Reduced Consumer Spending: A Challenge For Credit Card Companies

Table of Contents

Declining Transaction Volumes and Revenue Impacts

The direct correlation between consumer spending and credit card transaction fees is undeniable. Credit card companies earn revenue primarily through interchange fees – a percentage of each transaction processed. A decline in consumer spending directly translates to a reduction in these fees, significantly impacting their bottom line.

- Lower purchase frequency leading to reduced interchange fees: As consumers buy less, the number of credit card transactions decreases, directly impacting the revenue stream for credit card companies.

- Decreased average transaction value impacting revenue: Inflation and reduced disposable income often lead to consumers purchasing fewer or less expensive items, further reducing the value of each transaction and, consequently, the interchange fees earned.

- Potential increase in late payments and defaults due to financial strain: As consumers struggle financially, the likelihood of late payments and defaults on credit card debt increases, leading to losses for credit card companies and impacting their profitability.

- Impact on credit card rewards programs and their profitability: Generous rewards programs, while attractive to consumers, represent a significant expense for credit card companies. Reduced transaction volumes make it harder to offset these reward costs.

This reduction in credit card revenue directly impacts the profits and stock valuations of credit card companies. For example, several major players have reported decreased earnings in recent quarters, reflecting the challenges posed by reduced consumer spending. The impact of falling transaction volume on credit card revenue is a significant concern for industry analysts. The interplay between interchange fees and overall consumer spending behavior is a key factor influencing the financial health of these companies.

Strategies for Credit Card Companies to Adapt to Reduced Spending

Faced with declining transaction volumes, credit card companies are adopting various strategies to adapt and mitigate the effects of reduced consumer spending.

- Offering competitive interest rates and rewards programs to attract customers: Many companies are focusing on offering more attractive rewards and lower interest rates to retain existing customers and attract new ones. This necessitates a careful balance between attracting customers and maintaining profitability.

- Focusing on customer retention strategies, improving customer service: Prioritizing excellent customer service and implementing effective retention programs can help to minimize customer churn and protect revenue streams. Customer loyalty becomes even more crucial in a challenging economic climate.

- Investing in digital technologies to enhance convenience and usage: Improving mobile apps, online platforms, and digital payment solutions enhances user experience and potentially drives greater usage. This involves significant investment in digital transformation.

- Expanding into new markets or customer segments: Some companies are exploring new geographical markets or targeting underserved customer segments to diversify their revenue streams. This requires careful market analysis and strategic planning.

- Implementing stricter credit scoring and risk management practices: With a higher risk of defaults, credit card companies are tightening their lending criteria and improving risk management practices to protect their financial position. This might involve more stringent credit checks and stricter approval processes.

Companies like Visa and Mastercard are increasingly focusing on digital payment solutions, while others are expanding into areas like BNPL services to diversify their offerings. The strategic focus is on adapting to the changing landscape by leveraging technology and optimizing their offerings.

The Rise of Buy Now, Pay Later (BNPL) Services and Their Competition

The rapid growth of Buy Now, Pay Later (BNPL) services presents both a challenge and an opportunity for traditional credit card companies. BNPL offers consumers a flexible payment option, often with lower upfront costs.

- Advantages for BNPL: BNPL services are often seen as a more convenient and accessible payment option, especially for younger demographics.

- Disadvantages for Credit Card Companies: BNPL can attract customers away from traditional credit cards, reducing transaction volumes and market share.

- Responding to BNPL Competition: Credit card companies are responding by introducing their own BNPL options and integrating features of BNPL into existing credit card offerings.

The rise of BNPL represents a significant shift in the financial services landscape, forcing credit card companies to adapt their strategies and offerings to remain competitive in the Fintech disruption.

Long-Term Implications for the Credit Card Industry

Sustained reduced consumer spending could have profound long-term implications for the credit card industry.

- Consolidation within the credit card industry: Smaller players may struggle to survive, leading to mergers and acquisitions, resulting in greater industry consolidation.

- Increased focus on alternative revenue streams (e.g., lending): Credit card companies might diversify into related financial services like lending to offset revenue losses from reduced transaction volumes.

- Potential for regulatory changes and increased scrutiny: Increased defaults and financial instability could trigger regulatory scrutiny and potential changes to regulations governing the credit card industry.

- Shifting consumer behavior and preferences: The long-term impact of reduced consumer spending may lead to a permanent shift in consumer behavior, with customers increasingly prioritizing value and affordability.

The future of credit cards hinges on the ability of companies to adapt to these evolving economic conditions and changing consumer preferences. The regulatory landscape will also play a vital role in shaping the future of this industry.

Conclusion:

Reduced consumer spending presents a significant challenge for credit card companies, impacting transaction volumes, revenue, and profitability. Adapting to this new economic reality requires strategic innovation, focusing on customer retention, technological advancements, and a careful analysis of the competitive landscape, including the rise of BNPL. While the long-term effects remain uncertain, credit card companies that can effectively navigate these challenges through robust strategies will be best positioned for future success. Understanding the complexities of reduced consumer spending is crucial for investors and industry stakeholders alike. Staying informed about the latest trends and adapting to the evolving needs of consumers will be key to navigating this challenging environment and thriving in the future of the credit card industry.

Featured Posts

-

The Canadian Dollar A Case Study In Currency Market Volatility

Apr 24, 2025

The Canadian Dollar A Case Study In Currency Market Volatility

Apr 24, 2025 -

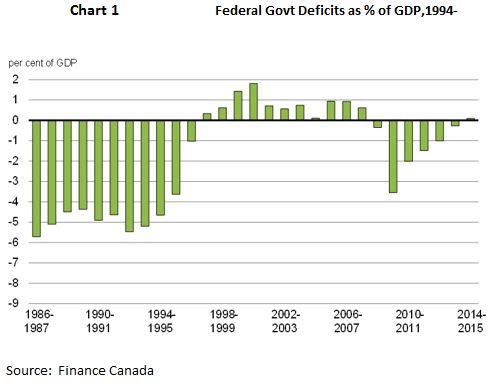

Canadas Fiscal Future A Need For Responsible Liberal Governance

Apr 24, 2025

Canadas Fiscal Future A Need For Responsible Liberal Governance

Apr 24, 2025 -

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025 -

Credit Card Companies Feel The Pinch Consumers Cut Back On Nonessential Spending

Apr 24, 2025

Credit Card Companies Feel The Pinch Consumers Cut Back On Nonessential Spending

Apr 24, 2025 -

Niftys Ascent Analyzing The Positive Market Trends In India

Apr 24, 2025

Niftys Ascent Analyzing The Positive Market Trends In India

Apr 24, 2025