Metro Vancouver Housing Market: Slower Rent Growth, Persistent Cost Increases

Table of Contents

Slowing Rent Growth in Metro Vancouver

Recent data indicates a slowdown in Metro Vancouver rent growth, a shift from the rapid increases seen in previous years. This trend, while offering some relief, doesn't negate the persistent affordability challenges in the region's rental market. Several factors contribute to this slowing growth:

-

Increased Rental Supply: New construction projects, particularly in areas like Surrey and Burnaby, are gradually adding to the rental inventory. The conversion of some older buildings into rental units also contributes to increased supply. This increased supply helps ease pressure on rental rates, although the impact varies across different neighbourhoods.

-

Economic Slowdown and Tenant Demand: A cooling economy impacts tenant demand. With economic uncertainty, some potential renters may delay their search or opt for smaller or less expensive units, lessening the competition and thus moderating rent increases.

-

Government Regulations: Provincial and municipal regulations aimed at protecting tenants and influencing rental rates play a role. Rent control measures, while intended to provide stability, can also contribute to slower rent growth.

Bullet Points:

- Recent reports show Metro Vancouver rent growth slowed to approximately 2% year-over-year in Q3 2023 (replace with actual data if available), down from 5% in Q3 2022.

- This slowdown is most noticeable in the apartment rental market, with condo rentals showing slightly more resilience.

- Rental vacancy rates remain low but have shown a marginal increase in certain areas, contributing to the slower rent growth.

- Areas like downtown Vancouver still experience higher rental rates compared to suburbs.

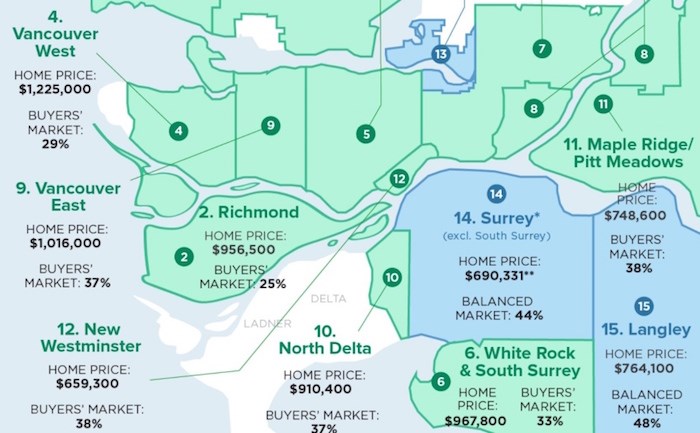

Persistent High Costs of Homeownership in Metro Vancouver

Despite the slowing rent growth, the cost of homeownership in Metro Vancouver remains exceptionally high. This persistent challenge stems from several interconnected factors:

-

High Demand and Limited Supply: The persistent high demand for housing, fueled by population growth and a strong economy (even with a slowdown), significantly outpaces the limited supply of available homes. This imbalance keeps prices elevated.

-

Land Scarcity and Development Challenges: The geographic constraints of Metro Vancouver, combined with lengthy development approval processes and zoning regulations, contribute to limited housing supply. Finding suitable land for development is often expensive and time-consuming.

-

Rising Construction Costs and Material Prices: The cost of building new homes has increased substantially due to rising material prices, labor shortages, and supply chain disruptions. These higher construction costs are directly passed on to homebuyers.

-

Continued Influx of New Residents: The ongoing migration of people to Metro Vancouver, driven by job opportunities and lifestyle factors, further intensifies the demand for housing and puts upward pressure on prices.

-

Impact of Interest Rates on Mortgage Affordability: Rising interest rates significantly reduce the purchasing power of prospective homebuyers, making it more difficult for many to afford a mortgage. This can indirectly moderate price increases, although prices remain high.

Bullet Points:

- Average home prices in Vancouver remain significantly higher than the national average. (Insert specific data here)

- The ratio of home prices to household income in Metro Vancouver remains amongst the highest in Canada. (Insert data here)

- Property taxes in Metro Vancouver are substantial and add significantly to the cost of homeownership.

- Affordability is a major challenge for first-time homebuyers and those in lower and middle-income brackets.

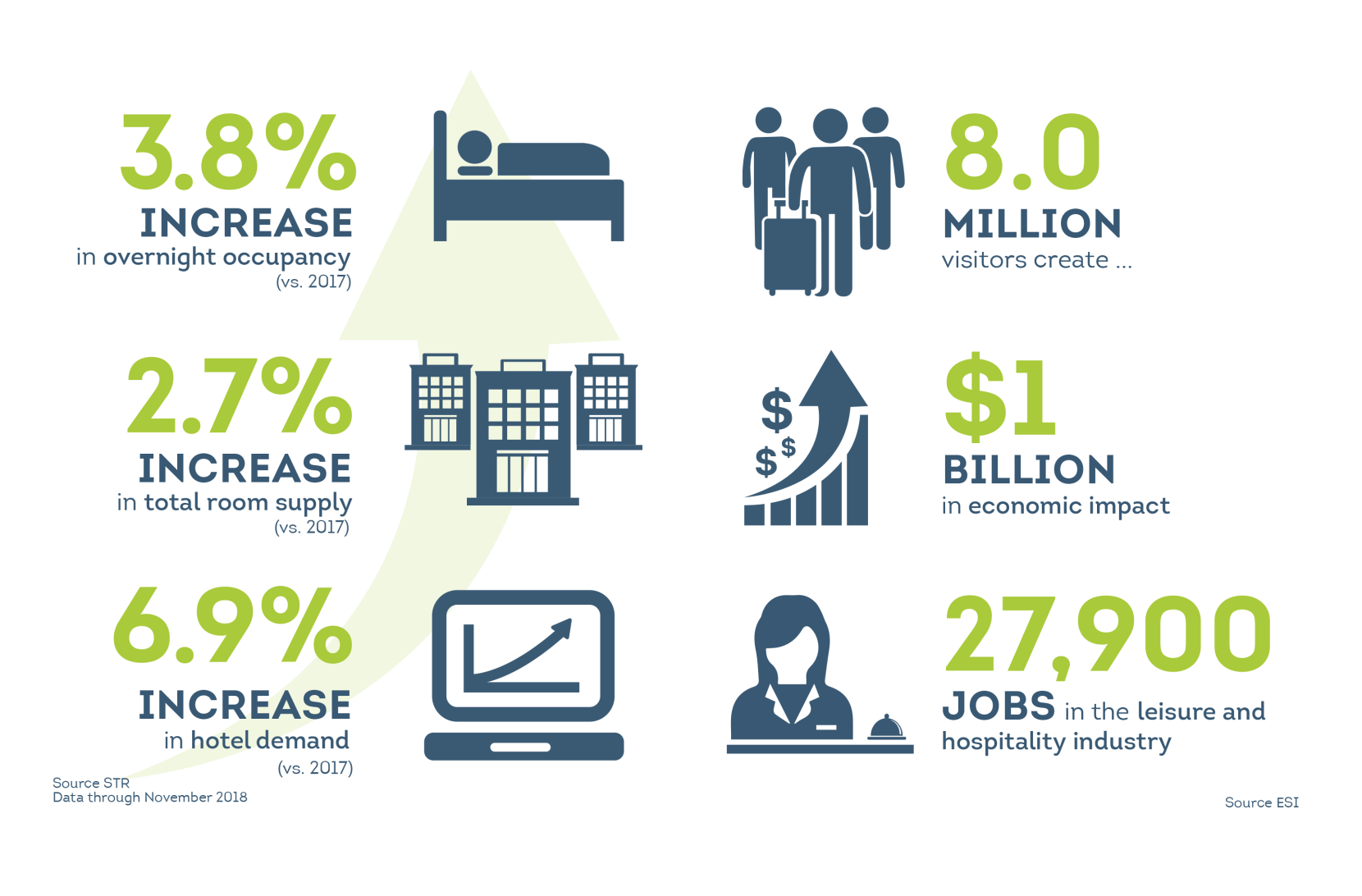

The Impact of Rising Interest Rates

Rising interest rates have a profound impact on both the rental and homebuying markets in Metro Vancouver. Higher borrowing costs reduce affordability for prospective homebuyers, leading to decreased demand and potentially slowing price appreciation. This decrease in buying activity can, in some cases, indirectly influence the rental market, as fewer people purchase homes, potentially increasing demand for rental properties.

Bullet Points:

- Current mortgage interest rates are significantly higher than they were a few years ago. (Insert specific data here)

- The increase in interest rates has substantially reduced the maximum mortgage amount many buyers can qualify for.

- This decrease in buyer purchasing power could lead to a stabilization or even a slight decrease in home prices in the long term.

- The impact on the rental market is complex. It could lead to increased competition and rents if the reduced homebuying activity leads to more demand for rentals.

Looking Ahead: Future Trends in the Metro Vancouver Housing Market

Predicting the future of the Metro Vancouver housing market is challenging, but several factors suggest a continued period of high housing costs despite the recent slowdown in rent growth.

-

Continued Slow Rent Growth, High Home Prices: We anticipate that rent growth will remain relatively slow, but the high cost of homeownership will persist due to the fundamental imbalance between supply and demand.

-

Potential for Increased Rental Vacancy Rates: While still low, there is a potential for a modest increase in rental vacancy rates in some areas as new construction adds to the inventory. However, this increase is unlikely to dramatically alter the affordability landscape.

-

Impact of Government Policies: Government policies aimed at increasing housing supply, such as changes to zoning regulations and density allowances, will play a critical role in shaping the future of the market. However, these changes often take time to impact the market.

Bullet Points:

- Forecasts suggest modest rent growth (1-3%) and relatively stable home prices in the next year. (Replace with actual data if available)

- Government policies focused on increasing housing density and streamlining approvals could alleviate the supply shortage in the long term.

- Long-term affordability challenges in Metro Vancouver will likely persist, requiring continued government intervention and market adjustments.

Conclusion

The Metro Vancouver housing market presents a complex picture. While rent growth has slowed, the overall cost of housing remains exceptionally high. Limited supply, strong demand, rising interest rates, and construction costs all contribute to this challenging situation for both renters and buyers. Understanding these intricacies is crucial for navigating this dynamic market effectively. Continue your research into the latest Metro Vancouver housing market trends and data to make informed decisions regarding your housing needs. This knowledge is crucial for finding the best option for you in this ever-evolving market.

Featured Posts

-

Bubba Wallace Breaking The Nascar Mold

Apr 28, 2025

Bubba Wallace Breaking The Nascar Mold

Apr 28, 2025 -

Canadian Travel Boycott Real Time Economic Effects On The Us

Apr 28, 2025

Canadian Travel Boycott Real Time Economic Effects On The Us

Apr 28, 2025 -

The First 100 Days Assessing The U S Dollars Performance Against Historical Precedents Nixon Era

Apr 28, 2025

The First 100 Days Assessing The U S Dollars Performance Against Historical Precedents Nixon Era

Apr 28, 2025 -

Actors Join Writers Strike A Complete Hollywood Production Shutdown

Apr 28, 2025

Actors Join Writers Strike A Complete Hollywood Production Shutdown

Apr 28, 2025 -

Are Gpu Prices Out Of Control Again A Detailed Look

Apr 28, 2025

Are Gpu Prices Out Of Control Again A Detailed Look

Apr 28, 2025