Stock Market Live: Tracking Dow Futures, Dollar, And Trade Tariffs

Table of Contents

Understanding Dow Futures and Their Impact on the Stock Market

What are Dow Futures?

Dow Jones Industrial Average futures contracts are agreements to buy or sell the Dow Jones Industrial Average (DJIA) at a predetermined price on a future date. These contracts act as a barometer, reflecting investor sentiment and anticipating potential movements in the actual Dow Jones index. Essentially, they offer a glimpse into the future direction of the market. Trading Dow futures allows investors to speculate on the index's performance without directly buying or selling individual stocks.

Interpreting Dow Futures Data

Changes in Dow futures prices offer valuable insight into potential market movements. A sustained upward trend often suggests a bullish outlook, while a downward trend signals potential bearish sentiment. However, simply observing the price isn't sufficient. Volatility, measured by price fluctuations, is equally critical. Large price swings indicate increased uncertainty and potential for sharp market corrections.

- Speculation: Dow futures trading is heavily influenced by speculation, meaning traders bet on future price movements based on their market analysis and predictions.

- Trading Volume: Consider trading volume alongside price changes. High volume during a price increase amplifies the significance of the upward trend. Conversely, high volume during a decline indicates strong bearish pressure.

- Contract Types and Expiry: Dow futures contracts have different expiry dates. Understanding contract specifications is vital for effective trading and hedging strategies.

The Dollar's Influence on Global Markets and Stock Prices

The Dollar's Role in International Trade

The US dollar's strength significantly impacts global markets and US stock prices. A strong dollar makes US exports more expensive for international buyers, potentially hurting corporate earnings of companies heavily reliant on foreign sales. Conversely, it makes imports cheaper, benefiting consumers but potentially harming domestic producers.

Analyzing the Dollar Index

The US Dollar Index (DXY) measures the dollar's value against other major currencies. A rising DXY suggests a strengthening dollar, while a falling DXY indicates weakening. This index acts as a critical indicator of the dollar's global influence and its effects on the stock market.

- Influencing Factors: Several factors influence the dollar's strength, including US interest rates, economic data releases (GDP, inflation), and geopolitical events.

- Multinational Corporations: Multinational corporations with significant international operations are particularly sensitive to fluctuations in the dollar's value. A strong dollar can negatively impact their reported earnings in US dollars.

- Currency Relationships: The dollar's value is interconnected with other major currencies (Euro, Yen, Pound). Tracking these relationships provides a more holistic view of the currency market's impact on stocks.

Trade Tariffs and Their Effect on Stock Market Volatility

How Trade Tariffs Work

Trade tariffs are taxes imposed on imported goods. They increase the cost of imported products, aiming to protect domestic industries and boost domestic production. However, tariffs can trigger retaliatory measures from other countries, escalating trade tensions and creating uncertainty.

Identifying Stocks Affected by Trade Tariffs

Specific industries are more vulnerable to trade tariffs than others. For example, industries heavily reliant on imported materials or exporting significant portions of their production are disproportionately affected. Identifying these vulnerable sectors allows investors to anticipate and adjust their portfolios proactively.

- Specific Tariff Impacts: The impact of specific trade tariffs, such as those imposed on steel and aluminum, can significantly affect related industries, causing stock price fluctuations.

- Trade Agreements: Understanding international trade agreements and their potential modifications is crucial for investors. News regarding renegotiated trade deals can substantially influence stock prices in affected sectors.

- News and Negotiations: News related to trade negotiations and potential tariff changes can significantly impact stock market volatility, creating both opportunities and risks for investors.

Conclusion

"Stock Market Live" performance is intricately linked to Dow futures, the dollar's strength, and the dynamics of trade tariffs. Real-time monitoring of these indicators is essential for formulating successful investment strategies. By understanding how these elements interact and impact the market, investors can make more informed decisions and navigate the complexities of stock market fluctuations. Stay informed about "Stock Market Live" updates by subscribing to reputable financial news sources and utilizing reliable tools for tracking Dow futures, the dollar index, and trade tariff-related news. Effective monitoring of these key factors is critical for successful investment in today's dynamic market.

Featured Posts

-

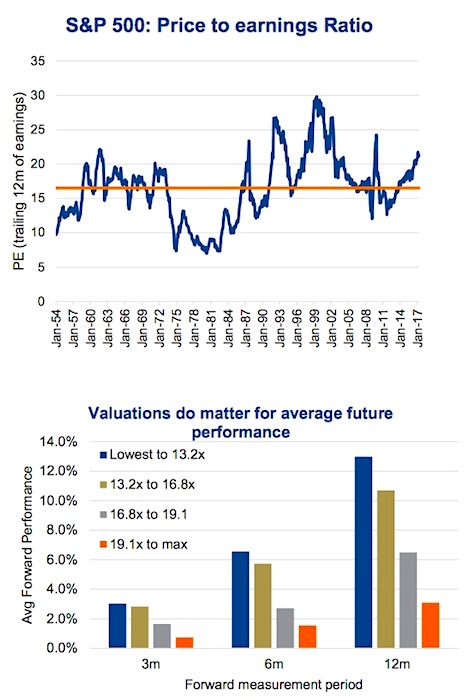

Why Current Stock Market Valuations Are Not A Cause For Alarm Bof A

Apr 22, 2025

Why Current Stock Market Valuations Are Not A Cause For Alarm Bof A

Apr 22, 2025 -

Dow Futures Drop Live Stock Market Updates And Analysis

Apr 22, 2025

Dow Futures Drop Live Stock Market Updates And Analysis

Apr 22, 2025 -

Swedens Tanks Finlands Troops A Look At The Pan Nordic Defense Force

Apr 22, 2025

Swedens Tanks Finlands Troops A Look At The Pan Nordic Defense Force

Apr 22, 2025 -

The Difficulties Of Automating Nike Sneaker Assembly

Apr 22, 2025

The Difficulties Of Automating Nike Sneaker Assembly

Apr 22, 2025 -

Section 230 And Banned Chemicals The Impact On E Bay Sellers

Apr 22, 2025

Section 230 And Banned Chemicals The Impact On E Bay Sellers

Apr 22, 2025