Market Rally: 1000-Point Dow Jump On Tariff Deal Optimism - Live Updates

Table of Contents

The Catalyst: Tariff Deal Optimism and its Impact on Market Sentiment

The primary catalyst for this astonishing market rally is the burgeoning optimism surrounding a potential tariff deal. While specifics remain somewhat elusive at this stage, whispers of a significant breakthrough in trade negotiations have ignited investor confidence. This renewed hope for a resolution to the protracted trade war has significantly boosted risk appetite, leading to a massive influx of investment into the market.

- Specifics of the Proposed Deal (if available): [Insert details of any reported agreements or concessions made by involved parties. If no concrete details are available, state this clearly and mention the sources of the optimism, e.g., positive statements from officials, unofficial reports from reliable sources.]

- Analyst Quotes: "[Quote from a reputable market analyst expressing optimism about the deal and its impact on the market rally]. This sentiment is echoed by [another analyst’s name] who stated [quote]."

- Previous Tariff Volatility: Recall the significant market volatility experienced during previous periods of heightened trade tensions. This current market rally represents a stark contrast to those periods, highlighting the impact of positive news on investor sentiment.

- Keywords: tariff deal, trade war, investor sentiment, market volatility, stock market rally, trade negotiations

Sector-Specific Performance: Winners and Losers of the 1000-Point Surge

The 1000-point market rally hasn't impacted all sectors equally. While some sectors have experienced significant gains, others have seen more modest increases or even slight losses. Analyzing sector-specific performance provides a deeper understanding of the market's response to this positive news.

- Technology: [Percentage change] - The technology sector, often sensitive to trade disputes, has experienced [significant gains/moderate gains/minimal change], reflecting investor confidence in the potential for reduced trade barriers. Specific companies like [Company A] and [Company B] saw particularly strong performance.

- Manufacturing: [Percentage change] - The manufacturing sector, directly impacted by tariffs, has seen [substantial gains/cautious gains/losses], indicating [explain the reason – e.g., relief from tariff burdens, continued uncertainty].

- Energy: [Percentage change] - The energy sector's performance during this market rally has been [describe performance and reasoning].

- Keywords: sector performance, stock market gains, stock market losses, sector analysis

Live Updates and Market Reactions: Tracking the Rally in Real-Time

[This section should be updated throughout the day with live market data. Include real-time stock indices data (Dow Jones, S&P 500, Nasdaq), key market indicators like the VIX (volatility index), and updates on trading volume.]

- Real-time Stock Indices Data: [Insert live data here – e.g., Dow Jones: 27,000 +1050 points; S&P 500: 3000 +120 points]

- VIX (Volatility Index): [Insert live data – e.g., VIX: 15 – indicating decreased volatility]

- Trading Volume: [Insert live data – e.g., Trading Volume: Significantly higher than average]

- Keywords: live market data, real-time updates, stock market indices, trading volume

Potential Downsides and Future Outlook: Cautious Optimism?

While this market rally is undeniably impressive, it's crucial to maintain a degree of cautious optimism. Several factors could potentially lead to a market correction.

- Possible Market Correction: The rapid and significant nature of this market rally raises concerns about a potential correction. Overbought conditions and profit-taking could trigger a downturn.

- Uncertainties Regarding the Tariff Deal: The details of the potential tariff deal remain unclear. Any unexpected changes or setbacks could quickly reverse the current market sentiment.

- Expert Opinions: [Include quotes from analysts expressing concerns or offering more cautious predictions about the sustainability of the rally].

- Keywords: market correction, risk assessment, market outlook, future predictions

Conclusion: Market Rally Analysis and Next Steps

Today's remarkable 1000-point Dow jump signifies a significant market rally driven by optimism surrounding a potential tariff deal. This positive sentiment has had a considerable impact across various sectors, boosting investor confidence and triggering significant gains in many areas. However, it is crucial to acknowledge potential downsides and maintain a balanced outlook. While the news is encouraging, uncertainties remain. Stay informed on the latest market rally updates and follow our coverage of the ongoing market rally for further analysis and developments. Subscribe to our newsletter to stay ahead of the curve! Don't miss out on crucial updates about this dynamic market rally!

Featured Posts

-

Trump Rejects Calls To Dismiss Federal Reserve Chair Jerome Powell

Apr 24, 2025

Trump Rejects Calls To Dismiss Federal Reserve Chair Jerome Powell

Apr 24, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 24, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Reporting

Apr 24, 2025 -

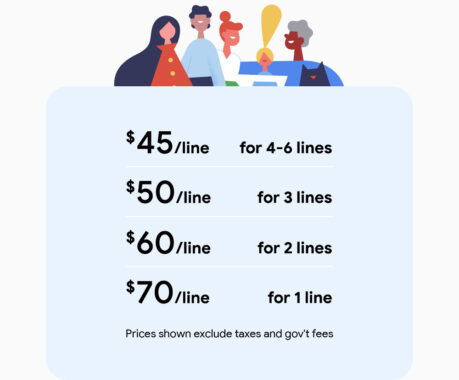

Understanding Google Fis New 35 Month Unlimited Plan

Apr 24, 2025

Understanding Google Fis New 35 Month Unlimited Plan

Apr 24, 2025 -

Months Long Chemical Contamination Ohio Train Derailment Aftermath

Apr 24, 2025

Months Long Chemical Contamination Ohio Train Derailment Aftermath

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025

The Bold And The Beautiful Spoilers Finns Promise To Liam On April 23rd

Apr 24, 2025