Live Stock Market Updates: Dow Soars, Positive Market Sentiment

Table of Contents

Dow Jones Industrial Average Surge

Record-Breaking Gains

The Dow Jones Industrial Average soared to record-breaking heights today, marking its largest single-day gain in six months. The index closed at [Insert Closing Value], representing a [Insert Percentage]% increase.

- Closing Value: [Insert Precise Closing Value]

- Percentage Increase: [Insert Precise Percentage]% compared to yesterday's closing.

- Comparison to Previous Week: [Insert Comparison to previous week's closing value and percentage change].

This dramatic surge signifies a significant shift in investor confidence and points towards a potentially strong economic outlook.

Contributing Factors to Dow's Rise

Several key factors contributed to the Dow's impressive rise. These include:

- Strong Corporate Earnings: Numerous companies released better-than-expected earnings reports, boosting investor confidence and driving up stock prices. Positive earnings revisions for the coming quarters further solidified this bullish sentiment.

- Positive Economic Data: Recent economic indicators, such as a higher-than-anticipated GDP growth and improved employment figures, painted a picture of robust economic health. These positive economic indicators fueled investor optimism.

- Increased Investor Confidence: Positive earnings reports and strong economic data have significantly increased investor confidence, leading to increased buying activity and pushing stock prices higher. This heightened investor sentiment is a key driver of the current market rally.

- Positive Global Market Trends: Positive developments in global markets, including [mention specific examples, e.g., easing trade tensions or positive economic news from other major economies], also contributed to the overall positive market sentiment.

Broad Market Strength Beyond the Dow

Positive Performance Across Sectors

The positive sentiment wasn't confined to the Dow alone. Other major market indices also experienced significant gains:

- S&P 500: [Insert Percentage]% increase.

- Nasdaq: [Insert Percentage]% increase.

Several sectors showed particularly strong performance, including technology and energy. This broad-based market strength suggests a widespread positive sentiment rather than a sector-specific rally.

Increased Trading Volume

The surge in the market wasn't just about price; trading volume also experienced a significant increase, exceeding [Insert Volume Figure] shares traded. This high volume indicates that the market move is not merely a short-lived fluctuation but could signal a sustained upward trend.

- Increased Volume: [Insert Precise Volume Figure] shares traded, compared to [Insert Previous Day/Week's Volume].

- Significance: The high volume confirms the strength of the bullish trend, suggesting that many investors are actively participating in the market's upward momentum.

The increased trading activity suggests strong conviction behind the market's upward movement.

Analyzing Market Sentiment and Future Outlook

Investor Confidence Indicators

Several indicators point to a strong positive investor sentiment:

- VIX Volatility Index: The VIX, often referred to as the "fear index," has fallen to [Insert VIX Value], indicating reduced market volatility and increased investor confidence. Lower VIX values suggest that investors are less concerned about potential market downturns.

- Other Indicators: [Mention other relevant indicators and their values, e.g., consumer confidence index].

These positive indicators reinforce the optimistic market sentiment currently observed. Many market analysts remain cautiously optimistic about future market performance, citing these positive indicators as key drivers.

Potential Risks and Challenges

While the outlook is positive, it's crucial to acknowledge potential risks:

- Inflation: Persistent inflationary pressures could dampen economic growth and negatively impact corporate earnings.

- Geopolitical Events: Uncertainties stemming from geopolitical events could trigger market volatility.

- Interest Rate Hikes: Potential interest rate hikes by central banks could impact borrowing costs and slow down economic activity.

Analysts urge caution, advising investors to consider these potential risks before making any significant investment decisions.

Conclusion

Today's live stock market updates reveal a significant surge in the Dow Jones Industrial Average, driven by robust corporate earnings, positive economic indicators, and strong investor confidence. The broad-based market strength, indicated by gains across major indices and increased trading volume, further solidifies the positive market sentiment. While potential risks exist, the current outlook is largely optimistic. To stay informed on future live stock market updates and gain further insights into market trends and Dow Jones performance, follow our regular analysis and subscribe for the latest updates. Stay tuned for more detailed live stock market updates and analysis.

Featured Posts

-

Oblivion Remastered Official Release And Details

Apr 24, 2025

Oblivion Remastered Official Release And Details

Apr 24, 2025 -

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Robot Development

Apr 24, 2025

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Robot Development

Apr 24, 2025 -

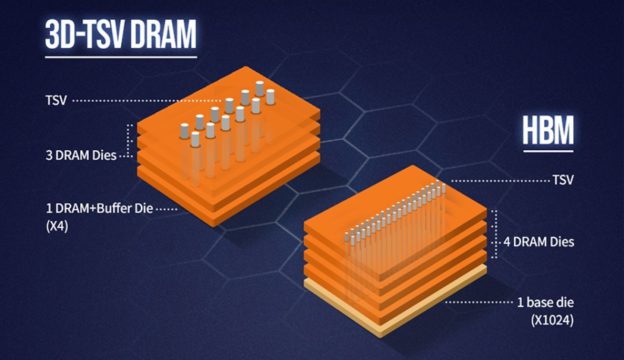

Sk Hynixs Dram Market Leadership Fueled By Ai Growth

Apr 24, 2025

Sk Hynixs Dram Market Leadership Fueled By Ai Growth

Apr 24, 2025 -

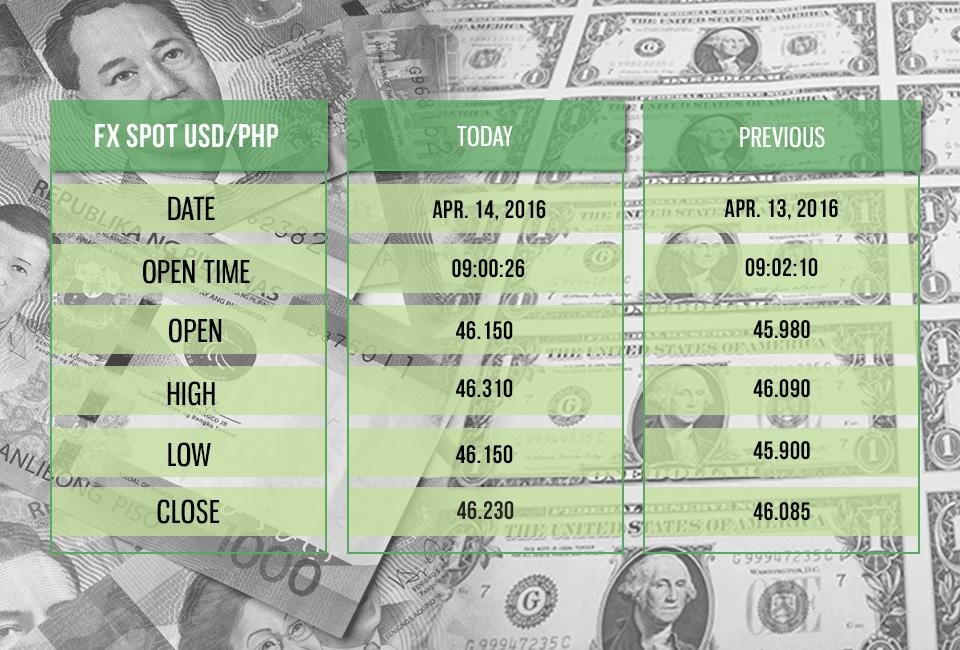

Canadian Dollars Complex Forex Performance A Current Overview

Apr 24, 2025

Canadian Dollars Complex Forex Performance A Current Overview

Apr 24, 2025 -

Nevideni Tarantino Film S Travoltom Koji Je Odbio

Apr 24, 2025

Nevideni Tarantino Film S Travoltom Koji Je Odbio

Apr 24, 2025