India Market Analysis: Tailwinds And The Nifty's Bullish Momentum

Table of Contents

Strong Corporate Earnings Fueling the Nifty's Rise

Robust corporate earnings across diverse sectors are a primary driver of the Nifty's rise. Indian companies are demonstrating impressive growth, exceeding expectations and boosting investor confidence. Increased profitability and revenue growth are key contributors to this market optimism. This strong performance reflects a healthy and expanding Indian economy.

- Increased domestic consumption driving sales growth: Rising disposable incomes and a burgeoning middle class are fueling demand for goods and services across various sectors, from consumer durables to automobiles.

- Successful export performance: Indian companies are increasingly competitive in the global market, leading to strong export performance and increased revenue streams.

- Positive impact of government initiatives: Government policies aimed at boosting specific sectors, such as the Production Linked Incentive (PLI) schemes, are contributing to increased production and profitability.

- Improved operational efficiency: Many Indian companies have implemented strategies to improve operational efficiency, leading to cost reductions and enhanced profitability.

For example, the strong Q3 2023 earnings reported by major IT companies and the consistent growth in the FMCG sector clearly showcase the health of the Indian corporate landscape. This positive trend strongly supports the Nifty 50 outlook.

Government Reforms and Policy Initiatives: A Catalyst for Growth

Government reforms and policy initiatives are playing a crucial role in fostering economic growth and boosting investor sentiment. Initiatives focused on infrastructure development, digitalization, and ease of doing business are creating a more conducive environment for businesses to thrive.

- Impact of Production Linked Incentive (PLI) schemes on specific sectors: PLI schemes are incentivizing domestic manufacturing in key sectors, boosting production and creating jobs.

- Successes and challenges in infrastructure projects: Significant investments in infrastructure, such as roads, railways, and ports, are improving connectivity and facilitating trade. While challenges remain, progress is evident.

- Digital India initiative and its effects on market participation: The Digital India initiative is expanding internet access and digital literacy, boosting financial inclusion and encouraging greater participation in the stock market.

These reforms are not only improving the ease of doing business but also sending a positive signal to both domestic and foreign investors, contributing significantly to the positive Nifty 50 outlook.

Foreign Institutional Investor (FII) Flows and Market Sentiment

Foreign Institutional Investors (FIIs) are playing a significant role in the Nifty's bullish momentum. Positive FII inflows indicate strong confidence in the Indian market and its growth potential. Factors influencing these inflows include India's relatively strong economic fundamentals compared to other emerging markets and the attractive valuations of Indian equities.

- Analysis of recent FII investment trends: Recent data shows a consistent inflow of FII investments into the Indian equity market, significantly contributing to the rising Nifty index.

- Comparison with other emerging markets: Compared to other emerging markets, India's robust growth story and stable political environment make it an attractive investment destination.

- Impact of geopolitical factors on FII investment decisions: While geopolitical uncertainties can impact FII flows, India's relatively stable political landscape and its strategic position in the global economy mitigate some of these risks.

Potential Headwinds and Risks to Consider

While the outlook for the Indian market is largely positive, it's crucial to acknowledge potential headwinds and risks.

- Inflationary pressures and their effect on interest rates: Rising inflation could lead to increased interest rates, potentially dampening economic growth and impacting stock valuations.

- Global economic slowdown and its potential spillover effects: A global economic slowdown could negatively impact India's exports and foreign investment flows.

- Geopolitical risks and their impact on investor sentiment: Geopolitical events can create uncertainty and volatility in the market, impacting investor sentiment.

Conclusion: India Market Analysis: A Bullish Outlook and Investment Opportunities

Our India market analysis reveals a compelling picture of strong tailwinds driving the Nifty's bullish momentum. Robust corporate earnings, proactive government reforms, and sustained FII inflows all contribute to a positive outlook. While potential risks exist, the overall picture remains bullish. The Indian economy's growth potential, coupled with the ongoing reforms, presents significant investment opportunities. Invest in the booming India market and capitalize on Nifty's bullish momentum. Analyze India's market growth potential and consider adding Indian equities to your portfolio. Don't miss the chance to be a part of this exciting growth story.

Featured Posts

-

Live Stock Market Updates Dow Soars Positive Market Sentiment

Apr 24, 2025

Live Stock Market Updates Dow Soars Positive Market Sentiment

Apr 24, 2025 -

Understanding The Tradition Why The Popes Ring Is Destroyed Upon Death

Apr 24, 2025

Understanding The Tradition Why The Popes Ring Is Destroyed Upon Death

Apr 24, 2025 -

Five Point Plan Unveiled Canadian Auto Dealers Tackle Us Trade War Challenges

Apr 24, 2025

Five Point Plan Unveiled Canadian Auto Dealers Tackle Us Trade War Challenges

Apr 24, 2025 -

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

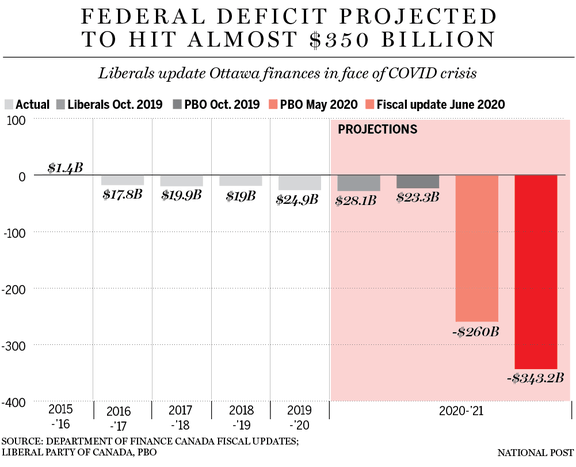

Is Canadas Fiscal Future At Risk Examining The Liberals Spending

Apr 24, 2025

Is Canadas Fiscal Future At Risk Examining The Liberals Spending

Apr 24, 2025