The Canadian Dollar: A Case Study In Currency Market Volatility

Table of Contents

Key Factors Influencing Canadian Dollar Volatility

Several interconnected factors contribute to the fluctuations in the Canadian dollar's value. These factors often interact in complex ways, making accurate forecasting challenging but highlighting the need for careful monitoring.

Commodity Prices and Their Impact

The Canadian economy is heavily reliant on commodity exports, primarily oil, natural gas, and lumber. These commodities represent a significant portion of Canada's GDP and exports, creating a direct link between their global prices and the Canadian dollar's strength. Fluctuations in global commodity markets, often driven by geopolitical events or changes in global demand, significantly influence the CAD's exchange rate.

- Higher commodity prices generally strengthen the CAD. When oil prices rise, for example, the increased revenue from Canadian oil exports leads to higher demand for the Canadian dollar, pushing its value upward.

- Lower commodity prices weaken the CAD. Conversely, a decline in oil prices, as seen in 2014-2016, puts downward pressure on the Canadian dollar due to reduced export earnings and decreased investor confidence.

- Detailed explanation: The 2014 oil price crash provides a prime example. The dramatic drop in oil prices significantly weakened the CAD, impacting numerous sectors of the Canadian economy and affecting everything from employment to consumer spending. The recovery in oil prices subsequently led to a strengthening of the Canadian dollar, illustrating the direct correlation.

Interest Rate Differentials and Monetary Policy

The Bank of Canada's monetary policy plays a crucial role in influencing the Canadian dollar's value. Interest rate differentials between Canada and other major economies significantly affect capital flows and investor sentiment.

- Increased interest rates attract foreign capital. Higher interest rates in Canada compared to other countries make Canadian investments more attractive to foreign investors, increasing demand for the CAD and strengthening its value.

- Decreased interest rates can lead to capital outflow. Conversely, lower interest rates can encourage capital flight as investors seek higher returns elsewhere, weakening the CAD.

- Detailed explanation: The Bank of Canada's decisions on interest rates are carefully considered, balancing inflation targets with economic growth. Announcements of interest rate changes often cause immediate and significant movements in the CAD's exchange rate, demonstrating the market's sensitivity to monetary policy.

Geopolitical Events and Global Uncertainty

Global geopolitical events and economic uncertainty can significantly impact the Canadian dollar's value. Investors often view the CAD as a riskier asset during times of global instability, leading to capital flight and currency depreciation.

- Trade tensions with the US can negatively affect the CAD. Given the strong economic ties between Canada and the US, any trade disputes or uncertainty in the relationship can lead to CAD weakness.

- Global economic downturns typically weaken the CAD. During periods of global economic recession, investors often move towards safer haven currencies like the US dollar, putting downward pressure on the CAD.

- Detailed explanation: The COVID-19 pandemic provides a recent example. The initial uncertainty and global economic slowdown led to a sharp decline in the CAD's value as investors sought safer assets.

US Dollar Strength and the CAD's Relationship

The Canadian dollar's value is strongly correlated with the US dollar's value due to close economic ties and substantial bilateral trade.

- USD strength usually correlates with CAD weakness. When the US dollar strengthens against other major currencies, the Canadian dollar tends to weaken as well.

- USD weakness often supports CAD appreciation. Conversely, a weakening US dollar can provide support for the CAD.

- Detailed explanation: This correlation is primarily due to the large volume of trade between Canada and the US. Many Canadian businesses price their goods and services in US dollars, meaning a stronger USD directly impacts their profitability and, consequently, the demand for CAD.

The Economic Impact of Canadian Dollar Volatility

Canadian Dollar volatility significantly impacts various sectors of the Canadian economy. Understanding this impact is crucial for businesses and policymakers alike.

Impact on Canadian Exporters

Fluctuations in the CAD's exchange rate directly affect the competitiveness of Canadian exports.

- A weak CAD benefits exporters but increases import costs. A weaker CAD makes Canadian goods cheaper for foreign buyers, boosting exports. However, it also leads to increased costs for importing raw materials and other necessary inputs.

- A strong CAD hurts exporters but reduces import costs. Conversely, a strong CAD makes Canadian goods more expensive for foreign buyers, hurting exports, but reduces the cost of imports.

- Detailed explanation: The impact varies across different export sectors. For example, resource-based industries are more sensitive to commodity price fluctuations and CAD movements than manufacturing sectors.

Impact on Canadian Importers

The exchange rate also influences the cost of imported goods and services for Canadian businesses and consumers.

- A strong CAD benefits consumers through lower import prices. A stronger CAD reduces the cost of imported goods, leading to lower prices for consumers.

- A weak CAD increases import costs for businesses and consumers. A weak CAD makes imports more expensive, potentially leading to inflation and reduced consumer spending.

- Detailed explanation: The impact on inflation is particularly significant. A weak CAD can exacerbate inflationary pressures by increasing the cost of imported goods, which can further impact the Bank of Canada's monetary policy decisions.

Conclusion

The Canadian dollar's volatility stems from a complex interplay of factors, primarily commodity prices, interest rate differentials, geopolitical events, and the strength of the US dollar. Understanding these drivers is essential for navigating the Canadian economy's fluctuations. By carefully monitoring these key indicators and understanding their impact on the Canadian dollar, individuals and businesses can make informed decisions and mitigate risks associated with Canadian Dollar volatility. For a deeper dive into forecasting Canadian Dollar movements, further research into macroeconomic indicators and global market trends is recommended. Learn more about managing the risks associated with Canadian Dollar Volatility today.

Featured Posts

-

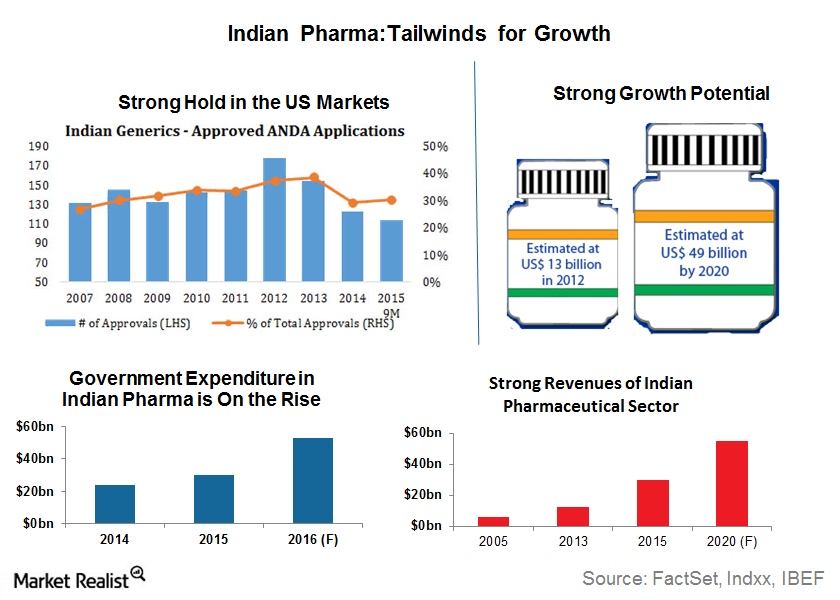

India Market Update Tailwinds Driving Niftys Strong Performance

Apr 24, 2025

India Market Update Tailwinds Driving Niftys Strong Performance

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Liams Medical Crisis And Fight For Survival

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Crisis And Fight For Survival

Apr 24, 2025 -

Bold And The Beautiful Recap April 3 Liams Health Crisis Following Bill Showdown

Apr 24, 2025

Bold And The Beautiful Recap April 3 Liams Health Crisis Following Bill Showdown

Apr 24, 2025 -

Village Roadshow Sale Finalized Alcon Acquires For 417 5 Million

Apr 24, 2025

Village Roadshow Sale Finalized Alcon Acquires For 417 5 Million

Apr 24, 2025 -

Miami Steakhouse John Travoltas Pulp Fiction Culinary Tribute

Apr 24, 2025

Miami Steakhouse John Travoltas Pulp Fiction Culinary Tribute

Apr 24, 2025