Private Credit Jobs: 5 Do's And Don'ts For Applicant Success

Table of Contents

5 Do's for Private Credit Job Success

Do 1: Network Strategically within the Private Credit Industry

Expanding your professional network is paramount when searching for private credit jobs. Don't underestimate the power of connections in this specialized field.

- Attend industry events: SuperReturn, ACG conferences, and smaller, regional gatherings offer invaluable networking opportunities. These events provide a chance to meet professionals, learn about new trends in private credit investing, and even discover unadvertised private credit jobs.

- Leverage online platforms: LinkedIn is your best friend. Join relevant groups, participate in discussions, and connect with professionals working in private credit. Targeted searches for private credit jobs on LinkedIn can yield amazing results.

- Informational interviews: Reach out to people working in private credit jobs that interest you. A short informational interview can provide unparalleled insights into specific roles, company cultures, and the day-to-day realities of the job.

- Utilize alumni networks: If you're an alumnus of a reputable business school, leverage your network. Many alumni work in the private credit industry and are often willing to help fellow graduates.

Do 2: Tailor Your Resume and Cover Letter to Specific Private Credit Roles

Generic applications rarely succeed in the competitive private credit market. Each application needs to be a bespoke reflection of your skills and how they align with the specific requirements of the role.

- Highlight relevant skills: Showcase your understanding of key private credit concepts: leveraged buyouts (LBOs), mezzanine financing, distressed debt, and credit analysis. Quantify your achievements whenever possible using metrics (e.g., "Increased portfolio returns by 15%," "Reduced delinquency rates by 10%").

- Keyword optimization: Use keywords directly from the job description in your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a strong match.

- Customize for each application: Demonstrate genuine interest by specifically referencing the company's recent deals, investment strategy, or company culture in your cover letter. This shows you've done your research and are genuinely interested in this specific private credit job.

- Focus on transferable skills: If you're transitioning from another area of finance, clearly highlight transferable skills like financial modeling, valuation, or due diligence.

Do 3: Showcase Your Financial Modeling and Analytical Skills

Private credit roles demand strong analytical and financial modeling skills. Demonstrate your proficiency through your application materials and during the interview.

- Proficiency in software: Showcase your expertise in Excel, Bloomberg Terminal, Argus, and other relevant financial modeling software.

- Portfolio of work: Include examples of your best financial modeling projects in your portfolio or resume. This allows recruiters to assess your skills directly.

- Credit analysis expertise: Highlight experience with credit analysis, valuation, and due diligence processes. This is crucial for many private credit jobs.

- Interpreting financial statements: Demonstrate your ability to analyze financial statements, interpret key financial ratios, and draw meaningful conclusions.

Do 4: Prepare Thoroughly for Private Credit Job Interviews

Thorough preparation is crucial for success in private credit job interviews. These interviews are often rigorous and test both your technical skills and your personality.

- Research the firm: Understand their investment strategy, recent transactions, and key personnel. This shows genuine interest and initiative.

- Practice common questions: Prepare answers to common interview questions related to your experience in finance, your understanding of private credit, and your career goals. Utilize the STAR method (Situation, Task, Action, Result) for behavioral questions.

- Prepare insightful questions: Asking thoughtful questions shows your engagement and curiosity. Prepare a few questions to ask the interviewers.

- Professionalism: Dress professionally, arrive on time, and maintain a positive and confident demeanor throughout the interview.

Do 5: Follow Up After the Interview

A timely and professional follow-up demonstrates your continued interest and reinforces your candidacy.

- Send a thank-you note: Send a personalized thank-you note to each interviewer within 24 hours of the interview.

- Reiterate interest: Reiterate your enthusiasm for the private credit jobs and highlight your key qualifications.

- Follow up (if necessary): If you haven't heard back within a reasonable timeframe, a polite follow-up email is acceptable.

5 Don'ts for Private Credit Job Applicants

Don't 1: Submit Generic Resumes and Cover Letters

Sending the same resume and cover letter for multiple applications is a significant mistake. It shows a lack of effort and genuine interest.

Don't 2: Neglect to Research the Firm and Industry

A lack of research demonstrates a lack of seriousness and understanding of the private credit market. Thorough research is essential.

Don't 3: Overlook the Importance of Networking

Networking is not optional; it's a critical element in securing private credit jobs. Don't underestimate its power.

Don't 4: Underestimate the Interview Process

Private credit interviews are challenging. Prepare adequately to showcase your skills and personality.

Don't 5: Fail to Follow Up

A simple, well-written thank-you note can leave a lasting positive impression and increase your chances of securing a job offer.

Conclusion

Securing private credit jobs requires a strategic approach. By following these five "Do's" and avoiding the five "Don'ts," you significantly increase your chances of landing your dream role. Remember to network strategically, tailor your applications, highlight your analytical skills, prepare thoroughly for interviews, and always follow up. Start building your career in the exciting world of private credit today! Begin your search for private credit jobs now and apply the strategies outlined above for success.

Featured Posts

-

Khtwt Tyran Jdydt Tyran Alerbyt Trbt Abwzby Bkazakhstan

Apr 28, 2025

Khtwt Tyran Jdydt Tyran Alerbyt Trbt Abwzby Bkazakhstan

Apr 28, 2025 -

Trumps Higher Education Policies A Nationwide Analysis

Apr 28, 2025

Trumps Higher Education Policies A Nationwide Analysis

Apr 28, 2025 -

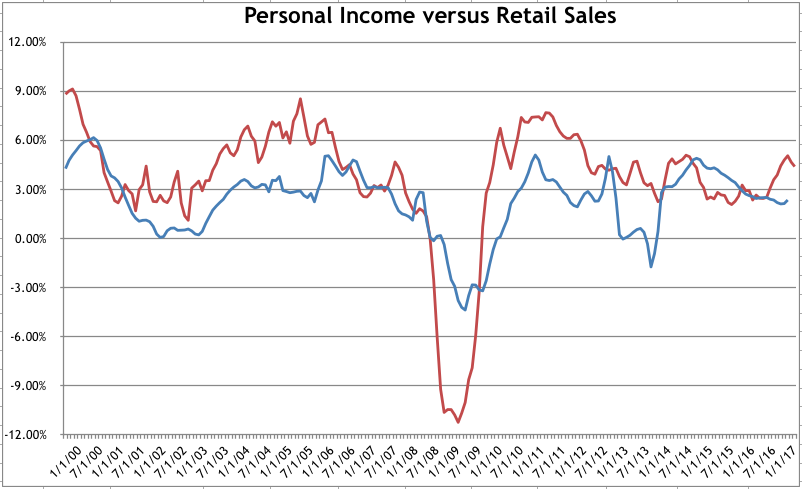

Economists Predict Rate Cuts Based On Weak Retail Sales

Apr 28, 2025

Economists Predict Rate Cuts Based On Weak Retail Sales

Apr 28, 2025 -

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025 -

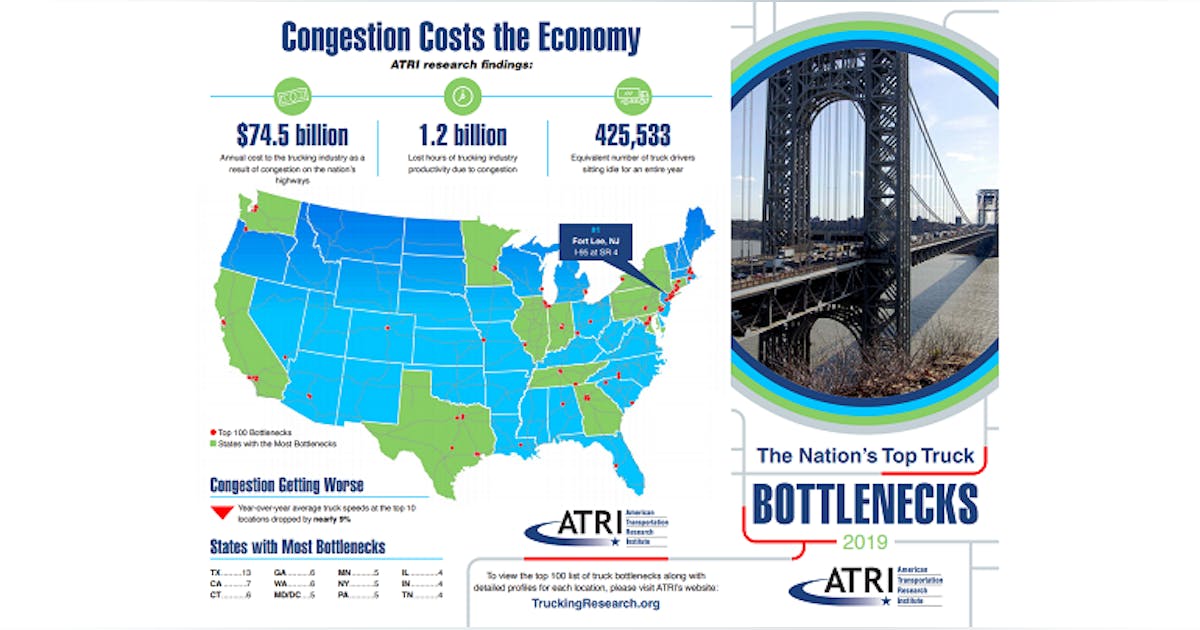

Is This The Antidote To Americas Truck Bloat Problem

Apr 28, 2025

Is This The Antidote To Americas Truck Bloat Problem

Apr 28, 2025