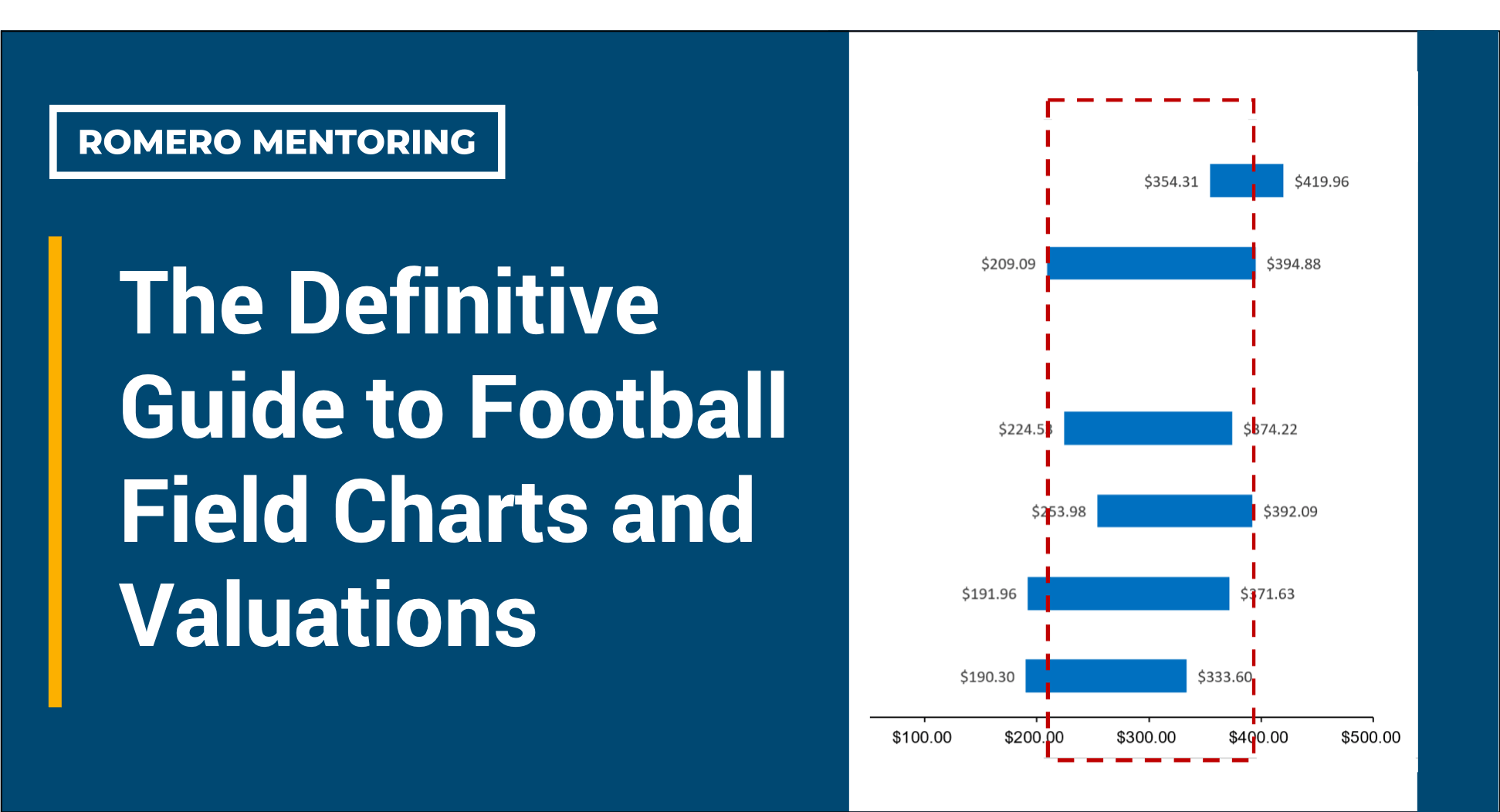

- Valuation Metrics: A Limited Perspective: Metrics like P/E ratio, PEG ratio, and Price-to-Sales (P/S) ratio can provide a starting point, but they shouldn't be the only factors considered. Their limitations become apparent when assessing high-growth companies where future earnings significantly outweigh current earnings.

- Qualitative Factors Matter: Consider qualitative factors such as the strength of the company's competitive advantage, the quality of its management team, its market position, and the potential for disruptive innovation.

- Utilizing Research Resources: Leverage reputable financial news sources, analyst reports, and company filings (10-K reports) to gather comprehensive information before making any investment decisions.

Managing the Risks of this Investment Strategy

While potentially rewarding, ignoring high valuations carries inherent risks. It's crucial to acknowledge and mitigate these risks proactively.

- Overpaying for Stocks: There's always a risk of overpaying, even for companies with strong growth potential. Thorough due diligence is paramount to ensuring the valuation, even if high, is justified.

- Market Corrections: High-valuation stocks are often more vulnerable during market corrections or downturns. These corrections can be significant, leading to substantial short-term losses.

- Diversification is Essential: Diversifying your portfolio across various sectors and investment types is vital to mitigating risk. Don't put all your eggs in one (high-valuation) basket.

- Long-Term Investment Horizon: This strategy is best suited for investors with a long-term perspective. Short-term fluctuations should be expected, and patience is key to realizing the long-term potential of high-growth stocks.

Case Studies: Successful Investments Despite High Valuations (Optional)

(This section would include specific examples of companies that, despite initially high valuations, delivered strong returns over the long term. Each case study would briefly detail the company's characteristics, its initial valuation, and the factors that contributed to its success. Data points supporting the strong returns would be included.)

Conclusion

Ignoring high stock valuations can be a viable investment strategy, particularly when coupled with a long-term perspective and thorough fundamental analysis, as supported by research from Bank of America. While it's crucial to acknowledge the inherent risks, such as the potential for overpaying and market corrections, the potential rewards can be substantial for those who identify companies with exceptional growth potential. By focusing on long-term growth, robust fundamental analysis, and diversification, investors can navigate the challenges associated with high-valuation stocks and potentially capture significant returns. Explore the BofA-supported strategy and learn more about investing in high-growth, high-valuation stocks. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Is Instagrams New Video Editor A Tik Tok Killer

Apr 24, 2025

Is Instagrams New Video Editor A Tik Tok Killer

Apr 24, 2025 -

Stock Market Gains Tariff Hopes Fuel Dow Nasdaq And S And P 500 Surge

Apr 24, 2025

Stock Market Gains Tariff Hopes Fuel Dow Nasdaq And S And P 500 Surge

Apr 24, 2025 -

Vote Liberal Review Their Platform First A Comprehensive Analysis

Apr 24, 2025

Vote Liberal Review Their Platform First A Comprehensive Analysis

Apr 24, 2025 -

Canadas Fiscal Future A Need For Responsible Liberal Governance

Apr 24, 2025

Canadas Fiscal Future A Need For Responsible Liberal Governance

Apr 24, 2025 -

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 24, 2025

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 24, 2025