Trump Rejects Calls To Dismiss Federal Reserve Chair Jerome Powell

Table of Contents

Trump's Rationale for Rejecting Calls to Dismiss Powell

Despite his past sharp criticisms of Powell's monetary policy decisions, former President Trump has, once again, refrained from publicly calling for his dismissal. Several factors might explain this seemingly surprising decision. One significant consideration is the potential for severe market instability that a sudden change in Fed leadership could trigger. Dismissing the chair mid-term would send shockwaves through financial markets, potentially leading to increased volatility and uncertainty.

- Political ramifications of dismissing a Fed Chair: Such an action would be unprecedented and could severely damage the perception of the Fed's independence, a cornerstone of a healthy US economy. It could also create political fallout, further polarizing an already divided nation.

- Potential market instability caused by such a move: The abrupt removal of Powell could erode investor confidence, leading to a sell-off in stocks and bonds. Uncertainty breeds risk aversion, potentially stifling economic growth.

- Trump's evolving perspective on Powell's leadership: While Trump's past criticisms were sharp, his current silence might reflect a recalibration of his views, a recognition of the potential downsides of replacing Powell, or simply a shift in political priorities.

- Analysis of Trump's statements regarding the Fed and its policies: A thorough examination of Trump's public pronouncements on the Fed reveals a complex relationship, marked by both praise and condemnation, indicating a fluctuating level of satisfaction with Powell's performance.

Analysis of Powell's Performance During Trump's Presidency

Powell's tenure as Federal Reserve Chair during the Trump administration was marked by significant economic events and policy decisions. Trump, often favoring lower interest rates to stimulate economic growth, frequently clashed with Powell over interest rate hikes implemented to combat inflation.

- Key interest rate hikes and cuts during Trump's term: Powell oversaw both increases and decreases in interest rates, responding to evolving economic conditions. These decisions were often met with criticism from Trump, who publicly expressed his preference for a more expansionary monetary policy.

- Trump's criticism of Powell's monetary policy decisions: Trump's frequent attacks on Powell's leadership were highly publicized, raising concerns about potential political interference in the Federal Reserve's decision-making processes.

- Impact of Powell's actions on economic growth and inflation: Assessing the overall impact of Powell's actions on economic growth and inflation during this period requires a nuanced analysis considering various global and domestic factors influencing economic performance.

- Public opinion on Powell's performance during this period: Public sentiment towards Powell's performance was divided, reflecting the diverse perspectives on the appropriate response to economic challenges during Trump's presidency.

The Implications of Trump's Stance on Future Economic Policy

Trump's continued (albeit tacit) support for Powell, despite past criticisms, holds significant implications for future economic policy and the Federal Reserve's independence. It underscores the complex interplay between politics and monetary policy.

- Potential impact on future Fed appointments: Trump's decision might influence future presidential appointments to the Federal Reserve Board, shaping the institution's direction for years to come.

- The ongoing debate about the independence of the Federal Reserve: The ongoing debate about the Federal Reserve's independence is critical for maintaining a stable and predictable economic environment. Political interference undermines this independence.

- The role of politics in influencing monetary policy decisions: The influence of political considerations on monetary policy decisions is a constant concern, and Trump's actions highlight the ongoing tension between political pressures and the need for independent central banking.

- Long-term economic consequences of political interference in the Fed: Excessive political interference in the Federal Reserve's operations can have long-term, detrimental consequences for economic stability and growth.

Public and Expert Reaction to Trump's Decision

The reaction to Trump's decision not to call for Powell's dismissal has been varied. Economists have expressed differing opinions, ranging from cautious optimism to concerns about the ongoing politicization of the Federal Reserve.

- Quotes from key economists and political analysts: Experts have offered a range of perspectives, highlighting both the potential benefits and risks associated with maintaining the current leadership at the Fed.

- Analysis of public opinion polls and surveys: Public opinion remains divided, reflecting the complex and often contradictory nature of economic debates.

- Impact on stock markets and investor sentiment: The markets have generally reacted positively to the continued stability at the Fed, although some volatility remains.

- Potential consequences for the upcoming election cycle: Trump's stance on the Federal Reserve could play a role in the upcoming election cycle, influencing voters' perspectives on economic policy.

Conclusion: Trump's Continued Support for Jerome Powell: A Look Ahead

This article examined former President Trump's decision not to actively pursue the removal of Federal Reserve Chair Jerome Powell. While Trump previously voiced harsh criticisms of Powell's monetary policy, his continued support, however implicit, has broad implications for the future of the Federal Reserve's independence and its influence on US economic policy. The diverse reactions from economists and the public underscore the complexities of this issue and the ongoing debate surrounding the intersection of politics and monetary policy. The Federal Reserve's independence remains crucial for maintaining a healthy US economy, and continued vigilance is necessary to ensure it remains free from undue political influence.

Continue following the developments surrounding the Federal Reserve Chair Jerome Powell, the Trump administration's legacy on economic policy, and the ongoing discussion about the balance between political pressures and the crucial independence of the Federal Reserve. Share your thoughts in the comments section below.

Featured Posts

-

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025 -

Anchor Brewing Company To Close After 127 Years The End Of An Era

Apr 24, 2025

Anchor Brewing Company To Close After 127 Years The End Of An Era

Apr 24, 2025 -

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

Apr 24, 2025

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

Apr 24, 2025 -

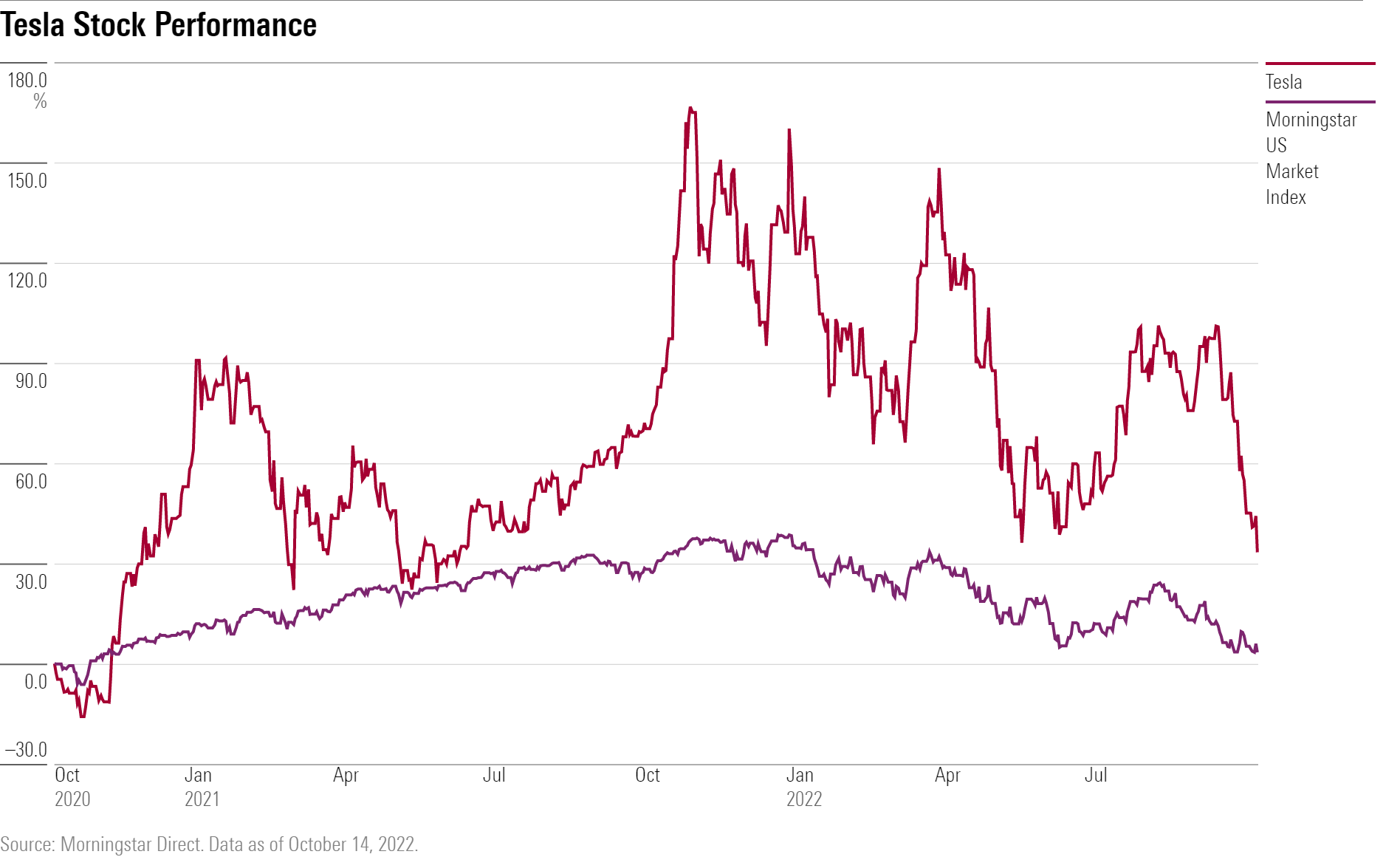

Tesla Stock Performance Q1 Profit Decline And Political Fallout

Apr 24, 2025

Tesla Stock Performance Q1 Profit Decline And Political Fallout

Apr 24, 2025 -

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Problem

Apr 24, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Problem

Apr 24, 2025